Neurotherapeutics Market Size& Industry Outlook

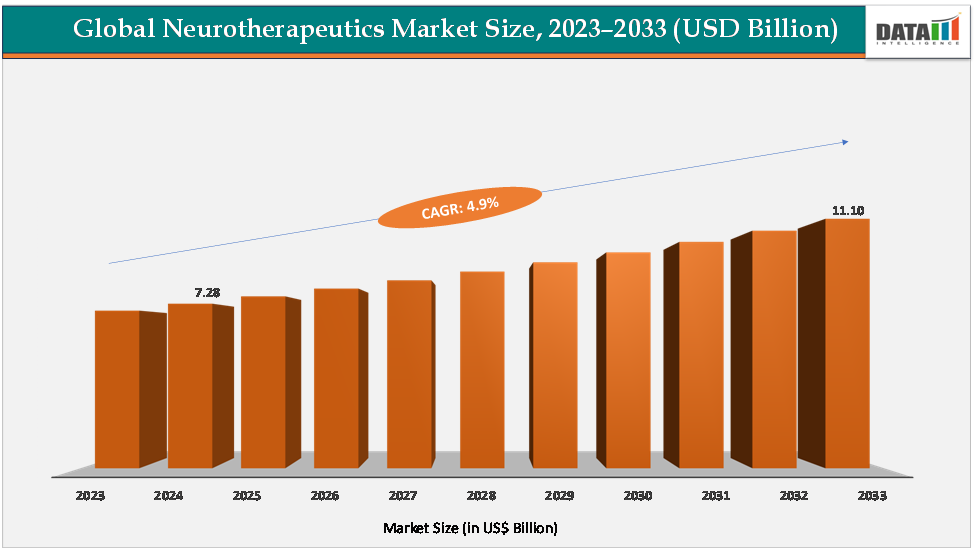

The global neurotherapeutics market size reached US$7.28Billion in 2024 from US$6.97Billionin 2023 and is expected to reach US$ 11.10Billion by 2033, growing at a CAGR of 4.9%during the forecast period 2025-2033.

The market is rapidly expanding, fueled by an aging population, which increases the prevalence of neurological disorders like Alzheimer's and Parkinson's. Technological advancements such as wearable devices, digital therapeutics such as EndeavorRxfor ADHD, and advanced neurostimulator systems such as Activa DBS and Infinity DBS are enhancing treatment efficacy. Regulatory support and increased healthcare investment are facilitating the approval and adoption of innovative therapies. Additionally, ongoing advancements in novel drugs and devices continue to drive market expansion and improved patient outcomes globally.

Key Market Highlights

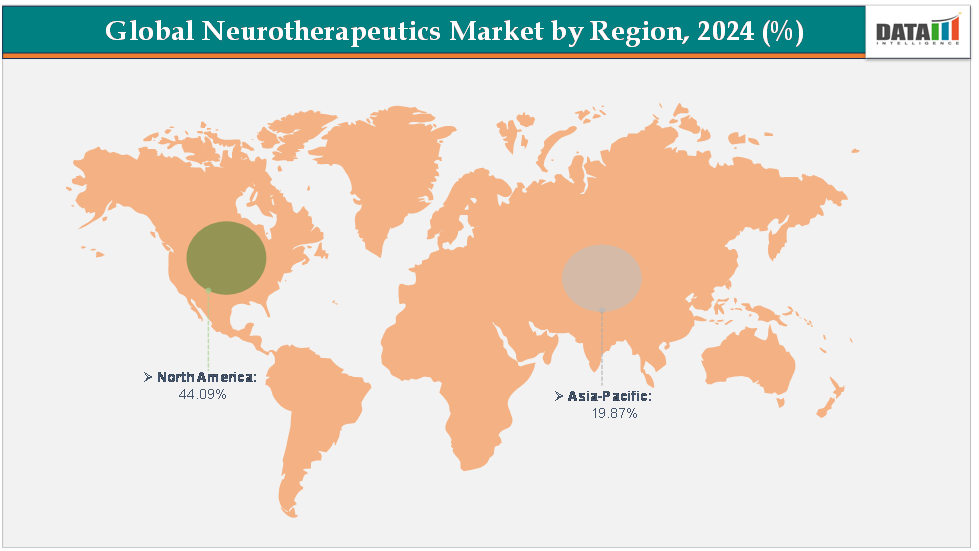

- North America dominates the neurotherapeutics market with the largest revenue share of 44.09% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of5.9% over the forecast period.

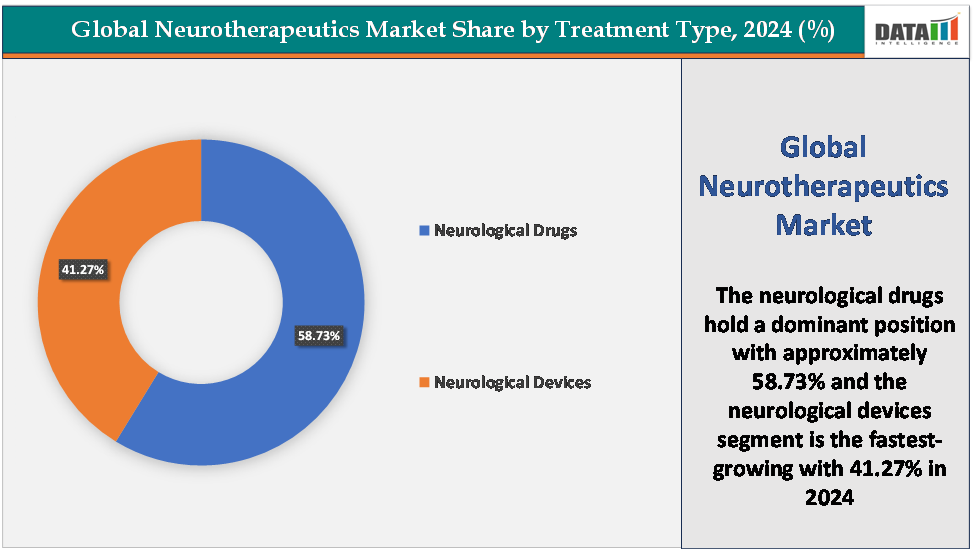

- Based on treatment type, the neurological drugs segment led the market with the largest revenue share of 58.73% in 2024.

- The major market players in the neurotherapeutics market are Medtronic, Boston Scientific Corporation, Abbott, Aleva Neurotherapeutics, NeuroPace, Inc., Biogen, Novartis AG, Teva Pharmaceutical Industries Ltd, Eli Lilly and Company, and Johnson & Johnson, among others

Market Dynamics

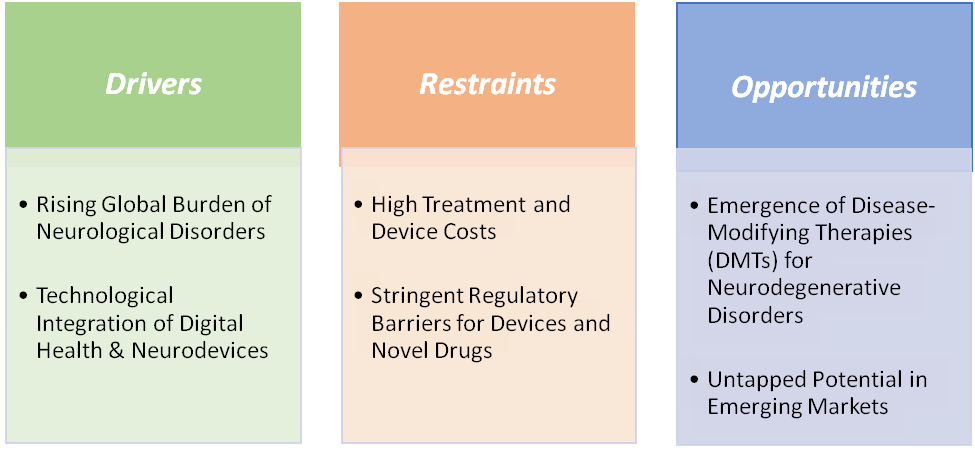

Drivers: The rising global burden of neurological disorders is significantly driving the neurotherapeutics market growth

The rising global burden of neurological disorders is a central force driving the neurotherapeutics market forward, as these conditions account for the leading cause of disability worldwide, affecting over 3 billion people. According to Alzheimer's Disease International, there were over 55 million people worldwide living with dementia in 2020. This number will almost double every 20 years, reaching 78 million in 2030 and 139 million in 2050. Much of the increase will be in developing countries. Already 60% of people with dementia live in low and middle-income countries, but by 2050 this will rise to 71%, creating huge demand for novel drugs such as Leqembi (lecanemab), the first FDA-approved disease-modifying therapy.

According to the Parkinson’s Foundation, an estimated 1.1 million people in the US are living with Parkinson's disease (PD). This number is expected to rise to 1.2 million by 2030. Parkinson's is the second-most common neurodegenerative disease after Alzheimer's disease. An estimated 90,000 people in the U.S. are diagnosed with PD each year. More than 10 million people worldwide are estimated to be living with PD, fueling growth in both pharmacological options like levodopa and advanced device-based therapies such as Medtronic’s Activa DBS system.

Epilepsy, impacting around 50 million people worldwide, continues to stimulate market uptake of anti-epileptic drugs alongside implantable technologies like NeuroPace RNS, designed for drug-resistant cases. Meanwhile, migraine, one of the most common neurological conditions, affects over 1.1 billion people globally and has accelerated the adoption of new biologics, including CGRP inhibitors like Aimovig, Emgality, and Ajovy, as well as non-invasive neuromodulation devices. This epidemiological pressure not only expands the addressable market but also ensures a sustained demand pipeline for advanced therapies across diverse neurological conditions.

Restraints: High treatment and device costs are hampering the growth of the market

High treatment and device costs represent one of the most significant restraints on the neurotherapeutics market, as they directly limit patient accessibility and burden healthcare systems. Advanced neurological drugs and devices often carry extraordinary price tags, making them affordable only in high-income regions. For instance, the gene therapy Zolgensma, used for spinal muscular atrophy, costs over USD 2 million per dose, making it one of the most expensive treatments in the world. Similarly, Spinraza, another SMA therapy, exceeds USD 750,000 in the first year, creating barriers for broader adoption despite clinical efficacy.

Device-based therapies are equally costly, such as deep brain stimulation (DBS) surgeries for Parkinson’s can range between USD 35,000–70,000, excluding ongoing maintenance and battery replacement costs, while NeuroPace RNS for epilepsy and vagus nerve stimulators also involve high upfront surgical and long-term expenses. Even in developed regions, high out-of-pocket costs deter patients from pursuing long-term treatment adherence, especially for chronic conditions like Alzheimer’s, Parkinson’s, and epilepsy that require sustained care. Thus, while innovation is robust, the economic inaccessibility of cutting-edge neurotherapeutics creates a widening gap between clinical potential and real-world adoption, ultimately slowing the market’s overall growth trajectory.

For more details on this report – Request for Sample

Segmentation Analysis

The global neurotherapeutics market is segmented based on treatment type, application, end-user, and region.

Treatment Type:

The neurological drugs segment is dominating the neurotherapeutics market with a 58.73% share in 2024

The neurological drugs segment dominates the neurotherapeutics market largely because of its wide accessibility, established treatment protocols, and the breadth of approved therapies addressing multiple high-burden disorders. For conditions like Alzheimer’s disease, drugs such as donepezil, rivastigmine, and memantine remain the frontline treatments, while more recent launches further accelerate the market. For instance, in August 2025, Eisai Co., Ltd. and Biogen Inc. announced that the U.S. Food and Drug Administration (FDA) approved the Biologics License Application (BLA) for once-weekly lecanemab-irmb subcutaneous injection LEQEMBI IQLIK for maintenance dosing. LEQEMBI IQLIK autoinjector is indicated for maintenance dosing to treat Alzheimer's disease (AD) in patients with mild cognitive impairment (MCI) or mild dementia stage of disease.

In Parkinson’s disease, traditional mainstays like levodopa and dopamine agonists continue to serve millions globally, supported by adjunctive drugs such as safinamide (Xadago) and new extended-release formulations that improve patient adherence. Similarly, the antiepileptic drug market is well established with products like valproate, lamotrigine, and levetiracetam, but innovation persists with newer agents such as cenobamate (Xcopri) and brivaracetam (Briviact), catering to drug-resistant epilepsy.

In migraine care, the drug segment has undergone a revolution with the advent of CGRP inhibitors, including Aimovig, Ajovy, and Emgality, which have rapidly gained traction due to superior efficacy over older triptan therapies. Beyond these, multiple sclerosis drugs such as ocrelizumab (Ocrevus) and siponimod (Mayzent) continue to expand the neuroimmunology portfolio, providing long-term disease-modifying benefits.The recent surge in Alzheimer’s and migraine drug approvals further reinforces the dominance of neurological drugs, making them the largest revenue-generating segment and the cornerstone of growth in the neurotherapeutics market.

The neurological devices segment is the fastest-growing in the neurotherapeutics market, with a 41.27% share in 2024

The neurological devices segment is the fastest-growing area of the neurotherapeutics market, fueled by rapid technological innovation, expanding clinical indications, and rising demand for non-pharmacological or drug-resistant solutions. Devices such as deep brain stimulation (DBS) systems provide long-term, adjustable therapy for conditions like Parkinson’s disease, essential tremor, and dystonia. Market leaders such as Medtronic’s Activa DBS, Abbott’s Infinity DBS, and Boston Scientific’s Vercise Genus have set new standards by integrating features like directional leads, rechargeable batteries, and wireless programming to improve precision and patient outcomes.

Similarly, Spinal Cord Stimulation (SCS) and Vagus Nerve Stimulation (VNS) devices, including LivaNova’s VNS Therapy, are increasingly adopted for epilepsy and depression, especially in drug-resistant patients. The FDA-approved NeuroPace RNS is another breakthrough, offering a closed-loop system that detects and responds to abnormal brain activity in epilepsy, representing a leap toward personalized neuromodulation. In addition, Transcranial Magnetic Stimulation (TMS) devices, such as those developed by Neuronetics (NeuroStar) and BrainsWay Deep TMS, have seen expanding approvals, moving beyond depression into OCD and migraine management.

Recent product launches are further driving the segment’s growth. For instance, in February 2025, Medtronic plc announced US Food and Drug Administration (FDA) approval of BrainSense Adaptive deep brain stimulation (aDBS) and BrainSense Electrode Identifier (EI).There is no cure for debilitating neurological conditions like Parkinson's; however, deep brain stimulation (DBS) has been transforming the lives of people with Parkinson's and other neurological disorders for more than 30 years. DBS is similar to a cardiac pacemaker, but for the brain. It uses a surgically implanted neurostimulator via a minimally invasive procedure to transmit electrical signals to specific parts of the brain affected by debilitating neurological disorders.

Geographical Analysis

North America is expected to dominate the global neurotherapeutics market with a 44.09% in 2024

North America, particularly the United States, stands as the dominant region in the global neurotherapeutics market, supported by its strong healthcare infrastructure, advanced R&D ecosystem, and favorable regulatory and reimbursement frameworks. Favorable reimbursement policies, combined with strong venture capital investment in biotech and medtech startups, further reinforce North America’s dominance by ensuring rapid commercialization and adoption of cutting-edge therapies. With a highly specialized workforce, world-class research hubs, and strong patient advocacy networks, North America continues to set the pace in neurotherapeutics, making it the most lucrative and influential region in the global market.

US Neurotherapeutics Market Trends

The US bears a high neurological disease burden, with Alzheimer’s affecting over 6 million Americans, Parkinson’s prevalence having surpassed 1 million cases, and epilepsy impacting 3.4 million people in the US alone, driving consistent demand for both drugs and devices. The FDA has played a central role in accelerating innovation, granting approvals for groundbreaking therapies such as Leqembi (lecanemab) for Alzheimer’s, which was the first disease-modifying drug to gain traditional approval. In migraine management, the US was the launchpad for CGRP inhibitors like Aimovig, Ajovy, and Emgality, which rapidly penetrated the market due to high awareness, strong marketing, and robust insurance uptake.

On the device side, the US has pioneered neuromodulation therapies: Medtronic’s Activa DBS, Abbott’s Infinity DBS, and Boston Scientific’s Vercise Genus have all gained FDA approvals and are widely adopted for Parkinson’s and movement disorders. Similarly, innovative systems like the NeuroPace RNS for drug-resistant epilepsy and Neuronetics’ NeuroStar TMS for major depressive disorder showcase the region’s leadership in device-based interventions. The US also leads in non-invasive options, with FDA-cleared wearables like the Cala Trio for essential tremor and gammaCore for cluster headaches and migraines.

The Asia Pacific region is the fastest-growing region in the global neurotherapeutics market, with a CAGR of 5.9% in 2024

The Asia Pacific region is the fastest-growing market in global neurotherapeutics, driven by its massive patient population, rising healthcare investments, and improving access to advanced therapies. The region faces an escalating neurological disease burden, with China and India together housing over 300 million people aged 60+, fueling sharp increases in Alzheimer’s, Parkinson’s, and stroke cases. For instance, China alone reports over 15 million dementia patients, while India has nearly 1 million Parkinson’s patients, creating enormous unmet medical needs.

Growing awareness, combined with government initiatives to strengthen neurology care infrastructure, is accelerating diagnosis and treatment uptake. Multinational pharma companies are actively expanding in this region; drugs such as donepezil and memantine for Alzheimer’s and levodopa and rasagiline for Parkinson’s are widely available, while recent biologics like CGRP inhibitors (Aimovig, Ajovy, Emgality) are gradually entering markets through regional partnerships. On the devices front, Asia Pacific is witnessing rapid adoption of advanced neuromodulation systems such as Medtronic’s Activa DBS, Abbott’s Infinity DBS, and Boston Scientific’s Vercise Genus, with expanding surgical expertise and government-approved neurosurgical centers supporting growth.

Europe Neurotherapeutics Market Trends

In Europe, the neurotherapeutics market is experiencing strong growth, driven by a combination of a rapidly aging population, high disease prevalence, and proactive regulatory support. The region has more than 10 million people living with dementia, including Alzheimer’s, and around 1.2 million Parkinson’s patients, which creates a sustained demand for effective therapies. The European Medicines Agency (EMA) and European Commission (EC) approvals such as several cornerstone drugs, such as donepezil, rivastigmine, and memantine for Alzheimer’s, as well as levodopa, safinamide (Xadago), and rasagiline for Parkinson’s.

More recently, in August 2025, Eisai Co., Ltd. and Biogen Inc. announced that the anti-amyloid beta (Aβ) monoclonal antibody LEQEMBI launched in Austria in August 2025 and in Germany in September 2025. LEQEMBI received the European Commission (EC) approval in April 2025 as the first therapy that targets an underlying cause of Alzheimer’s disease (AD). It is indicated for the treatment of adult patients with a clinical diagnosis of mild cognitive impairment (MCI) and mild dementia due to AD (collectively referred to as early AD) who are apolipoprotein E ε4 (ApoE ε4) non-carriers or heterozygotes with confirmed amyloid pathology. Germany and Austria will mark the first launches in the EU.

Competitive Landscape

Top companies in the neurotherapeutics market include Medtronic, Boston Scientific Corporation, Abbott, Aleva Neurotherapeutics, NeuroPace, Inc., Biogen, Novartis AG, Teva Pharmaceutical Industries Ltd, Eli Lilly and Company, andJohnson & Johnson, among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Treatment Type | Neurological Drugs and Neurological Devices |

| Application | Alzheimer’s Disease, Parkinson’s Disease, Multiple Sclerosis Epilepsy, Amyotrophic Lateral Sclerosis, Traumatic Brain Injury, and Others | |

| End-User | Hospitals, Specialty Clinics, Academic and Research Institutes, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global neurotherapeutics market report delivers a detailed analysis with 62 key tables, more than 56visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here