Global Medical Devices Market: Industry Outlook

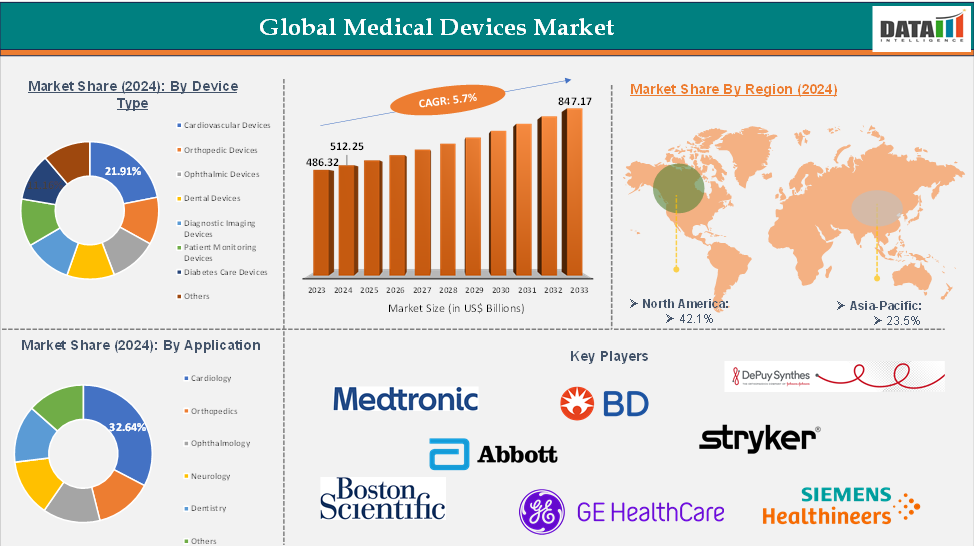

The global medical devices market reached US$ 486.32 billion in 2023, with a rise of US$ 512.25 billion in 2024, and is expected to reach US$ 847.17 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2025-2033.

The global medical devices market is experiencing significant growth due to advancements in diagnostics, therapeutics, and patient monitoring technologies. The growing burden of chronic conditions like cardiovascular disorders, diabetes, and respiratory diseases is driving demand for advanced devices like minimally invasive surgical systems, implantable devices, and connected wearables. Digital health integration, particularly AI-powered diagnostics, is transforming care delivery by improving precision and reducing hospital stays. Opportunities lie in emerging markets with expanding healthcare infrastructure and accelerating adoption of affordable, portable, and smart devices.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Chronic Diseases

The global medical devices market is driven by the increasing prevalence of chronic diseases like cardiovascular disorders, diabetes, cancer, and respiratory illnesses. Longer life expectancy and sedentary lifestyles have led to a surge in patient populations requiring continuous monitoring, early diagnosis, and advanced treatment options.

For instance, the US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases. Over the past two decades, prevalence has steadily increased, and this trend is expected to continue. An increasing proportion of Americans are dealing with multiple chronic conditions, with 42% having two or more and 12% having at least five. Chronic diseases also significantly impact the US healthcare system, accounting for 90% of annual $4.1 trillion expenditure.

Moreover, the growing burden of multimorbidity among aging populations has pushed hospitals and homecare providers to adopt technologically advanced medical devices, presenting long-term growth opportunities.

Restraint: High Cost of Advanced Medical Devices and Procedures

The global medical devices market faces significant challenges due to the high cost of advanced technologies like robotic-assisted surgical systems and AI-enabled diagnostics. These devices are less accessible in low- and middle-income regions, and reimbursement limitations and rising healthcare expenditure burden hospitals, clinics, and patients. This cost barrier restricts equitable access to life-saving technologies and pressures healthcare providers to balance quality care with affordability, impacting market growth.

Cardiovascular devices are expensive medical devices, ranging from pacemakers to ICDs. They are crucial for managing life-threatening conditions, but their high costs and ongoing maintenance make them a financial burden for healthcare systems, limiting access in lower-income regions. Complex systems can cost up to $50,000 per valve.

For more details on this report, Request for Sample

Segmentation Analysis

The global medical devices market is segmented based on device type, application, end user, and region.

Device Type:

The cardiovascular devices from the device type segment the expected to have 21.91% of the medical devices market share.

The cardiovascular devices market is growing due to the increasing global burden of heart-related disorders, such as coronary artery disease, heart failure, and arrhythmias, and the increasing prevalence of risk factors like diabetes, hypertension, obesity, and sedentary lifestyles. The adoption of minimally invasive procedures, such as transcatheter aortic valve replacement and percutaneous coronary interventions, has fueled the uptake of stents, catheters, and structural heart devices. Technological advancements, such as next-generation pacemakers and AI-enabled imaging systems, are also enhancing treatment precision and patient outcomes.

For instance, in April 2025, Medtronic, the only healthcare technology company with two FDA-approved PFA systems, conducted two studies during Heart Rhythm 2025. The first study examined one-year outcomes among heart patients treated with Medtronic's Sphere-360 single-shot PFA catheter. Results showed that treatment with Sphere-360 was associated with 88% freedom from arrhythmia recurrence and 98% chronically durable pulmonary vein isolation in targeted veins. The full study was published in Heart Rhythm.

Geographical Share Analysis

The North America global medical devices market was valued at 42.1% market share in 2024

The North American medical devices market is experiencing growth due to advanced healthcare infrastructure, high healthcare expenditure, and rapid adoption of innovative technologies. The region has a strong presence of leading manufacturers and continuous R&D investments, accelerating the development of AI-enabled diagnostics, robotic-assisted surgeries, and connected wearable devices.

For instance, in June 2025, Cardinal Health has launched the Kendall DL Multi System, a multi-parameter, single-patient use monitoring cable and lead wire system. This system allows continuous monitoring of cardiac activity, blood oxygen level, and temperature with one point of connection, enhancing clinician workflows, determining the best care course, and maximizing hospital value.

Moreover, the high prevalence of chronic diseases like cardiovascular disorders, diabetes, and cancer drives demand for advanced diagnostic and therapeutic solutions. Supportive reimbursement frameworks and faster regulatory approvals also encourage device adoption. The shift towards home healthcare and remote patient monitoring solidifies North America's position as a leading market for medical technologies.

Major Players

The major players in the medical devices market include Medtronic, Johnson & Johnson (DePuy Synthes), Abbott Laboratories, Cardinal Health, Stryker Corporation, Siemens Healthineers, Becton, Dickinson and Company, GE Healthcare, Koninklijke Philips N.V., and Boston Scientific among others.

Key Developments

In July 2025, China's National Medical Products Administration (NMPA) has released a policy aimed at optimizing whole-life-cycle regulations for high-end medical devices, including AI-powered devices and medical robots. The policy outlines 10 regulatory measures to accelerate the development and approval of these technologies.

In June 2025, The International Biomed Cross (IBC) is a global initiative launched on 23 May to support the maintenance and repair of medical devices during disasters and health emergencies. It was initiated by the Andhra Pradesh MedTech Zone (AMTZ) with support from the Universal Clinical Engineering Federation. The IBC aims to build a global network of biomedical and clinical engineers to provide technical assistance to hospitals, clinics, and emergency units.

Report Scope

Metrics | Details | |

CAGR | 5.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Device Type | Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Dental Devices, Diagnostic Imaging Devices, Patient Monitoring Devices, Diabetes Care Devices, Others |

Application | Cardiology, Orthopedics, Ophthalmology, Neurology, Dentistry, Others | |

End User | Hospitals, Ambulatory Surgical Centers (ASCs), Homecare Settings, Others. | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global medical devices market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here