Pharmaceuticals Market Size

The global pharmaceuticals market size reached US$ 1,740.44 Billion in 2024 from US$ 1,635.82 Billion in 2023 and is expected to reach US$ 3,178.63 Billion by 2033, growing at a CAGR of 7.0% during the forecast period 2025-2033.

Pharmaceuticals Market Overview

The pharmaceuticals market is undergoing a period of transformation driven by shifting healthcare needs, innovation, and structural pressures. Rising incidences of chronic and lifestyle-related diseases, coupled with aging populations, continue to fuel sustained demand for medicines across therapeutic categories. Innovation remains a key growth driver, with breakthroughs in biologics, gene therapies, and personalized medicine reshaping treatment approaches and expanding pipelines. At the same time, digitalization and AI are accelerating drug discovery and improving clinical trial efficiency, while online pharmacies and direct-to-consumer models are altering traditional distribution dynamics.

However, the industry faces headwinds in the form of patent expirations, regulatory complexities, and increasing pricing pressures from governments and insurers. Competition from generics and biosimilars is intensifying, forcing established players to invest heavily in R&D and explore strategic alliances to maintain market leadership. Despite these challenges, the sector remains resilient, supported by strong innovation momentum and global healthcare demand.

Pharmaceuticals Market Executive Summary

Pharmaceuticals Market Dynamics

Drivers:

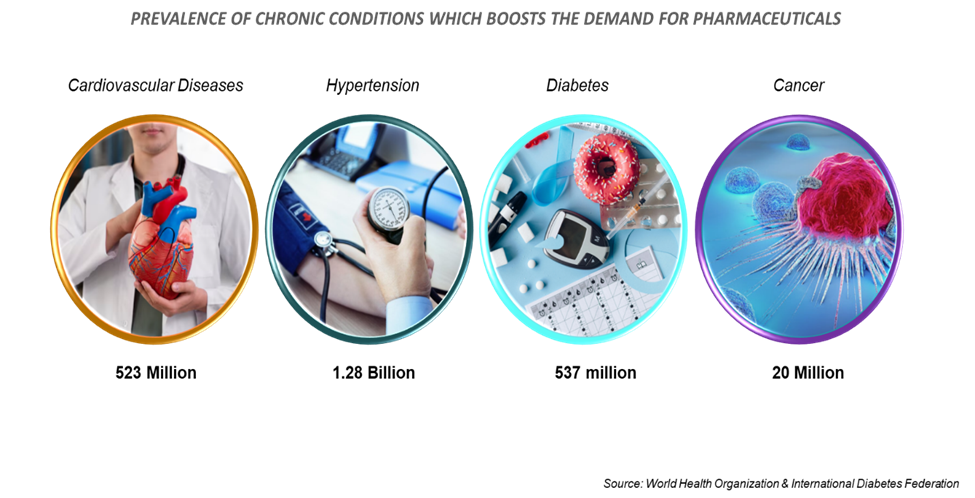

Rising prevalence of chronic diseases and ageing population is significantly driving the pharmaceuticals market growth

The rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, cancer, and respiratory illnesses is creating sustained demand for long-term therapies, boosting pharmaceutical consumption worldwide. For instance, the global diabetes epidemic is fueling demand for insulin analogs and GLP-1 therapies from companies like Novo Nordisk and Eli Lilly. Similarly, oncology remains the largest therapeutic area, with growing need for targeted drugs and immunotherapies as cancer cases continue to rise.

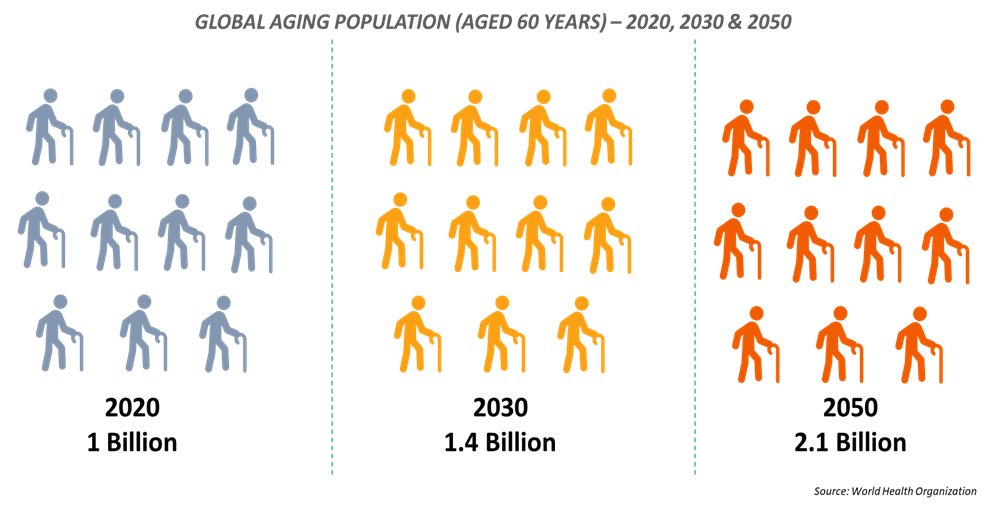

At the same time, the aging population is driving higher demand for treatments related to Alzheimer’s, osteoporosis, arthritis, and cardiovascular conditions, which are more prevalent in older adults. For instance, according to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. At this time the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion in 2030. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). As life expectancy increases, older populations often require multiple medications, further accelerating pharmaceutical market.

Restraints:

Regulatory hurdles and regional disparities are hampering the growth of the pharmaceuticals market

The growth of the pharmaceuticals market is significantly hampered by complex regulatory frameworks and uneven regional standards. Each region has its own drug approval requirements, for instance, while the FDA (US) emphasizes rigorous clinical trial data, the EMA (Europe) applies cost-effectiveness assessments, and emerging markets often have slower, less transparent review systems. These disparities delay global product launches and increase compliance costs.

In some cases, regulatory delays mean patients wait years for access, for instance, cancer drugs available in the US often reach developing markets much later. Pricing and reimbursement rules also vary widely countries like Germany and the UK impose strict health technology assessments (HTAs) before approving drug coverage, whereas the US allows higher launch prices. Meanwhile, inconsistent enforcement in parts of Asia and Africa enables counterfeit drugs to enter the market, undermining trust and safety. Together, these regulatory hurdles and regional disparities create fragmented access, rising costs, and slower innovation diffusion, limiting the market’s full growth potential.

For more details on this report – Request for Sample

Pharmaceuticals Market, Segment Analysis

The global pharmaceuticals market is segmented based on type, drug type, therapeutic area, route of administration, distribution channel, and region.

The branded drugs segment from the drug type is dominating the pharmaceuticals market with a 74.91% share in 2024

The branded drugs segment continues to dominate the global pharmaceuticals market, largely because of their premium pricing and innovative value. These drugs, typically under patent protection, allow companies to recoup massive R&D investments and command strong margins. For instance, blockbuster branded drugs like Keytruda (Merck) in oncology, Humira (AbbVie) in immunology, and Ozempic/Wegovy (Novo Nordisk) for diabetes and obesity generated tens of billions of dollars annually, contributing heavily to company revenues.

The dominance is further reinforced by strong pipelines of biologics and specialty medicines, which treat complex diseases where few alternatives exist. Branded drugs also benefit from aggressive marketing strategies, physician loyalty, and payer coverage, ensuring broad market uptake despite high costs. Even as generics and biosimilars grow, their value share remains smaller because branded therapies address high-growth therapeutic areas like oncology, immunology, and CNS disorders. While patent expirations create vulnerability, the introduction of next-generation branded therapies, particularly biologics, gene therapies, and mRNA-based treatments, ensures that this segment retains its leadership in driving global market revenues.

Pharmaceuticals Market, Geographical Analysis

North America is expected to dominate the global pharmaceuticals market with a 45.89% in 2024

North America remains the leading region in the global pharmaceuticals market, contributing the largest share driven by high healthcare spending, advanced R&D capabilities, and the presence of major pharmaceutical giants such as Pfizer, Johnson & Johnson, Merck & Co., AbbVie, Bristol-Myers Squibb, and Eli Lilly. The US, in particular, is the world’s largest single pharmaceutical market, accounting for high global drug spending, fueled by a strong demand for branded and specialty medicines.

For instance, blockbuster drugs like Keytruda (Merck), Humira (AbbVie), and Ozempic (Novo Nordisk, marketed heavily in the US) generate billions annually, reflecting the region’s purchasing power. North America also leads in biologics and advanced therapies, supported by robust biotech clusters. Furthermore, the region’s favorable regulatory environment under the FDA, though stringent, allows faster approval of breakthrough therapies compared to many global counterparts.

The growing adoption of digital health, AI-driven R&D, and online pharmacy platforms also add to its leadership. Additionally, high prevalence of chronic diseases like diabetes, cancer, and cardiovascular disorders further sustains strong drug demand. Despite pricing pressures from reforms like the Inflation Reduction Act, North America’s innovation ecosystem and high per-capita healthcare expenditure ensure it remains the dominant force in the global pharmaceuticals market.

Pharmaceuticals Market Competitive Landscape

Top companies in the pharmaceuticals market include Johnson & Johnson, F. Hoffmann-La Roche Ltd, Merck & Co., Inc., Pfizer Inc., AbbVie Inc., AstraZeneca, Novartis AG, Bristol-Myers Squibb Company, Eli Lilly and Company, Sanofi, Novo Nordisk A/S, GSK plc, Amgen Inc., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Gilead Sciences, Inc., Bayer AG, Merck KGaA, and Teva Pharmaceutical Industries Ltd., among others.

Pharmaceuticals Market, Key Developments

In August 2025, Tonix Pharmaceuticals Holding Corp. announced that the U.S. Food and Drug Administration (FDA) approved Tonmya (cyclobenzaprine HCl sublingual tablets) for the treatment of fibromyalgia in adults. Tonmya is a first-in-class, non-opioid, once-daily bedtime analgesic with a unique sublingual formulation that is designed for rapid absorption into the bloodstream. Tonmya is the first new FDA-approved therapy for the treatment of fibromyalgia in over 15 years.

In August 2025, Intas Pharmaceuticals launched HETRONIFLY (Serplulimab), the first PD-1 inhibitor globally approved for the treatment of Extensive-Stage Small Cell Lung Cancer (ES-SCLC), in the Indian market. This marks another major milestone, following the successful Launch in Europe.

In July 2025, Sun Pharmaceutical Industries Ltd launched LEQSELVI (deuruxolitinib) in the United States for the treatment of severe alopecia areata. The drug demonstrated rapid efficacy during clinical trials, with one-third of patients regaining nearly full scalp hair by Week 24. Some patients showed significant results as early as 8 weeks.

Pharmaceuticals Market Scope

Metrics | Details | |

CAGR | 7.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Prescription Drugs and Over-the-Counter (OTC) Drugs |

Drug Type | Branded Drugs and Generic Drugs | |

Therapeutic Area | Cardiovascular Diseases, Oncology, Neurology, Respiratory Diseases, Endocrine & Metabolic Diseases, Gastrointestinal Disorders, Musculoskeletal Disorders, Dermatology Disorders and Others | |

Route of Administration | Oral, Topical, Parenteral, Inhalations and Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global pharmaceuticals market report delivers a detailed analysis with 105 key tables, more than 87 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here