Pacemakers Market: Industry Outlook

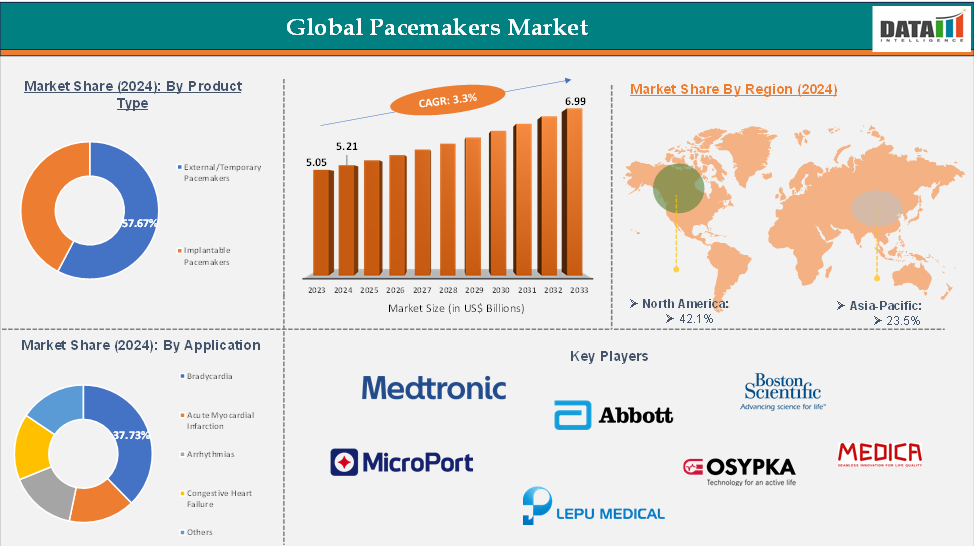

The global pacemakers market reached US$ 5.05 billion in 2023, with a rise of US$ 5.21 billion in 2024, and is expected to reach US$ 6.99 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2025-2033.

Key Trends and Insights

The North America pacemaker market accounted for the largest revenue share in 2024, driven by advanced healthcare infrastructure and high adoption of cardiac devices.

The U.S. pacemaker market held the largest regional market share, owing to rising cardiovascular disease prevalence and supportive reimbursement policies.

Based on product type, the External/Temporary Pacemakers segment is expected to dominate the market in 2024, due to better synchronization and improved patient outcomes.

Leadless pacemakers are witnessing significant adoption, representing a fast-growing segment due to minimally invasive implantation and reduced complications.

Based on end-user, hospitals is expected to account for the largest revenue share in 2024, as they perform the majority of cardiac device implantations.

Market Size and Forecast Analysis

Historical Year: 5.05 Bn

Base Year: 5.21 Bn

Forecast Year: 6.99 Bn

CAGR: 3.3%

Largest Region: North America

Executive Summary

Dynamics: Drivers & Restraints

Driver—Rising Prevalence of Cardiovascular Diseases

The global pacemakers market is experiencing a surge due to the rise in cardiovascular diseases, such as arrhythmias, heart failure, and bradycardia, due to aging populations, lifestyle changes, and comorbidities like diabetes and hypertension. This demand for advanced cardiac pacing devices is primarily driven by developed regions like North America and Europe, where awareness and healthcare infrastructure are higher. Emerging markets in Asia-Pacific, including India, are also experiencing a rise in cardiovascular disease prevalence due to urbanization, sedentary lifestyles, and dietary changes.

For instance, between 2025 and 2050, global cardiovascular disease prevalence is projected to increase by 90%, with crude mortality and disability-adjusted life years (DALYs) rising by 73.4% and 54.7%, respectively .

Restraint—High Cost of Devices

The high cost of pacemaker devices in the US, ranging from USD 9,600 to USD 96,000, poses a significant market challenge. In contrast, European countries have lower prices, such as USD 1,400 for dual-chamber pacemakers. This disparity limits accessibility in low- and middle-income regions, restraining market penetration despite the increasing prevalence of cardiovascular diseases.

For more details on this report, Request for Sample

Segmentation Analysis

The global pacemakers market is segmented by product type, application, end user, and region.

Product Type—The external/temporary pacemakers from the product type segment the expected to have 57.6% of the pacemakers market share.

The external/temporary pacemakers segment is gaining momentum due to the critical role of external or temporary pacemakers in acute cardiac care. These devices are used in emergency settings like cardiac surgery, myocardial infarction, and transient bradyarrhythmias. The growth of this segment is driven by increasing hospital admissions, demand for short-term pacing solutions, and advancements in device portability and safety. Temporary pacemakers offer a less invasive and cost-effective solution, making them preferred in intensive care units and cardiac intervention centers.

For instance, in April 2025, Northwestern University has developed a small, portable pacemaker for temporary use in newborns with congenital heart defects. The device, smaller than a grain of rice, can be injected via syringe and activated by light pulses from a wearable chest patch. It operates on a galvanic cell battery powered by biofluids and dissolves naturally after use, eliminating the need for surgical removal. This innovative approach addresses the need for safe, temporary pacing in pediatric patients.

Application—The bradycardia from the application segment the expected to have 32.39% of the pacemaker market share.

Pacemakers are crucial in treating bradycardia, a condition characterized by abnormally slow heart rates that can lead to fatigue, dizziness, and even heart failure. They restore normal heart rhythm and improve patient quality of life. The increasing prevalence of bradyarrhythmias, especially among the aging population, has increased demand for permanent pacemaker implantation. Advancements in device technology, such as dual-chamber and leadless pacemakers, have enhanced safety and patient compliance, driving market growth. This segment drives revenue globally, especially in North America and Europe, where early diagnosis and adoption rates are high.

Geographical Share Analysis

The North America global pacemakers market was valued at 42.1% market share in 2024

North America region is expected to dominate the global pacemaker’s market due to high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and arrhythmia management awareness. The region benefits from advanced pacemaker technologies, reimbursement policies, and aging populations. The region's early diagnosis, clinical adoption, and favorable regulatory environment make it a strong growth engine for pacemaker demand, contributing to the region's significant growth in cardiac arrhythmias.

For instance, in November 2024, Abbott has launched the AVEIR VR single-chamber ventricular leadless pacemaker for treating patients with slow heart rhythms in India, which has been approved by the CDSCO and the US FDA.

The Asia Pacific global pacemakers market was valued at 42.1% market share in 2024

The Asia-Pacific pacemakers market is experiencing rapid growth due to rising cardiovascular disease prevalence, urbanization, and lifestyle factors. Key markets include India, Japan, and China, driven by increased awareness, expanding hospital networks, and improved healthcare access. Despite affordability concerns in low- and middle-income countries, government initiatives, insurance coverage, and technological innovations are driving adoption. The region's large patient pool and demand for minimally invasive pacing solutions are expected to sustain market growth in the coming years.

For instance, in June 2025, Medtronic has introduced the smallest leadless Minic AV2 and Micra VR2 pacemakers, offering a revolutionary solution for bradycardia patients. These pacemakers are less invasive, efficient, and effective in managing cardiac rhythms. Medtronic's innovation-driven approach aims to cater to emerging India's changing cardiac requirements, offering longer operation durations and a more efficient healthcare system.

Competitive Landscape

The major players in the pacemakers market include Medtronic, Abbott, Boston Scientific Corporation, MicroPort Corporation, Lepu Medical Technology (Beijing) Co., Ltd., Medico S.p.A., and Osypka Medical GmbH among others.

Key Developments

In December 2024, Manipal Hospitals in India has introduced the Abbott Aveir Leadless Pacemaker, a wireless device powered by advanced nanotechnology, to improve cardiac care in India, offering superior longevity, compatibility, and remote monitoring capabilities.

In March 2024, UC San Diego Health has successfully implanted the world's first dual chamber and leadless pacemaker system, helping treat people with abnormal heart rhythms. The device, held by cardiologist Ulrika Birgersdotter-Green, is the first of its kind in San Diego.

Report Scope

Metrics | Details | |

CAGR | 3.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | External/Temporary Pacemakers, Implantable Pacemakers |

Application | Bradycardia, Acute Myocardial Infarction, Arrhythmias Congestive Heart Failure, Others | |

End User | Hospitals, Ambulatory Surgical Centers, Cardiology & Electrophysiology Clinics, Academic & Research Institutes | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global pacemakers market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here