Liver Disease Treatment Market Size & Industry Outlook

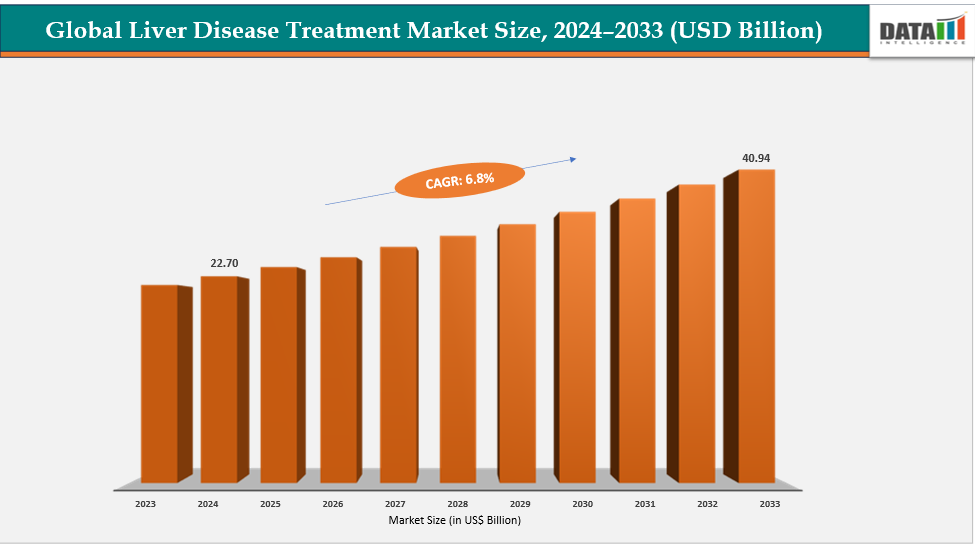

The global liver disease treatment market size reached US$ 21.36 billion with rise of US$ 22.70 billion in 2024 is expected to reach US$ 40.94 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033. One of the major drivers of the global liver disease treatment market is increasing awareness and early diagnosis initiatives. Governments, healthcare organizations, and non-profits are actively promoting liver health education and screening programs, leading to earlier detection of conditions like hepatitis B and C, fatty liver disease, and liver cancer. For instance, the World Health Organization (WHO) has launched global hepatitis elimination programs that encourage widespread testing and early treatment. Early diagnosis not only improves patient outcomes but also drives demand for antiviral therapies, liver-protective drugs, and innovative treatments, thereby fueling market growth.

Key Highlights

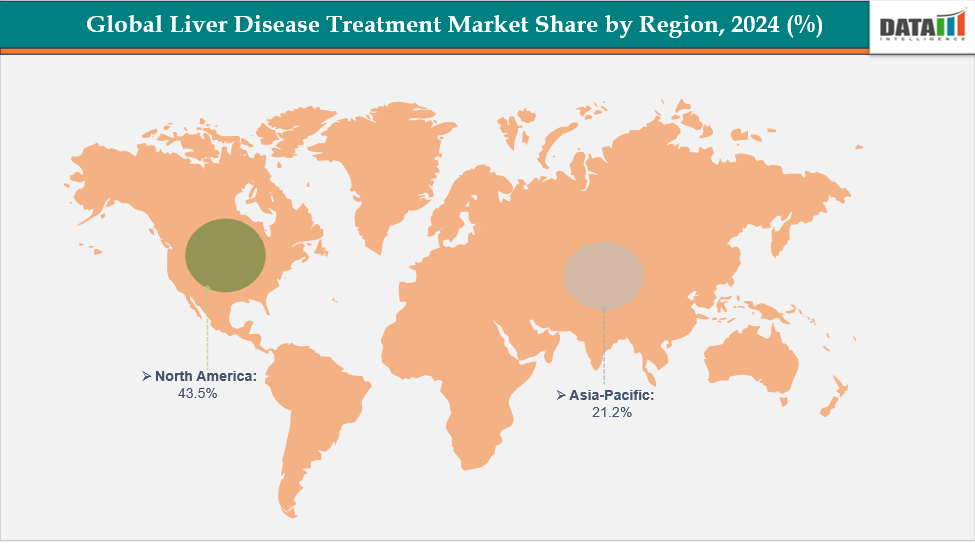

- North America dominates the liver disease treatment market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

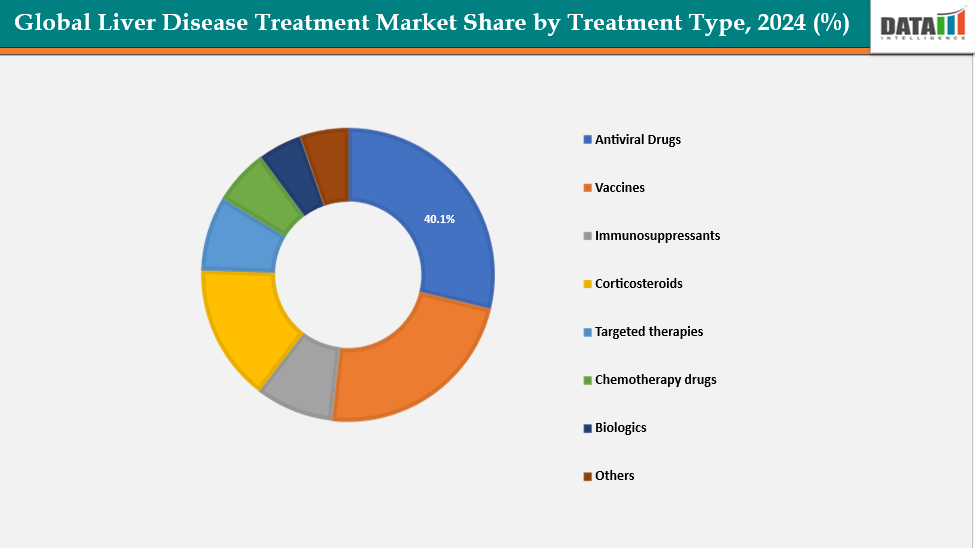

- Based on treatment type, antiviral drugs segment led the market with the largest revenue share of 40.1% in 2024.

- The major market players in the AbbVie, Gilead Sciences, Inc, F. Hoffmann-La Roche Ltd., Bristol-Myers Squibb, Astellas Pharma Inc., Intercept Pharmaceuticals, Madrigal Pharmaceuticals, Akero Therapeutics and among others.

Market Dynamics

Drivers: Increasing incidence of liver diseases is significantly driving the liver disease treatment market growth

A key driver of the global liver disease treatment market is the increasing incidence of liver diseases, which has been rising steadily over the past decades due to various lifestyle, environmental, and demographic factors. Conditions such as hepatitis B and C, non-alcoholic fatty liver disease (NAFLD), metabolic dysfunction-associated steatohepatitis (MASH), cirrhosis, and liver cancer are becoming more prevalent worldwide.

For instance, according to the World Health Organization (WHO), an estimated 296 million people were living with chronic hepatitis B infection in 2022, while hepatitis C affected around 58 million people globally. Additionally, the growing prevalence of obesity and type 2 diabetes has contributed to a surge in NAFLD and MASH cases, which are emerging as major public health concerns. This rising burden of liver diseases increases the demand for effective diagnostics, antiviral therapies, immunomodulators, and novel liver-targeted treatments.

Restraints: Strict regulatory approvals are hampering the growth of the liver disease treatment market

The global liver disease treatment market faces a significant challenge due to strict regulatory approvals from authorities like the FDA and EMA. These regulations ensure drug safety, efficacy, and quality, but can delay the introduction of innovative treatments. For example, antiviral drugs for hepatitis or novel therapies for NASH/MASH require multiple clinical trials and stringent manufacturing standards. This rigorous regulatory environment can limit treatment speed, restrict market growth, and pose financial and operational challenges for pharmaceutical companies in the liver disease treatment sector.

For more details on this report – Request for Sample

Segmentation Analysis

The global liver disease treatment market is segmented based on treatment type, disease type, route of administration, distribution channel, and region.

Treatment Type: The antiviral drugs from treatment type segment to dominate the liver disease treatment market with a 40.1% share in 2024

The antiviral drug segment is a major driver of the liver disease treatment market due to the high prevalence of viral hepatitis infections worldwide. Chronic hepatitis B and C infections affect hundreds of millions of people globally, creating a persistent demand for effective antiviral therapies. Innovations in direct-acting antivirals (DAAs) have significantly improved cure rates for hepatitis C, while nucleos(t)ide analogs have become the standard of care for hepatitis B, reducing the risk of liver cirrhosis and hepatocellular carcinoma.

For instance, in June 2025, Enanta Pharmaceuticals has received FDA approval for MAVYRET, an oral pangenotypic direct acting antiviral therapy, as the only eight-week treatment for adults and pediatric patients three years and older with acute or chronic HCV infection without cirrhosis or with compensated cirrhosis. The FDA has approved the treatment for viral infections and immunological diseases.

Additionally, government initiatives and WHO-led hepatitis elimination programs are promoting widespread screening and treatment, further boosting the uptake of antiviral drugs. The availability of oral, convenient, and highly effective antiviral regimens has made this segment one of the fastest-growing contributors to the liver disease therapeutics market.

Disease Type:The hepatitis segment is estimated to have a 41.2% of the liver disease treatment market share in 2024

The hepatitis disease type segment drives market growth due to the ongoing global burden of both hepatitis B (HBV) and hepatitis C (HCV) infections. Factors such as unsafe medical practices, blood transfusions, and high-risk behaviors contribute to the continued spread of these viral infections, particularly in developing regions. The rising prevalence of chronic hepatitis increases the demand for early diagnosis, long-term management, and treatment interventions, including antivirals, vaccines, and liver-protective therapies. Public health campaigns, increasing awareness, and government-supported vaccination programs for hepatitis B are also stimulating growth in this segment, making hepatitis-related therapies a cornerstone of the liver disease treatment market.

Geographical Analysis

North America dominates the global liver disease treatment market with a 43.5% in 2024

The liver disease treatment market in North America is primarily driven by the high prevalence of hepatitis C, liver cancer, and non-alcoholic fatty liver disease (NAFLD). Widespread awareness campaigns, advanced healthcare infrastructure, and strong reimbursement policies encourage early diagnosis and treatment. Additionally, continuous investment in research and development of novel antiviral and NASH-targeted therapies fuels market growth.

In the United States, the market is propelled by the high incidence of chronic liver diseases and obesity-related NAFLD/NASH cases. Federal initiatives such as the CDC’s hepatitis screening and elimination programs increase patient identification, leading to greater demand for antiviral drugs, immunosuppressants, and liver-protective therapies. The presence of leading pharmaceutical companies and clinical trial activity also contributes significantly.

For instance, in August 2025, The U.S. Food and Drug Administration has approved Wegovy (semaglutide) injection to treat metabolic-associated steatohepatitis (MASH) in adults with moderate-to-advanced fibrosis (excessive scar tissue in the liver). MASH, also known as nonalcoholic steatohepatitis, is a serious liver disease.

Europe is the second region after North America which is expected to dominate the global liver disease treatment market with a 34.5% in 2024

Europe’s market growth is driven by the aging population, rising liver disease prevalence, and strong government support for healthcare initiatives. Countries like France, Italy, and the UK have implemented nationwide hepatitis vaccination and screening programs. The focus on early diagnosis and treatment of NAFLD/NASH and liver cancer creates steady demand for innovative therapeutics.

In Germany, the market is boosted by well-established healthcare infrastructure, high patient awareness, regulatory approvals and robust reimbursement frameworks. The country’s emphasis on chronic disease management, coupled with widespread hepatitis vaccination programs and access to advanced therapies, supports the adoption of antiviral drugs, biologics, and targeted treatments.

For instance, in August 2025, Madrigal Pharmaceuticals has received conditional marketing authorization from the European Commission for Rezdiffra, a novel therapeutic for metabolic dysfunction-associated steatohepatitis (MASH). The treatment is now the first and only approved therapy in the EU for adults with noncirrhotic MASH with moderate to advanced liver fibrosis.

The Asia Pacific region is the fastest-growing region in the global liver disease treatment market, with a CAGR of 8.1% in 2024

The Asia Pacific market is driven by the high burden of viral hepatitis, particularly HBV and HCV, in countries like China and India. Rapid urbanization, lifestyle changes, and increasing rates of obesity contribute to NAFLD/NASH prevalence. Expanding healthcare access, government-led vaccination campaigns, and rising awareness about liver diseases further accelerate market growth.

Japan’s market growth is supported by the aging population and high prevalence of liver cancer and chronic hepatitis. Strong healthcare infrastructure, early diagnosis programs, and availability of advanced antiviral and immunomodulatory therapies contribute to increasing adoption. Government initiatives to reduce hepatitis-related mortality also enhance treatment uptake.

For instance, in September 2025, Japan's Ministry of Health, Labour and Welfare has approved Bylvay (odevixibat) for treating pruritus associated with progressive familial intrahepatic cholestasis (PFIC). PFIC is a rare genetic disorder causing liver damage and potentially liver failure. Symptoms include severe itching, skin mutilation, sleep disruption, irritability, and impaired cognitive and social development. The condition severely impacts quality of life through debilitating symptoms.

Competitive Landscape

Top companies in the liver disease treatment market include AbbVie, Gilead Sciences, Inc, F. Hoffmann-La Roche Ltd, Bristol-Myers Squibb, Astellas Pharma Inc., Intercept Pharmaceuticals, Madrigal Pharmaceuticals, Akero Therapeutics and among others.

AbbVie: AbbVie is a key player in the liver disease treatment market, leveraging its strong portfolio of antiviral and liver-targeted therapies to address chronic hepatitis and related conditions. The company’s products, such as Viekira Pak and Mavyret, have been instrumental in providing highly effective treatment options for hepatitis C, offering shorter treatment durations and high cure rates. AbbVie also invests in research and development for emerging liver diseases, including NASH and autoimmune liver disorders, aiming to expand its therapeutic offerings beyond traditional antivirals.

Market Scope

| Metrics | Details | |

| CAGR | 6.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Treatment Type | Antiviral drugs, Vaccines, Immunosuppressants, Corticosteroids, Targeted therapies, Chemotherapy drugs Biologics, Others |

| Disease Type | Hepatitis, Alcohol-related liver disease, Haemochromatosis, Primary biliary cholangitis, Others | |

| Route of Administration | Oral, Injectable | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global liver disease treatment market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here