Global Aluminum Recycling Market Overview

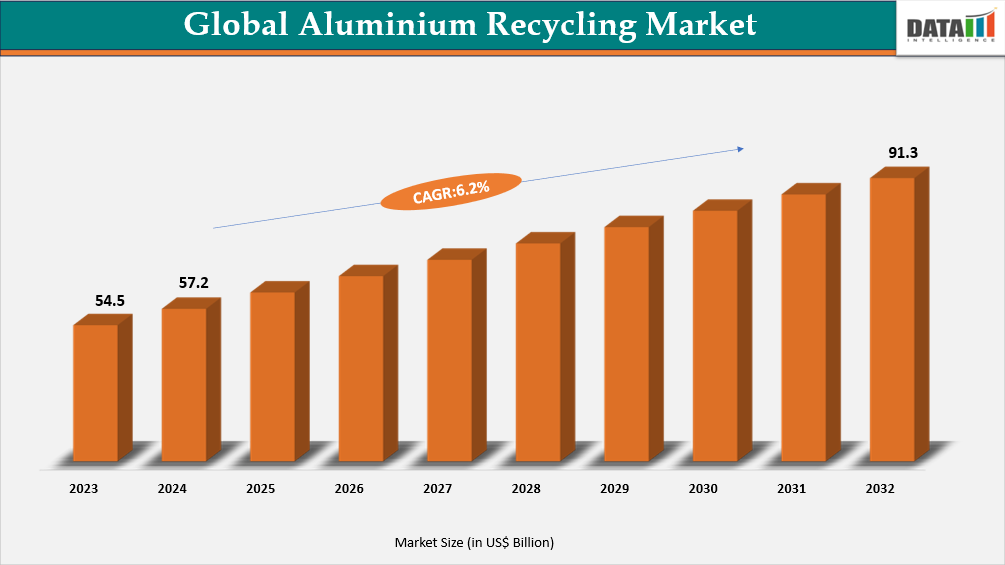

The global aluminum recycling market reached US$54.5 billion in 2023, rising to US$57.2 billion in 2024 and is expected to reach US$91.3 billion by 2032, growing at a CAGR of 6.2% from 2025 to 2032.

The global aluminum recycling market is witnessing strong growth, driven by increasing environmental awareness, regulatory push for sustainability, and the cost-efficiency of secondary aluminum compared to primary aluminum. As aluminum is 100% recyclable without losing its properties, recycling has become a strategic priority for industries such as automotive, construction, packaging, and electronics.

Globally, over 75% of all aluminum ever produced is still in use today, demonstrating its circular economy potential. Countries such as Germany and Japan have established mature recycling infrastructures, with Japan achieving recycling rates of over 90% for aluminum cans, largely driven by public awareness and policy support. Companies like TOMRA Sorting Solutions are providing automated systems that allow recyclers to meet the stringent purity standards required for high-value applications like aerospace and electronics.

Aluminum Recycling Market Industry Trends and Strategic Insights

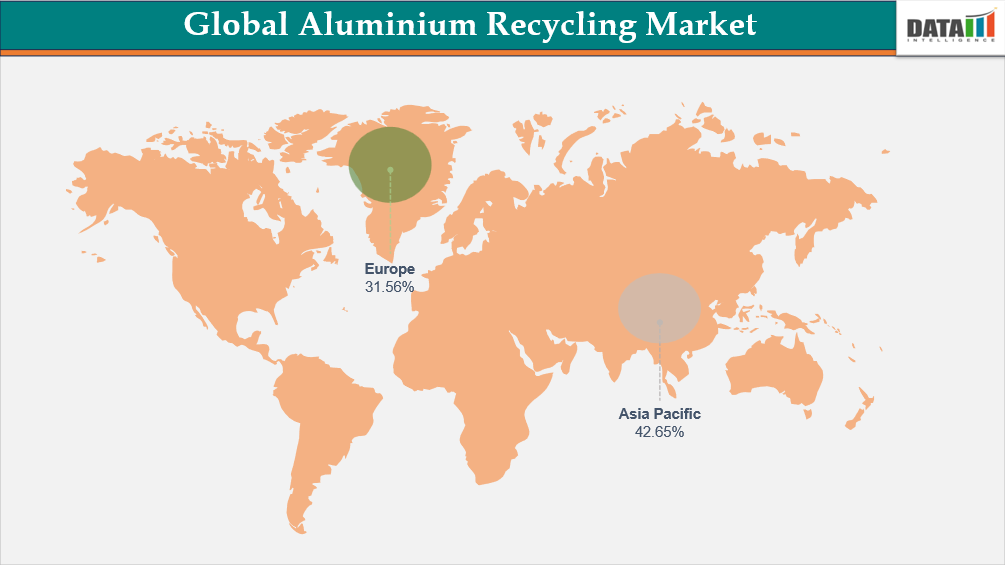

- Asia-Pacific leads the global aluminum recycling market, capturing the largest revenue share of 42.65% in 2024.

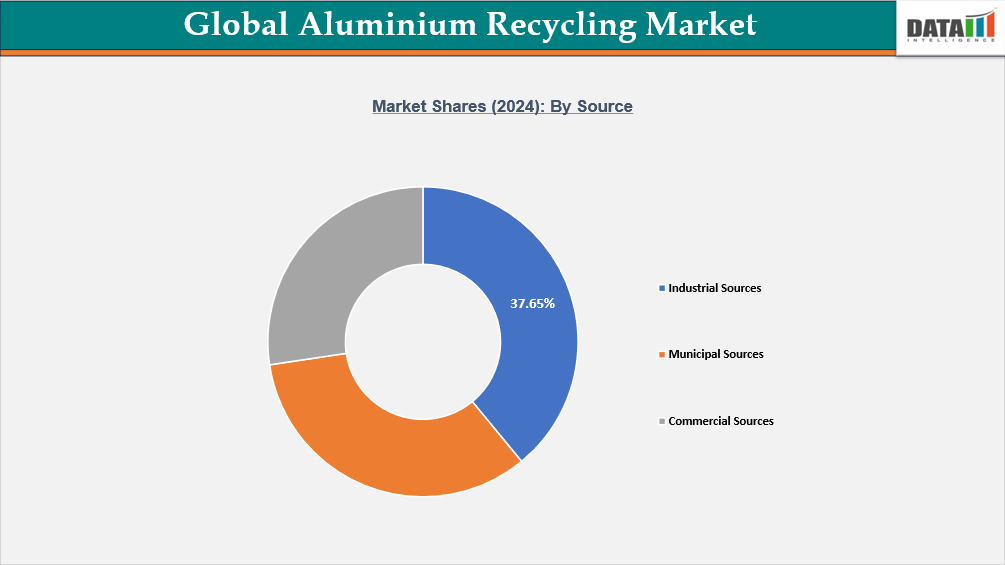

- By source segment, industrial sources led the global aluminum recycling market, capturing the largest revenue share of 37.65% in 2024.

Global Aluminum Recycling Market Size and Future Outlook

- 2024 Market Size: US$57.2 billion

- 2032 Projected Market Size: US$91.3 billion

- CAGR (2025–2032): 6.2%

- Dominating Market: Asia-Pacific

- Fastest Growing Market: Europe

Market Scope

| Metrics | Details |

| By Source | Industrial Sources, Municipal Sources, Commercial Sources |

| By Aluminum Type | Cast, Sheet, Wire, Alloy, Others |

| By End-User | Machinery & Equipment, Building & Construction, Electrical & Electronics, Packaging, Aerospace, Automotive, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For more details on this report, Request for Sample

Market Dynamics

Rising Sustainability Mandates and Climate Goals

With growing emphasis on net-zero carbon targets, governments and corporations are adopting aluminum recycling to reduce their carbon footprints. For instance, in April 2020, European Aluminum launched its Circular Aluminum Action Plan, a strategy for achieving aluminum’s full potential for a circular economy by 2030. The action plan aims to ensure that all end-of-life aluminum products are collected and recycled efficiently in Europe to maximize aluminum recycling rates and to keep the material in active use. It builds on the aluminum industry’s Vision 2050 and provides policy recommendations for the sector to achieve full circularity. Thus, the above factors help to boost the market growth.

Leading players are also boosting aluminum recycling capacity through major investments. Novelis has invested about US$90 million to double used beverage can recycling in the UK, cutting over 350,000 tonnes of CO₂e annually. In 2024, it achieved 63% recycled content and processed 2.3 million tonnes of scrap. Since 2011, Novelis has invested nearly US$2 billion in circular initiatives, with its Nachterstedt facility handling 400,000 tonnes yearly and new 2024 sorting technology expected to save 8,500 tonnes of primary aluminum and prevent 80,000+ tonnes of CO₂ emissions.

Global Aluminum Recycling Market, Segmentation Analysis

The global aluminum recycling market is segmented based on source, aluminum type, end-user, and region.

Industrial Scrap Leads the Way: Clean, Consistent, and Cost-Effective Recycling Source

The industrial sources segment dominates the global aluminum recycling market primarily due to the high volume, consistent quality, and cost-efficiency of scrap generated from industrial processes. These sources include manufacturing scrap generated during the production of aluminum-based products, machining off-cuts, and dross from smelters and casting facilities.

One of the key reasons industrial scraps dominates is its consistent quality, higher purity levels, and easier traceability, which make it ideal for direct remelting and reuse in high-grade applications. For instance, companies like Novelis, Hydro, and Constellium operate closed-loop recycling systems with automotive and aerospace OEMs, where clean, pre-consumer scrap from stamping plants is immediately recycled into new aluminum sheets.

The growing use of aluminum in modern vehicles, 250–300 kg per car and over 400 kg for Evs, generates large volumes of manufacturing scrap. Automakers like Ford, using 20% recycled aluminum in F-150 production and investing in closed-loop recycling at plants, ensure most industrial scrap is captured and reused. This high-quality, clean scrap is easier and cheaper to recycle than post-consumer scrap. As a result, industrial (new) scrap accounts for the largest share in the aluminum recycling market.

Municipal Sources Hold a Significant Share Driven by Consistent Recycling Supply of Household Aluminum Waste

Municipal sources hold a significant share in the aluminum recycling market because post-consumer items like beverage cans, foil, and packaging generate a large and steady volume of recoverable aluminum. Well-developed collection and sorting systems allow municipalities to efficiently capture this material and feed it back into the recycling stream. Since aluminum is infinitely recyclable without quality loss, municipal waste becomes a reliable input for secondary production. As consumer packaging demand rises, the contribution of municipal sources continues to expand, strengthening their overall market share.

Global Aluminum Recycling Market, Geographical Penetration

Dominating Market: Asia-Pacific Driven by Rapid Industrial Growth and Increasing Demand For Recycled Aluminum

Asia-Pacific commands the aluminium recycling landscape with a commanding over 42% regional share, propelled by substantial secondary capacity expansions across China, India, Japan, and South Korea. China maintains dominance with approximately 48% market share in 2024, reinforced by plans to cap primary aluminium smelting capacity at 45 million tons by 2030 and recycle over 15 million tons of aluminium annually by 2027. China currently operates 14 million tonnes of recycling capacity, representing 30% of 2024 primary production, while accounting for 27.0% of the global metal recycling market revenue in 2024.

India Aluminum Recycling Market Insights

The India aluminum recycling market is steadily growing, with about 40% of the country’s aluminum production now relying on recycled feedstock, according to MRAI (Material Recycling Association of India). The sector is expected to expand further as demand for sustainable and cost-efficient production rises. Reducing GST on aluminum scrap from 18% to 5% or lower would ease liquidity pressures and encourage more formal recycling practices. This policy change is likely to enhance competitiveness across the aluminum value chain and support the country’s circular economy goals.

Japan Aluminum Recycling Market Industry Growth

Japan has established one of the world’s most efficient recycling systems, with over 90% recycling rates for aluminum cans, driven by public awareness, strong collection networks, and advanced sorting technologies. Companies such as HANWA and Daiki Aluminum are leading the charge in high-quality scrap utilization for applications in the automotive and packaging sectors. Additionally, in India, rapid urbanization and infrastructure growth are generating vast amounts of construction and industrial scrap.

Fastest Growing Market: Europe is the Fastest Market Fueled by Advanced Infrastructure and High Overall Aluminum Recycling Efficiency

Europe holds a strong position in the aluminium recycling market due to its advanced recycling infrastructure and high efficiency in processing both post-consumer and industrial scrap. Strict environmental regulations and government policies encourage circular economy practices, pushing manufacturers to adopt recycled aluminium. The region benefits from well-established collection and sorting systems, ensuring a steady supply of high-quality scrap. Growing demand from the automotive and construction sectors, which increasingly use lightweight and sustainable materials, further drives recycling. Additionally, technological innovations in secondary smelting and energy-efficient recycling processes support Europe’s leadership in this market.

Germany Aluminum Recycling Market Outlook

The Germany aluminum recycling market is robust, driven by advanced infrastructure, strong environmental regulations, and growing demand from automotive and construction sectors. In July 2024, Germany-based Speira GmbH announced an US$11 million investment to install four new recycled-metal furnaces at its Grevenbroich and Töging plants, boosting capacity for low-grade and contaminated scrap. These upgrades, including tiltable rotary furnaces, charging machines, suction hoods, and thermal afterburners, highlight the focus on maximizing aluminum recovery.

Italy Aluminum Recycling Market Trends

The Italy aluminum recycling market is performing strongly, driven by effective collection systems, regulatory support, and growing demand from packaging, automotive, and construction sectors. Italy’s National Aluminium Packaging Consortium (CIAL) reported that 73.6% of aluminium packaging waste was recycled last year, surpassing the country’s 2025 and 2030 targets, with the rate rising to 78% when including energy recovery. This achievement reflects the market’s focus on sustainability and circular economy practices, encouraging investments in advanced recycling technologies.

Sustainability Analysis

Globally, over 30 million tonnes of aluminum scrap are recycled annually, making aluminum one of the most recycled materials worldwide. Its unique combination of lightness, strength, durability, and recyclability positions it as a key material for a sustainable future. Rising population and economic growth are expected to double global aluminum demand by 2050. Recycling will play a critical role, with 50–60% of this demand expected to be met through recycled metal.

Recycling aluminum requires up to 95% less energy compared to primary production, significantly reducing carbon emissions and overall energy consumption. This efficiency not only conserves natural resources but also supports global climate goals. Increased adoption of aluminum recycling strengthens circular economy practices across industries. As demand rises, sustainable recycling practices will be essential to balance growth with environmental responsibility.

Competitive Landscape

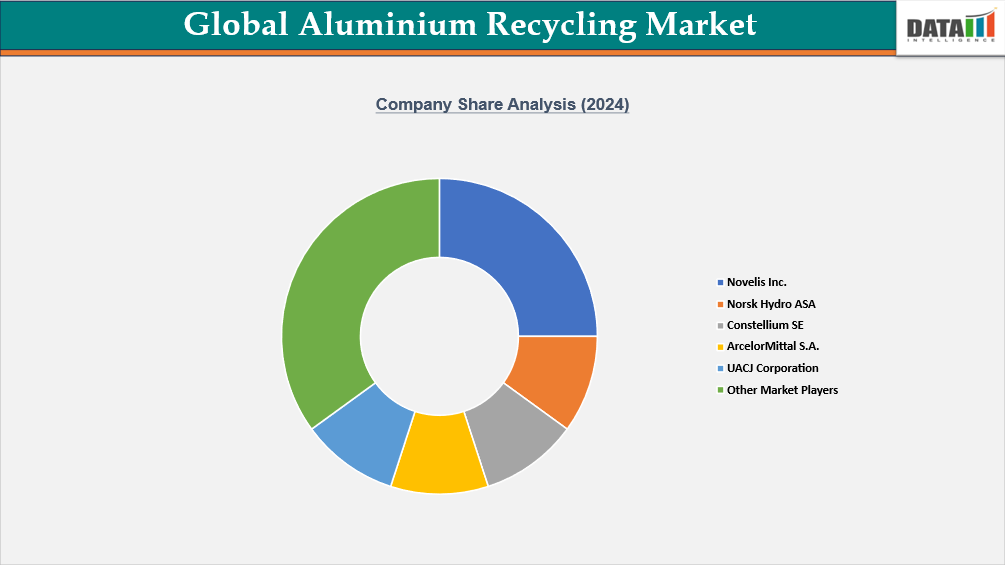

- The global aluminum recycling market is characterized by robust competition among a mix of global metal giants and specialized recycling players.

- The major global players in the market include Novelis Inc., Norsk Hydro ASA, Constellium SE, ArcelorMittal S.A., UACJ Corporation, Real Alloy, Sigma Metals, Tri-Arrows Aluminium Inc., Matalco Inc., Aurubis AG and others.

- Key players are investing in advanced recycling technologies such as secondary smelting, tiltable rotary furnaces, and automated sorting systems to improve recovery rates and efficiency. Strategic partnerships and collaborations across regions help strengthen supply chains and access high-quality scrap streams.

Key Developments

- In April 2025, Novelis launched operations at its US$65 million recycling center in Ulsan, South Korea, developed in partnership with Kobe Steel. The facility can process up to 100,000 tons of scrap annually, including beverage cans, auto parts, and industrial materials—to produce low-carbon aluminum sheet ingots, supporting its circular production strategy.

- In September 2024, Hydro opened a new aluminum recycling plant in Hungary. Hydro’s new aluminum recycling plant in Szekesfehervar, Hungary, has an annual capacity of 90,000 tonnes, mainly serving the automotive market.

Investment & Funding Landscape

The aluminum recycling market is experiencing strong investment as companies focus on scaling capacity, improving efficiency, and adopting advanced recycling technologies. Major players are allocating significant capital toward expanding processing facilities, integrating closed-loop recycling, and implementing advanced sorting systems to maximize recovery rates. Investments are also directed at increasing the use of post-consumer scrap, producing high-quality recycled aluminum, and reducing energy consumption and emissions compared with primary production.

| Company | Investment/Funding | Year | Details | |

| Hydro Aluminium | investment of EUR 180 million (US$209.19) | 2025 | Construction of a flagship aluminum recycling plant in Torija, Spain, with an annual capacity of 120,000 tonnes of extrusion ingots, recycling up to 70,000 tonnes of post-consumer scrap, creating 65 jobs, and enhancing circular economy capabilities in Europe. | |

| Sortera Technologies | Funding of US$45 million | 2025 | Funding to scale AI-powered metal recycling, expand domestic aluminum recycling capacity, and build a new processing facility in Lebanon, Tennessee. Uses AI-enabled multi-sensor sorting to produce high-purity recycled aluminum, increasing annual production to ~240 million pounds, supporting sustainability and supply chain efficiency. | |

What Sets This Global Aluminum Recycling Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by Component, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Aluminum Recycling commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.