Global PD-L1 Testing and Therapeutics Market: Industry Outlook

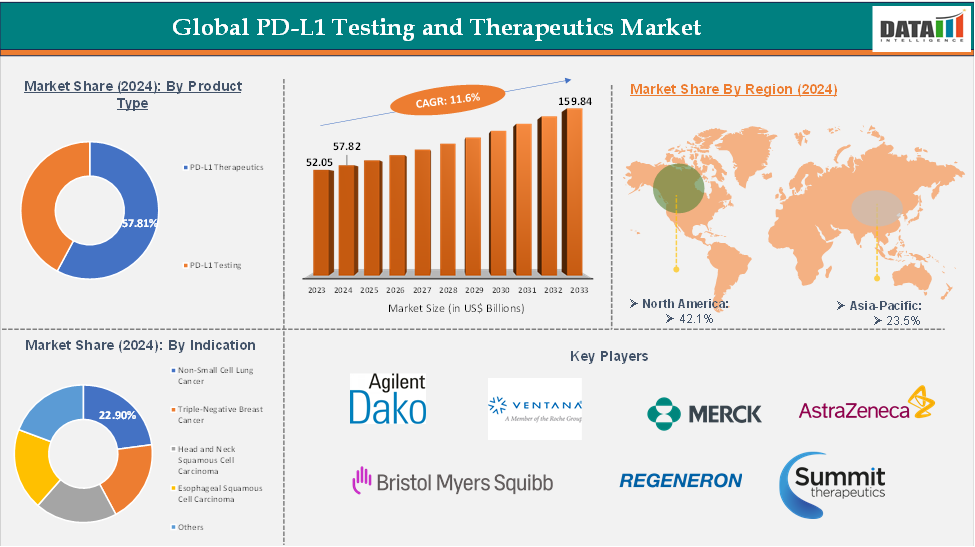

The global PD-L1 Testing and Therapeutics market reached US$ 52.05 billion in 2023, with a rise of US$ 57.82 billion in 2024, and is expected to reach US$ 159.84 billion by 2033, growing at a CAGR of 11.6% during the forecast period 2025-2033.

The Global PD-L1 Testing and Therapeutics Market is experiencing significant growth due to the increasing use of immuno-oncology therapies and biomarker-driven precision medicine in cancer care. PD-L1 testing, primarily through immunohistochemistry assays, is crucial for detecting PD-1/PD-L1 inhibitors and ensuring appropriate patient selection across various cancer types. The market is dominated by blockbuster drugs like Merck's Keytruda, Bristol Myers Squibb's Opdivo, Roche's Tecentriq, AstraZeneca's Imfinzi, and Regeneron/Sanofi's Libtayo. Competition from Novartis, BeiGene, Pfizer, BioNTech, and Summit Therapeutics is also increasing. North America is expected to dominate the market due to advanced healthcare infrastructure and high immunotherapy uptake, followed by Europe and Asia-Pacific markets.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Rising Adoption of Immuno-Oncology and Precision Medicine

The Global PD-L1 Testing and Therapeutics Market is driven by the rise in immuno-oncology therapies and precision medicine. PD-L1 testing helps oncologists identify patients who benefit from PD-1/PD-L1 inhibitors, improving treatment efficacy and reducing high-cost therapies. The expanding FDA- and EMA-approved indications for drugs like pembrolizumab, nivolumab, and atezolizumab cover various cancers, accelerating demand for companion diagnostics and integrating PD-L1 biomarker analysis into standard cancer care.

For instance, in June 2025, Merck has approved KEYTRUDA, its anti-PD-1 therapy, for adult patients with resectable locally advanced head and neck squamous cell carcinoma (HNSCC) expressing PD-L1. The FDA-approved test determined that the therapy can be used as a single agent, continued as adjuvant treatment in combination with radiotherapy, and as a single agent. The treatment is approved by the FDA.

Restraint: High Cost of Testing and Therapeutics

The high cost of PD-L1 testing and immunotherapy drugs is a significant barrier to market growth. Companion diagnostic assays can be costly, especially in resource-limited settings. Therapeutics, such as PD-1/PD-L1 inhibitors, can cost thousands of dollars per treatment cycle, limiting patient access in low- and middle-income countries. Even in developed markets, reimbursement barriers and cost-containment pressures can slow adoption rates, potentially hindering market penetration despite strong clinical demand.

For more details on this report, Request for Sample

Segmentation Analysis

The global PD-L1 testing and therapeutics market is segmented based on product type, testing type, indication, end user, and region.

Product Type:

The PD-L1 Therapeutics from the product type segment the expected to have 57.81% of the PD-L1 Testing and Therapeutics market share.

The PD-L1 therapeutics segment in the Global PD-L1 Testing and Therapeutics Market is driven by several factors, including the expansion of approved indications for leading drugs like pembrolizumab, nivolumab, atezolizumab, and durvalumab, particularly in high-burden cancers like first-line metastatic NSCLC, adjuvant settings in resected NSCLC, and unresectable Stage III disease.

The U.S. FDA and EMA have also approved PD-L1 inhibitors for rare or aggressive cancers like triple-negative breast cancer and cervical cancer. Survival benefits from landmark trials have shifted treatment guidelines towards earlier-line PD-L1 blockade, boosting prescription volumes. The pipeline is diversifying with next-generation PD-L1 drugs and bispecific antibodies under development by companies like BioNTech, Pfizer, and Summit Therapeutics. Combination regimens with chemotherapy, targeted therapies, and checkpoint inhibitors are expanding market potential.

For instance, in August 2025, Akeso, Inc. has been approved by China's National Medical Products Administration and the U.S. Food and Drug Administration to initiate a global, multicenter, randomized Phase II registrational trial (COMPASSION-36/AK104-225) to evaluate cadonilimab, Akeso's first-in-class PD-1/CTLA-4 bispecific antibody, in combination with lenvatinib for the treatment of advanced hepatocellular carcinoma in patients previously treated with atezolizumab and bevacizumab.

Geographical Share Analysis

The North America global PD-L1 Testing and Therapeutics market was valued at 42.1% market share in 2024

The North America region dominates the Global PD-L1 Testing and Therapeutics Market due to advanced healthcare infrastructure, high immunotherapy adoption rates, and strong regulatory and reimbursement frameworks. The U.S. FDA's proactive approval of PD-1/PD-L1 inhibitors has enabled rapid market entry for drugs like pembrolizumab, nivolumab, atezolizumab, and durvalumab. The widespread availability of companion diagnostics and high cancer incidence rates fuel uptake. Favorable reimbursement policies from Medicare, Medicaid, and private insurers reduce financial barriers. The presence of leading pharmaceutical innovators and ongoing clinical trials solidify the region's dominance in innovation and market penetration.

For instance, in March 2025, The FDA has approved pembrolizumab, along with trastuzumab, fluoropyrimidine, and platinum-containing chemotherapy, for first-line treatment in adults with advanced HER2-positive gastric or GEJ adenocarcinoma expressing PD-L1 (CPS ≥1).

Global PD-L1 Testing and Therapeutics Market – Major Players

The major players in the PD-L1 Testing and Therapeutics market include Agilent Technologies (Dako), Roche/Ventana Medical Systems, Merck & Co., Inc, Bristol Myers Squibb, AstraZeneca, Regeneron Pharmaceuticals, and Summit Therapeutics Inc among others.

Key Developments

In February 2025, Leica Biosystems is pleased to announce the launch of two new primary antibodies, PD-L1 and HER2, developed to support cancer research and therapy development. These antibodies, widely used in studying breast, lung, and other cancers, underscore our commitment to empowering pharmaceutical partners with high-quality assays.

Report Scope

Metrics | Details | |

CAGR | 11.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | PD-L1 Therapeutics, PD-L1 Testing (Diagnostics) |

Testing Type | Immunohistochemistry (IHC), Next-Generation Sequencing (NGS) | |

Indication | Non-Small Cell Lung Cancer, Triple-Negative Breast Cancer, Head and Neck Squamous Cell Carcinoma, Esophageal Squamous Cell Carcinoma, Others | |

End User | Hospitals, Cancer Specialty Clinics, Diagnostic Laboratories, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global PD-L1 Testing and Therapeutics market report delivers a detailed analysis with 59 key tables, more than 56 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here