Companion Diagnostics Market Size

The global companion diagnostics market reached US$6.1 billion in 2022 and is projected to witness lucrative growth by reaching up to US$15.0 billion by 2030. The global companion diagnostics market is expected to exhibit a CAGR of 12.2% during the forecast period (2024-2031), according to DataM Intelligence report.

Companion diagnostics refer to medical tests or devices that are used alongside specific drugs or therapies to help identify patients who are most likely to benefit from those treatments. These diagnostics are designed to determine whether a patient's specific genetic or molecular characteristics make them suitable candidates for a particular medication or therapy.

The main purpose of companion diagnostics is to personalize medical treatments and improve patient outcomes by ensuring that the right treatment is given to the right patient at the right time. By identifying patients who are more likely to respond positively to a particular drug, companion diagnostics can help avoid ineffective treatments and reduce the risk of adverse side effects.

Companion diagnostics typically involve analyzing genetic markers, gene mutations, protein expression levels, or other biomarkers in a patient's tissue sample or bodily fluids. The results of these tests provide valuable information about the patient's specific disease or condition and guide healthcare professionals in making treatment decisions.

Companion Diagnostics Market Scope

| Metrics | Details |

| CAGR | 12.2% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2023-2030 |

| Data Availability | Value (US$) |

| Segments Covered | Product & Services, Technology, Indication, End User |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For more details on this report –Request for Sample

Companion Diagnostics Market Dynamics

Advancing Novel Frameworks for Companion Diagnostics is Expected to Drive Global Companion Diagnostics Market Growth

The development of companion diagnostics continues to progress rapidly, showing no signs of slowing down. It is crucial for the entire landscape surrounding companion diagnostics to keep pace with this growth.

Collaborations between pharmaceutical and diagnostic companies are essential in delivering high-quality care and improving patient outcomes, especially as medicine becomes increasingly personalized. The evolving regulatory requirements and novel development pathways also influence the strategies adopted by pharmaceutical and diagnostics companies.

The 14th annual Advancing Novel Frameworks for Companion Diagnostics conference, organized by the Cambridge Healthtech Institute, aims to address these issues, promote collaboration between pharmaceutical and diagnostics companies, and explore areas of agreement and divergence among executives, business experts, regulators, scientists, clinicians, and other stakeholders involved in companion diagnostics, drug-diagnostics co-development, and precision medicine.

Growing Partnerships for Advanced Next-Generation Sequencing Companion Diagnostics is Expected to Drive Global Companion Diagnostics Market Growth

On January 5, 2023, QIAGEN, a company specializing in molecular diagnostics, announced an exclusive strategic partnership with Helix, a population genomics leader based in California. The partnership aims to advance companion diagnostics for hereditary diseases. Companion diagnostics play a crucial role in precision medicine by helping guide clinical decision-making and identifying patients who are most likely to benefit from specific therapeutic products.

The partnership will leverage Helix's Laboratory Platform, which has received FDA de novo class II authorization for a whole exome sequencing platform. This innovative solution will be marketed and contracted exclusively by QIAGEN in the United States. It will complement both companies' existing offerings, such as Helix's population genomics programs and QIAGEN's diagnostic expertise and QIAseq Human Exome Kits. The collaboration will support hereditary disease therapies and research initiatives outside the United States.

QIAGEN is known for its expertise in precision medicine and has numerous collaboration agreements with global pharmaceutical and biotechnology companies. These collaborations aim to develop and commercialize companion diagnostic tests for drug candidates. QIAGEN's companion diagnostic offerings encompass technologies ranging from next-generation sequencing (NGS) to polymerase chain reaction (PCR) and digital PCR (dPCR).

The company has also received FDA approval for 11 PCR-based companion diagnostics and has collaborated with Neuron23 to develop an NGS-based companion diagnostic for a novel Parkinson's disease drug.

The partnership between QIAGEN and Helix represents a significant step forward in advancing companion diagnostics for hereditary diseases. By combining their respective strengths, the companies aim to improve patient access to genomic testing and target treatments more effectively using genomic medicine. Thus, owing to the above factors, the market is expected to drive over the forecast period.

Challenges Associated with Companion Diagnostic Development are Expected to Hamper Global Companion Diagnostics Market Growth

According to the National Center for Biotechnology Information, recent advancements in cancer treatment involve targeting specific gene mutations present in cancer cells. To streamline the drug discovery process, enhance clinical trials, and personalize cancer therapy, the development of companion diagnostic tests has become crucial.

However, there are several challenges associated with companion diagnostic development. For instance, pharmaceutical companies may be hesitant to limit the use of their drugs through biomarker tests.

Additionally, there are difficulties in progressing companion diagnostics from the discovery stage to clinical validation, and regulatory obstacles in aligning the review processes of therapeutics and diagnostic devices used for personalized treatment. Thus, owing to the above factors, the market is expected to hamper over the forecast period.

Companion Diagnostics Market Segment Analysis

The global companion diagnostics market is segmented based on product & services, technology, indication, end user, and region.

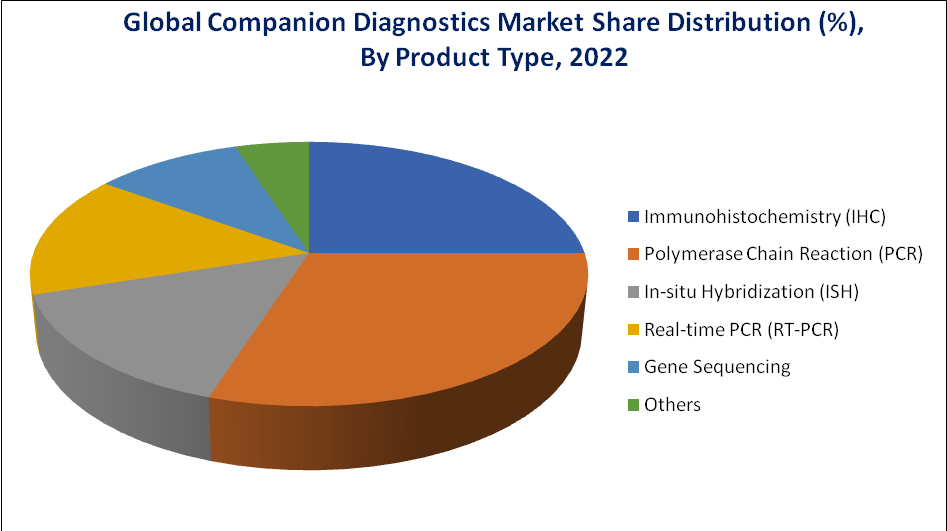

The PCR Segment Accounted for Approximately 34.3% of the Companion Diagnostics Market Share

The PCR segment can be attributed to the ease of use and widespread availability of PCR kits & reagents in companion diagnostic testing, growing applications of PCR in the high-throughput detection of mutants with a limited or low allele frequency of genes, and high turnaround time of PCR as compared to other technologies. PCR techniques are used in clinical and research laboratories for a broad variety of applications, which include clinical diagnosis, criminal forensics, and biomedical research.

PCR-based molecular diagnostic tests are increasingly being used to guide patient management, particularly in the fields of infectious diseases, cancer, and congenital abnormalities. Globally, the prevalence of genetic, infectious, and chronic diseases, coupled with the increased availability of genetic and genomic information, is on the rise, and it has led to the rapid incorporation of PCR techniques in clinical laboratories.

The rising COVID-19 cases and the spread of the disease in major countries have increased the demand for diagnostic tests of the virus in the suspected population. This trend is primarily due to the low or non-availability of rapid or specific diagnostic tests for such diseases. Therefore, pertaining to the broad applications of PCR in clinical diagnostics, the segment is likely to register high growth during the forecast period.

The high specificity, sensitivity, and low sample requirement make PCR-based molecular assay a go-to technique for clinical diagnosis. PCR-based molecular assays are becoming the primary mode of diagnosis for the detection of pathogens in case of a rapid disease outbreak, such as the recent Zika and coronavirus outbreaks.

Source: DataM Intelligence Analysis (2023)

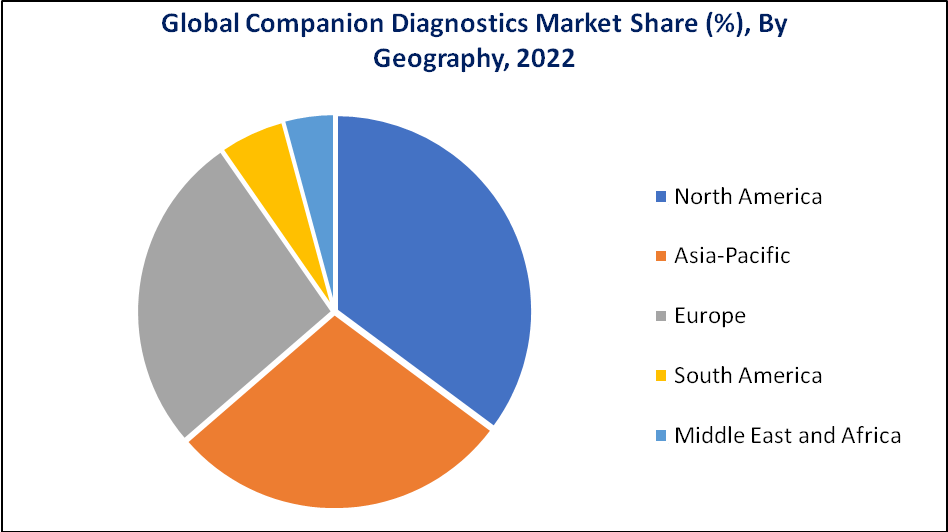

Companion Diagnostics Market Geographical Share

North America Accounted for Approximately 39.8% of the Market Share in 2022, Owing to the Increasing FDA Approvals and Increasing Prevalence of Chronic Diseases

According to the American Cancer Society, it is projected that the United States will witness approximately 1.9 million new cancer cases by the conclusion of 2022. Additionally, individuals afflicted with long-term illnesses are the primary consumers of companion diagnostics within the country, thereby propelling the expansion of the market.

Furthermore, on August 12, 2022, the U.S. Food and Drug Administration (FDA) granted premarket approval to Thermo Fisher Scientific’s Oncomine Dx Target Test as a companion diagnostic (CDx) to identify patients whose tumors have a HER2 (ERBB2) activating mutation (SNVs & Exon 20 Insertion) in non-small cell lung cancer (NSCLC) who may be candidates for ENHERTU (fam-trastuzumab deruxtecan-nxki). ENHERTU is a specifically engineered HER2-directed antibody-drug conjugate (ADC) being jointly developed and commercialized by Daiichi Sankyo and AstraZeneca.

Source: DataM Intelligence Analysis (2023)

Companion Diagnostics Market Competitive Landscape

The major global players in the market include F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Qiagen N.V., Thermo Fisher Scientific, Inc., Abbott Laboratories, Inc., Biomerieux SA, Siemens Healthcare, Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter Inc.), Guardant Health and Illumina Inc and others.

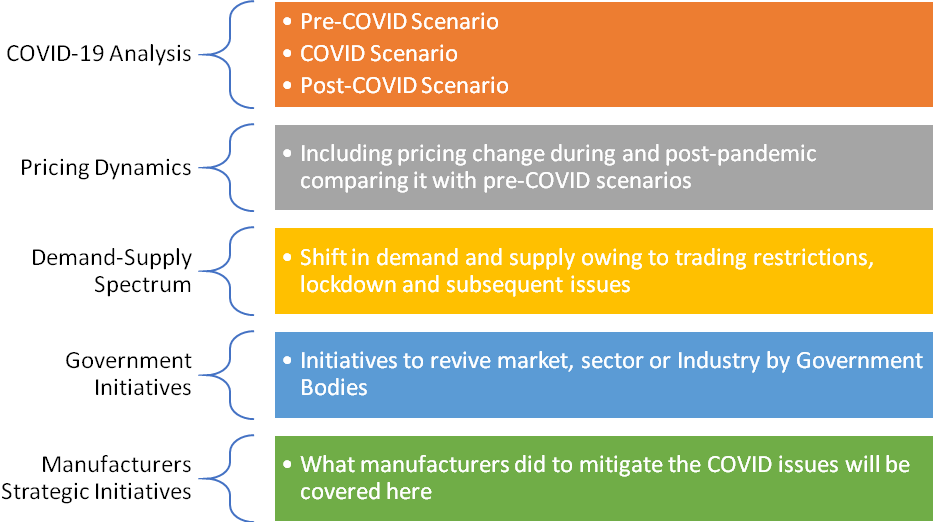

COVID-19 Impact Analysis

Russia Ukraine Conflict Analysis

The Russian-Ukraine war has had an impact on the companion diagnostics market. The conflict has disrupted healthcare systems and infrastructure in Ukraine, leading to challenges in accessing medical services and supplies, including companion diagnostics.

The war has created an unstable environment for research and development activities in the region, affecting the progress and advancement of companion diagnostics. Limited resources and the diversion of funds towards military efforts have likely hindered investments in healthcare and biomedical research, including the development and implementation of companion diagnostics.

Additionally, the conflict has resulted in population displacement and migration, causing disruptions in patient care and healthcare delivery systems. This disruption impacted the demand for companion diagnostics and limit their accessibility to individuals in need.

Moreover, the geopolitical tensions and economic instability resulting from the war had broader implications for international collaborations and investments in the companion diagnostics market. Uncertainty and geopolitical risks can deter foreign investors and companies from engaging in the Ukrainian market, potentially impacting the availability and adoption of companion diagnostics in the region.

Key Developments

- On February 10, 2022, Genetron Holdings Limited, a leading precision oncology platform company in China that specializes in offering molecular profiling tests, early cancer screening products, and companion diagnostics development, announced that it has signed a collaboration agreement with HUTCHMED (China) Limited for the joint development of a companion diagnostic (CDx) test for ORPATHYS (savolitinib) in China.

- On January 13, 2022, Amoy Diagnostics Co., Ltd., and PREMIA Holdings (HK) Limited announced the commercial launch of the AmoyDx Pan Lung Cancer PCR Panel (the “PLC Panel”) in Japan as a reimbursed companion diagnostic for multiple anti-cancer agents. AmoyDx is the inventor and manufacturer and PREMIA is the developer of the PLC Panel in Japan.

- On July 15, 2022, Almac Diagnostic and AstraZeneca CDx partnered. They intend to use NGS and qPCR to investigate new disease areas.

Why Purchase the Report?

- To visualize the global companion diagnostics market segmentation based on the product & services, technology, indication, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of companion diagnostics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global companion diagnostics market report would provide approximately 69 tables, 71 figures, and 195 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies