Molecular Diagnostics Market Size

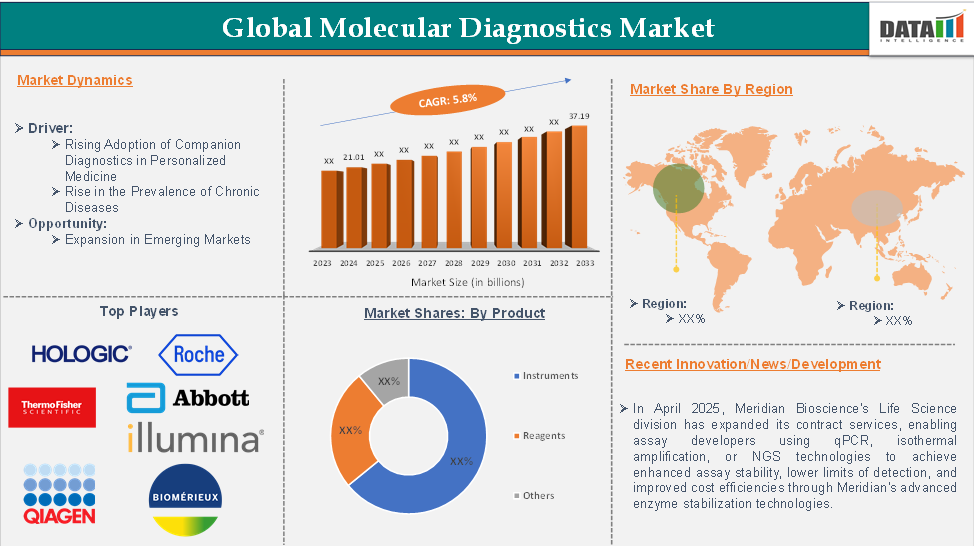

Global Molecular Diagnostics Market reached US$21.01 billion in 2024 and is expected to reach US$37.19 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033, according to DataM Intelligence report.

In 2022, the Molecular Diagnostics Market was at US$29.82 billion, and by 2023, it had reached US$31.01 billion, marking a significant growth in market value.

Molecular diagnostics is a method that uses molecular biology to analyze biological markers in the genome and proteome. It uses technologies like PCR, NGS, and in situ hybridization to detect specific DNA, RNA, or protein sequences. These tools are used to identify genetic diseases, infectious diseases, cancer biomarkers, and monitor therapeutic responses. Molecular diagnostics is crucial in personalized medicine, enabling the identification of genetic variations influencing disease development, prognosis, and treatment response.

Executive Summary

For more details on this report, Request for Sample

Molecular Diagnostics Market Dynamics: Drivers & Restraints

Rising Adoption of Companion Diagnostics in Personalized Medicine

The increasing use of companion diagnostics is playing a pivotal role in driving the growth of the global molecular diagnostics market. These diagnostics are essential in the personalized medicine landscape, where treatments are tailored based on individual genetic profiles. In particular, companion diagnostics help identify biomarkers that predict how a patient will respond to specific therapies, especially in oncology, infectious diseases, and autoimmune disorders.

This precision not only improves patient outcomes but also reduces the trial-and-error approach of conventional treatment methods. As healthcare providers and regulatory bodies continue to emphasize the importance of targeted therapy, the integration of companion diagnostics is becoming more widespread, significantly boosting demand for molecular diagnostic technologies across clinical settings.

Regulatory Complexity and Delays

The global molecular diagnostics market faces challenges due to complex regulatory frameworks, leading to barriers to innovation, commercialization, and market access. The lack of harmonization among regulatory bodies across different countries and regions complicates product approval processes, increasing development costs and compliance burdens. Novel technologies like next-generation sequencing complicate the development pipeline, and issues related to data privacy and patient health information intensify compliance. This results in a slower adoption rate of advanced diagnostics globally, particularly in regions lacking robust regulatory support systems.

Molecular Diagnostics Market Segment Analysis

The global molecular diagnostics market is segmented based on Product, application, end-user, and region.

Product:

The instruments segment of the product is expected to dominate the molecular diagnostics market with the highest market share.

The instruments segment grew from US$8.55 billion in 2022 to US$8.97 billion in 2023, owing to rising adoption in the global market.

Instruments are specialized tools designed for specific tasks in technical, scientific, or professional fields. They range from simple hand-held tools like wrenches to complex machines like spectrometers or robotic systems. Instruments are essential in various industries, including healthcare, scientific research, and music.

The instruments segment is experiencing rapid growth, driven by advanced technologies like PCR, NGS, and digital PCR. These technologies offer sensitivity and precision in disease detection and genetic analysis, with PCR technology dominating over 50% of the market. Automation and artificial intelligence have enhanced their efficiency, enabling high-throughput testing and real-time data analysis. The growing emphasis on personalized medicine and early disease detection has increased demand for sophisticated diagnostic instruments.

For instance, in March 2024, Roche Diagnostics introduced the cobas 5800 System, a new molecular laboratory instrument, in the UK. The fully automated system, which consolidates 90% of routine testing on a single platform, can help increase testing volumes, improve operational efficiency, and manage increasing laboratory demand. Its small footprint makes it accessible to more labs, minimizing hands-on time and improving productivity. The system is scalable for smaller labs or larger ones.

Molecular Diagnostics Market Geographical Analysis

North America is expected to hold a significant position in the molecular diagnostics market, with the highest market share.

North America led the Molecular Diagnostics Market in 2022 with a market size of US$13.27 billion and expanded further to US$13.78 billion in 2023.

The North American molecular diagnostics market is experiencing rapid growth due to the increasing adoption of precision medicine, particularly in oncology, and the rising prevalence of chronic and infectious diseases like cancer and cardiovascular conditions.

Technological advancements, particularly Next-Generation Sequencing, have revolutionized molecular diagnostics by providing high-throughput, detailed genetic analysis at affordable costs. Government and private sector investments in research and development accelerate innovation in diagnostic technologies.

Moreover, the region's well-established healthcare infrastructure, strong reimbursement policies, and leading diagnostic companies further support the growth and adoption of molecular diagnostics, solidifying its position as a leader in this market.

For instance, in January 2025, Genomadix, a global leader in precision medicine diagnostics, obtained a medical device license from Health Canada for the marketing of its "Genomadix CubeTM CYP2C19 System" automated sample-to-result PCR test.

Molecular Diagnostics Market Major Players

The major global players in the molecular diagnostics market include Hologic Inc., F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Abbott Laboratories, QIAGEN N.V., Illumina Inc., BioMérieux SA, Agilent Technologies Inc., Siemens Healthineers AG, and Myriad Genetics Inc., among others.

Key Developments

- In April 2025, Meridian Bioscience's Life Science division expanded its contract services, enabling assay developers using qPCR, isothermal amplification, or NGS technologies to achieve enhanced assay stability, lower limits of detection, and improved cost efficiencies through Meridian's advanced enzyme stabilization technologies.

- In May 2024, Northwell Health Cancer Institute opened Long Island's first clinical Molecular Diagnostics Laboratory, a $3.2 million facility with next-generation sequencing technology. The 2,800 square foot facility will improve cancer diagnosis and prognosis accuracy, lower costs for patients and the health system, and provide point-of-care genomic profiling for precision cancer therapy.

Market Scope

| Metrics | Details | |

| CAGR | 5.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Instruments, Reagents, Others |

| Technology | Polymerase Chain Reaction (PCR), In Situ Hybridization Chips and Microarrays, Mass Spectrometry (MS), Sequencing, Others | |

| Application | Infectious Disease, Oncology, Pharmacogenomics Microbiology, Genetic Disease Screening, Human Leukocyte Antigen Typing, Blood Screening | |

| End User | Hospitals, Pharmaceutical and Biotechnology Laboratories, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global molecular diagnostics market report delivers a detailed analysis with 70 key tables, more than 74 visually impactful figures, and 165 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.