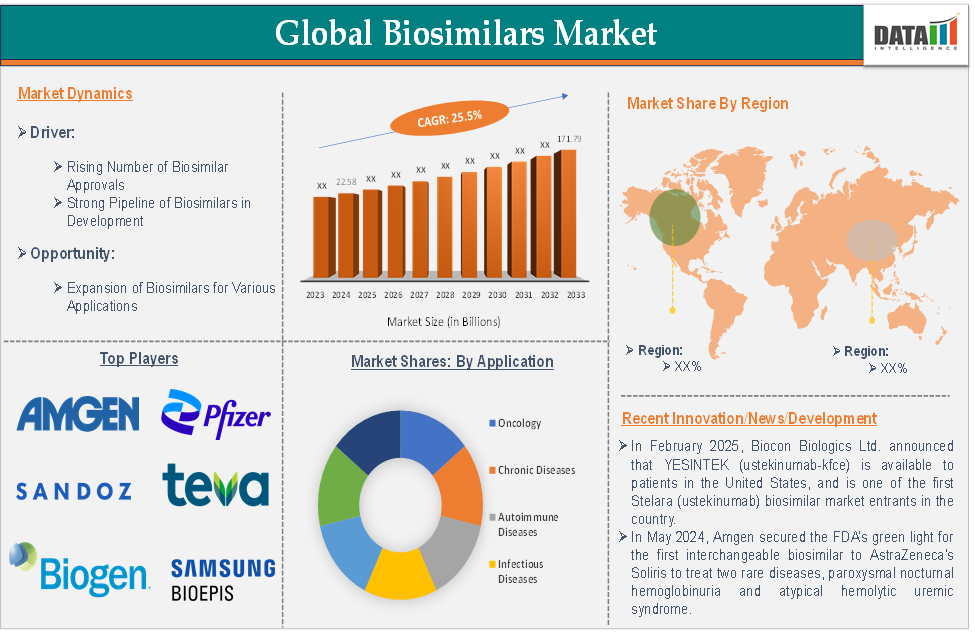

Biosimilars Market Size

Global biosimilars market size reached US$ 22.58 billion in 2024 and is expected to reach US$ 171.79 billion by 2033, growing at a CAGR of 25.5% during the forecast period 2025-2033.

Biosimilars are biological medical products highly similar to an already approved reference biologic drug (also called the originator or reference product), with no clinically meaningful differences in safety, purity, and potency. These products are made using living organisms through complex processes such as recombinant DNA technology. They must demonstrate similarity to the reference product through extensive analytical, preclinical, and clinical studies.

One of the primary benefits of biosimilars is the potential for cost savings compared to reference biologic drugs. Since biosimilar manufacturers do not bear the high costs associated with the initial development and marketing of the original biologic, biosimilars are usually priced lower, which can reduce overall healthcare costs and make essential biologic therapies more accessible to patients.

Executive Summary

For more details on this report – Request for Sample

Biosimilars Market Dynamics: Drivers & Restraints

The rising number of biosimilar approvals is significantly driving the biosimilars market growth

The approval of multiple biosimilars targeting different biologics expands the market into various therapeutic areas. Biosimilars are being approved for complex conditions like oncology, chronic diseases, autoimmune diseases, diabetes, and hematology.

For instance, in March 2025, Celltrion announced the U.S. Food and Drug Administration (FDA) approved OMLYCLO (omalizumab-igec) as the first and only biosimilar designated as interchangeable with XOLAIR (omalizumab) for the treatment of moderate to severe persistent asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), Immunoglobulin E (IgE)-mediated food allergy, and chronic spontaneous urticaria (CSU).

List of recently FDA approved biosimilar products:

| Biosimilar Name | Approval Date | Reference Product |

| Omlyclo (omalizumab-igec) | March 2025 | Xolair (omalizumab) |

| Osenvelt (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Stoboclo (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Merilog (insulin aspart-szjj) | February 2025 | Novolog (insulin aspart) |

| Ospomyvtm and Xbryktm (denosumab-dssb) | February 2025 | Prolia and Xgeva (denosumab) |

| Avtozma (tocilizumab-anoh) | January 2025 | Actemra (tocilizumab) |

| Steqeyma (Ustekinumab-stba) | December 2024 | Stelara (ustekinumab) |

| Yesintek (ustekinumab-kfce) | November 2024 | Stelara (ustekinumab) |

| Imuldosa (ustekinumab-srlf) | October 2024 | Stelara (ustekinumab) |

| Otulfi (ustekinumab-aauz) | September 2024 | Stelara (ustekinumab) |

| Pavblu (aflibercept-ayyh) | August 2024 | Eylea (aflibercept) |

| Enzeevu (aflibercept-abzv) | August 2024 | Eylea (aflibercept) |

| Epysqli (eculizumab-aagh) | July 2024 | Soliris (eculizumab) |

| Ahzantive (aflibercept-mrbb) | June 2024 | Eylea (aflibercept) |

| Nypozi (filgrastim-txid) | June 2024 | Neupogen (filgrastim) |

| Pyzchiva (ustekinumab-ttwe) | June 2024 | Stelara (ustekinumab) |

The rising number of biosimilar approvals not only expands the availability of affordable biologic treatments but also promotes market competition, which leads to lower drug costs and greater patient access. With regulatory confidence, an increasing number of biosimilars in various therapeutic areas and expanding global market penetration, this growing trend is fueling the biosimilars market and improving patient access to life-saving treatments worldwide.

Immunogenicity and safety concerns hampering the market growth

Despite the benefits of biosimilars, concerns about their immune response, long-term safety, and overall clinical equivalence to their reference biologics have affected their widespread acceptance and use. Immunogenicity refers to the potential of a biological product (including biosimilars) to induce an immune response in patients. This immune response can lead to the formation of antibodies against the biosimilar, which can reduce its effectiveness or cause harmful side effects.

While biosimilars are required to demonstrate high similarity to the reference biologic, even minor differences in the manufacturing process (such as the glycosylation patterns, amino acid sequences, or post-translational modifications) can result in slightly altered molecular structures that may provoke different immune responses.

For instance, in some cases, patients treated with biosimilars for autoimmune diseases or oncology treatments have reported immune reactions like allergic responses or infusion-related reactions. The biosimilar of rituximab (Truxima) faced issues related to infusion reactions in certain patients, leading to safety concerns among healthcare providers.

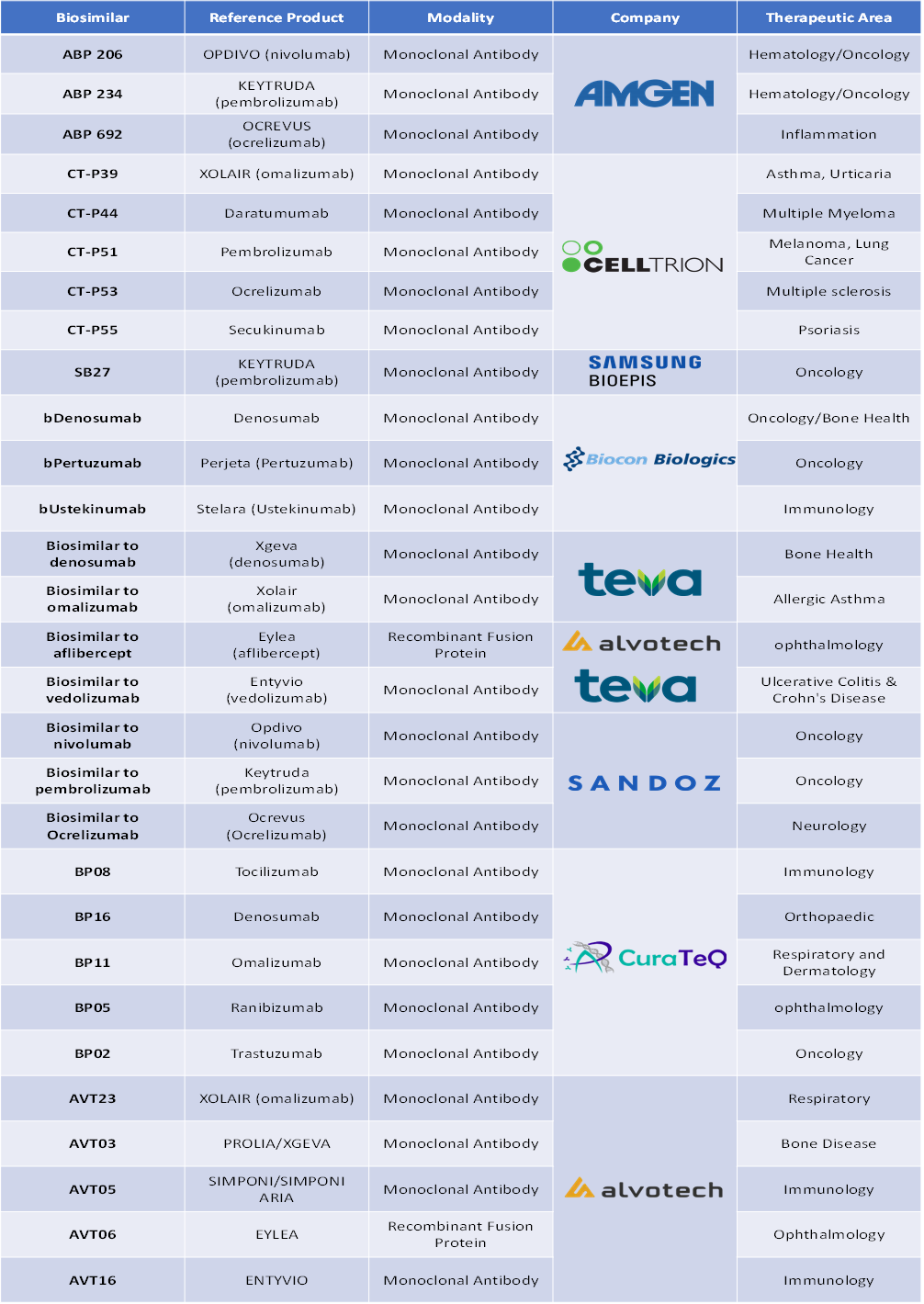

Pipeline Analysis

Top biosimilars in late-stage clinical trials are:

Biosimilars Market Segment Analysis

The global biosimilars market is segmented based on product type, application, and region.

Application:

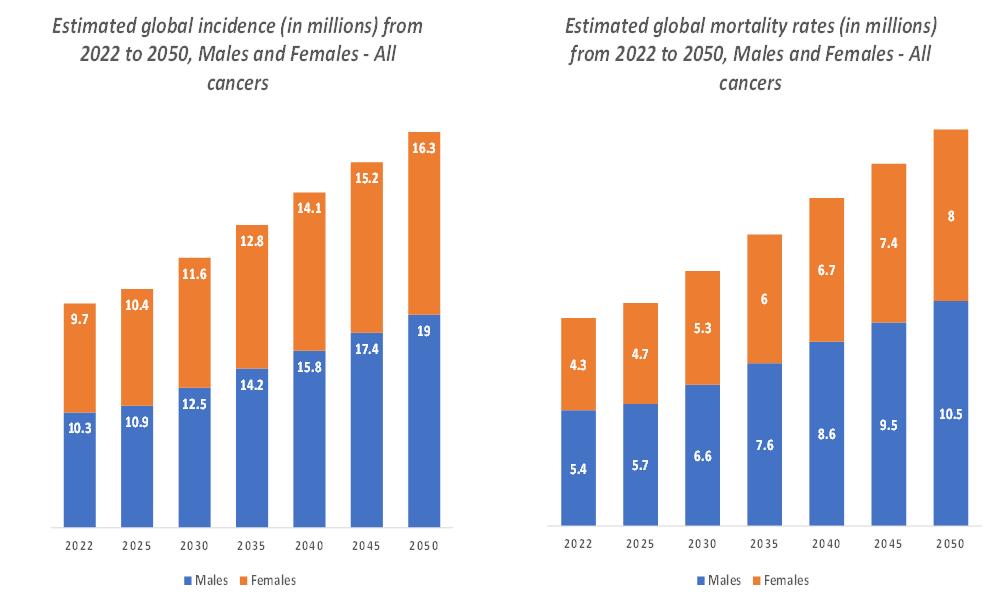

The oncology segment is expected to dominate the biosimilars market with the highest market share

The incidence of cancer worldwide continues to rise, and the demand for oncology treatments is expected to grow as a result. According to the National Institute of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million.

Additionally, according to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million. As the demand for cancer therapies increases, the need for more affordable treatment options like biosimilars becomes even more pressing. This is contributing to the increasing share of oncology drugs in the biosimilar market.

The oncology segment has seen the earliest and most frequent approvals for biosimilars, thanks to the availability of clinical data supporting their efficacy and safety. Regulatory agencies like the FDA and EMA have approved biosimilars for a range of oncology treatments, boosting confidence in their use.

Example: Several biosimilars for Herceptin, Rituxan (rituximab), and Avastin (bevacizumab) have been approved by the FDA. As of 2023, biosimilars for more than five major oncology drugs are now available in multiple markets, with biosimilars for Trastuzumab, Rituximab, and Bevacizumab being key examples of how this segment has expanded rapidly.

List of biosimilars approved for cancer treatment:

| Biologic Medicine | Biosimilars |

| bevacizumab (Avastin) | Mvasi Zirabev Alymsys Vegzelma Avzivi |

| rituximab (Rituxan) | Truxima Ruxience Riabni |

| trastuzumab (Herceptin) | Ogivri Herzuma Ontruzant Trazimera Kanjinti Hercessi |

| filgrastim (Neupogen) | Zarxio Nivestym Releuko Nypozi |

| pegfilgrastim (Neulasta) | Fulphila Udenyca Ziextenzo Nyvepria Fylnetra Stimufend |

| epoetin alfa (Epogen or Procrit) | Retacrit |

| denosumab (Xgeva) | Wyost Osenvelt |

Biosimilars Market Geographical Share

North America is expected to hold a significant position in the global biosimilars market with the highest market share

The U.S. FDA (Food and Drug Administration) has played a pivotal role in driving the growth of the biosimilars market in North America. The FDA established a formal biosimilars pathway with the passage of the Biologics Price Competition and Innovation Act of 2009 (BPCI Act). This pathway allowed for the approval of biosimilars based on a demonstration of similarity to existing reference biologics without the need for duplicating the extensive clinical trials of the original product.

For instance, the first biosimilar approved by the FDA, Zarxio (a biosimilar of Neupogen), was approved in 2015 and marked a significant milestone. Since then, there have been 71 biosimilars approved by the U.S. Food and Drug Administration (FDA). The most recent biosimilar approval was Omlyclo (omalizumab-igec) on March 7, 2025, contributing to significant market growth in North America.

North America is home to the world's largest pharmaceutical companies, including Amgen, Pfizer, Sandoz and Boehringer Ingelheim, all of which are heavily involved in the development, production and distribution of biosimilars. These companies have invested in the development of a variety of biosimilars across different therapeutic areas.

For instance, Amgen and Pfizer are key players in the North American biosimilars market, with products like Amjevita (adalimumab biosimilar) and Inflectra (infliximab biosimilar) already approved and available in the U.S. market. Additionally, in March 2025, Celltrion announced the U.S. launch of STEQEYMA (ustekinumab-stba), a biosimilar to STELARA (ustekinumab), following approval by the U.S. Food and Drug Administration (FDA) in December 2024. STEQEYMA is approved for the same indications as STELARA, providing consistency in treatment for patients and healthcare providers.

Biosimilars Market Top Companies

Top biosimilar companies includes Amgen Inc., Pfizer Inc., Sandoz Group AG, Teva Pharmaceuticals USA, Inc., Biogen, Biocon Biologics Inc., Boehringer Ingelheim International GmbH, Samsung Bioepis, Dr. Reddy’s Laboratories Ltd., Fresenius Kabi AG and among others.

Market Scope

| Metrics | Details | |

| CAGR | 25.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Monoclonal Antibodies, Recombinant Human Growth Hormone (rhGH), Insulin, Anti-coagulants, Erythropoietin, Granulocyte Colony Stimulating Factor, Follitropin, Interferons and Others |

| Application | Oncology, Chronic Diseases, Autoimmune Diseases, Infectious Diseases, Growth Hormone Deficiency, Hematology and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global biosimilars market report delivers a detailed analysis with 54 key tables, more than 52 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.