Sustainable Pharmaceutical Packaging Market Size

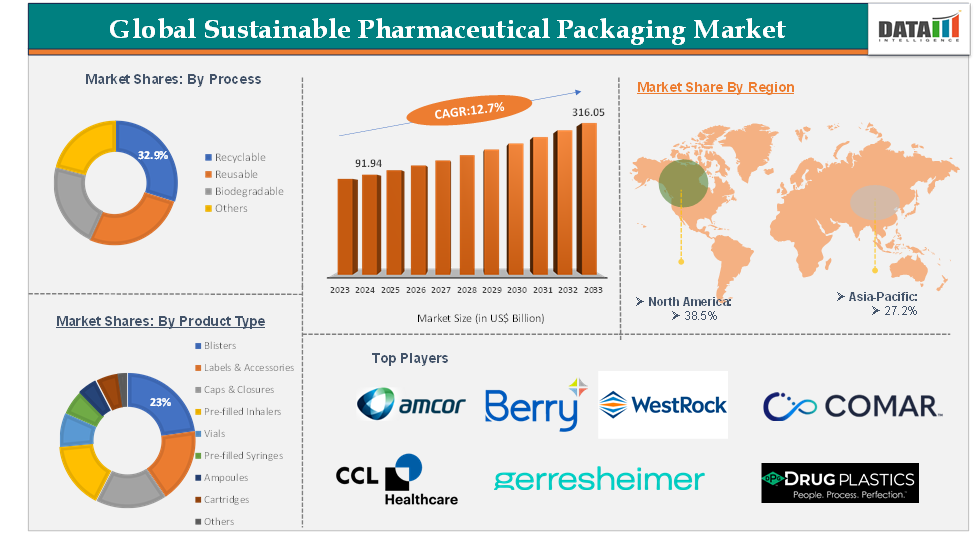

Sustainable Pharmaceutical Packaging Market size reached US$ 91.94 Billion in 2024 and is expected to reach US$ 316.05 Billion by 2033, growing at a CAGR of 12.7% during the forecast period 2025-2033, according to DataM Intelligence report.

The global sustainable pharmaceutical packaging market is experiencing robust growth, driven by the rising prevalence of respiratory disorders such as COPD, asthma, and sleep apnea, along with a growing geriatric population requiring long-term oxygen therapy. Increasing patient preference for home-based and mobile healthcare solutions, especially in the wake of the COVID-19 pandemic, has further fueled demand for lightweight, user-friendly devices. Technological advancements are transforming oxygen concentrators into essential tools for chronic care management.

Executive Summary

For more details on this report – Request for Sample

Sustainable Pharmaceutical Packaging Market Dynamics: Drivers & Restraints

Rising consumer preference for recyclable and eco-friendly materials is expected to drive the sustainable pharmaceutical packaging market growth significantly

Consumer preference for recyclable and eco-friendly materials is increasingly influencing the sustainable pharmaceutical packaging market. As environmental concerns rise, consumers are becoming more aware of the detrimental effects of packaging waste on the planet. This awareness is prompting them to advocate for pharmaceutical companies to adopt sustainable practices, prioritizing packaging made from recyclable, biodegradable, or renewable resources. Consequently, this shift in consumer behavior is compelling manufacturers to innovate and integrate eco-friendly materials into their product designs, aligning with the values of environmentally conscious consumers.

Manufacturers are developing innovative, sustainable solutions to reduce the impact of harmful plastic and other materials on the environment. For instance, in October, 2024, Bayer launched a first-of-its-kind in the healthcare industry, polyethylene terephthalate (PET) blister packaging on its renowned brand, Aleve.

The growing demand for eco-friendly packaging is driving significant investments in research and development within the pharmaceutical industry. Companies are exploring alternatives to traditional plastics, opting for materials such as glass, paper, and biodegradable polymers. For instance, in November 2023, ACG launched its new sustainable packaging technologies. These innovations are designed to enhance environmental responsibility and operational efficiency within the pharmaceutical sector. The introduction of these eco-friendly packaging solutions marks a significant step forward in ACG’s commitment to sustainability and innovation.

High costs associated with eco-friendly materials are expected to hinder the sustainable pharmaceutical packaging market

Sustainable packaging solutions often require advanced technologies, specialized materials, and unique production processes, which can lead to significantly higher manufacturing costs. For pharmaceutical companies that operate on tight profit margins, these additional expenses can present a considerable challenge. Furthermore, the price fluctuations associated with certain eco-friendly materials, such as biodegradable plastics and renewable resources, cause financial instability that could hinder their broader adoption in the market.

Sustainable Pharmaceutical Packaging Market Segment Analysis

The global sustainable pharmaceutical packaging market is segmented based on packaging type, process, raw material, product type, end-user, and region.

Process:

The recyclable segment is expected to hold 32.9% of the market share in 2024 in the sustainable pharmaceutical packaging market

The recyclable segment is anticipated to dominate the market due to its increasing popularity among consumers, regulatory pressures, and cost-effectiveness. As awareness of environmental concerns continues to grow globally, consumers are seeking packaging solutions that minimize waste and support sustainability.

Recyclable packaging offers a practical, eco-friendly option, allowing pharmaceutical companies to meet consumer demands while reducing their environmental impact. The ability to recycle materials not only helps reduce waste sent to landfills but also supports the circular economy, where resources are reused, making recyclable packaging a preferred solution.

Additionally, the rising initiatives to recycle pharmaceutical waste and packaging solutions are encouraging the adoption of recyclable packaging solutions in the pharmaceutical industry. For instance, in April 2024, the United Kingdom launched the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) initiative to develop and implement strategies for the end-of-use recycling of medicinal devices and pharmaceutical packaging.

Moreover, governments worldwide are implementing stricter packaging waste regulations, encouraging companies to shift towards recyclable materials. In response, pharmaceutical manufacturers are adopting recyclable packaging to comply with these policies and avoid potential penalties. Advancements in recycling technology are also enhancing the efficiency and practicality of recycling processes, making recyclable packaging more affordable and viable. This combination of consumer demand, regulatory incentives, and technological improvements is driving recyclable packaging to become a dominant force in the sustainable pharmaceutical packaging market.

Sustainable Pharmaceutical Packaging Market Geographical Analysis

North America is expected to dominate the global sustainable pharmaceutical packaging market with a 38.5% share in 2024

North America is expected to lead the sustainable pharmaceutical packaging market due to a variety of factors, such as growing consumer demand for eco-friendly products, stricter government regulations, and the presence of major industry players. Consumers in the region are increasingly concerned about environmental issues like climate change and plastic pollution, which has led to a rising demand for more sustainable packaging options.

In response, pharmaceutical companies in North America are focusing on adopting eco-friendly packaging solutions to meet these consumer expectations. This shift is further supported by a collective effort from both consumers and businesses to reduce waste and lessen their environmental impact, making North America a leader in sustainable packaging adoption.

In addition, government policies in North America are playing a significant role in driving the growth of sustainable pharmaceutical packaging. Both the U.S. and Canadian governments have introduced more stringent regulations on environmental practices and packaging waste management, motivating pharmaceutical companies to explore greener alternatives.

North America has several pharmaceutical manufacturers and packaging providers who are investing in new technologies and research to create innovative, sustainable packaging materials. For instance, in October 2024, Berry Global launched a range of clarified polypropylene (PP) bottles for healthcare applications, which offer sustainability and enhanced product protection compared to traditional colored PET pill bottles. ClariPPil bottles are ideal for a wide variety of products, including vitamins, nutraceuticals, dietary supplements, beauty supplements, and OTC treatments.

This combination of industry collaboration, favorable economic conditions, and access to advanced technologies positions North America as a key driver in the global market for sustainable pharmaceutical packaging.

Asia Pacific is expected to dominate the global sustainable pharmaceutical packaging market with a 38.5% share in 2024

The Asia Pacific region is experiencing the fastest growth in the global sustainable pharmaceutical packaging market due to several factors, including rapid industrial development, increasing consumer awareness, and evolving government regulations. As pharmaceutical industries in countries like China and India continue to expand, there is an increasing demand for packaging solutions that meet sustainability objectives. This shift is largely driven by a growing, environmentally conscious middle class, which is encouraging companies to embrace eco-friendly packaging alternatives.

The rising concerns about plastic waste and environmental impact in the region are prompting both consumers and businesses to prioritize sustainable packaging options, fueling the growth of the sustainable pharmaceutical packaging sector. The market players in the region are expanding their production of sustainable pharmaceutical packaging solutions, which is also contributing to the region’s market growth.

For instance, in November 2023, Amcor launched the next generation of its Medical Laminates solutions. Amcor’s latest innovation enables the development of all-film packaging that is recyclable in the polyethylene stream. The new solution reduces the carbon footprint of the final package while maintaining the performance requirements of device applications, helping medical companies to progress their sustainability goals without compromising patient safety.

Sustainable Pharmaceutical Packaging Market Top Companies

Top companies in the sustainable pharmaceutical packaging market include Amcor plc, Berry Global Inc., Gerresheimer AG, WestRock Company, Drug Plastics & Glass Co., Inc., CCL Healthcare, Comar, Bormioli Pharma S.p.A., Origin Pharma Packaging, Ascend Packaging Systems LLC., among others.

Market Scope

Metrics | Details | |

CAGR | 12.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Packaging Type | Primary Packaging, Secondary Packaging |

Process | Recyclable, Reusable, Biodegradable | |

Raw Material | Paper & Paperboard, Glass, Bioplastics, Metal | |

Product Type | Blisters, Labels & Accessories, Caps & Closures, Pre-filled Inhalers, Vials, Pre-filled Syringes, Ampoules, Cartridges, Others | |

End-User | Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global sustainable pharmaceutical packaging market report delivers a detailed analysis with 54 key tables, more than 45 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.