Sickle Cell Disease Treatment Market Overview

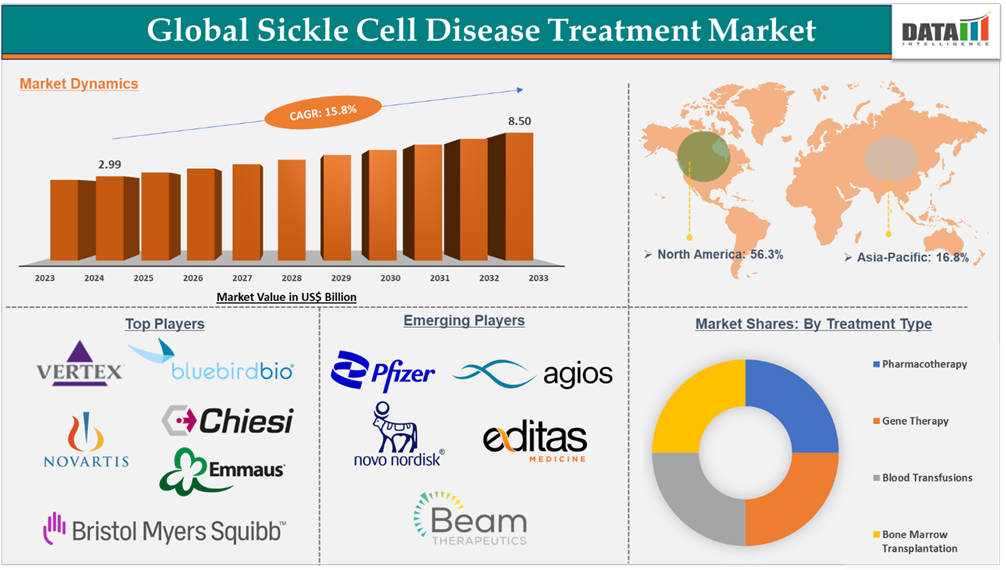

Sickle Cell Disease Treatment Market reached US$ 2.99 billion in 2024 and is expected to reach US$ 9.97 billion by 2033, growing at a CAGR of 14.8% during the forecast period 2025-2033, accordiong to DataM Intelligence report.

The sickle cell disease treatment market is experiencing significant growth due to the rising diagnosis and treatment rates, the rising prevalence of the disease, and the emergence of novel therapeutics. Gene therapies, which are currently in clinical development, are expected to revolutionize the sickle cell disease treatment landscape. However, product recalls and discrepancies in distribution can significantly hinder the market growth

Sickle Cell Disease Treatment Market Definition

Sickle cell disease (SCD) is a group of inherited blood disorders characterized by abnormalities in hemoglobin production. These abnormal hemoglobin cells are sickle-shaped unlike the regular disc-shaped hence the name sickle cell disease. These cells cannot perform regular functions and often accumulate in the small blood vessels obstructing blood flow, leading to painful episodes called vaso-occlusive crises, organ damage, and stroke.

Executive Summary

For more details on this report – Request for Sample

Sickle Cell Disease Treatment Market Dynamics: Drivers & Restraints

The rising novel drug development activities and regulatory approvals drive the sickle cell disease treatment market.

Sickle cell disease is one of the current global burdens of diseases with a rising number of prevalent cases. Despite the higher number of cases, the treatment options are limited to a handful of drugs and expensive blood transfusions and bone marrow transplantations. To tackle the high unmet demands, many innovators and market players are investing in rigorous R&D activities and are launching advanced therapies for patients. These advanced therapies include gene editing therapies, pyruvate kinase inhibitors, erythropoiesis-stimulating agents, etc.

For instance, in December 2023, the U.S. Food and Drug Administration (FDA) approved CASGEVY (exagamglogene autotemcel [exa-cel]) for the treatment of sickle cell disease in patients 12 years and older with recurrent vaso-occlusive crises. CASGEVY is a CRISPR/Cas9-based gene editing therapy co-developed by Vertex Pharmaceuticals Incorporated and CRISPR Therapeutics. Post its approval, Vertex administered CASGEVY to the first patient in the mid of 2024.

Moreover, on the same day, the U.S. FDA approved bluebird bio, Inc.’s LYFGENIA (lovotibeglogene autotemcel) for the same indication. Bluebird aims to complete cell collections from 50 LYFGENIA-administered patients by March 31, 2025, and from 70 patients by June 30, 2025.

On the other hand, L-glutamine oral powder sold under the brand name Enadri, manufactured by Emmaus Medical, Inc., is being approved across the globe for the treatment of symptoms of sickle cell disease. For instance, in May 2023, Enadri received marketing approval from the Bahrain National Health Regulatory Authority, followed by approval from the Oman Ministry of Health in July 2023, and in Puerto Rico in February 2024.

Product recalls and discrepancies in distribution can significantly hinder the Sickle cell disease treatment market growth.

The treatment options for sickle cell disease are limited, and any discrepancies in the product distribution or product recalls may hinder the market growth. Once a therapy has been approved, the adoption rate is high in conditions with high unmet needs. Manufacturers must ensure a regular supply of medicine to treat these patients. Any disruption can lead to decreased adoption and hindrance of the overall market.

For instance, in September 2025, Pfizer Inc. voluntarily discontinued OXBRYTA (voxelotor) from the worldwide markets, which was aimed at treating sickle cell disease. Pfizer has recalled all the lots of Oxbryta and also discontinued all the clinical trials after assessing that the overall benefits do not outweigh the risks. As per DataM estimates, the market for sickle cell disease treatment is expected to be disrupted in early 2025, due to Oxbryta discontinuation.

Sickle Cell Disease Treatment Market: Pipeline Analysis

Sickle Cell Disease Treatment Market Segment Analysis

The global sickle cell disease treatment market is segmented based on disease type, treatment type, and region.

Gene therapy in the treatment type segment is expected to grow with the highest CAGR of 17.5% in the forecasted period.

Gene therapy is a revolutionary treatment option for sickle cell disease and is considered the ultimate cure. They act on the root cause, modifying the genes either by gene addition, editing, or removal. The pathophysiology of sickle cell disease lies in the inheritance of mutated genes from parents, and in such conditions, gene therapy comes to the rescue.

Currently, two gene therapies have been approved for use in sickle cell disease, and they are notably Casgevy and Lyfgenia. Casgevy (exagamglogene autotemcel), co-developed by Vertex Pharmaceuticals Incorporated and CRISPR Therapeutics, is a CRISPR/Cas9-technology-based cellular gene therapy consisting of autologous CD34+ Hematopoietic stem cells (HSCs) edited at the erythroid-specific enhancer region of the BCL11A gene to reduce BCL11A expression in erythroid lineage cells, leading to increased fetal hemoglobin (HbF) protein production. Casgevy is prepared from the patient's hematopoietic stem cells and administered as an HSc transplant.

Whereas LYFGENIA (lovotibeglogene autotemcel) developed by Bluebird Bio, Inc. is also prepared from patient’s hematopoietic stem cells enriched with CD34+ cells and transduced with BB305 LVV encoding βA-T87Q-globin. This gene therapy is intended for one-time administration to add functional copies of modified genes into a patient’s hematopoietic stem cells.

These gene therapies are backed by favorable scientific evidence that demonstrates a safety and efficacy profile. The manufacturers of these two gene therapies are actively involved in regulatory submissions across the globe and are further conducting clinical trials in child populations below 12 years of age.

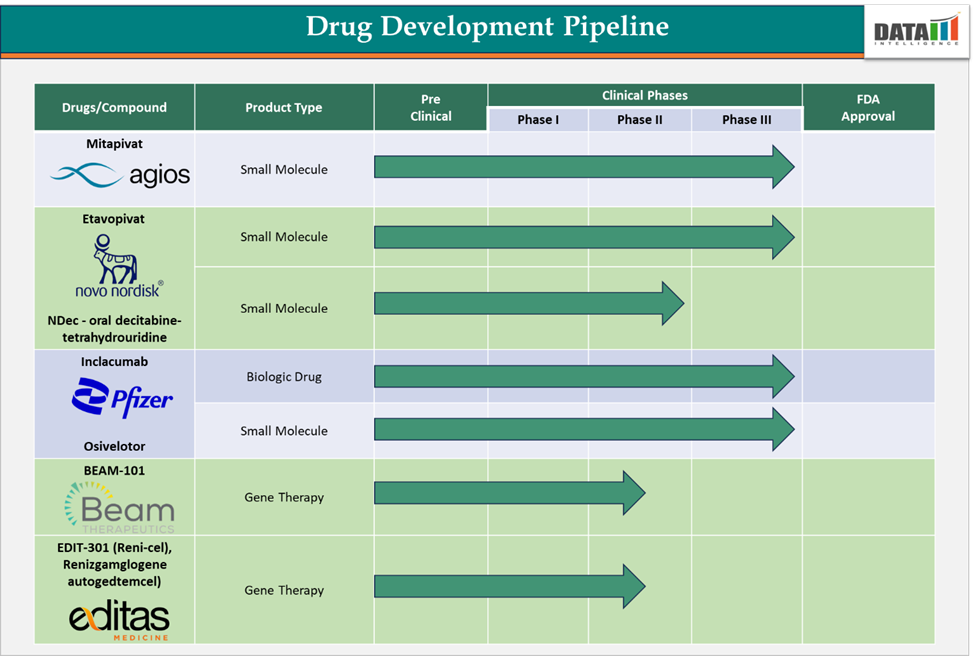

The adoption rate for these gene therapies is expected to pick up in 2025 and is expected to experience significant growth in the forecast period. Moreover, there are two more potential gene therapies in the pipeline being developed by Beam Therapeutics., and Editas Medicine, which is anticipated to make a market entry in this decade and contribute to the overall segment growth.

Sickle Cell Disease Treatment Market Geographical Analysis

North America dominates the sickle cell disease treatment market with the highest share of 42% in 2024.

North America led the global sickle cell disease treatment market in 2022 with a market size of US$ 1.04 billion and reached further to US$ 1.14 billion in 2023.

North America is estimated to hold the highest market share throughout the forecast period, owing to factors like the rising prevalence of cases of sickle cell disease, increasing research and development activities by market players, strong presence of market players, and higher revenue generation from approved therapies.

For instance, according to the American Society of Hematology and the Centers for Disease Control and Prevention, nearly 100,000 people are living with sickle cell disease in the U.S., which affects 1 in every 365 Black or African American births.

This higher prevalence, coupled with the availability of advanced therapies like Casgevy, Lyfgenia, Adekveo, Reblozyl, and Endari, represents the high treatment rate among the U.S. patient population. Moreover, these therapies/drugs are sold at higher prices by manufacturers in the U.S., which leads to higher revenue generation. For instance, in 2024, Bristol-Myers Squibb Company, the manufacturer of Rbelozyl, generated nearly 80% of the total US$ 1.7 billion revenue from the U.S.

All these factors signify the dominance of North America in the global sickle cell disease treatment market.

Sickle Cell Disease Treatment Market Major Players

The major players in the sickle cell disease treatment market are Novartis AG, Vertex Pharmaceuticals Incorporated, bluebird bio, Inc., Emmaus Medical, Inc., Bristol-Myers Squibb Company., CHIESI FARMACEUTICI S.p.A., and Teva Pharmaceutical Industries Ltd., among others.

Sickle Cell Disease Treatment Market Emerging Players

The emerging players in the sickle cell disease treatment market are Agios Pharmaceuticals, Inc., Beam Therapeutics, Editas Medicine, Novo Nordisk A/S, and Pfizer Inc., among others.

Key Developments

In December 2024, Agios Pharmaceuticals, Inc. announced that the European Commission (EC) has positive of designating mitapivat as an orphan medicinal product (OMP) for the treatment of sickle cell disease. The drug is an oral, small-molecule PK activator that has met primary endpoints in phase 3 clinical trials (ENERGIZE and ENERGIZE-T) of transfusion-dependent alpha- or beta-thalassemia, post which Agios has filed regulatory applications for mitapivat (PYRUKIND) in the U.S., EU, KSA, and UAE.

In December 2024, Editas Medicine, Inc. presented the updated results of the RUBY clinical trial evaluating Reni-cel in patients with severe sickle cell disease. The study concluded that Reni-cel is well tolerated and has continued to demonstrate a safety profile. 27 out of 28 patients were free of vaso-occlusive events (VOEs), and early normalization of total hemoglobin was observed in patients.

Market Scope

Metrics | Details | |

CAGR | 14.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Disease Type | Hemoglobin SS (HbSS), Hemoglobin SC (HbSC), Hemoglobin (HbS) Beta Thalassemia, and Others |

Treatment Type | Pharmacotherapy, Gene Therapy, Blood Transfusions, and Bone Marrow Transplantation | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |