Aluminium Scrap Market Size

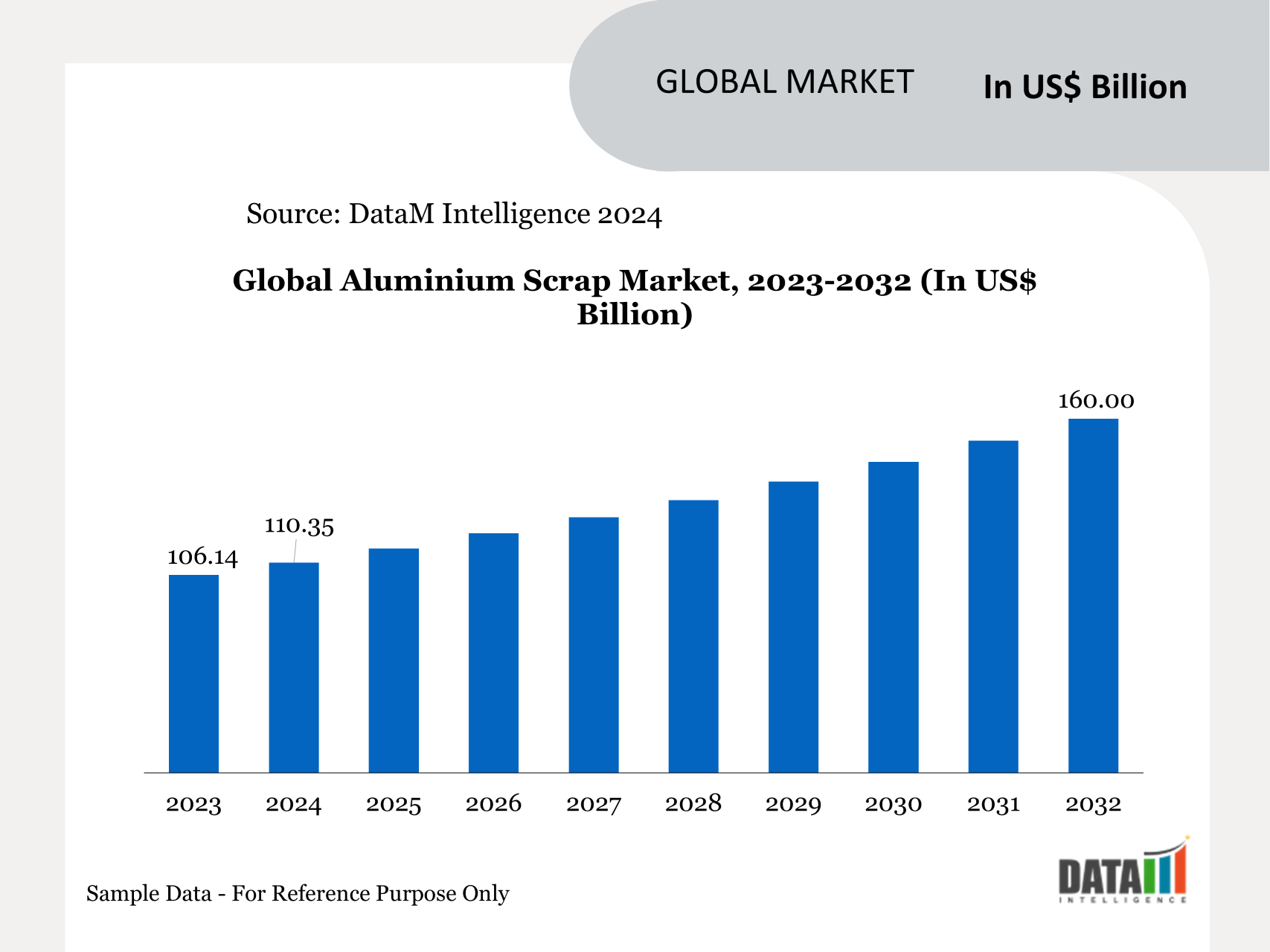

The global aluminium scrap market reached US$110.35 billion in 2024 and is expected to reach US$160.00 billion by 2032, growing at a CAGR of 4.84% during the forecast period 2025-2032. This growth can be attributed to the rising demand for sustainable and energy-efficient materials, as recycling aluminium consumes significantly less energy than primary production. Additionally, increasing industrialization, stringent environmental regulations, and the adoption of circular economy practices are driving the expansion of aluminium scrap recycling globally.

Aluminium Scrap Industry Trends and Strategic Insights

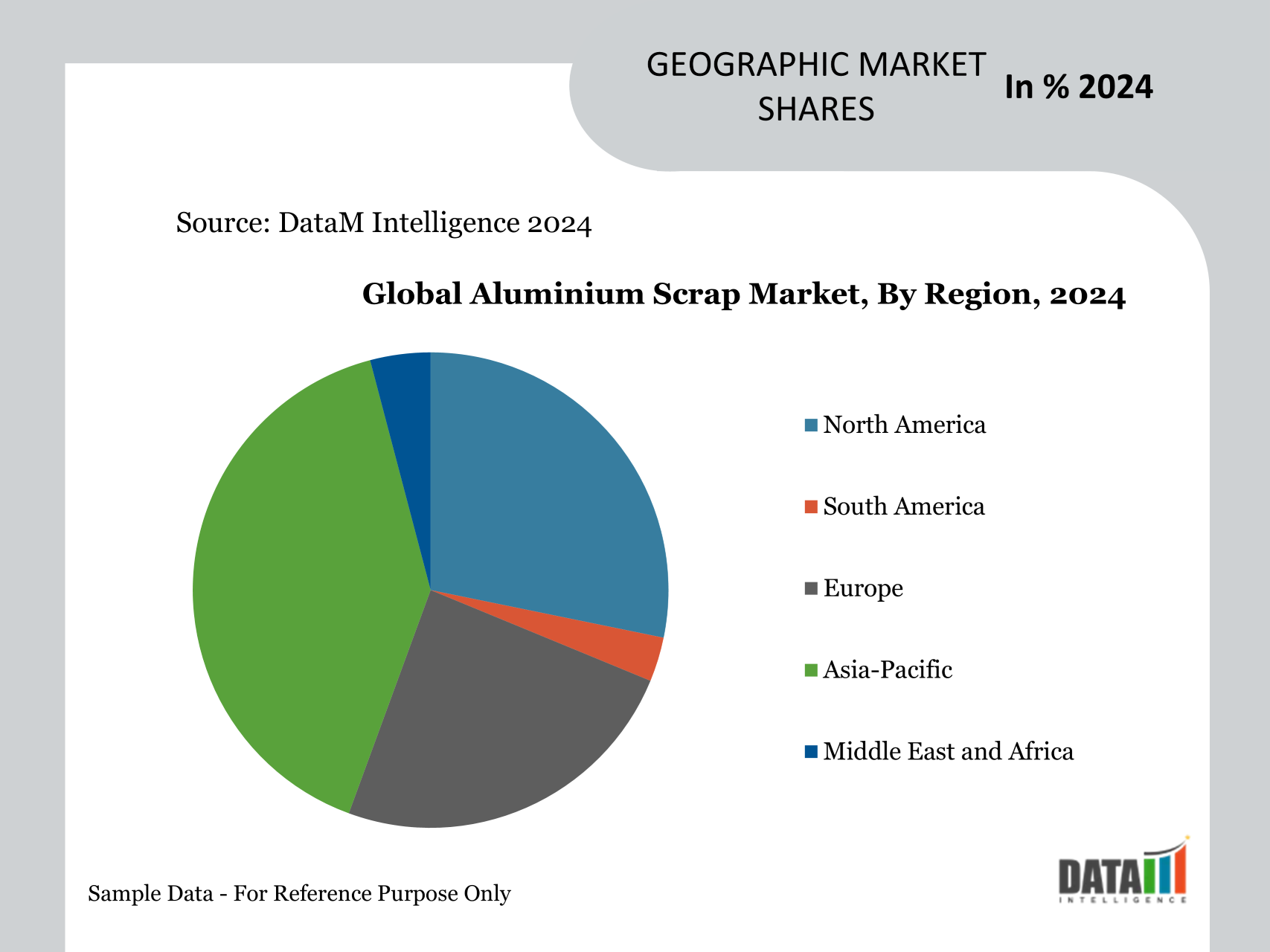

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 61.21% in 2024.

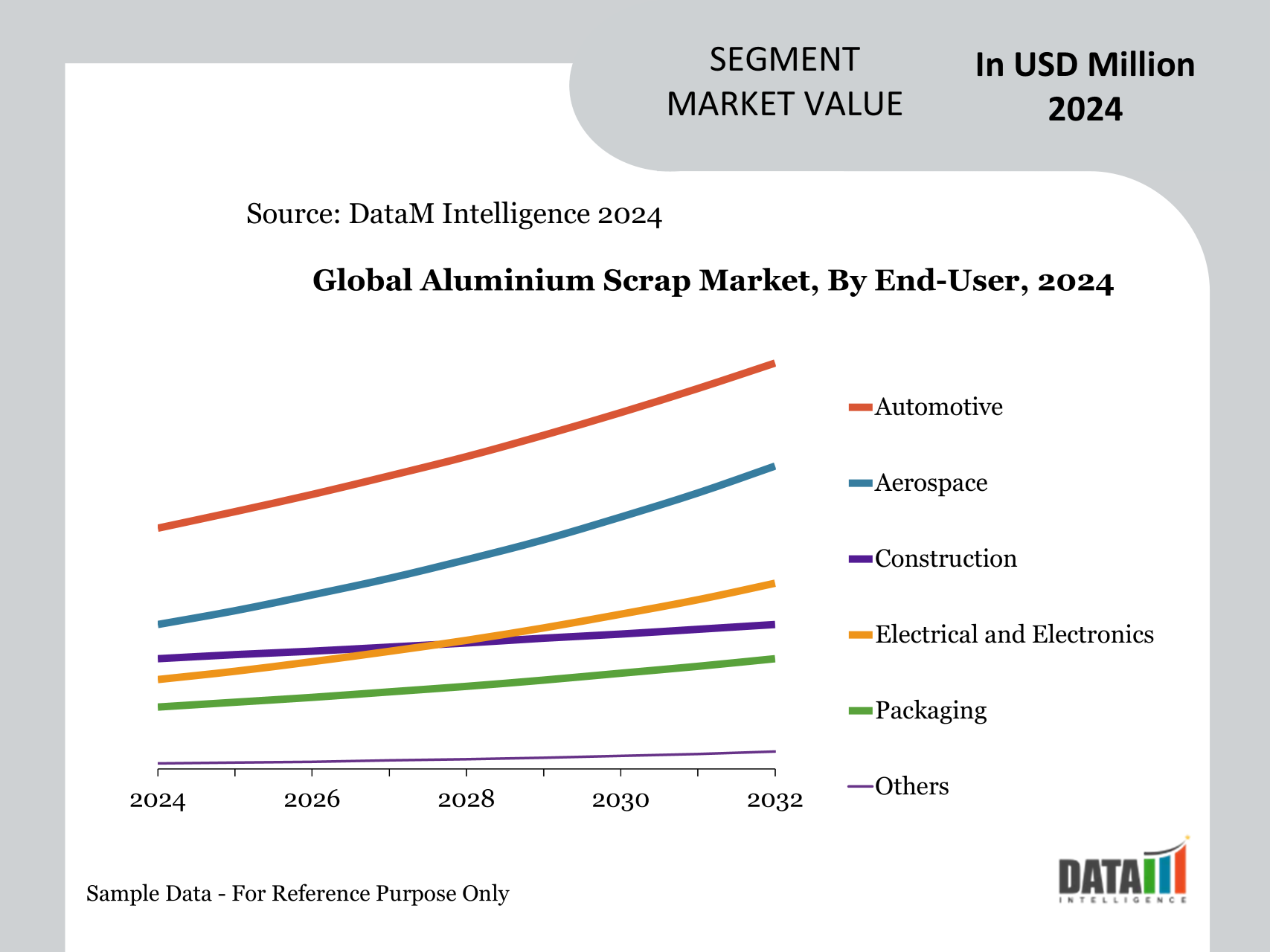

By end-user, the automotive segment is projected to experience the largest market, registering a significant 40.36% in 2024.

Global Aluminium Scrap Market Size and Future Outlook

2024 Market Size: US$110.35 Billion

2032 Projected Market Size: US$160.00 Billion

CAGR (2025-2032): 4.84%

Largest Market: Asia-Pacific

Fastest Market: North America

Market Scope

Metrics | Details |

By Type of Scrap | Pure Aluminium Scrap, Mixed Aluminium Scrap, Extrusion Scrap, Casting Scrap |

By Source of Scrap | Post-Consumer Scrap, Post-Industrial Scrap, New Scrap |

By End-User | Automotive, Aerospace, Construction, Electrical and Electronics, Packaging, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Environmental Sustainability and Energy Efficiency

Environmental sustainability and energy efficiency are major drivers for aluminium scrap usage. Recycling aluminium requires up to 95% less energy compared to producing new aluminium from bauxite, significantly reducing greenhouse gas emissions and conserving natural resources. This efficiency makes recycled aluminium highly attractive to industries seeking to minimize their carbon footprint.

According to the IAI, over 30 million tonnes of aluminium scrap are recycled globally every year, ensuring aluminium remains one of the most recycled materials on the planet. The growing emphasis on sustainable production and energy-efficient processes encourages manufacturers to prioritize recycled aluminium in their operations, reinforcing its importance in industrial supply chains.

Segmentation Analysis

The global Aluminium Scrap market is segmented based on equipment type, alloy, end-user and region.

Automotive Leads Aluminium Scrap as Lightweight Cars and ABS Growth Increase Recycling

The automotive sector holds a significant share in aluminium scrap usage due to the metal’s lightweight and durable properties. Aluminium helps reduce vehicle weight, improving fuel efficiency and lowering emissions, which aligns with global sustainability and regulatory goals. According to the Aluminum Association, aluminium is the fastest-growing automotive material, with usage expected to reach a record 514 pounds per vehicle by 2026, largely driven by increased use of auto body sheet (ABS).

As ABS adoption accelerates, new research published in the Resources, Conservation & Recycling (RCR) Journal indicates that demand for aluminium ABS scrap will reach an all-time high over the next decade. This trend is driven by the first mass-produced aluminium-bodied vehicles—such as the Ford F-150, Super Duty, Expedition, and Lincoln Navigator—approaching the end of their life, ensuring a steady supply of high-quality scrap and reinforcing the automotive sector’s crucial role in aluminium recycling.

Construction Drives Aluminium Scrap Demand Through Low-Carbon, Recycled Materials

The construction sector holds a significant share in aluminium scrap usage due to the growing demand for lightweight, durable, and corrosion-resistant materials in buildings and infrastructure. Recycled aluminium is increasingly preferred in construction projects for structural components, facades, and roofing, as it reduces environmental impact while maintaining performance standards.

In March 2025, Hydro began constructing a US$174.70 (€150) million aluminium recycling facility in Torija, Spain, designed to process up to 70,000 tonnes of post-consumer scrap annually. The plant will produce specialised alloys with a high share of recycled content, supporting construction, transportation, automotive, and energy industries with low-carbon aluminium. This initiative highlights the sector’s reliance on recycled aluminium for sustainable and efficient building solutions.

Geographical Penetration

Asia-Pacific Leads Aluminium Scrap Consumption, Driven by China and India’s Recycling Initiatives

Asia-Pacific dominates aluminium scrap usage globally, driven by rapid industrialization, infrastructure expansion, and increasing adoption of sustainable materials. The region’s focus on recycling and circular economy practices has strengthened the availability and consumption of aluminium scrap across industries such as automotive, construction, and packaging.

India Aluminium Scrap Market Outlook

India’s aluminium scrap usage is growing rapidly due to increasing demand from the construction, transportation, and electrical sectors. Government initiatives promoting sustainable manufacturing and energy-efficient processes are boosting recycled aluminium adoption. Major projects and local recycling facilities are expected to increase the supply of high-quality scrap, supporting India’s shift toward a circular economy in the coming years.

China Aluminium Scrap Market Trends

China is the largest consumer of aluminium scrap in Asia-Pacific, fueled by its massive manufacturing base and construction boom. The country’s aluminium scrap recycling capacity is approximately 14 million tonnes, accounting for 30% of its 2024 primary production. Policies promoting recycling and advanced processing technologies further enhance the use of recycled aluminium, reducing energy consumption and carbon emissions.

North America Holds a Significant Share in the Aluminium Scrap Industry Due to Advanced Recycling and Strong Industrial Demand

North America dominates aluminium scrap consumption due to its mature industrial base, advanced recycling technologies, and strong focus on sustainability, creating a robust ecosystem for circular aluminium use. This leadership is exemplified by RevoCast, which in May 2025 announced the construction of an aluminium remelting facility in Langley, British Columbia, with an annual capacity of 80,000 tonnes. The facility will produce high-quality recycled aluminium, support multiple industries and reinforcing the region’s commitment to efficient resource utilisation.

US Aluminium Scrap Market Insights

In the US, this regional momentum continues as Aluminz Corporation secured a 155-acre site in Mount Pleasant, Texas, in July 2025 to develop the nation’s first zero-landfill aluminium tolling facility. The project complements North America’s recycling infrastructure by ensuring all materials are recovered or reused, reducing environmental impact, and setting benchmarks for sustainable aluminium production.

Canada Aluminium Scrap Industry Growth

Canada also strengthens its regional position through major investments, such as Aluminerie Alouette’s July 2025 plan to invest up to US$1.08 (C$1.5) billion in upgrading smelting operations in northern Quebec. By enhancing production capacity and focusing on sustainable materials, Canada aligns with broader North American efforts to meet industrial demand while advancing the circular economy, linking the country’s initiatives seamlessly with US and regional developments.

Sustainability Analysis

The aluminium scrap sector plays a critical role in promoting sustainability by significantly reducing energy consumption and greenhouse gas emissions compared to primary aluminium production. Recycling aluminium requires up to 95% less energy, conserving natural resources and lowering environmental impact. Widespread recycling supports circular economy practices, ensuring materials are continuously reused across industries. As a result, aluminium scrap contributes to cleaner production processes and helps companies meet global sustainability targets.

Competitive Landscape

The competitive landscape of the aluminium scrap sector is characterized by a mix of established recycling firms, regional processors, and emerging players, all vying to capture market share through innovation and efficiency

Key players include Novelis Inc., Constellium SE, Hydro Aluminium, UACJ Corporation, Alcoa Corporation, Gränges AB, Kaiser Aluminum, AMAG Austria Metall AG, Zhongwang Group, China Hongqiao Group

Companies focus on enhancing collection networks, upgrading remelting and sorting technologies, and improving product quality to meet industrial demand. Strategic partnerships and investments in advanced recycling facilities help firms expand capacities and optimise supply chains.

Key Developments

In August 2025, Fayette County, Georgia, introduced a permanent aluminium can recycling trailer at McCurry Park to encourage residents and local staff to recycle while supporting the Georgia Firefighters Burn Foundation.

In May 2025, the Indian government introduced a national portal for recycling non-ferrous metals, including aluminium, to enhance sustainability and reduce dependence on imported raw materials.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report