Global Leukemia Therapeutics Market Size & Industry Outlook

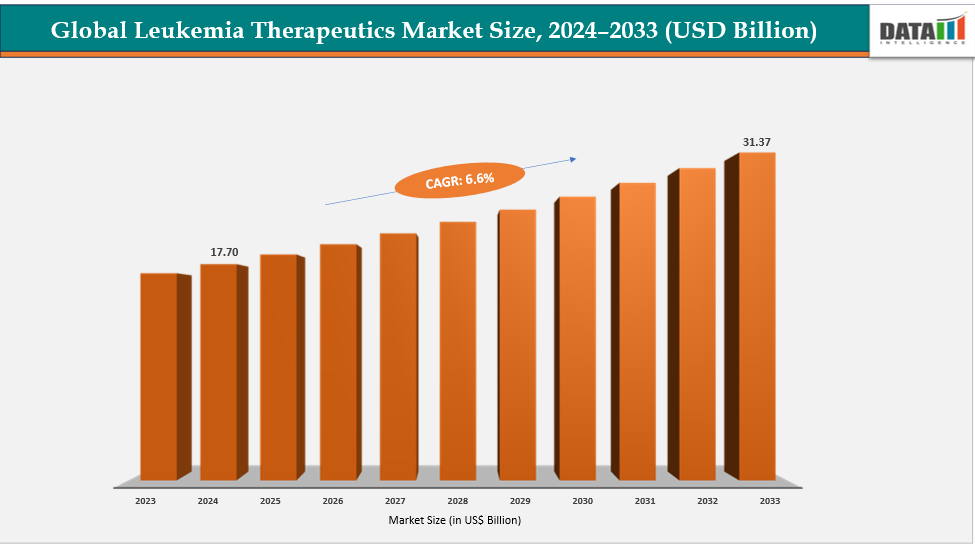

The global leukemia therapeutics market size reached US$ 17.70 billion in 2024 is expected to reach US$ 31.37 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. A significant long-term driver of the global leukemia therapeutics market is the growing shift toward advanced immunotherapies, including CAR-T cell therapies, monoclonal antibodies, and bispecific T-cell engagers (BiTEs). These therapies use the patient’s own immune system to identify and destroy leukemia cells, offering far higher precision than conventional chemotherapy. This shift has accelerated market expansion because immunotherapies not only improve survival rates but also provide options for patients who relapse or do not respond to earlier treatments. Their strong clinical outcomes and ability to treat heavily pre-treated patients make them a cornerstone of next-generation leukemia care.

For instance, CAR-T therapies like tisagenlecleucel demonstrated remarkable success in pediatric and young adult patients with relapsed or refractory B-cell acute lymphoblastic leukemia (ALL). Many of these patients had exhausted all other treatment options, yet CAR-T therapy enabled long-term remission in a substantial portion of them. This breakthrough changed treatment pathways worldwide, pushing hospitals, insurers, and governments to integrate advanced immunotherapies into leukemia care systems.

Key Highlights

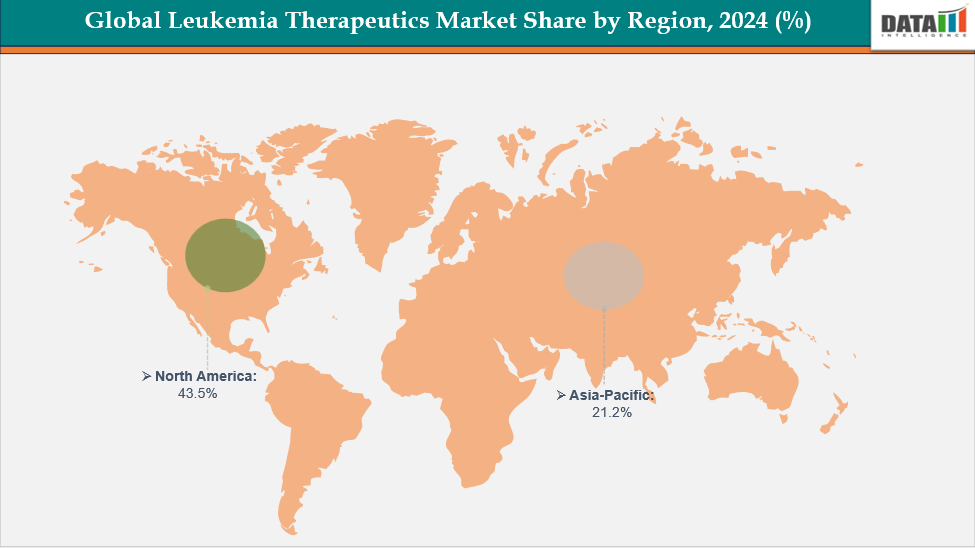

- North America dominates the leukemia therapeutics market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

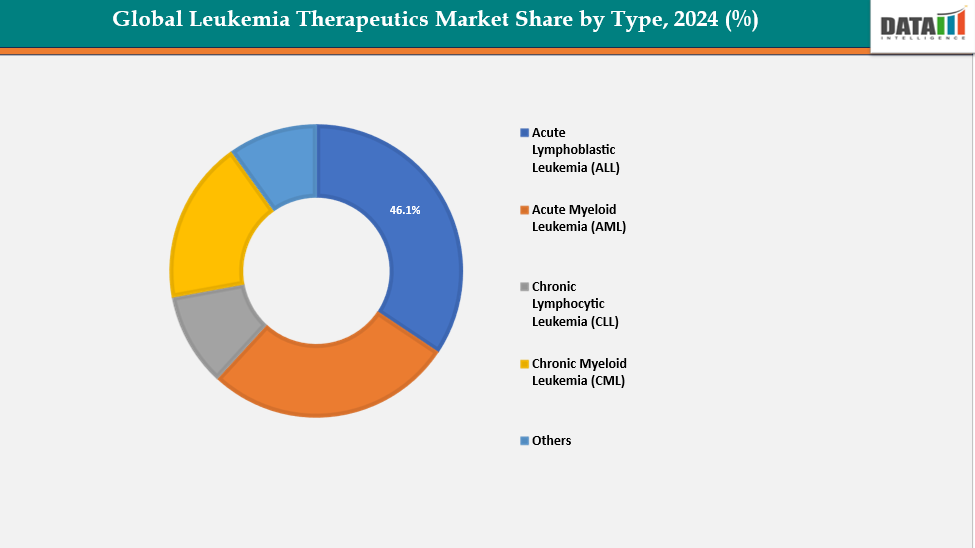

- Based on type Acute Lymphoblastic Leukemia (ALL) segment led the market with the largest revenue share of 46.1% in 2024.

- The major market players in the Leukemia Therapeutics Novartis AG, Pfizer Inc, Bristol-Myers Squibb Company, Amgen Inc, Astellas Pharma, AbbVie / Roche (Genentech) and among others.

Market Dynamics

Drivers: Rising global leukemia incidence, the global leukemia therapeutics market growth

The rising global incidence of leukemia plays a central role in driving the growth of the leukemia therapeutics market because it steadily increases the size of the patient population requiring diagnosis, treatment, and long-term care. As factors such as aging demographics, environmental exposures, lifestyle changes, and improved disease awareness contribute to more cases being identified worldwide, healthcare systems see a continuous rise in demand for effective therapies. Higher incidence is particularly evident in older adults, where leukemias like AML and CLL are more common, creating a sustained need for advanced treatments that offer better survival and tolerability.

For instance, The American Cancer Society estimates that in 2025, approximately 22,010 individuals in the United States will be diagnosed with acute myeloid leukemia (AML), with the majority of cases occurring in adults. An estimated 11,090 deaths are expected from AML, again mostly among adults. AML represents about one-third of all adult leukemia cases and roughly 1% of all cancers diagnosed. While AML can appear in children, it is far less common in people younger than 45, and the average age at diagnosis is around 69 years. The disease shows a slightly higher occurrence in men than in women, but the overall lifetime risk for both sexes remains low at about 0.5%.

Restraints: Severe side effects and toxicity of certain therapies are hampering the growth of the global leukemia therapeutics market

A major restraint in the global leukemia therapeutics market is the severe side effects and toxicity associated with many existing treatments, particularly intensive chemotherapy and some targeted drugs. These therapies can cause serious complications such as organ damage, infections, prolonged hospital stays, and reduced quality of life, making them unsuitable for many patients especially older adults, who represent a large portion of leukemia cases. High toxicity often forces dose reductions, treatment delays, or complete discontinuation, which limits therapeutic effectiveness and discourages both patients and clinicians from using certain regimens.

For more details on this report – Request for Sample

Global Leukemia Therapeutics Market, Segment Analysis

The global leukemia therapeutics market is segmented based on type, drug class, route of administration, distribution channel and region.

Type: The acute lymphoblastic leukemia (ALL) segment from product type segment to dominate the global leukemia therapeutics market with a 46.1% share in 2024

A key driving factor for the Acute Lymphoblastic Leukemia (ALL) segment in the global leukemia therapeutics market is the rapid advancement and increasing adoption of innovative immunotherapies, particularly CAR-T cell therapies and bispecific antibodies. These treatments have transformed outcomes for patients with relapsed or refractory ALL especially children and young adults who previously had very limited options. Their ability to deliver deep, durable remissions has significantly strengthened clinical confidence and expanded treatment guidelines worldwide.

At the same time, improvements in genetic testing and minimal residual disease (MRD) monitoring allow clinicians to identify high-risk patients early and tailor therapy more precisely, boosting demand for advanced ALL drugs. As more next-generation immunotherapies enter development and approvals expand to broader age groups, the ALL segment continues to grow rapidly within the overall leukemia therapeutics market.

For instance, in September 2025, The FDA has approved revumenib (Revuforj, Syndax Pharmaceuticals, Inc.) for patients with relapsed or refractory Acute Lymphoblastic Leukemia (ALL). Revumenib is a selective menin inhibitor that works by blocking the interaction between menin—a protein involved in regulating gene expression and the KMT2A gene.

Drug Class: The tyrosine kinase inhibitors (TKIS) is estimated to have a 44.1% of the global leukemia therapeutics market share in 2024

The Tyrosine Kinase Inhibitors (TKIs) segment is a major growth driver in the leukemia therapeutics market due to their targeted mechanism of action, strong clinical success, and expanding indications across leukemia subtypes. TKIs such as imatinib, dasatinib, and ponatinib have transformed outcomes in conditions like CML and Ph+ ALL by delivering high response rates, longer survival, and improved quality of life compared to traditional chemotherapy. Their oral formulation also enhances patient adherence and reduces hospital-based treatment costs.

For instance, in October 2024, Novartis announced that Scemblix (asciminib) has received accelerated FDA approval for adults newly diagnosed with Philadelphia chromosome–positive chronic myeloid leukemia in the chronic phase (Ph+ CML-CP). The approval is supported by results from the Phase III ASC4FIRST trial, where once-daily Scemblix achieved significantly higher major molecular response (MMR) rates at week 48 compared with investigator-selected standard-of-care TKIs (imatinib, nilotinib, dasatinib, or bosutinib), as well as versus imatinib alone.

In addition, next-generation TKIs with improved resistance profiles and lower toxicity are broadening treatment options for patients who relapse or develop resistance to earlier agents. Continuous R&D investments, label expansions, and the growing use of genomic testing to identify candidates for TKI therapy further strengthen this segment’s dominance and long-term growth momentum in the leukemia therapeutics landscape.

Global Leukemia Therapeutics Market, Geographical Analysis

North America dominates the global leukemia therapeutics market with a 43.5% in 2024

North America’s regulatory compliance market is driven by a highly complex regulatory environment, strict enforcement actions, and continuous updates in data protection, financial reporting, and healthcare regulations. Strong adoption of cloud-based RegTech platforms, rapid integration of AI-driven compliance tools, and heavy investment in digital transformation across financial services, life sciences, and energy sectors further support market growth. The presence of major compliance software vendors and strong enterprise willingness to spend on automation also strengthens regional demand. The U.S. market is primarily propelled by intense regulatory scrutiny from agencies such as the SEC, FDA, FTC, and FINRA, along with frequent policy revisions in areas like data privacy, healthcare, cybersecurity, and financial crime prevention.

For instance, in November 2025, The FDA has approved ziftomenib (Komzifti) for adults with an advanced form of acute myeloid leukemia (AML) carrying an NPM1 mutation. This mutation is present in roughly 30% of newly diagnosed AML cases, and nearly 70% of these patients relapse within three years, often within the first year. In clinical studies, 21.4% of patients receiving ziftomenib achieved either full remission or remission with partial blood count recovery, indicating the absence of detectable cancer cells in the bone marrow even if some blood values had not fully normalized.

Europe is the second region after North America which is expected to dominate the global leukemia therapeutics market with a 36.6% in 2024

Europe benefits from strong, harmonized regulatory frameworks such as GDPR, AMLD directives, MiFID II, and ESG reporting mandates, which collectively encourage continuous investment in compliance technologies. In the UK, regulatory momentum is shaped by the FCA’s strong oversight, post-Brexit rule divergence, and growing emphasis on operational resilience, financial crime prevention, and consumer protection. UK firms are early adopters of RegTech, driven by London’s role as a global fintech hub and the need for efficient reporting, risk scoring, and automated monitoring.

For instance, in October 2024, Leukaemia UK announced an investment of £600,000 to support four pioneering research projects focused on developing gentler, more effective treatment approaches for aggressive blood cancers. These projects aim to advance new therapeutic strategies for conditions such as acute myeloid leukaemia (AML), Burkitt lymphoma (BL), and T-cell acute lymphoblastic leukaemia (T-ALL).

The Asia Pacific region is the fastest-growing region in the global leukemia therapeutics market, with a CAGR of 8.1% in 2024

The Asia-Pacific region is expanding due to rapid digitalization, rising cyber threats, and increasing regulatory modernization across sectors such as banking, payments, telecommunications, and healthcare. Governments in countries like India, Singapore, and Australia are tightening reporting norms and introducing new data protection laws, prompting organizations to adopt automated compliance tools.

Japan’s market growth is driven by strict financial regulations, evolving data protection requirements, and strong government initiatives promoting corporate governance reform. The country’s large banking and insurance sectors are accelerating adoption of RegTech platforms to strengthen AML controls, improve reporting accuracy, and comply with frequent supervisory audits.

For instance, in November 2025, Kura Oncology, Inc and Kyowa Kirin Co., Ltd. announced that the FDA has granted full approval to KOMZIFTI (ziftomenib) for adults with relapsed or refractory acute myeloid leukemia (AML) carrying a susceptible NPM1 mutation and lacking satisfactory alternative treatment options. KOMZIFTI is now the first and only once-daily, oral menin inhibitor approved for this difficult-to-treat form of NPM1-mutated AML, offering a new therapeutic option for a population with historically limited choices.

Global Leukemia Therapeutics Market Competitive Landscape

Top companies in the global leukemia therapeutics market Novartis AG, Pfizer Inc., Bristol-Myers Squibb Company, Amgen Inc., Astellas Pharma, AbbVie / Roche (Genentech) and among others.

Novartis AG:- Novartis AG holds a prominent and influential position in the leukemia therapeutics market, driven by its strong portfolio of targeted therapies, continuous R&D investment, and leadership in next-generation precision medicines. The company has transformed treatment outcomes in chronic myeloid leukemia (CML) with its TKI franchise, including imatinib, nilotinib, and the recently advanced Scemblix (asciminib), which has shown superior molecular response rates and is rapidly becoming a key differentiator in first-line and resistant CML settings.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Acute Lymphoblastic Leukemia (ALL), Acute Myeloid Leukemia (AML), Chronic Lymphocytic Leukemia (CLL), Chronic Myeloid Leukemia (CML), Others |

| Drug Class | Tyrosine Kinase Inhibitors (TKIs), Monoclonal Antibodies Antimetabolites, Alkylating Agents, Cytokines, Others | |

| Route of Administration | Oral, Injectable | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global leukemia therapeutics market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggested Reports

For more pharmaceuticals-related reports, please click here