Aluminium Equipment Market Size

The global aluminium equipment market reached US$6,576.23 million in 2024 and is expected to reach US$10,160.95 million by 2032, growing at a CAGR of 5.70% during the forecast period 2025-2032. This growth is primarily attributed to the increasing adoption of lightweight, corrosion-resistant materials to enhance fuel efficiency and meet stringent maritime emission standards. Additionally, the rising demand for high-performance alloys in shipbuilding, naval vessels, and luxury yachts is further driving market expansion.

Aluminium Equipment Industry Trends and Strategic Insights

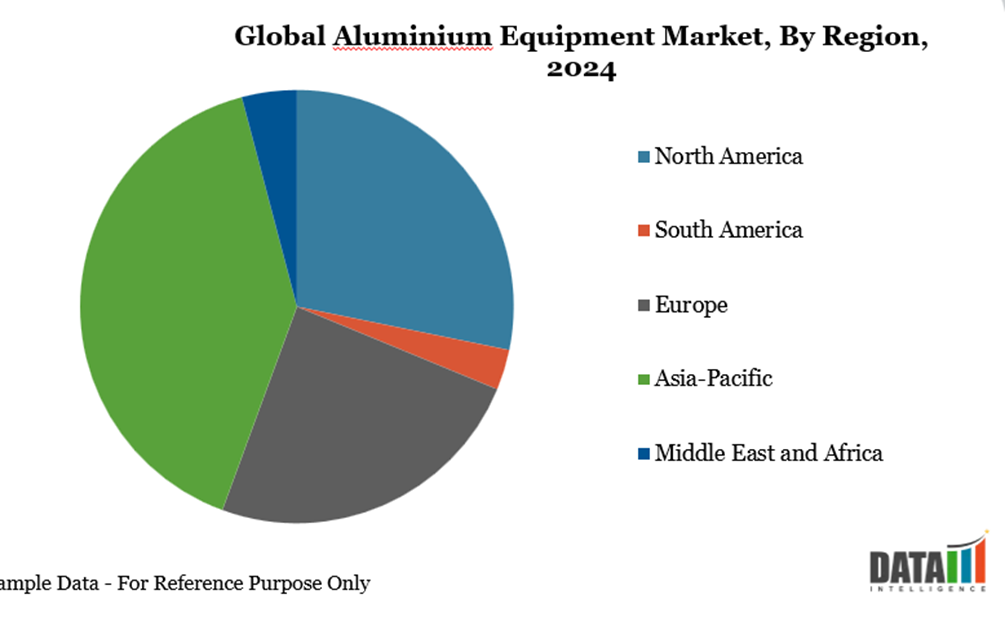

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 60.01% in 2024.

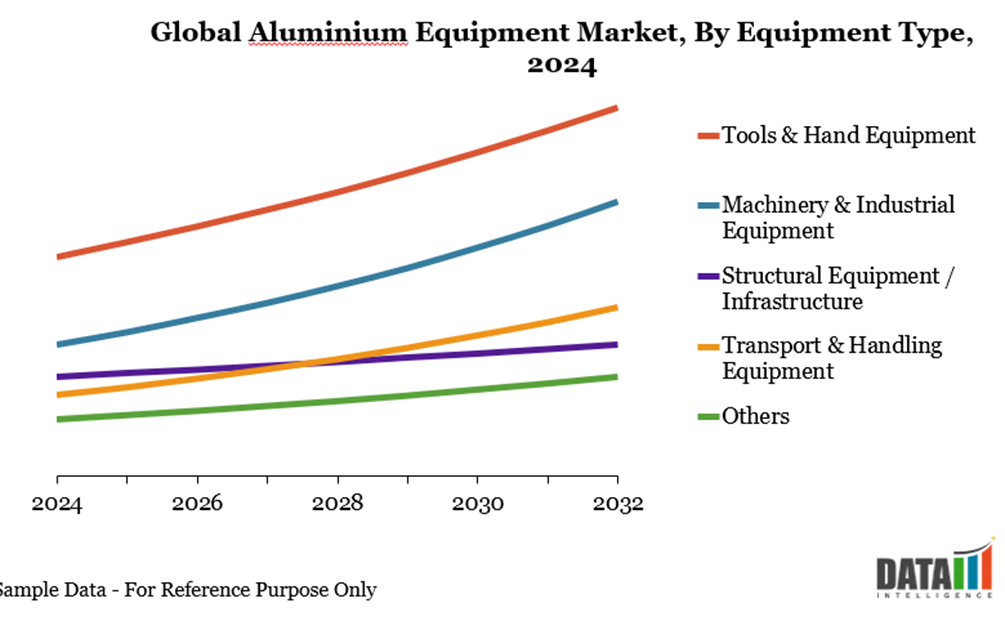

By equipment type, the machinery & industrial equipment segment is projected to experience the largest market, registering a significant 40.36% in 2024.

Global Aluminium Equipment Market Size and Future Outlook

2024 Market Size: US$6,576.23 Million

2032 Projected Market Size: US$10,160.95 Million

CAGR (2025-2032): 5.7%

Largest Market: Asia-Pacific

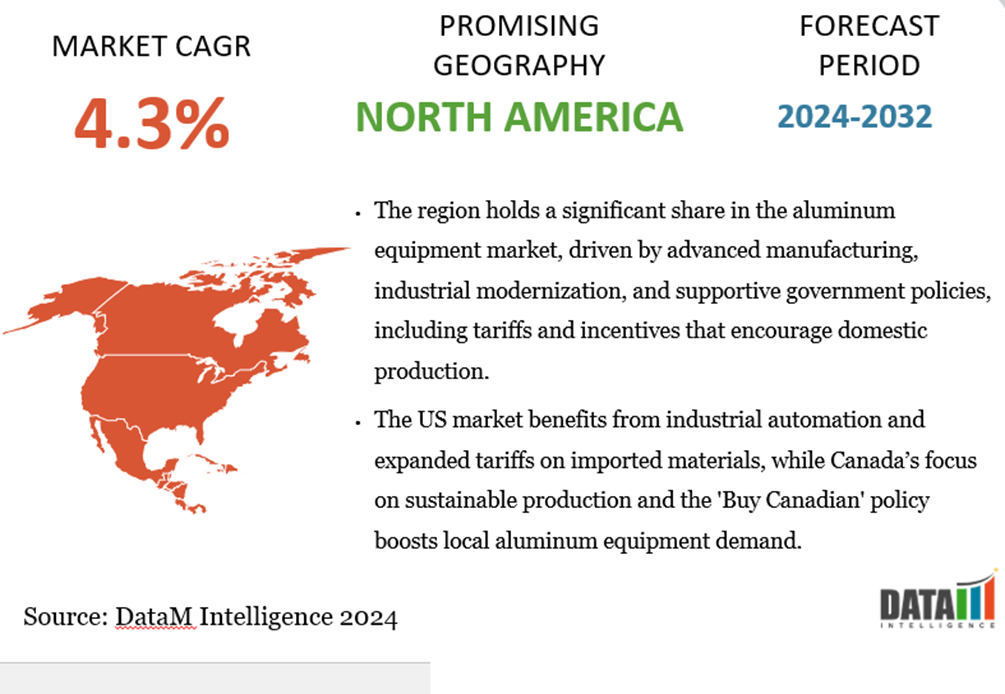

Fastest Market: North America

Market Scope

Metrics | Details |

By Equipment Type | Tools & Hand Equipment, Machinery & Industrial Equipment, Structural Equipment / Infrastructure, Transport & Handling Equipment, Others |

By Alloy | Wrought Alloys, Cast Alloys |

By End-User | Construction, Transportation, Packaging, Electrical, Consumer Goods, Machinery & Equipment, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rapid Industrialization and Urbanization

Rapid industrialization and urbanization are significantly boosting the demand for aluminum equipment. As cities expand and infrastructure projects multiply, industries require durable, lightweight, and corrosion-resistant solutions for construction, machinery, and transport applications. Aluminum equipment provides the efficiency and longevity needed in large-scale urban development projects, making it a preferred choice for builders and industrial operators.

Today, 55% of the world’s population lives in urban areas, a proportion expected to reach 68% by 2050. This urbanization, combined with global population growth, could add 2.5 billion people to cities by 2050, with nearly 90% of this increase in Asia and Africa. The rapid rise of urban centers in these regions directly fuels the adoption of aluminum equipment to support residential, commercial, and industrial infrastructure efficiently.

Segmentation Analysis

The global aluminium equipment market is segmented based on equipment type, alloy, end-user and region.

Machinery & Industrial Equipment: Largest Segment, Boosted by Industrial Demand

Machinery & Industrial Equipment holds a significant share in aluminum equipment due to its extensive use in construction, manufacturing, and heavy industries, where durable and lightweight solutions are critical. The growing focus on industrial automation and efficiency drives continued investment in advanced aluminum equipment. In March 2024, the US announced a US$500 million investment to build its first primary aluminum smelter in 45 years, aiming for a low-carbon, “green” facility, which underscores the renewed emphasis on domestic aluminum production. Such developments further strengthen the demand for machinery and industrial equipment across sectors.

Tools & Hand Equipment: Significant Share Due to Lightweight, Durable Aluminum Use in Industrial and Construction Applications

Tools & Hand Equipment holds a significant share in the aluminum equipment industry due to its widespread use in construction, maintenance, and small-scale industrial operations. The segment benefits from the growing demand for lightweight, durable, and corrosion-resistant tools. On 13 February 2024, Vedanta Aluminium launched Vedanta Metal Bazaar, India’s largest online superstore for primary aluminum, offering over 750 products including tools & hand equipment with AI-powered pricing and live shipment tracking. This digital platform enhances accessibility and efficiency, further boosting the segment’s share.

Geographical Penetration

Asia-Pacific: Largest Share Driven by Rapid Industrialization, Urbanization, and Infrastructure Growth in India and China

Asia-Pacific holds a significant share in aluminum equipment due to rapid industrialization, urbanization, and strong demand from the construction, transportation, and manufacturing sectors. The region benefits from abundant aluminum production, government incentives, and growing adoption of advanced machinery and equipment. Rising infrastructure projects, automotive expansion, and industrial growth are driving the demand for lightweight and corrosion-resistant aluminum equipment.

India Aluminium Equipment Market Outlook

India is a fast-growing market within Asia-Pacific, supported by rapid urbanization and large-scale infrastructure development. Over the period to 2040, an estimated 270 million people are likely to be added to India’s urban population, equivalent to adding a city the size of Los Angeles every year. Even with this rapid urbanization, the urban population share will remain below 50%, indicating long-term growth potential. The demand for aluminum equipment is further strengthened by industrial expansion, construction growth, and increasing adoption in transportation and packaging sectors.

China Aluminium Equipment Market Trends

China dominates the regional market, driven by its position as the world’s largest aluminum producer and massive industrial output. The country is modernizing its aluminum industry with greener and more efficient practices, including increasing aluminum recycling to over 15 million tons annually by 2027. Large-scale infrastructure, construction projects, and high industrial demand continue to propel the use of aluminum equipment across multiple sectors. Urbanization and technological upgrades in manufacturing reinforce China’s dominant share in the market.

North America Holds a Significant Share in the Aluminum Equipment Market – Driven by Advanced Manufacturing and Supportive Policies

North America holds a significant share in the global Aluminum Equipment market due to its mature industrial base, advanced manufacturing technologies, and strong demand across automotive, aerospace, and construction sectors. The region’s focus on sustainable production and modernization of manufacturing processes drives the adoption of high-efficiency aluminum equipment. Government policies and tariffs are shaping local production, encouraging investment in domestic manufacturing. Infrastructure development and industrial expansion further strengthen market growth.

US Aluminium Equipment Market Insights

The U.S. Aluminum Equipment market is driven by modernization in the automotive and industrial sectors and rising adoption of lightweight aluminum equipment. Advanced manufacturing technologies and industrial automation are boosting production efficiency. In August 2025, the U.S. Commerce Department expanded steel and aluminum tariffs, imposing a 50% duty on 407 additional product categories, including wind turbines, mobile cranes, and automotive parts. This move supports domestic production but raises concerns about higher costs for manufacturers relying on imported materials, indirectly promoting demand for local aluminum equipment.

Canada Aluminium Equipment Industry Growth

Canada’s market benefits from abundant aluminum resources and increasing focus on sustainable production. Expanding infrastructure projects and industrial activities are driving the demand for advanced aluminum processing and handling equipment. In January 2025, the government proposed a 'Buy Canadian' policy to support domestic aluminum producers amid ongoing tariff disputes with the U.S. This initiative aims to strengthen local production, reduce import dependency, and promote the adoption of Canadian-made aluminum equipment, ensuring steady market growth.

Sustainability Analysis

The sustainability of aluminum equipment is increasingly shaping market trends, as manufacturers focus on energy-efficient production and reducing carbon footprints. Lightweight aluminum equipment contributes to lower energy consumption in industrial operations and transportation applications. Recycling and reuse of aluminum materials further enhance environmental performance, minimizing waste and resource depletion. Companies are adopting eco-friendly manufacturing technologies and adhering to stricter environmental regulations, promoting sustainable growth. This shift toward greener practices not only meets regulatory demands but also improves operational efficiency and market competitiveness.

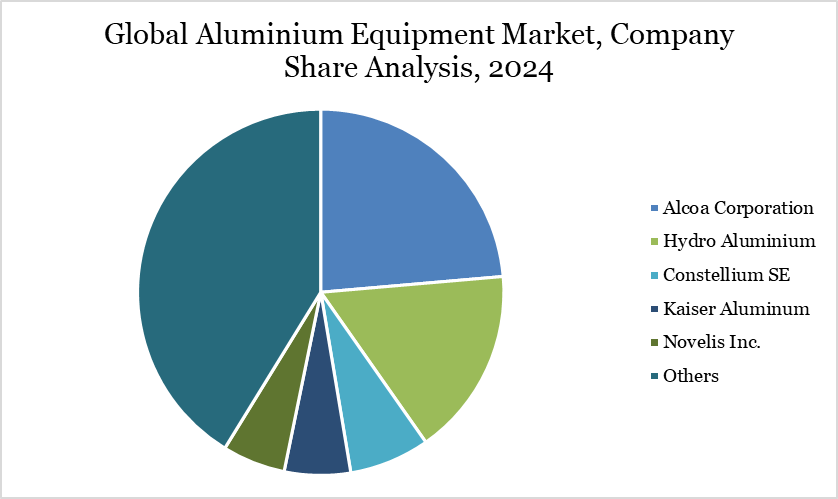

Competitive Landscape

The global aluminium equipment market features a competitive landscape characterised by rapid technological innovation and continuous capacity expansion.

Key players include Alcoa Corporation, Hydro Aluminium, Constellium SE, Kaiser Aluminum, Novelis Inc., Sapa Group (part of Hydro), Plexal Aluminium, Kitz Corporation, Ryerson Holding Corporation, Aluminium Ltd.

Companies are investing heavily in R&D to enhance production efficiency, reduce operational costs, and develop lightweight, high-performance equipment. Strategic collaborations, mergers, and partnerships are common to strengthen market presence and expand into emerging regions.

Key Developments

In March 2025, Stellar Industries introduced the 2025 TMAX Aluminium Mechanic Truck, featuring integrated mounting rails, improved compartment designs, and enhanced durability. These updates aim to provide greater flexibility, customisation, and ease of use for operators in the field.

In May 2025, Merritt Companies acquired Magnum Trailer & Equipment, enhancing its capabilities in aluminum truck accessories and trailer manufacturing. This acquisition strengthens Merritt's position in the heavy-duty truck market, expanding its product offerings and innovation potential

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report