Laboratory Robotics Market: Industry Outlook

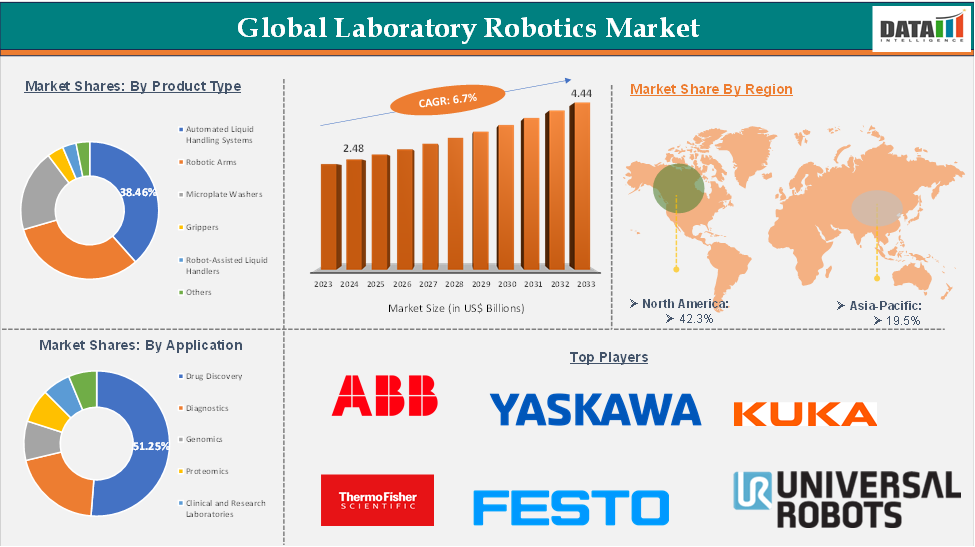

Laboratory Robotics Market reached US$ 2.48 Billion in 2024 and is expected to reach US$ 4.44 Billion by 2033, growing at a CAGR of 6.7% during the forecast period 2025-2033, according to DataM Intelligence report.

The laboratory robotics market is experiencing significant growth due to the increasing demand for automation in research and diagnostic laboratories, particularly in pharmaceutical, biotechnology, and healthcare sectors. Technological advancements, such as artificial intelligence, machine learning, and miniaturized robotic systems, are improving efficiency, accuracy, and scalability in laboratory processes, as per our research.

The North America region is emerging as a key growth hub due to industrialization, R&D investments, and healthcare infrastructure expansion. Despite challenges like high initial capital investment and complex integration, the market holds strong opportunities in emerging markets, customized robotic solutions, and AI integration.

Executive Summary

For more details on this report, Request for Sample

Laboratory Robotics Market Dynamics: Drivers & Restraints

Driver: Rise in the technological advancements

The laboratory robotics market is being driven by technological advancements, particularly the integration of artificial intelligence, machine learning, and advanced sensor technologies. These innovations enable robots to perform complex tasks with greater precision and efficiency, reducing human error and streamlining workflows. AI-driven robotic systems can optimize pipetting protocols and analyze data for quality control, providing unmatched decision-making support in research environments.

The miniaturization of robotic components and user-friendly interfaces have made laboratory robotics more accessible to a wider range of laboratories, including those with limited space and technical expertise. These advancements not only improve efficiency but also accelerate research and development processes, particularly in fields like drug discovery and genomics.

For instance, in January 2025, ABB and Agilent are partnering to enhance laboratory operations across various sectors, including pharma, biotechnology, energy, and food and beverage, by combining their technologies for faster and more efficient research and quality control processes. Agilent's advanced analytical instrumentation and laboratory software solutions will be combined with ABB's robotics, enhancing laboratory efficiency, precision, and flexibility.

Restraint: High initial investment and maintenance costs

The laboratory robotics market faces significant challenges due to high initial investment and ongoing maintenance costs. Implementing robotic automation requires substantial capital expenditure for advanced equipment, infrastructure modifications, and software integration, which can be prohibitive for small and mid-sized laboratories or institutions with limited budgets.

Maintaining and servicing complex robotic systems requires specialized technical expertise and additional operational expenses, impacting the return on investment and slowing the widespread adoption of laboratory robotics, especially in cost-sensitive markets.

Laboratory Robotics Market Segment Analysis

The global laboratory robotics market is segmented based on product type, application, end user, and region.

Product Type

The automated liquid handling systems segment from the product type is expected to hold 38.46% of the laboratory robotics market

The automated liquid handling systems segment dominates the laboratory robotics market, enhancing workflows, reducing human error, and increasing throughput. These systems are crucial in high-throughput screening, genomics, proteomics, and drug discovery applications.

The integration of advanced technologies like artificial intelligence and robotic arms enhances their adaptability and accuracy. They also support miniaturization of assays, reducing reagent costs and environmental waste. As laboratories prioritize efficiency, reproducibility, and scalability, demand for these systems continues to rise.

For instance, in January 2025, Tecan, a global leader in laboratory automation, unveiled Veya, a liquid handling platform designed to enhance efficiency, precision, and compliance in laboratories of all sizes. The platform was showcased at the Society for Laboratory Automation and Screening international conference in San Diego.

Laboratory Robotics Market Geographical Analysis

North America dominated the global laboratory robotics market with the highest share of 42.3% in 2024

North America dominates the laboratory robotics market due to product launches, automation investments, and innovation in pharmaceutical and biotechnology sectors. Key players, research institutions, and universities adopt robotic systems for efficiency improvement. Government initiatives, funding, and early AI adoption accelerate market growth. Demand for high-throughput screening and drug discovery solutions drives the adoption of laboratory robotics across various industries.

For instance, in January 2025, Trilobio showcased its first version of its comprehensive robotics, lab equipment, and software platform at the Society for Laboratory Automation and Screening conference, demonstrating its capabilities in enhancing research workflows.

Moreover, in May 2024, Clarapath, a medical robotics company, partnered with the Mayo Clinic to automate tissue sectioning, transfer, and quality control using robotics and AI, aiming to address labor shortages, quality control issues, and rising sample volumes.

Asia-Pacific is the global laboratory robotics market with a market share of 19.5% in 2024.

The Asia-Pacific laboratory robotics market is fueled by rapid industrialization, expanding pharmaceutical and biotechnology sectors, and healthcare infrastructure investments. Countries like China, India, Japan, and South Korea are experiencing increased demand for high-throughput laboratory processes due to R&D activities and a surge in chronic and infectious diseases.

Government initiatives promoting automation and digital transformation in labs are also contributing to market growth. The region's skilled professionals and lower manufacturing costs make it an attractive hub for advanced laboratory automation solutions.

For instance, in November 2024, Microsoft opened its first research and development center in Japan, Microsoft Research Asia Tokyo, integrating AI with robotics to advance research in manufacturing, healthcare, and societal applications, as part of its global AI research network.

Laboratory Robotics Market - Key Players

The major global players in the laboratory robotics market include ABB Ltd, Thermo Fisher Scientific Inc, Yaskawa Electric Corporation, KUKA AG, Festo AG & Co. KG, Universal Robots, Tecan Group Ltd, Hamilton Company, Hudson Robotics, Peak Analysis & Automation (PAA), and among others.

Key Developments

In April 2025, Covestro plans to open a state-of-the-art automated lab in 2025 to optimize coating and adhesive formulations, focusing on digitalization, circular materials, and customer-specific testing, with tens of thousands of annual tests.

In February 2025, Opentrons Labworks has launched an automation marketplace that offers tools and software from its partners for integration into their robotics systems, catering to sectors like drug discovery and microbiome research, and functions as an eCommerce hub.

Market Scope

Metrics | Details | |

CAGR | 6.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Automated Liquid Handling Systems, Robotic Arms, Microplate Washers, Grippers, Robot-Assisted Liquid Handlers, Others |

Application | Drug Discovery, Diagnostics, Genomics, Proteomics, Clinical and Research Laboratories, Chemical and Pharmaceutical Industries | |

End User | Pharmaceutical and Biotechnology Companies, Healthcare Institutions, Academic and Research Institutions | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |