Interventional Neurology Devices Market Size

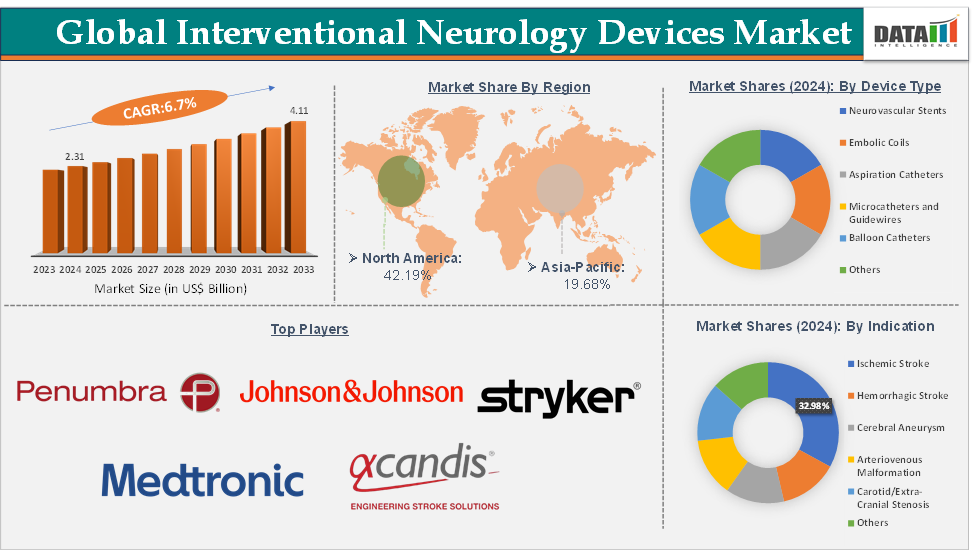

The global interventional neurology devices market size reached US$ 2.31 Billion in 2024 from US$ 2.18 Billion in 2023 and is expected to reach US$ 4.11 Billion by 2033, growing at a CAGR of 6.7% during the forecast period 2025-2033.

Interventional Neurology Devices Market Overview

The interventional neurology devices market is evolving rapidly as advances in minimally invasive technology reshape the treatment landscape for stroke and other neurovascular disorders. Rising global incidence of ischemic and hemorrhagic strokes, coupled with the growing prevalence of cerebral aneurysms and arteriovenous malformations, is fueling steady demand for innovative endovascular solutions. Regulatory agencies like the FDA and EMA are supporting innovation through streamlined approvals, leading to notable product launches, including Johnson & Johnson’s CEREGLIDE 71 and EMBOGARD and Penumbra’s RED reperfusion catheters.

North America dominates due to its advanced infrastructure and reimbursement frameworks, and Asia-Pacific is emerging as the fastest-growing region, driven by expanding healthcare investment and awareness campaigns. Despite its promise, the market faces restraints such as high device costs, reimbursement gaps in developing economies, and risks of complications like vessel perforation or device migration. However, ongoing innovation in biocompatible materials, robotics, and AI-assisted imaging presents opportunities for safer, faster, and more precise interventions. Overall, the market is positioned for sustained growth, underpinned by clinical necessity, technological progress, and a global push toward improving outcomes for stroke and neurovascular patients.

Interventional Neurology Devices Market Executive Summary

Interventional Neurology Devices Market Dynamics

Drivers:

The rising global incidence of stroke and neurovascular disorders is significantly driving the interventional neurology devices market growth

The rising global incidence of stroke and other neurovascular disorders has directly expanded the addressable patient population for endovascular interventions, lifting demand for interventional neurology devices as more patients become eligible for minimally invasive treatment. Manufacturers are responding with targeted product introductions aimed at those expanded indications, for instance, Johnson & Johnson’s CEREGLIDE 71 intermediate/aspiration catheter and EMBOGARD balloon guide were positioned to improve direct aspiration and combined-tech thrombectomy workflows.

According to the Centers for Disease Control and Prevention (CDC), every year, more than 795,000 people in the United States have a stroke. About 610,000 of these are first or new strokes. Additionally, according to the World Health Organization (WHO), more than 3 billion people worldwide were living with a neurological condition. This expanded patient pool also accelerates post-market evidence generation, which in turn feeds regulatory approvals and label expansions that further enlarge the market. Because many new stroke patients present beyond the old treatment windows, catheter and aspiration technology innovations that increase first-pass success are particularly valuable and see faster uptake.

Restraints:

Device-related risks, complications, and safety concerns are hampering the growth of the interventional neurology devices market

Despite strong momentum, the interventional neurology devices market faces significant headwinds from device-related risks, complications, and ongoing safety concerns, which collectively dampen physician confidence and slow broader adoption. While mechanical thrombectomy and flow diversion have revolutionized stroke and aneurysm care, real-world practice still reports complications such as vessel perforation, in-stent thrombosis, coil migration, incomplete clot retrieval, and distal embolization, which can result in serious morbidity or mortality.

Embolic coils and liquid embolics also face scrutiny for potential migration or incomplete occlusion, leading to retreatment and driving up costs for hospitals and payers. Reports of device malfunctions or recalls not only disrupt supply but also heighten liability concerns, pushing hospitals to adopt a more cautious stance toward newer or less proven technologies. Moreover, these risks translate into payer skepticism, with insurers and health systems demanding robust long-term evidence before granting reimbursement for premium devices. As a result, while innovation continues to push the field forward, persistent concerns about device-related complications remain a critical brake on market growth, influencing procurement decisions and physician preferences until confidence is rebuilt through safer designs and stronger clinical evidence.

For more details on this report – Request for Sample

Interventional Neurology Devices Market, Segment Analysis

The global interventional neurology devices market is segmented based on device type, indication, end-user, and region.

The ischemic stroke segment from the indication is dominating the interventional neurology devices market with a 32.98% share in 2024

The ischemic stroke segment dominates the interventional neurology devices market because mechanical thrombectomy has become the standard of care for large vessel occlusions, driving higher procedural volumes than any other neurovascular indication. Major and emerging market players have responded with continuous product innovation aimed at improving first-pass efficacy, reducing procedure times, and enabling combination techniques.

For instance, in February 2025, Johnson & Johnson MedTech launched the CEREGLIDE 92 Catheter System, a next-generation .092” catheter with the INNERGLIDE 9 delivery aid, indicated for use in facilitating the insertion and guidance of interventional devices in the neurovascular system. CEREGLIDE 92 is a .092" inner diameter catheter system that allows physicians to achieve large distal access and is designed to provide flow reduction in the M1i when inserting devices for the revascularization of patients with acute ischemic stroke.

Additionally, Stryker’s Trevo NXT ProVue Retriever, a widely adopted stent retriever, has been a cornerstone product in acute ischemic stroke. These product launches and platform upgrades reinforce the central role of ischemic stroke treatment in driving overall market revenue. Unlike aneurysm or AVM interventions, ischemic stroke procedures are highly time-sensitive and occur at a much greater frequency, which amplifies device utilization rates.

Interventional Neurology Devices Market, Geographical Analysis

North America is expected to dominate the global interventional neurology devices market with a 42.19% in 2024

North America, especially the United States, remains the dominant region in the interventional neurology devices market, driven by its advanced healthcare infrastructure, strong reimbursement systems, and high prevalence of stroke and neurovascular disorders. Recent product launches underscore the region’s leadership role, with Johnson & Johnson’s Cereglide 92 Catheter System, a new next-generation catheter to be used when treating acute ischemic stroke patients in February 2025.

Similarly, in February 2025, Penumbra launched the ACCESS25 Delivery Microcatheter, a single-lumen medical device designed to aid physicians in accessing the neurovasculature for the delivery of Penumbra’s advanced .020” coil platform. ACCESS25 is compatible with Penumbra’s MIDWAY Intermediate catheters and BENCHMARK/BMX guide catheters and was designed to facilitate ease of trackability and stable support when delivering Penumbra’s unique .020” coils for neurovascular embolization, such as PC400, POD400, and PAC400.

Interventional Neurology Devices Market Competitive Landscape

Top companies in the interventional neurology devices market include Medtronic, Stryker, Johnson & Johnson, Penumbra, Inc., Terumo Corporation, Boston Scientific Corporation, MicroPort Scientific Corporation, and Acandis GmbH, among others.

Interventional Neurology Devices Market Scope

Metrics | Details | |

CAGR | 6.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Device Type | Neurovascular Stents, Embolic Coils, Aspiration Catheters, Microcatheters and Guidewires, Balloon Catheters and Others |

Indication | Ischemic Stroke, Hemorrhagic Stroke, Cerebral Aneurysm, Arteriovenous Malformation, Carotid/Extra-Cranial Stenosis and Others | |

End-User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global interventional neurology devices market report delivers a detailed analysis with 56 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here