Marine Aluminum Market Size

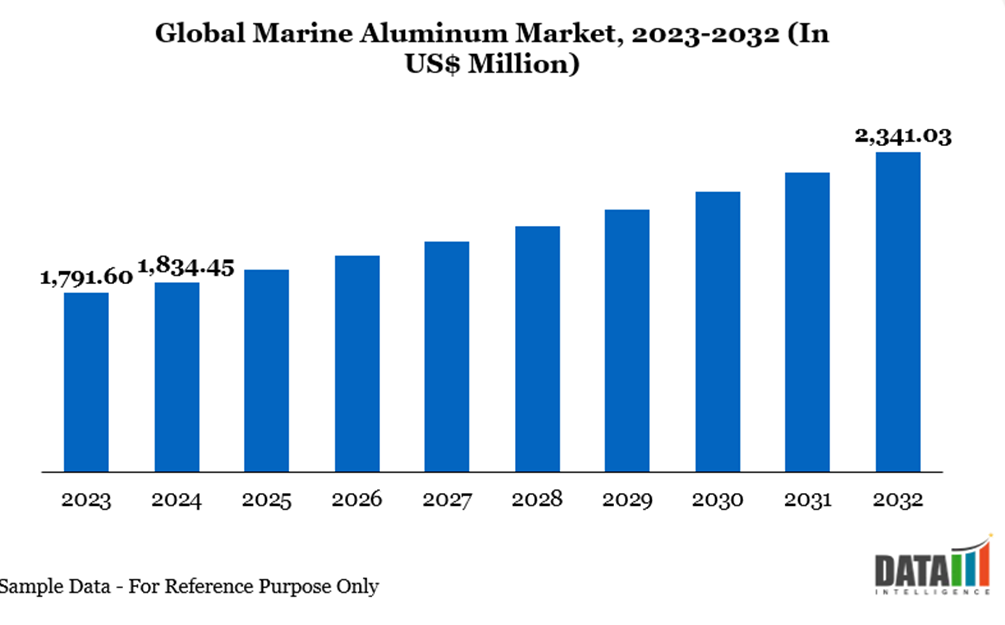

The marine aluminum market reached US$1,834.45 million in 2024 and is expected to reach US$2,341.03 million by 2032, growing at a CAGR of 3.18% during the forecast period 2025-2032. This growth is primarily attributed to the increasing adoption of lightweight, corrosion-resistant materials to enhance fuel efficiency and meet stringent maritime emission standards. Additionally, the rising demand for high-performance alloys in shipbuilding, naval vessels, and luxury yachts is further driving market expansion.

Marine Aluminum Industry Trends and Strategic Insights

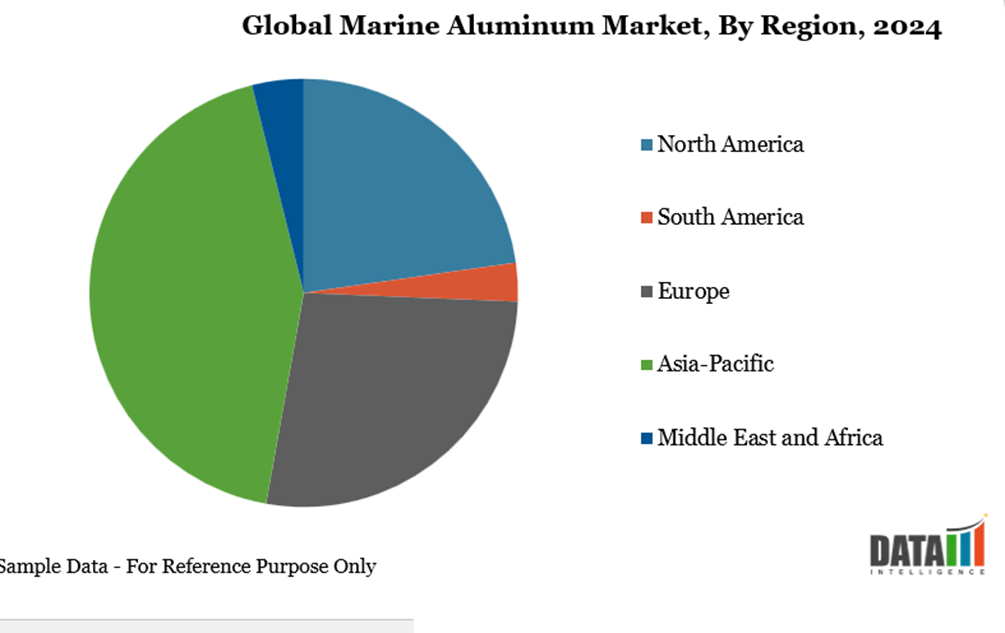

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 40.91% in 2024.

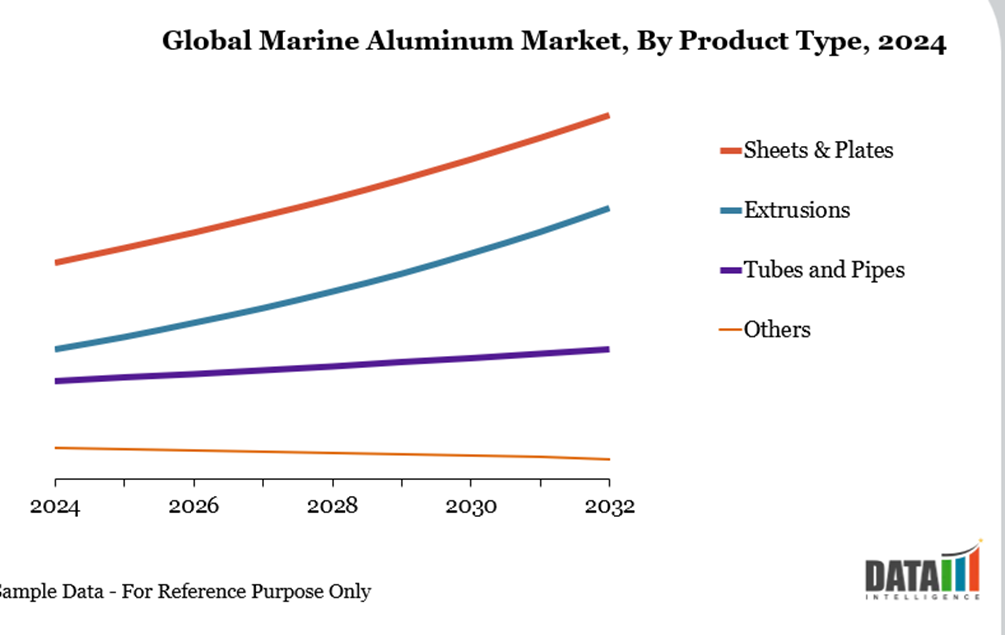

By product type, the sheet & plates segment is projected to experience the largest market, registering a significant 40.36% in 2024.

Marine Aluminum Market Size and Future Outlook

2024 Market Size: US$1,834.45 Million

2032 Projected Market Size: US$2,341.03 Million

CAGR (2025-2032): 3.8%

Largest Market: Asia-Pacific

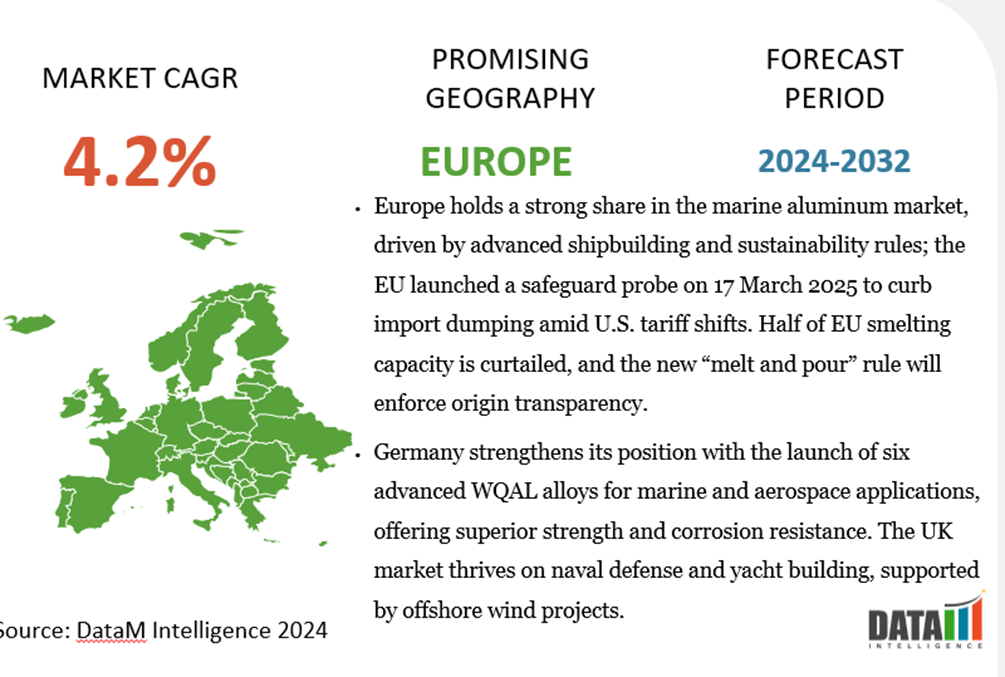

Fastest Market: Europe

Market Scope

Metrics | Details |

By Product Type | Sheets & Plates, Extrusions, Tubes and Pipes, Others |

By Alloy | Aluminum Silicon Alloy, Aluminum Magnesium Alloy, Others |

By Manufacturing Process | Hot Rolling, Cold Rolling |

By Application | Passenger Ship, Cargo Ship |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

The Push for Lightweighting and Fuel Efficiency

The marine industry is increasingly prioritizing lightweighting to improve fuel efficiency and reduce emissions, making aluminum the material of choice over heavier alternatives like steel. Its reduced weight allows ships to achieve higher speeds, consume less fuel, and carry more cargo while complying with IMO emission standards, lowering operational costs for operators.

This focus on lightweight solutions is evident in recent developments, such as CDT Marine launching The Aluminium Boat Company at Boatlife 2023, addressing the rising demand for aluminum boats in the UK. With strong interest from customers and plans to introduce premium brands like Buster boats and AB ribs, the emphasis on weight reduction and energy efficiency continues to drive aluminum adoption in the marine sector.

Segmentation Analysis

The Marine Aluminum market is segmented based on product type, alloy, manufacturing process, end-user and region.

Sheets & Plates Dominate Marine Aluminum Market for Hull and Structural Applications

Sheets and plates hold a significant share in the marine aluminum segment because they are essential for building ship hulls, decks, and structural components that require durability, corrosion resistance, and weight optimization. Their use in passenger ships, cargo vessels, ferries, and offshore platforms makes them the primary product type compared to extrusions or tubes, as they provide the large surface areas necessary for marine construction.

This dominance is further highlighted by new product introductions, such as Whittley Marine Group’s launch of the AL Series in June 2025, featuring aluminum boats, motor, and trailer packages designed for strength and performance. The series includes models like the Whittley AL 1150 TS, built with plate and pressed alloy construction to ensure toughness and longevity, reinforcing the critical role of sheets and plates in modern aluminum boat manufacturing.

Extrusions Gain Significant Share in Marine Aluminum Market for Structural Flexibility and Lightweight Design

Extrusions hold a significant share in the marine aluminum sector due to their versatility and strength, making them ideal for structural frameworks, railings, flooring, masts, and fittings in boats and ships. Their ability to be customized into complex shapes while maintaining lightweight properties supports the design of modern, fuel-efficient vessels and high-performance yachts.

Geographical Penetration

Asia-Pacific Dominates Marine Aluminum Market Driven by Shipbuilding Strength and Rising Aluminum Consumption

Asia-Pacific holds a major share in the global marine aluminum sector, driven by its strong shipbuilding industry, expanding offshore energy projects, and increasing adoption of lightweight materials for fuel efficiency. By 2030, aluminum consumption in Asia (outside China) is projected to increase by 8.6 million metric tons, with India alone accounting for about 61% of that growth, reflecting the region’s growing reliance on aluminum for marine and industrial applications.

India Marine Aluminum Market Outlook

India is emerging as a critical contributor with initiatives like Sagarmala and growing demand for fishing boats, patrol vessels, and coastal shipping. In February 2024, Marine Jet Power (MJP) launched MJP India, aiming to localize waterjet manufacturing for high-performance marine engines in defense and commercial sectors, further boosting aluminum adoption in marine applications.

China Marine Aluminum Market Trends

China leads the region with the world’s largest shipbuilding capacity, producing marine-grade aluminum for cargo vessels, ferries, and naval ships. Its advanced manufacturing capabilities and focus on green shipping strengthen its position as the key supplier of aluminum-based solutions for marine applications.

Europe Strengthens Market Position Amid Safeguard Measures and Sustainability Push

Europe maintains a significant share in the marine aluminum market, supported by its advanced shipbuilding industry and strict sustainability regulations. On 17 March 2025, the EU announced a safeguard investigation into aluminum imports after US tariffs raised fears of metal diversion to Europe. The European Commission highlighted that 50% of EU smelting capacity has been curtailed since 2021, with only 46% of demand met internally. To prevent dumping, the EU will implement the “melt and pour” rule, determining origin based on where the metal was melted.

Germany Marine Aluminum Market Insights

Germany remains a key player in the marine aluminum market due to its advanced shipbuilding technology and demand for lightweight, corrosion-resistant alloys. On 30 November 2023, WWEIQIAO Germany GmbH introduced six new WQAL aluminum materials, including high-strength and fatigue-resistant alloys, designed for marine, automotive, and aerospace applications. These alloys, such as WQAL WHS 340–400 and WQAL CHF 110–130, offer superior corrosion resistance and fatigue performance. The launch reinforces Germany’s leadership in innovation for the marine and shipbuilding sectors.

UK Marine Aluminum Industry Growth

The UK marine aluminum market benefits from a robust naval defense sector and an active yacht manufacturing industry. British shipyards increasingly use aluminum for high-speed vessels and patrol boats to meet efficiency and weight reduction standards. Investments in offshore wind and marine energy projects also boost demand for corrosion-resistant aluminum alloys. Sustainability targets and lightweight designs are pushing aluminum usage in new naval projects.

Regulatory and Tariff Analysis

Regulatory frameworks for the global marine aluminum market focus heavily on environmental sustainability, safety standards, and emissions reduction. International Maritime Organization (IMO) regulations, such as the Energy Efficiency Design Index (EEDI) and stricter emission norms, are pushing shipbuilders toward lightweight, corrosion-resistant aluminum to improve fuel efficiency. Additionally, EU policies on carbon neutrality and recycling requirements promote the adoption of aluminum in marine structures, while classification societies set stringent material performance and safety standards for vessels.

On the tariff front, recent US measures, including a 25% tariff on aluminum imports, have disrupted global trade flows, leading to increased dumping risks in regions like Europe and Asia. The EU’s safeguard investigation and “melt and pour” rule aim to curb redirected imports from the US market and protect local producers. Meanwhile, trade tensions and regional tariff variations continue to influence aluminum pricing, sourcing strategies, and supply chain resilience in the marine sector.

Competitive Landscape

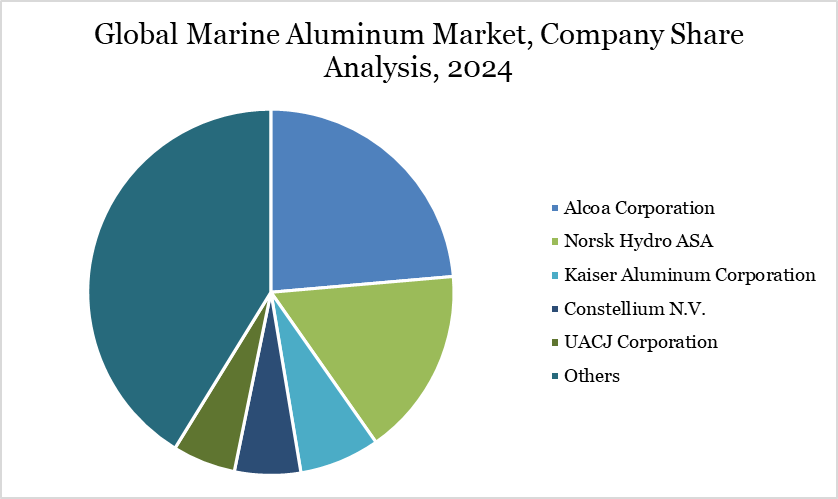

The marine aluminum market is moderately consolidated, with a mix of large integrated aluminum producers, regional alloy manufacturers, and specialized marine-grade material suppliers.

Key players include Alcoa Corporation, Norsk Hydro ASA, Kaiser Aluminum Corporation, Constellium N.V., UACJ Corporation, Novelis Inc., Century Aluminum Company, Aleris Corporation, China Zhongwang Holdings Limited, and Rusal.

Competition spans across primary metal producers, alloy manufacturers, and fabrication specialists serving shipbuilding, defense, and offshore sectors. Companies compete on cost efficiency, material innovation, and compliance with marine regulations.

Key Developments

On 11 May 2024, Speira’s VIA Maris Njørdal aluminum alloy received Life Cycle Assessment (LCA) certification from the Water Revolution Foundation for its sustainability benefits in shipbuilding. The high-strength 5000 series alloy, used in vessels like the Arksen 85 Explorer Yacht, offers 15% greater strength and up to 15% material savings compared to conventional 5083 alloy. Developed for marine and offshore applications, the alloy combines improved environmental performance with high recycled content, supporting eco-friendly yacht construction and reducing the industry’s carbon footprint.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report