Enteral Feeding Formulas Market: Industry Outlook

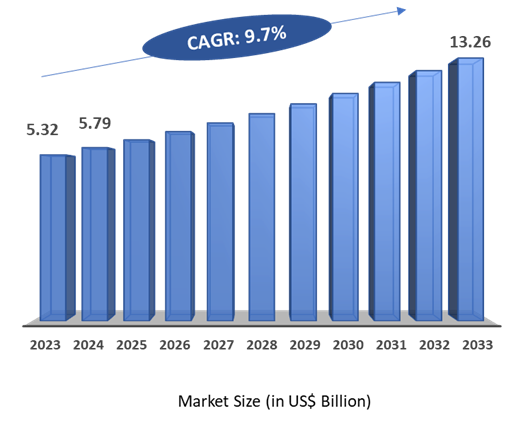

The global enteral feeding formulas market reached US$ 5.32 billion in 2023, with a rise to US$ 5.79 billion in 2024, and is expected to reach US$ 13.26 billion by 2033, growing at a CAGR of 9.7% during the forecast period 2025–2033. The growth of the enteral feeding formulas market is driven by the rising prevalence of chronic diseases and neurological disorders that impair patients’ ability to eat normally. Additionally, the increasing number of preterm births is creating greater demand for specialized nutritional support. Innovations and improvements in the composition and formulation of enteral feeding products are enhancing their nutritional value and patient tolerance. Furthermore, expanding healthcare infrastructure worldwide improves access to these feeding formulas across hospitals, rehabilitation centers, and home care settings.

Key Market Trends & Insights

North America accounted for approximately 39.8% of the global Enteral Feeding Formulas market in 2023 and is expected to retain a significant market share throughout the forecast period.

Asia Pacific is anticipated to be the fastest-growing region, supported by expanding healthcare facilities, growing awareness of neurological conditions, and increasing demand for advanced medical devices.

• Standard Formulas (whole protein formulas) remain the dominant product type.

Market Size & Forecast

2024 Market Size: US$ 5.79 Billion

2033 Projected Market Size: US$ 13.26 Billion

CAGR (2025–2033): 9.7%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Executive Summary

Market Dynamics

Driver: Rising Prevalence of Chronic Diseases and Neurological Disorders

The rising prevalence of chronic diseases and neurological disorders is a key factor driving the growth of the enteral feeding formulas market. Conditions such as stroke, Parkinson’s disease, Alzheimer’s disease, and multiple sclerosis often result in dysphagia or impaired swallowing, making it difficult for patients to consume adequate nutrition orally. Similarly, chronic illnesses like cancer, gastrointestinal disorders, and severe trauma can compromise a patient’s ability to meet nutritional needs through normal feeding. In such cases, enteral feeding formulas provide a safe and effective method of delivering essential nutrients directly into the gastrointestinal tract. Cancer patients undergoing chemotherapy often experience appetite loss and gastrointestinal side effects, requiring specialized nutritional support. The increasing global burden of these conditions, coupled with longer life expectancies and improved diagnosis rates, is expected to significantly boost demand for enteral nutrition products in both acute care and long-term care settings.

Restraint: High Cost of Specialized Enteral Feeding Products

The high cost of specialized enteral feeding formulas presents a significant barrier to market growth, particularly in low- and middle-income countries. These formulas, especially those tailored for specific conditions such as renal failure, diabetes, or malabsorption syndromes, often come at a premium price due to their advanced nutritional composition and clinical development. In long-term care settings or home healthcare scenarios, where enteral feeding may be required for extended periods, affordability becomes a critical concern. This economic challenge can lead to reduced adoption rates, treatment non-compliance, or reliance on less effective alternatives, ultimately limiting the market’s reach.

For more details on this report, Request for Sample

Enteral Feeding Formulas Market Segmentation Analysis

The enteral feeding formulas market is segmented based on product type, age group, flow type, application, end-user, and region.

Product Type-The standard formulas segment is estimated to have 42.8% of the Enteral Feeding Formulas market share.

The standard formulas segment is expected to dominate the enteral feeding formulas market due to its broad clinical use, cost-effectiveness, and ease of administration. These formulas, typically based on whole proteins, are suitable for patients with functional gastrointestinal systems and are widely used across hospitals, nursing homes, and home care settings for conditions such as neurological disorders, cancer, and post-surgical recovery. Their versatility makes them a preferred choice for both short- and long-term nutritional support.

Moreover, leading companies in the clinical nutrition space, such as Abbott, Nestlé Health Science, and Danone, are continuously investing in research and development to improve the nutritional profiles, digestibility, and palatability of standard formulas. Innovations such as fiber-enriched variants, formulas tailored for different calorie needs, and ready-to-use packaging formats are helping to expand the segment’s market share. As healthcare providers increasingly prioritize cost-efficient, reliable nutritional solutions, the demand for standard formulas is expected to remain strong throughout the forecast period.

Geographical Analysis

The North America enteral feeding formulas market was valued at 39.8% market share in 2024

North America is expected to dominate the enteral feeding formulas market throughout the forecast period, driven by well-established healthcare infrastructure, high healthcare spending, and greater awareness of clinical nutrition. The region has a high prevalence of chronic diseases and age-related conditions such as cancer, stroke, and neurodegenerative disorders, which often require long-term nutritional support through enteral feeding. For instance, according to the National Cancer Institute, in 2025, an estimated 2,041,910 new cases of cancer will be diagnosed in the United States. Additionally, strong reimbursement frameworks in countries like the United States and Canada make advanced nutritional products more accessible to patients in both hospital and home care settings.

Leading market players have a strong presence in the region and are continuously launching innovative products tailored to patient needs. Ongoing investments in healthcare facilities, an aging population, and the growing adoption of home enteral nutrition are further contributing to North America’s dominant position in the global market.

Competitive Landscape

The major players in the enteral feeding formulas market include Abbott, Nestlé Health Science, B. Braun SE, Fresenius Kabi AG, Nutritional Medicinals, LLC, Danone, and Otsuka Pharmaceutical Factory, Inc., among others.

Nestlé Health Science: Nestlé Health Science is a leading player in the enteral feeding formulas market, offering a diverse range of nutritional products designed for patients across various clinical settings. Its product portfolio includes standard formulas like Isosource and Nutren, peptide-based options such as Peptamen and Peptamen Junior for patients with gastrointestinal complications, and real-food formulas like Compleat and Compleat Organic Blends, which cater to growing demand for natural, whole-food-based nutrition. The company also provides disease-specific formulas like Modulen for Crohn's disease and Novasource Renal for kidney-related conditions. Nestlé continues to innovate by improving formula composition for better nutrient absorption, tolerance, and taste.

Key Developments:

- In January 2025, Otsuka Pharmaceutical Factory launched ENOSOLID Semi-Solid for Enteral Use, expanding its enteral nutrition product portfolio to better support patients who require nutritional management through non-oral routes. The new semi-solid formulation is designed to improve patient comfort and reduce the risk of aspiration, offering a more efficient and targeted approach to enteral feeding in clinical and home care settings.

In July 2023, Otsuka Pharmaceutical Factory, Inc. launched "ENORAS Liquid for Enteral Use, 200 kcal/125 mL standard, coffee flavor, and tea flavor" as new additions to its "ENORAS Liquid for Enteral Use" product line.

Enteral Feeding Formulas Market Scope

Metrics | Details | |

CAGR | 9.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Standard Formulas, Peptide Formulas, Specialized Formulas |

Age Group | Pediatrics, Adults, Geriatrics | |

Flow Type | Intermittent Feeding Flow, Continuous Feeding Flow | |

Application | Oncology, Diabetes, Neurology, Gastroenterology, Critical Care, Others | |

| End-User | Hospitals, Homecare, Hospices, Long-term Care Facilities, Nursing Homes, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The enteral feeding formulas market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here