Global Cardiac Biomarkers Market Size & Industry Outlook

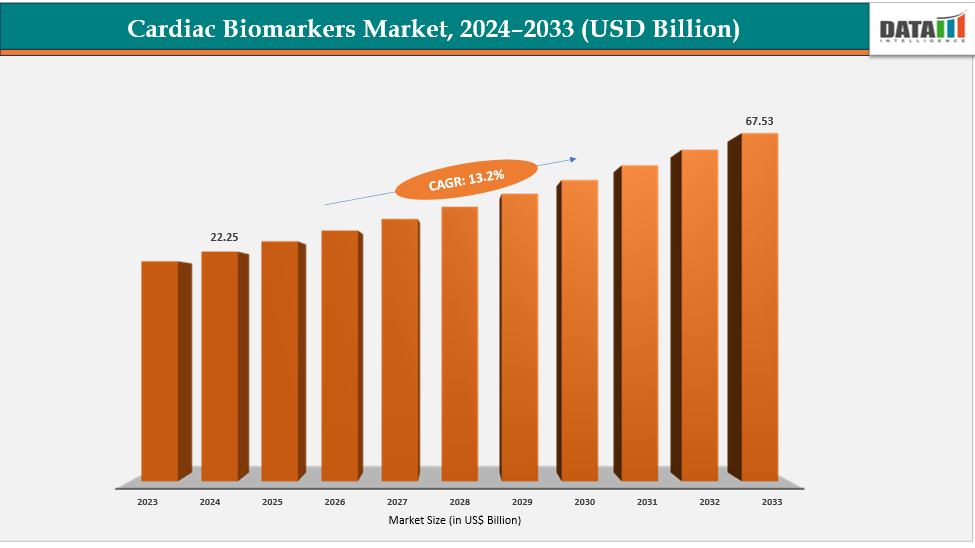

The global cardiac biomarkers market reached US$ 19.83 Billion with a rise of US$ 22.25 Billion in 2024 and is expected to reach US$ 67.53 Billion by 2033, growing at a CAGR of 13.22% during the forecast period 2025-2033.

The cardiac biomarkers market is being driven mostly by rising awareness of early diagnosis and preventative healthcare. Tests including CK-MB, BNP, and high-sensitivity troponin are in greater demand as patients and healthcare professionals place a higher priority on routine screening for cardiovascular risk factors. Patient outcomes are improved when myocardial infarction, heart failure, and acute coronary syndrome are detected early enough to allow for prompt intervention. Market expansion is further supported by technology developments in multiplex and point-of-care assays, as well as public and corporate programs encouraging preventative care. Modern healthcare is becoming increasingly dependent on cardiac biomarker testing due to the increasing incidence of cardiovascular disorders and proactive patient behaviour.

Key Highlights

- Based on cardiac biomarker tests, the troponin segment is leading the market with strong growth potential, with a 48.3% share in 2024

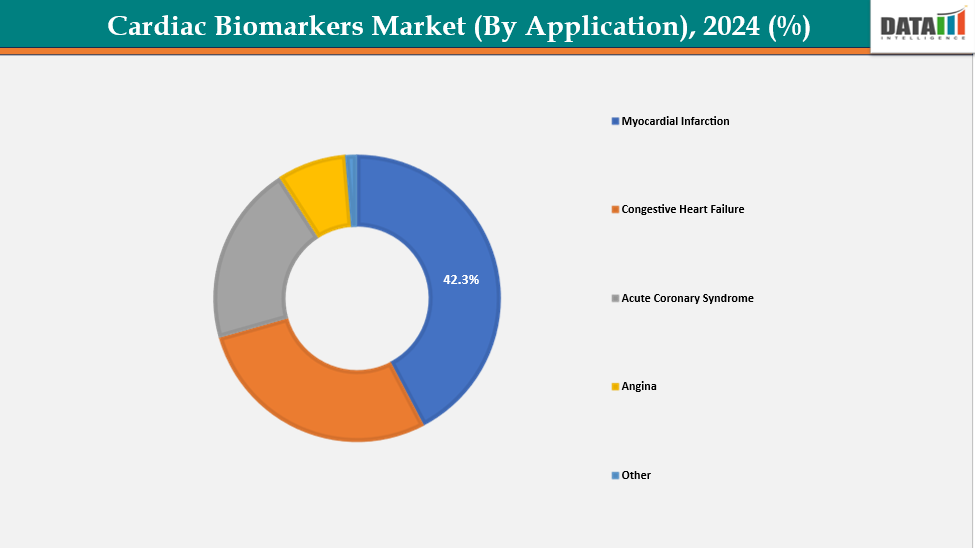

- Based on the application, myocardial infarction is dominating the cardiac biomarker market with a 42.3% share in 2024

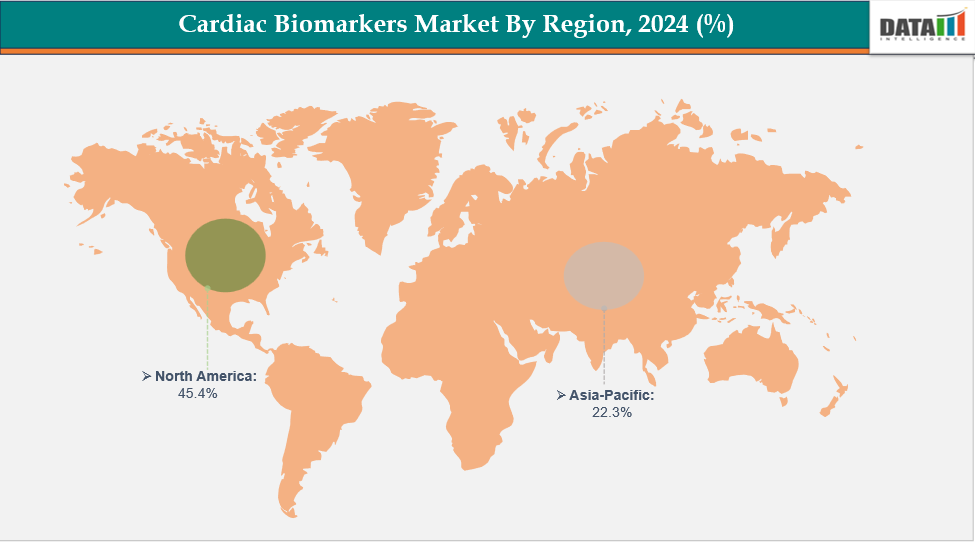

- North America is dominating the cardiac biomarkers market with the largest revenue share of 45.4% in 2024.

- Asia Pacific is the fastest-growing region and is expected to grow over the forecast period with a CAGR of 7.5% during 2024

- Top companies in the Cardiac Biomarkers Market are Roche Diagnostics Limited, Abbott, Siemens Healthineers AG, Thermo Fisher Scientific Inc., AdvaCare Pharma, Novus Biologicals, Fine Biotech Co., Ltd., Labome, Vitrosens Biyoteknoloji, and Real-Gene Labs, among others.

Market Dynamics

Drivers:Rising prevalence of cardiovascular diseases are significantly driving the cardiac biomarkers market growth

The rising prevalence of cardiovascular diseases (CVDs) is a key driver of the cardiac biomarkers market. Rapid and precise diagnostics are now more important than ever because of the rise in heart attacks, heart failure, and acute coronary syndromes brought on by aging populations, diabetes, obesity, and sedentary lifestyles. Troponins, CK-MB, and BNP are examples of cardiac biomarkers that are crucial for early diagnosis, risk assessment, and monitoring in both normal and emergency situations. Global adoption of high-sensitivity assays and point-of-care cardiac biomarker kits has increased dramatically as a result of governments, hospitals, and insurers prioritizing improved diagnostic tools due to rising healthcare expenditures and mortality from CVDs.

For instance, according to recent WHO and CDC data, cardiovascular diseases (CVDs) remain the leading global cause of death, with an estimated 19.8 million deaths in 2022, accounting for 32% of all deaths worldwide. Of these, 85% were due to heart attacks and strokes. In the United States alone, about 805,000 people experience a heart attack each year, including 605,000 first-time cases and 200,000 recurrent cases, underscoring the urgent need for effective prevention and treatment strategies for cardiac arrest and related conditions.

Restraints: The high cost of advanced assays and devices of cardiac biomarkers tests are hampering the growth of the cardiac biomarker market.

The high cost of advanced cardiac biomarker assays and devices is a major factor restraining market growth. High-sensitivity troponin tests, BNP assays, and point-of-care devices require significant investment, making them less accessible in low- and middle-income countries. Low insurance reimbursement further raises patients' costs and discourages them from getting regular screenings or follow-up exams. The widespread adoption of expensive equipment is slowed by smaller hospitals and rural clinics' frequent avoidance of it. Costlier substitutes like imaging and ECG are also favored in environments with limited resources. This disparity in pricing limits the number of tests that can be performed and postpones widespread acceptance, which eventually hinders the market expansion for cardiac biomarkers.

For more details on this report, see Request for Sample

Global Cardiac Biomarkers Market, Segment Analysis

The global cardiac biomarkers market is segmented based on cardiac biomarker tests, application, testing location, and region.

By Application: Myocardial infarction is leading the cardiac biomarkers market with strong growth potential, with a 42.3% share in 2024

Myocardial infarction (MI) is leading the cardiac biomarkers market due to its high global prevalence and critical need for timely diagnosis. Troponins, CK-MB, and myoglobin are examples of biomarkers that are crucial for early MI detection, treatment guidance, and patient recovery monitoring. The patient base is growing as a result of rising cardiovascular disease rates brought on by sedentary lifestyles, diabetes, and obesity. High-sensitivity assays and other technological developments increase accuracy and uptake, while expansions in healthcare infrastructure make tests more accessible. Furthermore, biomarker testing for MI is highly recommended by clinical guidelines. When taken as a whole, these elements place MI as the market leader for cardiac biomarkers with significant room for expansion.

Owing to factors such as the global prevalence, for instance, in the United States, approximately 805,000 individuals experienced a heart attack annually, of which about 200,000 were recurrent events.

By Cardiac Biomarker Tests: The troponin segment from Cardiac Biomarker tests dominating the cardiac biomarker market with a 48.3% share in 2024

The troponin segment dominates the cardiac biomarkers market due to its high clinical importance and diagnostic accuracy. The gold standard for identifying myocardial infarction is troponins I and T, which have higher sensitivity and specificity than more traditional biomarkers like myoglobin and CK-MB. They raise total demand when used in serial testing, and high-sensitivity assays allow for the early identification of heart damage. Troponin tests are highly recommended by international cardiology recommendations, and their use is further fueled by the growing incidence of cardiovascular disease globally. Troponins also assist in prognosis, risk assessment, and treatment choices, which further solidifies their critical role in patient care and maintains robust market expansion.

Owing to factors such as the troponin biomarker, in March 2024, Polymedco received US FDA 510(k) clearance for the PATHFAST high-sensitivity cardiac troponin I (hs-cTnI-II) test to aid in diagnosing myocardial infarction. The test enabled rapid, accurate point-of-care diagnosis, bringing central lab-quality results closer to clinicians and patients and saving critical time in evaluating individuals with potentially life-threatening cardiac conditions.

Geographical Analysis

North America is dominating the global cardiac biomarkers market share with 45.4% in 2024

North America holds a dominant position in the cardiac biomarkers market owing to a combination of advanced healthcare infrastructure, high adoption of innovative diagnostic assays, supportive regulatory frameworks, and a strong presence of leading diagnostics and biotechnology companies. The region has one of the highest utilization rates of high-sensitivity troponin, BNP, CK-MB, and other cardiac biomarker tests, supported by state-of-the-art laboratories, point-of-care testing platforms, and widespread access in hospitals, clinics, and emergency care settings.

Moreover, North America is at the forefront of technological innovation, with leading diagnostics and biotech companies actively developing next-generation high-sensitivity cardiac biomarker assays, multiplex testing platforms, point-of-care diagnostic devices, and advanced cardiac risk assessment tools. For instance, in October 2024, Siemens Healthineers received FDA clearance for a new claim for its Atellica IM high-sensitivity troponin I (TnIH) test. The test enabled healthcare providers to identify patients at risk of death or major cardiac events up to one year after presenting with acute coronary syndrome symptoms in the emergency department.

Europe is the second-largest region to dominate the global cardiac biomarkers market share with 33.2% in 2024

Europe represents a significant market for cardiac biomarkers, ranking just behind North America, supported by its robust healthcare infrastructure, well-defined regulatory frameworks, and widespread adoption of high-sensitivity troponin, BNP, CK-MB, and other biomarker assays. The rising prevalence of cardiovascular diseases, including myocardial infarction, heart failure, and acute coronary syndrome, is driving demand for innovative and accurate diagnostic tests across the region. For instance, According to European Union, In 2022, diseases of the circulatory system placed a considerable burden on healthcare systems and government budgets in the European Union. The region recorded 1.68 million deaths from these diseases, accounting for 32.7% of all fatalities that year.

The region is also witnessing rapid adoption of advanced cardiac biomarker tests, as healthcare providers increasingly prefer high-sensitivity assays, multiplex testing platforms, and point-of-care diagnostics for improved accuracy and faster decision-making. Countries such as Germany, the UK, France, and Spain lead adoption due to robust healthcare infrastructure, supportive reimbursement policies, and access to specialized cardiac care centers, while Eastern and Southern Europe are gradually increasing usage as healthcare modernization and awareness of advanced diagnostic tools expand.

The Asia Pacific region is the fastest-growing region in the global cardiac biomarkers market, with a CAGR of 7.5% during 2024

Asia-Pacific is projected to be the fastest-growing region in the cardiac biomarkers market, driven by the rising prevalence of cardiovascular diseases, increasing awareness of early diagnosis, and improving healthcare infrastructure. Growing adoption of high-sensitivity assays, point-of-care testing, and advanced diagnostic technologies is further fueling market expansion across the region. The region has a large patient pool; a study reported that 33.6% of adults aged 60 and above in India have cardiovascular diseases. Despite this high disease burden, access to advanced biologics, monoclonal antibodies, vaccines, and peptide therapies remains limited. This gap creates significant growth potential, as improvements in healthcare access, increasing awareness, and the adoption of innovative cardiac biomarker markets.

Japan has a rapidly aging population, leading to a high prevalence of cardiovascular diseases, including myocardial infarction, heart failure, and acute coronary syndrome. The country has recently witnessed the adoption of advanced cardiac biomarker tests, such as high-sensitivity troponin, BNP, and CK-MB assays, aimed at improving early detection and patient management. Growing healthcare infrastructure, strong regulatory support, and increasing awareness among clinicians are driving the adoption of innovative diagnostic tools and point-of-care cardiac biomarker testing across Japan.

Competitive Landscape

Top companies in the Cardiac Biomarkers Market are Roche Diagnostics Limited, Abbott, Siemens Healthineers AG, Thermo Fisher Scientific Inc., AdvaCare Pharma, Novus Biologicals, Fine Biotech Co., Ltd., Labome, Vitrosens Biyoteknoloji, and Real-Gene Labs, among others.

Roche Diagnostics Limited: Roche Diagnostics is a global leader in cardiac biomarker testing, offering high-sensitivity assays such as Elecsys Troponin T Gen 5 and Elecsys proBNP II, along with the cobas h 232 point-of-care system. These solutions enable rapid, accurate diagnosis and management of myocardial infarction and heart failure across laboratories, hospitals, and point-of-care settings.

Key Development

In September 2024, GE HealthCare received FDA approval for Flyrcado, a new progressive claim for its Atellica IM high-sensitivity troponin I (TnIH) test. This blood test assists healthcare providers in identifying patients at risk of death and major cardiac events up to a year after presenting with signs and symptoms of acute coronary syndrome.

In October 2023, Mindray expanded its cardiac biomarker portfolio by introducing new assays for high-sensitivity troponin I and NT-proBNP. Developed in collaboration with HyTest, these assays were validated by Wuhan Asian Heart Hospital and Hennepin Healthcare Research Institute, providing enhanced clinical performance for the diagnosis and management of cardiovascular diseases.

Market Scope

| Metrics | Details | |

| CAGR | 13.22% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Cardiac Biomarker Tests | Troponin, Creatine kinase, Myoglobin, Galectin-3 and Other |

| By Application | Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, Angina and Other | |

| By Testing Location | Laboratory Testing, Point of Care Testing | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global cardiac biomarkers market report delivers a detailed analysis with 62 key tables, more than 55 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Reports

For more pharmaceutical-related reports, please click here