Wearable Medical Devices Market Overview

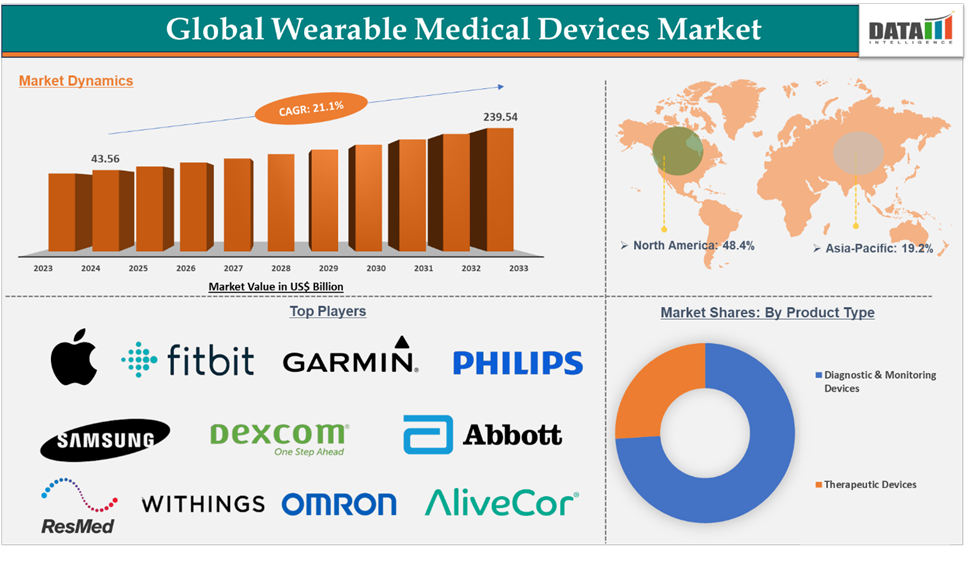

Wearable Medical Devices Market reached US$ 43.56 billion in 2024 and is expected to reach US$ 220.98 billion by 2033, growing at a CAGR of 20.3% during the forecast period 2025-2033.

In 2022, the Global Wearable Medical Devices Market was at US$ 33.67 billion, and by 2023, it had reached US$ 38.04 billion, marking a significant growth in market value.

The wearable medical devices market is experiencing lucrative growth due to the rising prevalence of chronic diseases, increasing awareness among the population regarding their health, increasing adoption of telemedicine services, and technological advancements in wearable devices. The data collected can be transmitted directly to healthcare providers, enhancing clinical decision-making and potentially improving patient outcomes. However, the rapid adoption of wearable medical devices raises concerns about user acceptance, security, and ethical implications. Addressing these issues is crucial for the full realization of their potential in modern healthcare systems.

Executive Summary

For more details on this report – Request for Sample

Wearable medical devices Market Dynamics: Drivers & Restraints

The growing prevalence of chronic diseases is driving the market growth

Wearable medical devices are gaining huge importance due to the rising prevalence of chronic diseases. These devices find their major application in monitoring patients with chronic illnesses, such as diabetes, cardiovascular disease, respiratory conditions, and cancer etc. Monitoring these patients in traditional methods through frequent physician visits can pose a significant economic burden on the patient and the healthcare system. Hence, wearable medical devices have evolved, which are significantly reducing the healthcare costs and increasing the treatment efficiency and patient outcomes.

As the technology advances, global healthcare spending rises, along with the growing prevalence of chronic diseases, the adoption of wearable medical devices is expected to rapidly grow in future.

For instance, according to the International Diabetes Federation, in 2024, globally, 588.71 million people are living with diabetes, and by 2050, this number is expected to reach 852.47 million. Among these people, the adoption of wearable medical devices like continuous glucose monitoring devices, insulin pumps is rapidly growing. The presence of key market players such as Abbott, Dexcom, Inc., who have gained popularity in the diabetes devices landscape, and their constant innovations to fulfill the high unmet needs, is expected to further boost the market growth.

Moreover, governments and healthcare organizations all over the world are advocating for these devices to reduce readmissions into hospitals and enhance patient outcomes. They also become more attractive with their association with digital health platforms and mobile applications for real-time data tracking, analysis, and alert.

The financial burden of chronic diseases, accounting for 90% of annual healthcare expenditure, underscores the need for cost-effective solutions. The rising prevalence of chronic diseases and the need for multifunctional wearables drive advancements and market expansion worldwide.

Data privacy and security concerns may restrain the market growth

The wearable medical device market faces challenges due to data privacy and security concerns. With the vast amount of sensitive health data generated and transmitted, concerns about unauthorized access, data breaches, and misuse of personal health information arise. Cybersecurity threats, particularly as devices become interconnected through IoT, pose a challenge to user trust. The lack of standardized regulations across regions further complicates the situation. Consumers are hesitant to adopt these technologies due to privacy concerns, potentially slowing market growth. Companies face increasing pressure to invest in robust security protocols and comply with evolving legal frameworks.

Wearable Medical Devices Market Segment Analysis

The global wearable medical devices market is segmented based on product type, application, and region.

Diagnostic & monitoring devices in the type segment accounted for 74.3% of the market share in 2024 in the global wearable medical devices market

In 2022, the Diagnostic & Monitoring Devices segment represented one of the fastest-growing segments, reaching US$20.66 billion, and further increased to US$ 23.39 billion in 2023.

The diagnostic & monitoring devices refer to wearable medical devices whose purpose is to measure and assess the health parameters in real time, and offer continuous data on one’s health. These mainly include blood pressure monitoring devices, glucose monitoring devices, ECG monitoring devices, fitness trackers, sleep tracking devices, etc.

The dominance of diagnostic & monitoring devices is attributable to increasing awareness of health among the public, rising prevalence of chronic diseases, increasing demand for home-based care, etc. Moreover, with the rising adoption of telemedicine, these devices play a crucial role in diagnosing patients, monitoring their health, and transmitting the data to physicians for validation and to make clinical decisions.

As per DataM Intelligence, the global telemedicine market was valued at US$129.70 billion in 2024 and is expected to reach US$488.89 billion by 2033, growing at a CAGR of 16.8% during the forecast period 2025-2033. With the growing telemedicine market, the demand for wearable diagnostic & monitoring devices is expected to grow significantly.

Moreover, the rising technological advancements, innovations, and product launches are also expected to boost the segment's growth in the future.

For instance, in October 2024, Samsung launched the Galaxy Ring in India, a wearable device designed to enhance digital health through Galaxy AI. The sleek and compact device offers personalized health insights and tailored experiences. The Galaxy Ring is a significant step in active and autonomous health management, providing users with valuable guidance for healthier lifestyles. Its advanced sensors provide insights into users' lifestyle patterns, helping them manage their health goals.

Wearable Medical Devices Market Geographical Analysis

North America dominated the wearable medical devices market with the highest share of 48.4% in 2024

North America led the Global Wearable Medical Devices Market in 2022 with a market size of US$ 12.00 billion and expanded further to US$ 13.55 billion in 2023.

The North America region, especially the United States, is well known for its innovations in the healthcare industry. The country has a greater number of health technology firms, heavily investing in advancing the healthcare landscape worldwide. In the wearable medical devices market landscape, North America’s dominance is attributed to the high burden of chronic diseases, such as diabetes, cardiovascular diseases, and obesity, which are giving rise to a considerable demand for wearable technologies where monitoring and management can be performed in real time.

For instance, according to the Centers for Disease Control and Prevention, the US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases. Over the past two decades, prevalence has steadily increased, and this trend is expected to continue.

Moreover, the high disposable income, along with the readiness of consumers to adopt advanced medical technologies, further boosts the market growth. Government initiatives to promote preventive healthcare and telemedicine encourage adoption as well. Additionally, the key player's innovations and the regulatory approvals further drive the market growth.

For instance, in April 2025, DexCom, Inc. announced the U.S. Food and Drug Administration (FDA) approval of Dexcom G7 15 Day Continuous Glucose Monitoring System for use in people over the age of 18 with diabetes. This device is clinically proven to lower HbA1c levels and reduce hyper- and hypoglycaemia.

Wearable Medical Devices Market Major Players

The major players in the Wearable medical devices market are Apple Inc., Fitbit (Google LLC), Garmin Ltd., SAMSUNG, Koninklijke Philips N.V., Dexcom, Inc., Abbott, Resmed, Withings, OMRON Healthcare, Inc., and AliveCor, Inc., among others.

Key Development

- In May 2025, AliveCor, Inc. announced the launch of KardiaMobile 6L Max, which is a new artificial intelligence (AI) based personalized ECG system. Along with this system, the company has also launched KardiaAlert, an app feature, exclusively for KardiaCare subscribers. With this system, the user can monitor their heart health and take timely actions.

- In September 2024, Senseonics Holdings, Inc., and Ascensia Diabetes Care announced that the U.S. Food and Drug Administration (FDA) approved Eversense 365 CGM system. This is a next-generation 1 year continuous glucose monitoring device designed to be used in patients aged 18 years or older with type 1 or type 2 diabetes.

- In September 2024, Abbott announced the availability of Lingo, a prescription-free continuous glucose monitoring device in the U.S. market. Lingo system is based on Abbott’s FreeStyle Libre continuous glucose monitoring technology and consists of a biosensor and a mobile app.

Market Scope

| Metrics | Details | |

| CAGR | 21.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Diagnostic & Monitoring Devices and Therapeutic Devices |

| Component | Remote Patient Monitoring, Sports and Fitness Tracking, Chronic Disease Management, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |