Diabetes Drugs Market Size & Industry Outlook

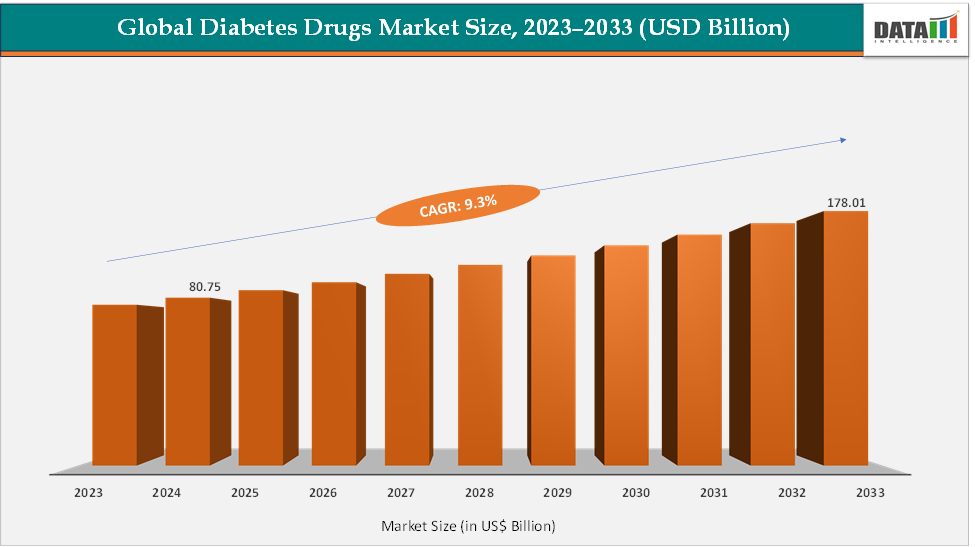

The global diabetes drugs market size reached US$ 80.75 Billion in 2024 from US$ 67.16 Billion in 2023 and is expected to reach US$ 178.01 Billion by 2033, growing at a CAGR of 9.3% during the forecast period 2025-2033.

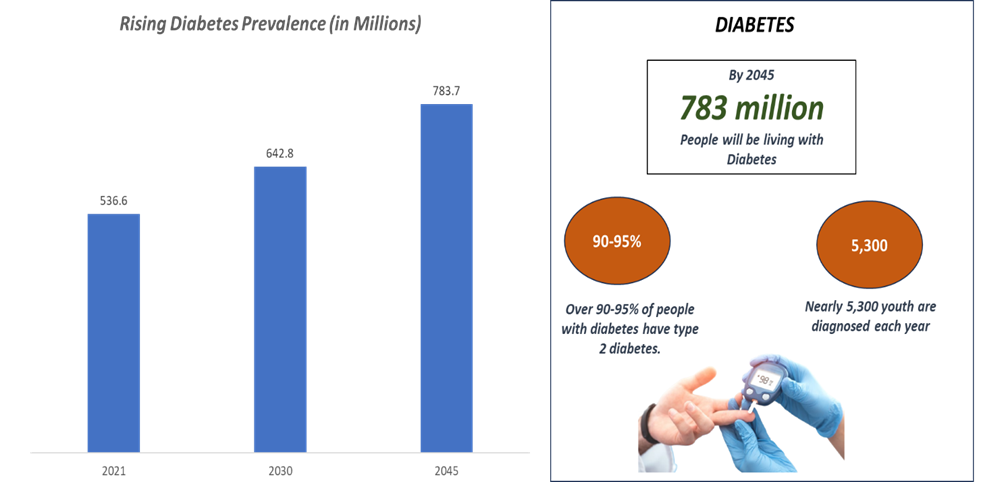

The growth of the global diabetes drugs market is being strongly driven by the escalating prevalence of diabetes worldwide and the rising demand for effective and accessible treatment options. According to the International Diabetes Federation (IDF), an estimated 537 million adults were living with diabetes in 2021, and this number is projected to surge to 783 million by 2045, highlighting a significant and expanding patient base. This rising diabetes cases are significantly driving the diabetes drugs market by expanding the global patient pool and increasing long-term treatment demand. This surge fuels the need for innovative, effective, and accessible therapies, prompting pharmaceutical companies to invest heavily in new drug classes, delivery systems, and combination treatments to manage the growing disease burden.

As a result, the need for advanced therapeutics such as GLP-1 receptor agonists (Ozempic, Trulicity) and SGLT2 inhibitors (Jardiance, Farxiga) has surged, with these drug classes showing double-digit growth rates in recent years. Further supporting this shift, treatment patterns reveal a decline in conventional metformin monotherapy (from 32.5% to 25%) and a growing preference for combination therapies. According to the National Institutes of Health, the adoption of SGLT2 inhibitors has risen sharply (10% to 22.5%), reflecting their dual role in glycemic control and cardiovascular protection.

Key Market Highlights

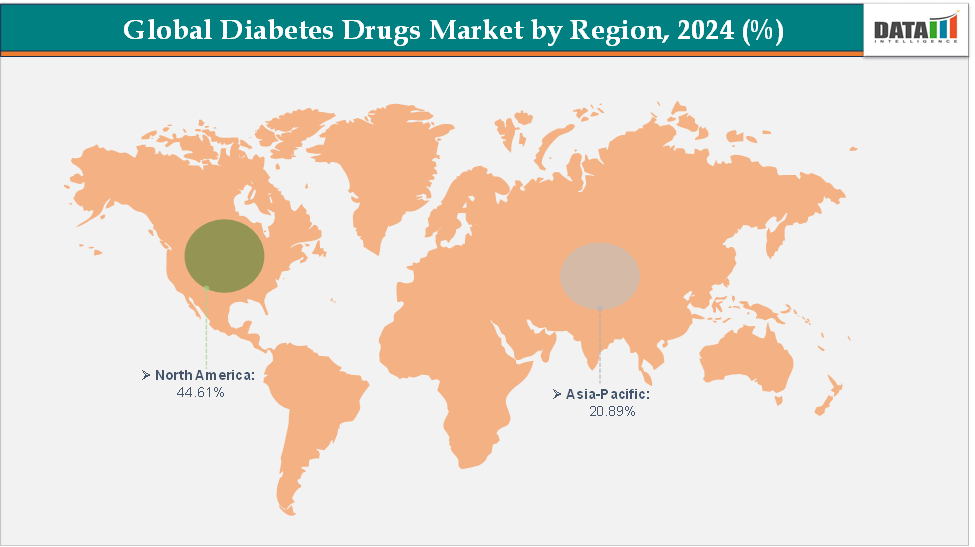

- North America dominates the diabetes drugs market with the largest revenue share of 44.61% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 9.7% over the forecast period.

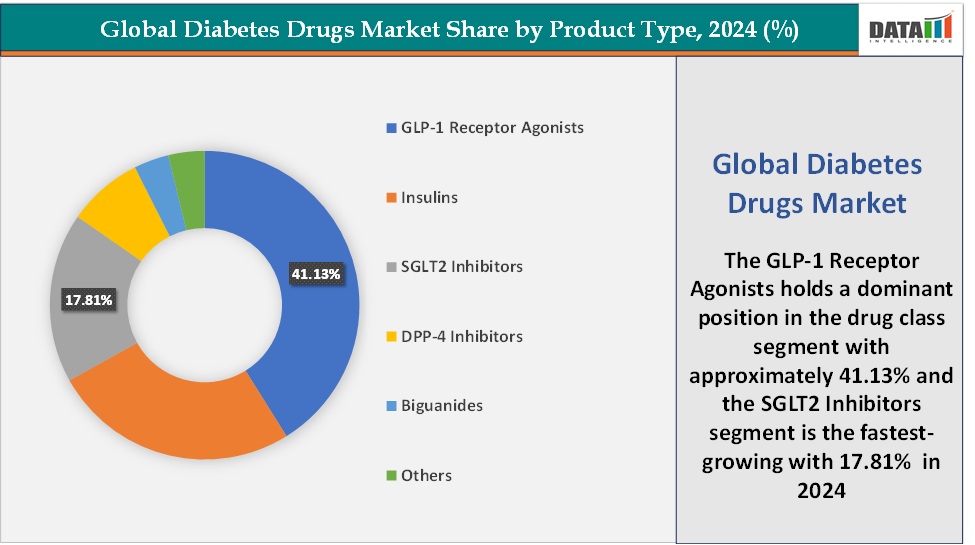

- Based on drug class, the GLP-1 receptor agonists segment led the market with the largest revenue share of 41.32% in 2024.

- The major market players in the diabetes drugs market are Eli Lilly and Company, Novo Nordisk, Merck & Co., Inc., Boehringer Ingelheim Pharmaceuticals, Inc., Sanofi, AstraZeneca, Takeda Pharmaceutical Company Limited, and Novartis AG, among others

Market Dynamics

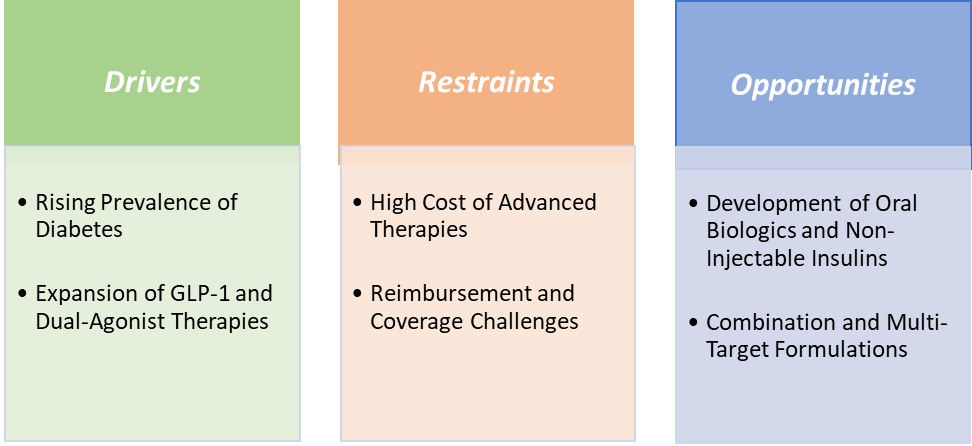

Drivers: Rising incidence of cancer cases is significantly driving the Diabetes Drugs market growth

The rising prevalence of diabetes is one of the most powerful forces driving the growth of the global diabetes drugs market, creating sustained demand for innovative and accessible therapies. According to the International Diabetes Federation (IDF), the global diabetic population stood at 537 million adults in 2021 and is expected to reach 643 million by 2030 and 783 million by 2045, reflecting a staggering 46% increase within two decades.

This surge is largely attributed to sedentary lifestyles, obesity, unhealthy dietary habits, and population aging, particularly in emerging economies such as India and China, which together account for more than one-third of global diabetes cases. As the diabetic population expands, especially in low- and middle-income nations, the diabetes drugs market is poised for robust, sustained growth driven by the urgent global need for effective, long-term disease management solutions.

Restraints: The high cost of advanced therapies is hampering the growth of the market

The high cost of advanced diabetes therapies is a significant barrier restraining the growth of the global diabetes drugs market, limiting accessibility and adherence among patients. Innovative treatments such as GLP-1 receptor agonists and dual agonists including Ozempic (semaglutide) and Mounjaro (tirzepatide). The cost of Ozempic 0.25 or 0.5 mg (1 x 1.5-mL pen) is $997.58, Ozempic 1 mg (1 x 3-mL pen) costs $997.58, and Ozempic 2 mg (1 x 3-mL pen) costs $997.58, making them unaffordable for many without comprehensive insurance coverage.

Even in developed markets, patients face high co-payments and insurance restrictions, while in low- and middle-income countries, these drugs are often completely out of reach. The affordability gap widens as demand for these drugs also extends to obesity management, increasing strain on supply and pricing. Traditional insulins and generics remain cheaper alternatives, but they lack the additional weight and cardiovascular benefits of newer drugs. This cost disparity discourages early adoption, particularly in public healthcare systems, which often prioritize cost-effective generics.

For more details on this report – Request for Sample

List of Some Key Approved Drugs

Epidemiology Analysis

Diabetes Drugs Market, Segment Analysis

The global diabetes drugs market is segmented based on drug, class, application, route of administration, distribution channel, and region.

Drug Class: The GLP-1 receptor agonists segment is dominating the diabetes drugs market with a 41.32% share in 2024

The GLP-1 receptor agonists segment has emerged as the dominant and fastest-growing segment in the global diabetes drugs market, reshaping the competitive landscape of diabetes care. These drugs, which mimic the body’s natural incretin hormones to enhance insulin secretion, suppress appetite, and promote weight loss, offer dual benefits for glycemic control and obesity management, a combination driving massive adoption.

Leading brands such as Novo Nordisk’s Ozempic (semaglutide) and Eli Lilly’s Trulicity (dulaglutide) have become blockbuster products, with Ozempic generated USD 4,485.25 million in 2024 sales and Trulicity generated USD 5,253.5 million, reflecting unprecedented demand. The launch of Eli Lilly’s Mounjaro (tirzepatide), a dual GIP/GLP-1 receptor agonist has further accelerated market momentum, achieving record-breaking adoption.

The rising use of GLP-1s in obesity management, alongside diabetes treatment, has expanded their market reach beyond traditional diabetic populations. Moreover, their favorable cardiovascular and renal outcomes, validated in major clinical trials, have strengthened their position in treatment guidelines and insurance coverage.

Pharmaceutical giants like Novo Nordisk and Eli Lilly are ramping up production capacity to meet global shortages, particularly in North America and Europe. Overall, the GLP-1 receptor agonist class is not only dominating the diabetes drugs market but also redefining its future trajectory through innovation, therapeutic versatility, and surging global demand.

The SGLT2 inhibitors segment is the fastest-growing in the diabetes drugs market with a 17.81% share in 2024

The SGLT2 inhibitors segment (sodium-glucose cotransporter 2 inhibitors) is widely recognised as the fastest-growing class within the diabetes drugs market. First, SGLT2 inhibitors such as Jardiance (empagliflozin) and Farxiga (dapagliflozin) have expanded far beyond glycaemic control in type 2 diabetes to treat cardiovascular disease (CVD) and chronic kidney disease (CKD). For instance, Jardiance was approved by the U.S. Food and Drug Administration (FDA) in September 2023 for the treatment of adults with CKD, reducing risk of kidney-disease progression and cardiovascular death.

Similarly, the clinical evidence supporting SGLT2 inhibitors is compelling, trials like EMPA-KIDNEY and others have shown meaningful reductions in hospitalization for heart failure, CKD progression, and cardiovascular events. This broadening of indications means the patient base for SGLT2 inhibitors now spans diabetics and non-diabetics with heart or kidney disease.

Diabetes Drugs Market, Geographical Analysis

North America is expected to dominate the global diabetes drugs market with a 44.61% in 2024

North America dominates the global diabetes drugs market because it combines a high disease burden, deep payer markets, rapid uptake of premium therapies, and a favorable regulatory and commercialization ecosystem. The US alone has roughly 38.4 million people with diabetes (≈11.6% of the population), producing a large, clinically managed patient base that drives chronic drug demand.

US Diabetes Drugs Market Trends

Rapid regulatory approvals and an active FDA pathway for new antidiabetic and weight-management agents have accelerated product launches and label expansions. For instance, in October 2025, MannKind Corporation announced that the U.S. Food and Drug Administration (FDA) has accepted the supplemental biologics license application (sBLA) seeking approval for Afrezza (insulin human) Inhalation Powder in children and adolescents living with type 1 or type 2 diabetes. The application has been assigned a Prescription Drug User Fee Act (PDUFA) target action date of May 29, 2026.

Similarly, in April 2025, Meitheal Pharmaceuticals secured approval from the US Food and Drug Administration (FDA) for its liraglutide injection (18mg/3mL), a generic equivalent of Victoza, and has commenced its distribution in the US.

Major pharma players, notably Novo Nordisk, Eli Lilly, and Sanofi have concentrated commercial operations, manufacturing scale, and patient-support programs in North America, with blockbuster GLP-1 franchises fueling revenue growth; for instance, Novo Nordisk reports very large semaglutide-family sales tied heavily to North American demand.

The Asia Pacific region is the fastest-growing region in the global diabetes drugs market, with a CAGR of 9.7% in 2024

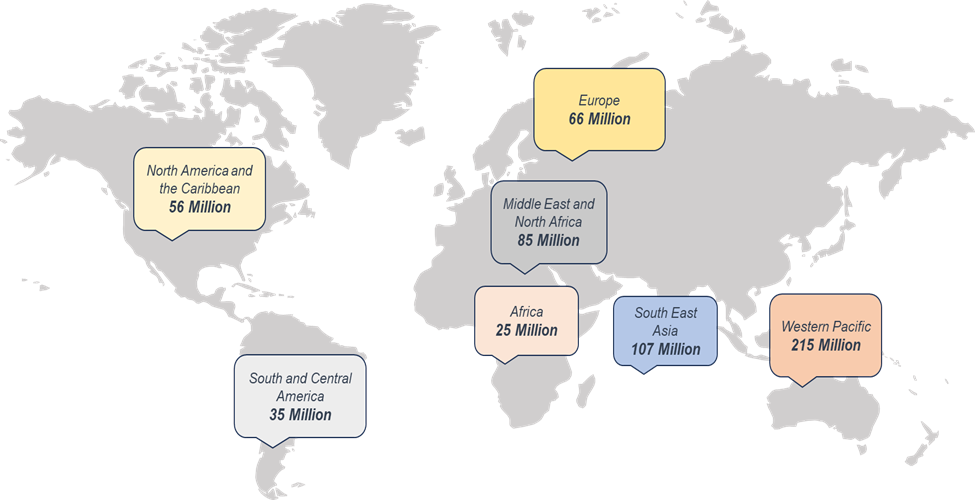

The Asia‑Pacific region is the fastest-growing market in the global diabetes drugs landscape, driven by a combination of high unmet need, rapid urbanisation and favourable demographics. For instance, the International Diabetes Federation reports that the Western Pacific sub-region alone had approximately 215 million adults aged 20–79 years with diabetes in 2024, representing about 37 % of the global adult diabetic population.

Rising regulatory support for novel product approvals further driving the market growth in the region. For instance, in March 2025, American pharmaceutical major Eli Lilly and Company launched its diabetes and obesity management drug Mounjaro (tirzepatide) in India. The company launched the drug in a single-dose vial following marketing authorisation from the Central Drugs Standard Control Organisation (CDSCO).

Similarly, partnerships and collaborations further accelerate the growth of the market by offering various top products in the market. For instance, in May 2025, Sumitomo Pharma Co., Ltd. announced that Sumitomo Pharma and Novo Nordisk Pharma Ltd. have entered into a co-promotion agreement in Japan for Ozempic Subcutaneous Injection 2 mg, a once-weekly subcutaneous GLP-1 receptor agonist indicated for the treatment of type 2 diabetes.

Europe Diabetes Drugs Market Trends

The diabetes drugs market in Europe is gaining strong momentum, driven by rising disease prevalence, regulatory approvals of innovative therapies, and increasingly favourable health-care infrastructure. In the World Health Organization European Region an estimated at least 64 million adults live with diabetes, with nearly one in ten Europeans likely to have the condition by 2045.

A key catalyst has been the approval of advanced drug classes in the region. For instance, in February 2025, Biocon launched its liraglutide products in the UK. The products are generic versions of Novo Nordisk’s Victoza, to treat type 2 diabetes, and Saxenda, used in the treatment of weight management. Biocon’s products are marketed under the brand names Liraglutide Biocon (gVictoza) and Biolide (gSaxenda). Biocon’s liraglutide became the first UK-approved generic to Novo Nordisk’s liraglutide products in March 2024.

Competitive Landscape

Top companies in the diabetes drugs market include Eli Lilly and Company, Novo Nordisk, Merck & Co., Inc., Boehringer Ingelheim Pharmaceuticals, Inc., Sanofi, AstraZeneca, Takeda Pharmaceutical Company Limited, and Novartis AG, among others.

Market Scope

| Metrics | Details | |

| CAGR | 9.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | GLP-1 Receptor Agonists, Insulins, SGLT2 Inhibitors, DPP-4 Inhibitors, Biguanides, and Others |

| Application | Type 2 Diabetes, Type 1 Diabetes, Gestational Diabetes, and Prediabetes | |

| Route of Administration | Injectable and Oral | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global diabetes drugs market report delivers a detailed analysis with 64 key tables, more than 63 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here