Market Size

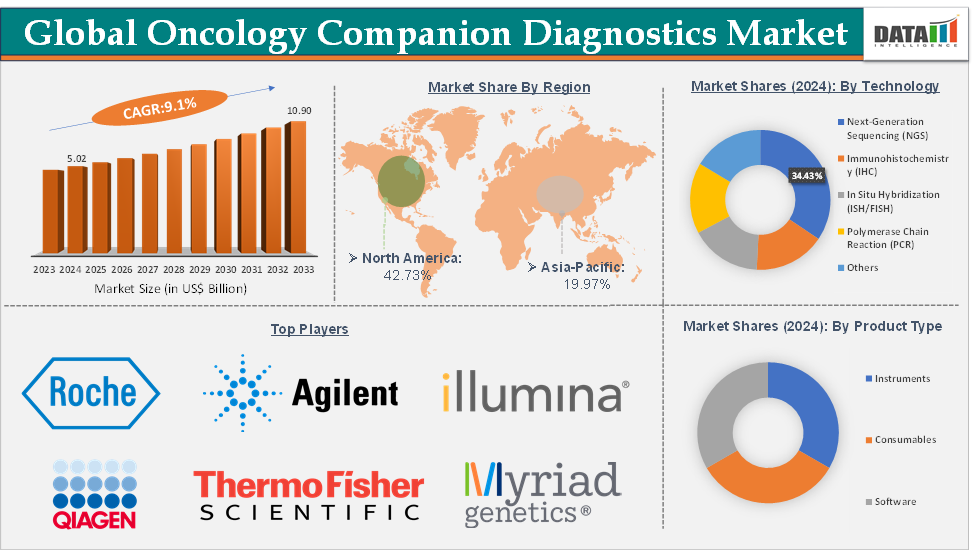

The global oncology companion diagnostics market size reached US$ 5.02 Billion in 2024 from US$ 4.64 Billion in 2023 and is expected to reach US$ 10.90 Billion by 2033, growing at a CAGR of 9.1% during the forecast period 2025-2033.

Market Overview

The oncology companion diagnostics market is experiencing robust growth, driven by the rising global cancer burden, advancements in personalized medicine, and increasing regulatory approvals for targeted therapies. These diagnostics are critical for identifying patients most likely to benefit from specific cancer treatments, especially in areas like non-small cell lung cancer (NSCLC), breast cancer, and colorectal cancer. As pharmaceutical companies increasingly collaborate with diagnostic firms to co-develop drug-diagnostic pairs, the demand for companion diagnostics is expected to surge. Major market players such as Roche, Thermo Fisher Scientific, QIAGEN, and Agilent Technologies are leading innovation through next-generation sequencing (NGS), PCR, and immunohistochemistry (IHC)-based platforms.

Executive Summary

Market Dynamics

Drivers:

The rising prevalence of cancer is significantly driving the oncology companion diagnostics market growth

The rising global prevalence of cancer is a primary catalyst driving growth in the oncology companion diagnostics (CDx) market, as it amplifies the demand for precision diagnostics that can guide targeted treatments. For instance, according to the National Institutes of Health, by 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. Additionally, according to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million.

As incidence rates soar, particularly for types like non-small cell lung cancer (NSCLC), breast, colorectal, and prostate cancers, there is an urgent need for more personalized and effective treatment strategies. Companion diagnostics play a critical role by identifying specific genetic mutations, biomarkers, or protein expressions that determine a patient’s likelihood to respond to a targeted therapy.

The surge in personalized medicine, combined with aging populations and lifestyle risk factors, further intensifies cancer prevalence. This trend not only increases the number of patients eligible for biomarker-driven therapies but also encourages pharmaceutical companies to co-develop diagnostic tools with therapeutics. Consequently, the market for oncology companion diagnostics is expanding rapidly, as it directly aligns with the need for safer, smarter, and more cost-effective cancer treatment pathways tailored to individual patient profiles.

Restraints:

Limited biomarker access & heterogeneity are hampering the growth of the oncology companion diagnostics market

Limited biomarker access and tumor heterogeneity significantly hamper the growth of the oncology companion diagnostics (CDx) market by reducing the effectiveness and scalability of these tests. Intra-tumor and inter-patient heterogeneity complicate diagnosis and treatment selection. A single biopsy may not accurately represent the genetic profile of the entire tumor, especially in cancers with high mutation rates or those that evolve under treatment pressure. For instance, a lung cancer patient might test negative for a biomarker in one part of the tumor but positive in another, leading to potential misclassification and suboptimal treatment.

Additionally, accessing high-quality tumor samples is a challenge in late-stage or hard-to-biopsy cancers, which can limit biomarker detection altogether. These limitations reduce the clinical reliability and utility of companion diagnostics, discouraging adoption among clinicians and slowing market expansion. As a result, the full potential of personalized oncology remains constrained by biomarker and tumor complexity.

For more details on this report – Request for Sample

Segment Analysis

The global oncology companion diagnostics market is segmented based on product type, technology, application, end-user, and region.

The next‑generation sequencing (NGS) from the technology segment is dominating the oncology companion diagnostics market with a 34.43% share in 2024

Next-generation sequencing (NGS) is dominating the oncology companion diagnostics (CDx) market due to its unparalleled ability to analyze multiple genes and biomarkers simultaneously, offering a comprehensive and efficient approach to precision oncology. Unlike traditional single-gene tests like PCR or IHC, NGS enables high-throughput, multiplexed analysis of entire cancer-related gene panels or even whole exomes, making it ideal for identifying complex mutational profiles across various tumor types.

This technological advantage is especially critical in cancers like non-small cell lung cancer (NSCLC) or melanoma, where multiple genetic alterations such as EGFR, ALK, ROS1, BRAF, and MET may guide treatment decisions. NGS panels can detect all of these mutations in one test, reducing the time and tissue required while providing actionable insights for therapies. Furthermore, NGS is essential in assessing tumor mutational burden and microsatellite instability, two emerging biomarkers critical for predicting response to immune checkpoint inhibitors like pembrolizumab.

Companies like Roche, QIAGEN, Thermo Fisher Scientific, and Illumina have developed FDA-approved NGS-based CDx platforms, which are now standard tools in advanced oncology care. For instance, in June 2025, QIAGEN N.V. and Incyte announced a new global collaboration to develop a novel diagnostic panel to support Incyte’s extensive portfolio of investigational therapies for patients with myeloproliferative neoplasms, a group of rare blood cancers, including Incyte’s monoclonal antibody INCA033989, targeting mutant calreticulin (mutCALR), which is being developed in myelofibrosis (MF) and essential thrombocythemia (ET). The panel will be validated using the next-generation sequencing (NGS) technology and the Illumina NextSeq 550Dx platform as part of QIAGEN’s partnership with Illumina to leverage its NGS diagnostic platforms for patient testing by laboratories worldwide.

Geographical Shares

North America is expected to dominate the global oncology companion diagnostics market with a 42.73% in 2024

North America dominates the global oncology companion diagnostics (CDx) market due to its advanced healthcare infrastructure, strong pharmaceutical and biotechnology ecosystem, and supportive regulatory environment. The United States, in particular, accounts for the largest market share, driven by the widespread adoption of precision medicine, high cancer prevalence, and substantial investment in biomarker research and targeted therapies.

The U.S. Food and Drug Administration (FDA) has played a key role by establishing clear regulatory guidelines for companion diagnostics and offering expedited pathways like Breakthrough Device Designation, which encourages innovation and rapid market entry. For instance, the FDA’s approval of FoundationOne CDx, an NGS-based test developed by Foundation Medicine (a Roche subsidiary), is now widely used for comprehensive genomic profiling in solid tumors.

Additionally, the presence of major diagnostic and life sciences companies such as Thermo Fisher Scientific, Illumina, Agilent Technologies, and QIAGEN North America supports local production, co-development with pharma companies, and clinical trial activity. The region is also home to a large number of leading cancer centers, which routinely incorporate CDx into clinical decision-making.

Competitive Landscape

Top companies in the oncology companion diagnostics market include F. Hoffmann-La Roche Ltd, Agilent Technologies, Inc., Illumina, Inc., QIAGEN, Thermo Fisher Scientific Inc., Myriad Genetics, Inc., Guardant Health, Labcorp, Quest Diagnostics and Invivoscribe, Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 9.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Instruments, Consumables and Software |

Technology | Polymerase Chain Reaction (PCR), Next‑Generation Sequencing (NGS), Immunohistochemistry (IHC), In Situ Hybridization (ISH/FISH), Liquid Biopsy and Others | |

Application | Non‑Small Cell Lung Cancer (NSCLC), Breast Cancer, Prostate Cancer, Colorectal Cancer and Others | |

End-User | Hospitals, Diagnostic Laboratories, Academic and Research Institutions and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global oncology companion diagnostics market report delivers a detailed analysis with 70 key tables, more than 68 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more clinical diagnostics-related reports, please click here