Medical Device Contract Manufacturing Market Size & Industry Outlook

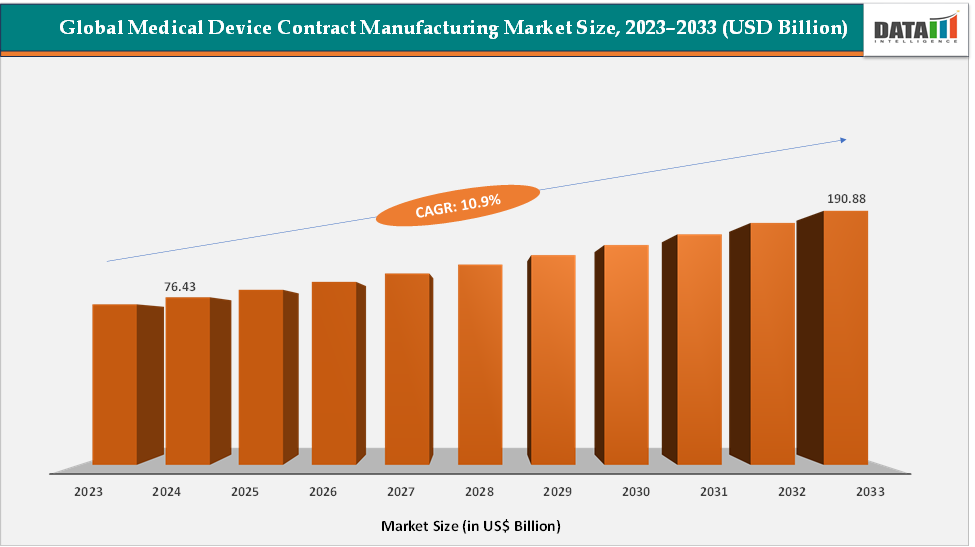

The global medical device contract manufacturing market size reached US$ 76.43 Billion in 2024 from US$ 69.54 Billion in 2023 and is expected to reach US$ 190.88 Billion by 2033, growing at a CAGR of 10.9% during the forecast period 2025-2033. The market is being driven primarily by the increasing trend of outsourcing by Original Equipment Manufacturers (OEMs) seeking to reduce costs, accelerate time-to-market, and focus on core R&D activities. Rising demand for complex and high-precision devices, such as cardiovascular implants, orthopedic implants, and diagnostic equipment, has led companies to rely on specialized contract manufacturers for advanced production capabilities.

Technological advancements, including automation, additive manufacturing, and IoT-enabled devices, further boost outsourcing opportunities. Additionally, regulatory compliance pressures and stringent quality standards encourage OEMs to collaborate with experienced contract manufacturers. For instance, Jabil and other major market players have partnered with multiple startups and established medical companies to develop and manufacture innovative devices with AI and robotics efficiently. The growing healthcare needs in aging populations globally and the shift toward minimally invasive procedures also drive market growth, creating long-term demand for scalable, reliable manufacturing solutions.

Key Market Highlights

North America dominates the medical device contract manufacturing market with the largest revenue share of 43.78% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 10.7% over the forecast period.

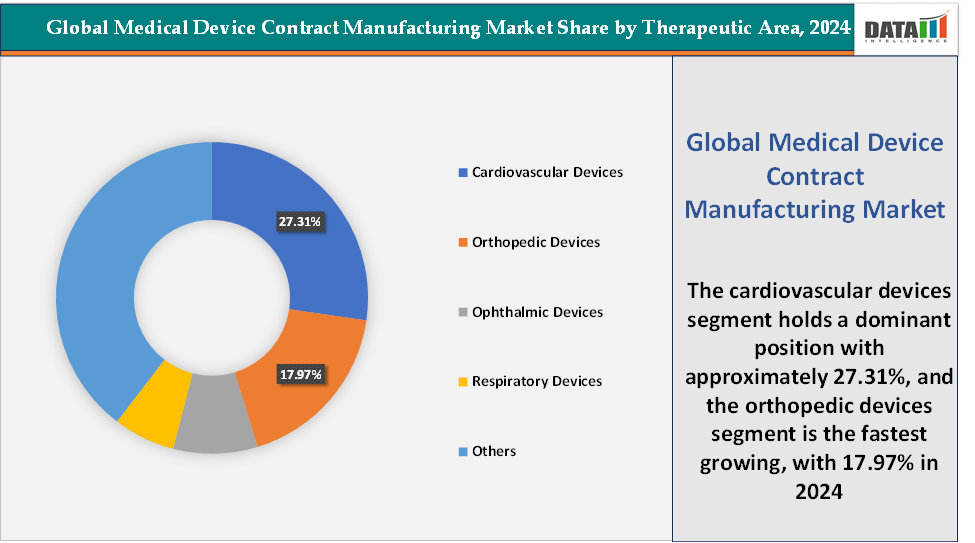

Based on therapeutic area, the cardiovascular devices segment led the market with the largest revenue share of 27.31% in 2024.

The major market players in the medical device contract manufacturing market are Jabil Inc., Thermo Fisher Scientific Inc. (PPD), Integer Holdings Corporation, Sanmina Corporation, Celestica Inc., Phillips Medisize, Plexus Corp., Inc., and Gerresheimer AG, among others

Market Dynamics

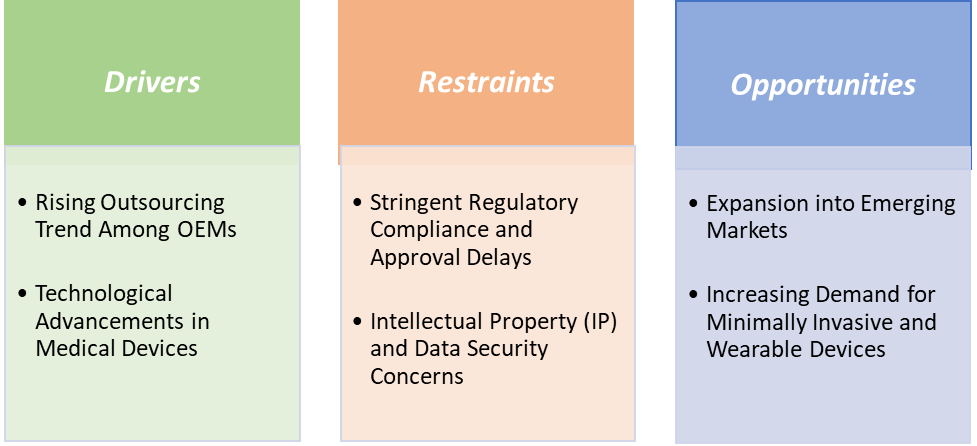

Drivers: The rising outsourcing trend among OEMs is significantly driving the medical device contract manufacturing market growth

The rising outsourcing trend among Original Equipment Manufacturers (OEMs) is profoundly shaping the growth trajectory of the medical device contract manufacturing market. OEMs are increasingly turning to specialized contract manufacturers to handle complex production processes, reduce capital expenditure, and optimize operational efficiency, allowing them to concentrate on core competencies such as research and development, regulatory compliance, and marketing.

Innovations in medical devices by the market players are further accelerating the market growth. For instance, in June 2025, Phillips Medisize launched TheraVolt Medical Connectors. As the first medical connectors launched under the Phillips Medisize brand, TheraVolt is engineered to optimize device integration, functionality, reliability and performance. TheraVolt provides device engineers with enhanced functionality, offering solutions to handle both signals and high voltage lines. With the launch of TheraVolt, the first of several Phillips Medisize–branded connectors, the company is excited to bring deeper collaboration and innovation to complement exceptional contract design and manufacturing services and proven Molex connectivity solutions to medtech customers.

Real-world instances include Sanmina’s collaboration with cardiac device manufacturers to produce complex pacemakers and Integer Holdings’ work with orthopedic OEMs to manufacture patient-specific implants, illustrating how CMOs are pivotal in bringing high-quality medical devices to the global market efficiently. In essence, the outsourcing trend allows OEMs to manage costs, accelerate innovation, and expand their market reach, making it a key driver in the rapid growth and evolution of the medical device contract manufacturing industry.

Restraints: Stringent regulatory compliance and approval delays are hampering the growth of the market

Stringent regulatory compliance and approval delays are significant challenges hampering the growth of the medical device contract manufacturing market. The industry is heavily regulated to ensure patient safety, with companies required to adhere to strict standards set by regulatory bodies such as the US FDA and the European Medicines Agency (EMA). For instance, in March 2025, Dexcom received a warning letter from the FDA following inspections of its San Diego and Mesa facilities, highlighting deficiencies in manufacturing processes and quality management systems.

These regulatory hurdles not only delay product approvals but also increase costs and operational risks. Furthermore, evolving regulations, such as the European Union Medical Device Regulations 2017/745, have added requirements for clinical evaluations, particularly for high-risk devices, further prolonging approval timelines. While these measures ensure the safety and efficacy of medical devices, the associated complexities and delays significantly affect time-to-market, cost efficiency, and overall growth in the medical device contract manufacturing sector.

For more details on this report – Request for Sample

Medical Device Contract Manufacturing Market, Segment Analysis

The global medical device contract manufacturing market is segmented based on device class, service type, therapeutic area, and region.

Therapeutic Area: The cardiovascular devices segment is dominating the medical device contract manufacturing market with a 27.31% share in 2024

The segment is driven by the rising global prevalence of cardiovascular diseases such as coronary artery disease, heart failure, and arrhythmias, which require advanced diagnostic and therapeutic devices. Companies like Medtronic and Boston Scientific have developed and received FDA approval for several innovative cardiovascular devices. Medtronic's product portfolio includes coronary balloons, catheters, stents, and guidewires, which are essential for treating various cardiovascular conditions. Boston Scientific offers a range of devices, such as the Agent drug-coated balloon catheter, designed to treat coronary in-stent restenosis by delivering paclitaxel to prevent vessel re-narrowing. These innovations highlight the critical role of specialized contract manufacturers in producing high-quality, FDA-approved cardiovascular devices that meet stringent regulatory standards and address complex medical needs.

Contract manufacturers play a pivotal role by providing specialized services such as precision machining, micro-molding, and regulatory compliance support, which are essential for producing complex Class II and III devices. The growing adoption of wearable cardiac monitors and implantable devices further amplifies the need for sophisticated manufacturing capabilities. Overall, the segment’s dominance is fueled by high demand for advanced cardiac care solutions, the necessity for specialized manufacturing expertise, and significant investments by industry leaders to enhance cardiovascular device offerings.

The orthopedic devices are the fastest-growing segment in the medical device contract manufacturing market, with a 17.97% share in 2024

The orthopedic devices segment is the fastest-growing in the medical device contract manufacturing market, driven by the increasing prevalence of musculoskeletal disorders, an aging population, and advancements in surgical techniques. This growth is particularly evident in the spine and trauma segments, which are expected to see the fastest expansion due to rising incidences of spinal injuries and sports-related trauma.

Contract manufacturers specializing in orthopedic devices provide essential services such as precision machining, forging, casting, and assembly of implants and surgical instruments. For instance, Unity Precision Manufacturing specializes in precision manufacturing of medical devices and surgical instruments, including complex orthopedic implants, components, and hardware. These manufacturers play a critical role in meeting the increasing demand for high-quality orthopedic products, ensuring timely delivery, and adhering to stringent regulatory standards.

Geographical Analysis

North America is expected to dominate the global medical device contract manufacturing market with a 43.78% in 2024

North America is the dominant region in the global medical device contract manufacturing market, driven by a combination of regulatory robustness, technological innovation, and the presence of leading industry players. The region benefits from state-of-the-art manufacturing facilities and a highly skilled workforce capable of producing complex Class II and III medical devices with precision and reliability.

US Medical Device Contract Manufacturing Market Trends

Major companies such as Jabil Inc., Thermo Fisher Scientific (PPD), Integer Holdings Corporation, and Sanmina Corporation have established a strong presence in the United States, contributing to the region’s leadership through innovation, quality assurance, and strategic partnerships with OEMs. The stringent regulatory environment enforced by the US Food and Drug Administration (FDA) ensures that medical devices manufactured in the US meet the highest standards of safety and efficacy, which increases trust among global healthcare providers and patients.

Additionally, the US has embraced cutting-edge technologies such as 3D printing, robotics, automation, and AI-driven production processes, allowing contract manufacturers to deliver complex devices like cardiovascular stents, orthopedic implants, and diagnostic instruments efficiently and accurately. The combination of a mature healthcare ecosystem, access to advanced manufacturing technologies, compliance with rigorous regulatory frameworks, and strong industry presence has made the US the preferred hub for OEMs seeking reliable, high-quality contract manufacturing solutions. CMOs successfully producing FDA-approved devices, including pacemakers, orthopedic implants, and minimally invasive surgical instruments, demonstrate the region’s capacity to meet rising global demand while maintaining quality and compliance, further solidifying its position as the leader in the medical device contract manufacturing market.

The Asia Pacific region is the fastest-growing region in the global medical device contract manufacturing market, with a CAGR of 10.7% in 2024

The Asia Pacific (APAC) region is emerging as the fastest-growing hub in the global medical device contract manufacturing market, driven by a unique combination of economic, technological, regulatory, and demographic factors. Cost-effective manufacturing is a major advantage, as countries such as China, India, and Japan offer lower labor costs, established industrial infrastructure, and streamlined supply chains, making them attractive destinations for the production of a wide range of devices, including diagnostic tools, surgical instruments, orthopedic implants, and cardiovascular devices.

Japan is emerging as a key hub in the Asia Pacific medical device contract manufacturing market, driven by advanced healthcare infrastructure, stringent regulatory standards, and a rapidly aging population. The growing demand for devices addressing age-related conditions like cardiovascular diseases, orthopedic issues, and diabetes is prompting hospitals and clinics to adopt innovative medical solutions. Additionally, Japan’s strict regulatory framework, enforced by the PMDA, encourages partnerships with specialized manufacturers that ensure technical expertise and compliance, further strengthening its position in the market.

Technological adoption, including 3D printing, robotics, automation, and AI-driven manufacturing processes, further enhances APAC’s capability to produce sophisticated medical devices at scale. Government initiatives such as India’s “Make in India” program and China’s medical device industrial parks provide additional support by offering incentives, infrastructure, and policy frameworks that encourage both domestic production and foreign investment. The demographic trends, particularly Japan’s aging population, are driving demand for devices such as orthopedic implants, cardiac monitors, and minimally invasive surgical instruments, while China serves as a strategic hub for OEMs seeking both cost-efficient production and access to a massive domestic market.

Europe Medical Device Contract Manufacturing Market Trends

The European medical device contract manufacturing market is experiencing robust growth, driven by several key factors. A significant driver is the increasing demand for cost-effective and scalable manufacturing solutions among original equipment manufacturers (OEMs). By outsourcing production to contract manufacturers, companies can optimize costs and streamline operations, allowing them to focus more on core competencies such as research, development, and marketing, while ensuring timely delivery and consistent product quality.

Additionally, contract manufacturers provide flexible production capacity, enabling OEMs to quickly scale operations based on market demand without significant capital expenditure. The rising prevalence of chronic diseases across Europe further contributes to the growth of the medical device contract manufacturing market. Approximately 35% of the European population suffers from chronic diseases, and this prevalence is anticipated to grow in the coming years, leading to increased demand for medical devices and, consequently, a rise in medical device outsourcing. The aging population in the region is more susceptible to chronic diseases like diabetes, cardiovascular disease, and arthritis, creating a need for continuous monitoring of these conditions through remote patient monitoring devices. The manufacturing of advanced medical devices incorporating cutting-edge technologies promotes the growth of the European medical device contract manufacturing market.

Competitive Landscape

Top companies in the medical device contract manufacturing market include Jabil Inc., Thermo Fisher Scientific Inc. (PPD), Integer Holdings Corporation, Sanmina Corporation, Celestica Inc., Phillips Medisize, Plexus Corp., Inc., and Gerresheimer AG, among others.

Market Scope

Metrics | Details | |

CAGR | 10.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Device Class | Class I Devices, Class II Devices, and Class III Devices |

Service Type | Device & Component Manufacturing Services, Quality Management Services, Packaging & Assembly Services, and Others | |

Therapeutic Area | Cardiovascular Devices, Orthopedic Devices, Ophthalmic Devices, Respiratory Devices, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global medical device contract manufacturing market report delivers a detailed analysis with 56 key tables, more than 53 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical devices-related reports, please click here