Overview

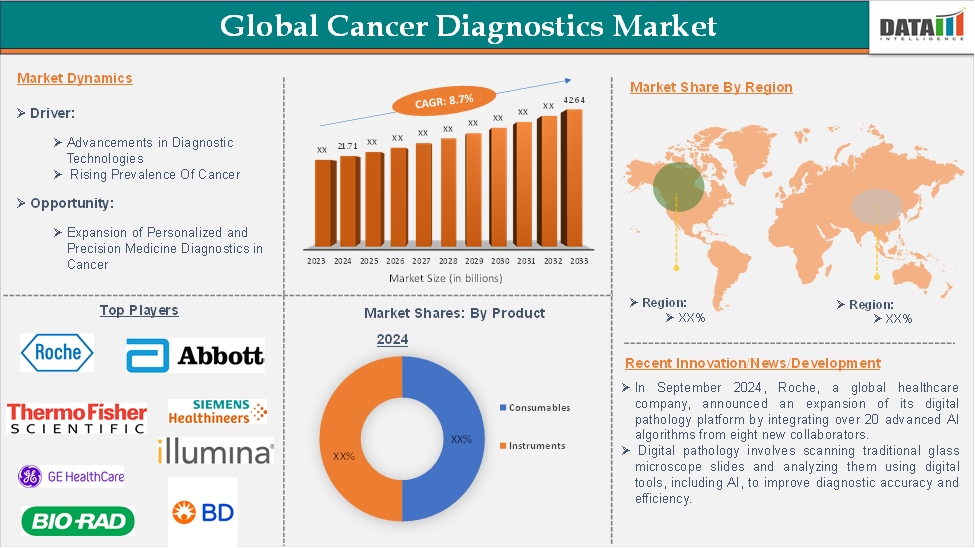

The global cancer diagnostics market reached US$ 21.71 billion in 2024 and is expected to reach US$ 42.64 billion by 2033, growing at a CAGR of 8.7% during the forecast period of 2025-2033.

The global cancer diagnostics market encompasses the industry focused on medical devices, tools, technologies, and services used to detect and diagnose various types of cancer, particularly at early stages. This market includes a wide array of diagnostic solutions, such as imaging methods (e.g., MRI, CT scans, PET scans), molecular and genetic tests (e.g., next-generation sequencing, liquid biopsy), pathology tests, and screening techniques that help identify cancer-related biomarkers.

The primary objective of these diagnostic tools is to provide accurate and timely cancer detection, enabling more effective, personalized treatment options and ultimately improving patient outcomes and survival rates. The market is propelled by the growing prevalence of cancer, ongoing advancements in diagnostic technologies, and increasing demand for early detection and personalized cancer care.

Executive Summary

Market Dynamics: Drivers & Restraints

Rising Incidence and Prevalence Of Cancer

The rising incidence and prevalence of cancer are significantly driving the growth of the diagnostics for the cancer market and are expected to drive the market over the forecast period. For instance, according to the Globocon data in 2022, the cancer incidence for males was 10.3 million, while for females, it was 9.7 million. By 2025, the cancer incidence is projected to reach 12.5 million for males and 11.6 million for females. This escalating incidence highlights the urgent need for accessible and cost-effective cancer diagnostics solutions.

The aging global population is contributing to a higher risk of cancer, as older individuals are more susceptible to developing the disease. This demographic shift has resulted in a rise in cancer cases, highlighting the increasing demand for diagnostic tests that can detect cancer at earlier stages, ultimately improving treatment outcomes.

As a result, the rising number of cancer cases directly boosts the demand for cancer diagnostics, leading to a growing market for related products and services. This includes diagnostic tests, imaging systems, and laboratory services that are crucial for identifying and monitoring different types of cancer. These trends create a pressing need for advanced diagnostic technologies, fuel market growth, and underscore the importance of addressing disparities in cancer care globally.

High Costs of Diagnostic Procedures and Equipment

High costs of diagnostic procedures and equipment are a significant barrier to the growth of diagnostics for the cancer market. Several advanced diagnostic tools are essential for the early and accurate detection of cancer, but the high expenses associated with their implementation can create significant challenges. These tools, such as next-generation sequencing (NGS), liquid biopsy, and high-resolution imaging systems, come with a combination of direct and indirect costs that limit their accessibility and widespread use.

According to the researchers, the estimated $43 billion annual cost for initial cancer screening in 2021 is lower than the reported annual cost of cancer treatment in the U.S. during the first 12 months following diagnosis. They emphasize that understanding cancer screening costs and their underlying factors is crucial for informing policy decisions and guiding the development of programs aimed at improving access to recommended cancer screening services.

Advanced diagnostic technologies require a substantial upfront investment. For instance, NGS systems can cost hundreds of thousands of dollars, and high-resolution imaging machines like PET/CT scanners or MRI machines can cost millions. The price of purchasing these machines is a major barrier, especially for smaller hospitals, clinics, or healthcare facilities in low- and middle-income countries.

Segment Analysis

The global cancer diagnostics market is segmented based on product, indication, and region.

Product:

The consumables segment in the product is expected to dominate the global cancer diagnostics market with the highest market share

Consumables in cancer diagnostics encompass the single-use or limited-use materials necessary for conducting various diagnostic tests. These items play a critical role in ensuring accurate, reliable, and efficient cancer detection. These items are critical for every step of the diagnostic process, from sample collection and processing to the execution of complex assays.

Consumables are the backbone of the day-to-day operations in cancer diagnostic laboratories. They ensure that every step of the testing process, from sample collection to final analysis, adheres to rigorous quality standards, ultimately improving early detection, treatment planning, and patient outcomes.

Consumables include antibodies, kits & reagents, probes, and other related tools form the foundation of modern cancer diagnostics. They empower clinicians to perform precise, dependable, and increasingly personalized tests, leading to earlier cancer detection and customized treatment strategies for individual patients.

Furthermore, key players in the industry are making innovative launches that would drive this segment's growth in the market. For instance, in August 2024, Oncosure developed and launched a rapid cancer screening test that can detect all types of cancer using just a single blood draw. This indicates that Oncosure has developed and launched an innovative diagnostic tool that rapidly identifies cancer. These factors have solidified the segment's position in the global cancer diagnostics market.

Top of Form

Geographical Analysis

North America is expected to hold a significant position in the global cancer diagnostics market, with the highest market share

North America is expected to hold the largest market share in the global cancer diagnostics market. North America, particularly the United States, has a high cancer prevalence, which fuels the demand for cancer diagnostics solutions.

According to the National Institutes of Health (NIH) data in May 2024, cancer has a significant impact on society both in the United States and globally. Cancer statistics offer insight into the scope of the disease and reflect its burden on society. In 2024, it is estimated that 2,001,140 new cases of cancer will be diagnosed in the United States, and 611,720 people will succumb to the disease. The escalating incidence of cancer underscores the urgent need for cancer diagnostics solutions that are both accessible and cost-effective.

The field of early cancer screening is in dire need of a revolution. Over the next 30 years, more than 40 million Americans are expected to be diagnosed with late-stage cancer, representing 44% of all new cancer diagnoses in the U.S. In this region, a major number of key players are present, including government initiatives, programs, and product approvals that would drive this market growth.

For instance, in February 2024, the National Institutes of Health (NIH) launched the Cancer Screening Research Network (CSRN) to evaluate and advance emerging technologies for cancer screening. This initiative is part of the broader efforts to support the Biden-Harris administration’s Cancer Moonshot initiative, which aims to accelerate progress in cancer research and reduce cancer mortality by making significant advances in early detection and treatment.

Also, in August 2024, the Biden-Harris Administration's ARPA-H (Advanced Research Projects Agency for Health) launched a new program aimed at developing an at-home multi-cancer screening test. This initiative is designed to revolutionize the way we detect cancers, especially those that are difficult to diagnose early.

Similarly, in August 2024, Illumina, Inc. announced that the Food and Drug Administration (FDA) had approved its TruSight Oncology (TSO) Comprehensive test as an in vitro diagnostic (IVD) tool, along with its first two companion diagnostic (CDx) indications. This approval marks a significant advancement in cancer diagnostics, providing a valuable tool for both clinicians and patients. Thus, the above factors are consolidating the region's position as a dominant force in the global cancer diagnostics market.

Competitive Landscape

The major global players in the cancer diagnostics market include F. Hoffmann-La Roche Ltd, Abbott, Thermo Fisher Scientific Inc., Siemens Healthcare Private Limited, GE HealthCare, Illumina, Inc., Bio-Rad Laboratories, Inc., Hologic, Inc., Koninklijke Philips N.V., BD, and QIAGEN, among others.

Key Developments

- In January 2025, Roche received FDA approval for a companion diagnostic—a test designed to identify patients who are most likely to benefit from a specific treatment. In this case, the test determines whether patients with HER2-ultralow metastatic breast cancer are eligible for treatment with ENHERTU.

- In September 2024, Roche announced an expansion of its digital pathology platform by integrating over 20 advanced AI algorithms from eight new collaborators. Digital pathology involves scanning traditional glass microscope slides and analyzing them using digital tools, including AI, to improve diagnostic accuracy and efficiency.

| Metrics | Details | |

| CAGR | 8.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Consumables, Instruments |

| Indication | Breast Cancer, Colorectal Cancer, Cervical Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Ovarian Cancer, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and product pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzed product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global cancer diagnostics market report delivers a detailed analysis with 57 key tables, more than 51 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.