Cardiovascular Devices Market Size

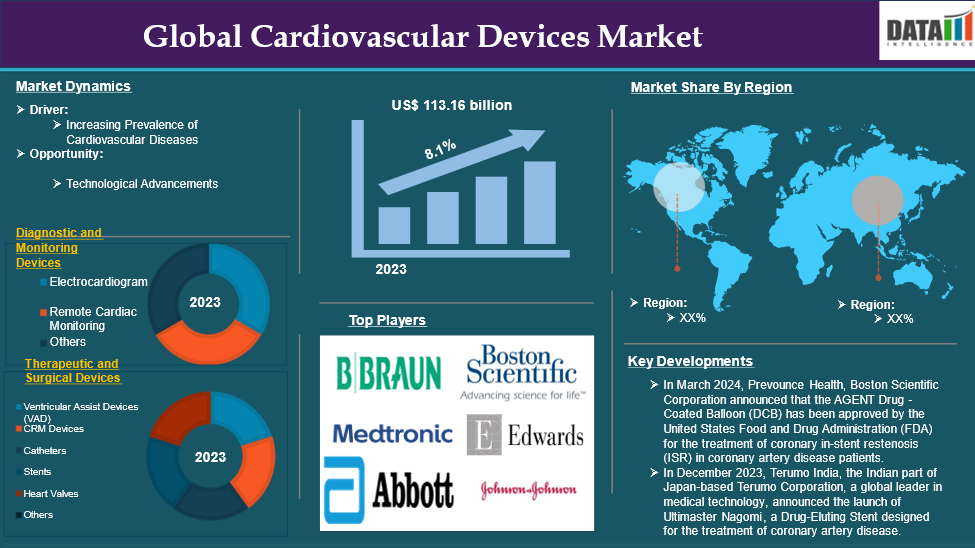

The Global Cardiovascular Devices Market reached US$ 61.45 billion in 2023 and is expected to reach US$ 113.16 billion by 2031, growing at a CAGR of 8.1% during the forecast period 2024-2031.

Cardiovascular devices are devices that are used to diagnose, monitor, and treat a variety of heart problems and disorders. They play an important role in cardiovascular health management, particularly in the treatment of cardiac rhythm abnormalities, heart failure, and structural heart diseases. The market for these devices includes a diverse variety of medical devices such as cardiac implantable electronic devices (CIEDs), stents, defibrillators, and prosthetic heart valves.

The increasing prevalence of cardiovascular diseases and device evolution due to technological advancements is the driving factor that drives the market over the forecast period. For instance, according to the British Heart Foundation 2023, stated that around 620 million people live with heart and circulatory diseases across the world and this number has been rising due to changing lifestyles, an aging, and growing population, and improved survival rates from heart attacks and strokes and will continue to rise if these trends continue.

Executive Summary

For more details on this report Request for Sample

Market Dynamics: Drivers & Restraints

Increasing prevalence of cardiovascular diseases

The increasing prevalence of cardiovascular devices is expected to be a significant factor in the growth of the global cardiovascular devices market. The increased prevalence of cardiovascular diseases is driving healthcare systems to seek novel diagnostic and treatment approaches. The cardiovascular device market includes a wide range of goods, such as stents, pacemakers, defibrillators, and heart valves, all of which are meant to improve patient outcomes and effectively manage heart problems. With technological breakthroughs resulting in the creation of more complex and less invasive technologies, healthcare providers are progressively incorporating these innovations into patient treatment. For instance, drug-eluting stents have transformed the management of coronary artery disease by lowering the risk of restenosis and enhancing long-term results.

The market is expanding rapidly as a result of the rise in cardiovascular diseases. For instance, according to the Centers for Disease Control and Prevention, heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the United States. One person dies every 33 seconds in the United States from cardiovascular disease. About 695,000 people in the United States died from heart disease, that’s 1 in every 5 deaths. To overcome the increasing prevalence of cardiovascular diseases, the major players have launched cardiovascular devices by inculcating the latest technologies. For instance, in October 2023, Masimo announced the CE mark, under the European Union Medical Device Regulation, for the LiDCO board-in-cable (BIC) module. The LiDCO BIC module is designed to connect to multi-patient monitoring platforms, like the Masimo Root Patient Monitoring and Connectivity Hub, to provide advanced hemodynamic monitoring. With this solution, clinicians can easily add LiDCO hemodynamic monitoring. Moreover, in April 2023, French medical device company, Vygon India launched its advanced hemodynamic monitoring system, Mostcare Up, in North India during a Society of Critical Care Medicine (ISCCM) symposium in Chandigarh. The Mostcare Up system is a minimally invasive arterial pressure-based monitor powered by a patented algorithm based on the Pressure Recording Analytical Method (PRAM). It is the only monitor that can follow even the slightest hemodynamic variations in real-time and from beat to beat.

Stringent regulatory requirements

Factors such as stringent regulatory requirements are expected to hamper the global cardiovascular devices market. Stringent regulatory constraints are projected to severely hamper the growth of the global cardiovascular devices market. To assure patient safety and efficacy, regulatory authorities such as the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) set high standards for medical device approval and commercialization. While these restrictions are necessary to protect public health, they can also pose significant challenges for firms looking to offer innovative products. The lengthy and complex regulatory processes frequently cause delays, which can discourage innovation and hinder the timely availability of breakthrough cardiovascular technologies on the market.

Market Segment Analysis

The global cardiovascular devices market is segmented based on diagnostic and monitoring devices, therapeutic and surgical devices, application, end user, and region.

Therapeutic and surgical devices segment is expected to dominate the global cardiovascular devices market share.

The therapeutic and surgical devices segment is expected to dominate the global cardiovascular devices market due to a number of compelling factors such as the increasing prevalence of cardiovascular diseases, technological advancements, and recent launches. This segment includes a diverse variety of devices, such as stents, pacemakers, defibrillators, heart valves, and ventricular assist devices (VADs), all of which play important roles in the treatment and management of various cardiovascular diseases. The increasing prevalence of diseases such as coronary artery disease (CAD), heart failure, and cardiac arrhythmias has increased demand for these devices, which are critical for successful patient care and intervention. Top of Form

There are recent launches of various therapeutic and surgical devices with technological advancements inculcated in them. For instance, in May 2024, Abbott, the global healthcare company, announced the launch of the XIENCE Sierra Everolimus (drug) Eluting Coronary Stent System in India. According to the company, XIENCE Sierra is one of the latest generation stents in the XIENCE family, now available to people suffering from blocked coronary arteries. Moreover, in June 2024, Philips announced the first implant of the Duo Venous Stent System, an implantable medical device indicated to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI), following premarket approval (PMA) from the U.S. Food and Drug Association (FDA).

Market Geographical Analysis

North America is expected to hold a significant position in the global cardiovascular devices market share.

North America is expected to hold a significant portion of the global cardiovascular devices market. North America's large position in the worldwide cardiovascular devices market may be ascribed to the high prevalence of cardiovascular disorders, the presence of prominent manufacturers, advanced healthcare infrastructure, supportive regulatory frameworks, and rising healthcare expenditures. As these variables come together, they create an ideal atmosphere for extending growth and innovation in the cardiovascular devices sector, establishing North America as a vital participant in the global cardiovascular device market.

For instance, according to the National Institute of Health, approximately 82.6 million people in the United States currently have one or more forms of cardiovascular disease (CVD), making it a leading cause of death for both men and women. Common types of cardiovascular disease include coronary heart disease (CHD), stroke, hypertension, and congestive heart failure. An estimated 16.3 million Americans aged 20 and older have CHD, a prevalence of 7 percent.

There are recent launches and approvals in this region, making North America hold a significant portion of the global cardiovascular devices market. For instance, in March 2024, Silk Road Medical, Inc. announced the launch of its Tapered ENROUTE Transcarotid Stent System in hospitals across the United States. This launch builds on the company's previous ENROUTETranscarotid Stent System, providing more options to better customize the Transcarotid Artery Revascularization (TCAR) treatment to patient anatomy. TCAR is a minimally invasive surgical method that aims to deliver best-in-class stroke protection while minimizing complications.

Asia Pacific is growing at the fastest pace in the global cardiovascular devices market

Asia Pacific is experiencing the fastest growth in global cardiovascular devices owing to the increasing incidence of cardiovascular diseases and technological advancements in the region. For instance, according to the National Institute of Health, India has one of the highest rates of cardiovascular disease (CVD) worldwide. The annual number of CVD fatalities in India is expected to increase from 2.26 million to 4.77 million. Coronary heart disease prevalence rates in India have been estimated over several decades and have ranged from 1.6% to 7.4% in rural populations and from 1% to 13.2% in urban populations.

Competitive Landscape

The major global players in the global cardiovascular devices market include B. Braun SE, Medtronic, Abbott, Boston Scientific Corporation, Edwards Lifesciences Corporation, Johnson & Johnson Services, Inc., GE HealthCare, LivaNova, Inc., Koninklijke Philips N.V., Terumo Cardiovascular Systems Corporation among others.

Key Developments

- In December 2023, Terumo India, the Indian part of Japan-based Terumo Corporation, a global leader in medical technology, announced the launch of Ultimaster Nagomi, a Drug-Eluting Stent designed for the treatment of coronary artery disease.

- In March 2024, Prevounce Health, Boston Scientific Corporation announced that the AGENT Drug-Coated Balloon (DCB) has been approved by the United States Food and Drug Administration (FDA) for the treatment of coronary in-stent restenosis (ISR) in coronary artery disease patients. ISR is defined as the obstruction or narrowing of a stented artery caused by plaque or scar tissue.

Emerging Players

Vectorious Medical Technologies, FibriCheck, and Magicardio among others

Report Insights

| Metrics | Details | |

| CAGR | 8.1% | |

| Market Size Available for Years | 2022-2031 | |

| Estimation Forecast Period | 2024-2031 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Diagnostic and Monitoring Devices | Electrocardiogram, Remote Cardiac Monitoring, Others |

| Therapeutic and Surgical Devices | Ventricular Assist Devices (VAD), CRM Devices, Catheters, Stents Heart Valves, Others | |

| Application | Coronary Artery Diseases, Cardiac Arrhythmia, Heart Failure, Others | |

| End User | Hospitals, Specialty Clinics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global cardiovascular devices market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.