Aluminum Sheet Market Size

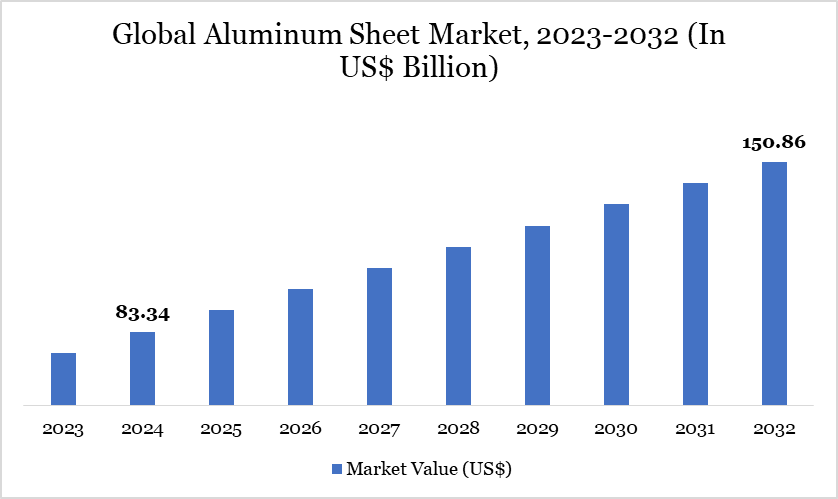

Aluminum Sheet Market Size reached US$ 83.34 billion in 2024 and is expected to reach US$ 150.86 billion by 2032, growing with a CAGR of 7.7% during the forecast period 2025-2032.

The global aluminum sheet market is experiencing substantial growth, driven by the increasing demand across key sectors such as automotive, aerospace, construction, packaging, and electrical. One of the major drivers is the global push toward lightweighting in vehicles to improve fuel efficiency and meet stricter emission regulations. For instance, automakers like Suzuki and Renault have incorporated high-strength aluminum sheets into vehicle bodies, significantly reducing vehicle weight while maintaining structural integrity.

Additionally, in the construction sector, the demand for aluminum sheets is surging due to their corrosion resistance, aesthetic appeal, and long service life. Countries like China, India, and the US are witnessing rapid urban infrastructure growth, which is boosting the consumption of aluminum sheets in cladding, roofing, and facades.

Aluminum Sheet Market Trend

The rapid growth of the electric vehicle sector is a major catalyst for aluminum sheet demand. Aluminum's lightweight properties are essential for enhancing EV efficiency and range. In China, for instance, new energy vehicles are projected to constitute 20% of total vehicle sales by 2025, with domestic demand for automotive aluminum sheets expected to reach 470,000 tons. Innovations in aluminum sheet production, such as continuous casting and rolling, have enhanced product quality and performance.

These advancements are crucial for meeting the stringent requirements of industries like automotive and aerospace. For instance, the development of high-strength aluminum alloys has improved the material's applicability in various automotive Grades, supporting the industry's lightweighting goals.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Grade | 1000 Series, 2000 Series, 3000 Series, 4000 Series, 5000 Series, Others | |

| By Thickness | Below 0.2 mm, 0.2 mm – 0.5 mm, 0.5 mm – 2.0 mm, Others | |

| By Application | Flat-Rolled Products, Casting & Forging, Foil, Others | |

| By End User | Automotive, Packaging, Aerospace & Defense, Medical, Building & Construction, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Aluminum Sheet Market Dynamics

Growth in Electric Vehicle (EV) Production

The surge in electric vehicle (EV) production is playing a pivotal role in propelling the global aluminum sheet market, owing to aluminum’s excellent strength-to-weight ratio, corrosion resistance, and recyclability. As EV manufacturers focus on enhancing energy efficiency and extending driving range, reducing overall vehicle weight becomes essential — and aluminum sheets serve as a key substitute for heavier steel components in areas such as battery enclosures, chassis, structural frames, and body panels.

For instance, Tesla incorporates extensive aluminum use in its Model S and Model X models to achieve lighter body structures, thereby improving performance and acceleration while maintaining safety standards. Furthermore, nearly 14 million new electric cars were registered globally in 2023, bringing the global EV fleet to around 40 million, as per the Global EV Outlook 2023. This marks a 35% increase from 2022, with 3.5 million more electric cars sold year-over-year. Such robust growth in EV adoption is fueling the demand for lightweight and high-performance materials like aluminum sheets, thereby significantly contributing to market expansion.

Stringent Environmental Regulations

Stringent environmental regulations are acting as a restraint on the growth of the global aluminum sheet market, primarily due to the high energy consumption and carbon emissions associated with primary aluminum production. Producing aluminum from bauxite requires significant electricity, often generated from fossil fuels, which contributes to environmental pollution.

Therefore, governments worldwide are imposing stricter emissions norms and sustainability mandates on aluminum smelters and rolling mills. For instance, the European Union’s Emissions Trading System (EU ETS) places a financial burden on aluminum producers by requiring them to purchase carbon credits, thereby increasing production costs. Consequently, such environmental compliance obligations are slowing down market growth and investment in new aluminum sheet production facilities.

Aluminum Sheet Market Segment Analysis

The global aluminum sheet market is segmented based on grade, thickness, application, end user and region.

The Role of the Automotive Industry in Shaping the Global Aluminum Sheet Market

The automotive sector is one of the dominant end-users in the global aluminum sheet market, driven by the increasing demand for lightweight materials to enhance fuel efficiency, reduce carbon emissions, and meet stringent regulatory standards. Aluminum sheets are widely used in vehicle manufacturing due to their excellent strength-to-weight ratio, which contributes to lower vehicle weight and improved performance without compromising safety.

For instance, Maruti Suzuki, India’s largest automaker, has adopted aluminum for various parts of its vehicles, including the body panels and engine components in models like the Maruti Suzuki Vitara Brezza and Maruti Suzuki S-Cross. This shift to aluminum allows Maruti Suzuki to reduce vehicle weight, improve fuel economy, and meet the increasingly stringent emission norms in India. These instances highlight the automotive industry's strong reliance on aluminum sheets to meet performance, regulatory, and environmental requirements, driving sustained market demand.

Aluminum Sheet Market Geographical Share

Asia-Pacific: Dominating the Global Aluminum Sheet Market

The Asia-Pacific region dominates the global aluminum sheet market, driven by its robust manufacturing capabilities, increasing industrialization, and significant demand from key sectors like automotive, construction, and packaging. The region’s dominance is fueled by rapid urbanization, particularly in countries like China and India, where aluminum is widely used in infrastructure projects, transportation, and consumer goods.

Additionally, South Korea has highest per capita aluminum consumption in the world with 46.7 kg of aluminum per person. India’s aluminum per capita consumption is significantly lower than that of countries like China, with India consuming only 2.5 kg per person. These factors position Asia-Pacific as the leading hub for aluminum sheet production and consumption, driving continued market growth in the coming years.

Sustainability Analysis

Sustainability plays a critical role in the global aluminum sheet market, as the industry increasingly faces pressure to reduce environmental impact and adopt eco-friendly practices. Aluminum, being 100% recyclable, offers a significant advantage in terms of sustainability. Recycling aluminum requires only 5% of the energy compared to primary production, which significantly reduces carbon emissions and energy consumption.

As sustainability becomes a key focus for both manufacturers and consumers, the demand for recycled aluminum sheets has risen, especially in industries such as automotive, packaging, and construction. For instance, Hindalco Industries, one of India’s largest aluminum producers, has implemented a sustainable approach by focusing on recycling and reducing the carbon footprint in its operations.

Aluminum Sheet Market Major Players

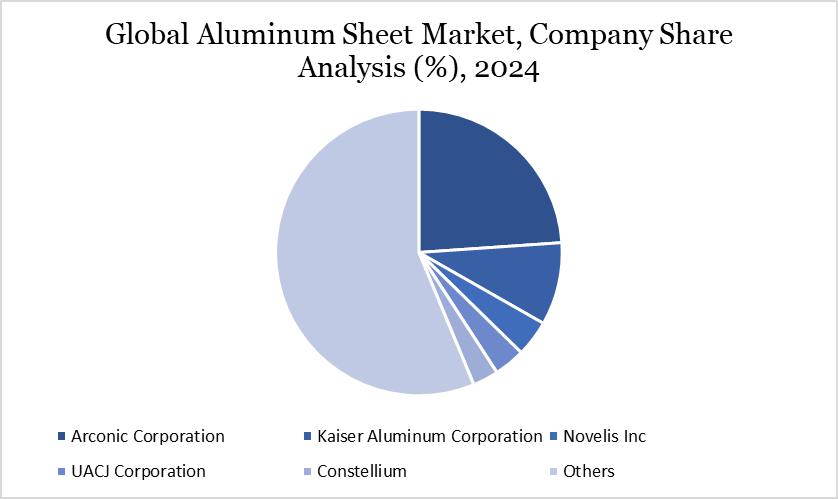

The major global players in the market include Arconic Corporation, Kaiser Aluminum Corporation, Novelis Inc, UACJ Corporation, Constellium, Aleris, Champagne Metals, American Douglas Metals, China Zhongwang Holdings Limited, Gränges AB and among others.

Key Developments

- In 2023, Hindalco Industries announced that its subsidiary Novelis Inc. signed a long-term agreement with Ball Corporation early this year for the supply of aluminum beverage can sheet.

- In 2024, ALUCOBOND, a flagship brand of a Swiss major 3A Composites, which is a global innovator and a leading manufacturer of high – quality Aluminum Composite Materials, has launched an innovative product labelled ‘ALUCODUAL’ (pre-coated solid aluminum sheet) to boost its premier portfolio of technologically – superior, new-age cladding solutions.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies