Biotechnology Market Size& Industry Outlook

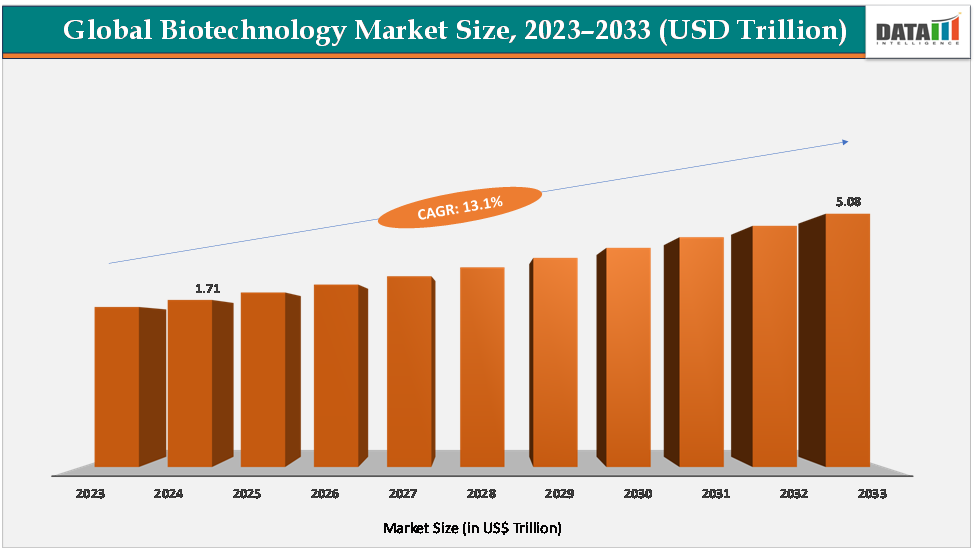

The global biotechnology market size reachedUS$1.71Trillion in 2024 from US$1.53Trillionin 2023 and is expected to reach US$ 5.08Trillion by 2033, growing at a CAGR of 13.1%during the forecast period 2025-2033.

The market is expanding rapidly, driven by advances in genomics, personalized medicine, and biologics that address unmet medical needs. Rising demand for targeted therapies and vaccines has accelerated innovation, illustrated by mRNA platforms like Moderna’s Spikevax and Pfizer/BioNTech’s Comirnaty, which reshaped the vaccine landscape during COVID-19.

Breakthroughs in oncology are fueling further growth, with immunotherapies such as Merck’s Keytruda achieving blockbuster status through improved patient outcomes. In rare and genetic diseases, companies like Vertex with Trikafta for cystic fibrosis and Pfizer with Beqvez gene therapy for hemophilia B showcase how advanced biotech can transform treatment. Meanwhile, rising global prevalence of chronic diseases, growing investment in cell and gene therapies, and increased regulatory approvals are reinforcing market momentum and widening access to next-generation therapies.

Key Market Highlights

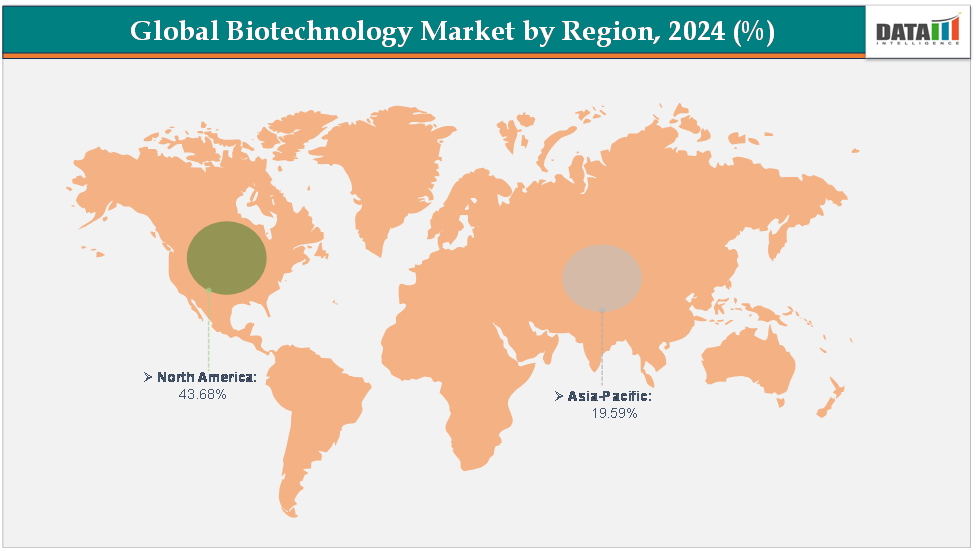

- North America dominates the Biotechnology Market with the largest revenue share of 43.68% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of12.9% over the forecast period.

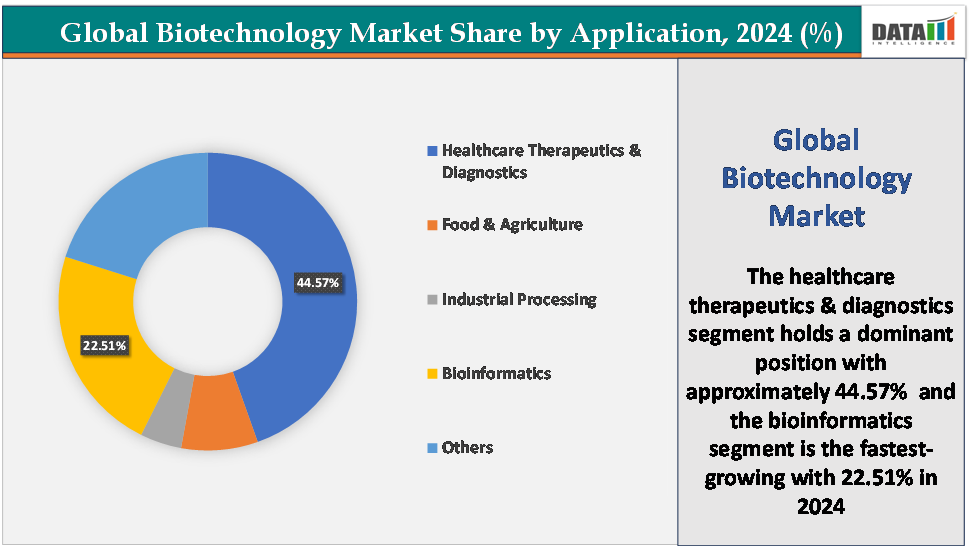

- Based on application, the healthcare therapeutics & diagnostics segment led the market with the largest revenue share of 44.57% in 2024.

- The major market players in the biotechnology market are Amgen Inc., Moderna, Inc., Regeneron Pharmaceuticals Inc., Merck & Co., Inc., Pfizer Inc., AbbVie Inc., AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Sanofi, and Biogen, among others

Market Dynamics

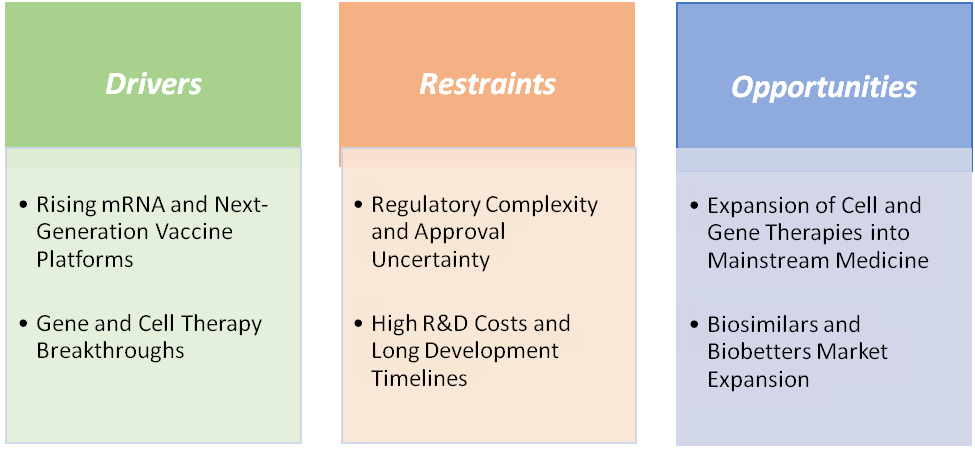

Drivers:

Rising mRNA and next-generation vaccine platforms are significantly driving the biotechnology market growth

The rapid rise of mRNA and next-generation vaccine platforms is acting as a major catalyst in driving biotechnology market growth, primarily because these technologies have shifted vaccines from traditional slow-moving development models to highly adaptable, scalable solutions. The unprecedented success of Pfizer-Biotech's Comirnaty and Moderna’s Spike ax during the COVID-19 pandemic demonstrated not only high efficacy and rapid development but also global commercialization potential, establishing confidence in mRNA platforms as viable, profitable, and transformative.

Building on this foundation, next-generation vaccines are now expanding beyond infectious diseases like COVID-19 and influenza into areas such as oncology. For instance, in September 2025, Russia’s Federal Medical Biological Agency (FMBA) announced that preclinical trials for its mRNA-based cancer vaccine EnteroMix have been completed. The announcement was made by Veronika Skvortsova, head of the FMBA at the Eastern Economic Forum (EEF).The vaccine will be first used with colorectal cancer. They are also developing vaccines in an advanced stage for glioblastoma and melanoma, including ocular melanoma.

These platforms are moving toward therapeutic cancer vaccines and personalized immunotherapies, marking a paradigm shift from prevention to treatment. Together, the proven efficacy of approved products, robust pipelines, favorable economics, and technological improvements underscore how rising mRNA and next-generation vaccine platforms are not only reshaping modern medicine but also significantly accelerating the expansion of the global biotechnology market.

Restraints:

Regulatory complexity and approval uncertainty are hampering the growth of the biotechnology market

Regulatory complexity and approval uncertainty remain some of the most significant barriers restraining biotechnology market growth, as biotech products often face prolonged, unpredictable, and region-specific evaluation processes before reaching patients. Unlike small-molecule drugs, biologics and advanced therapies such as gene and cell treatments undergo stricter scrutiny due to their novelty, manufacturing complexity, and potential long-term safety risks. For instance, Novartis’ gene therapy Zolgensma, priced at over USD 2.1 million per dose, faced delayed adoption in several European markets because health authorities demanded additional safety and cost-effectiveness data, even after its FDA approval in 2019.

Similarly, Biogen’s Aduhelm for Alzheimer’s disease was granted accelerated approval by the FDA in 2021 despite limited clinical evidence, sparking global controversy and causing regulators in Europe and Japan to reject its application. This demonstrates how divergent regional regulatory decisions can restrict market potential, delay commercialization, and erode investor confidence. Moreover, navigating different approval frameworkssuch as the FDA in the U.S., EMA in Europe, and PMDA in Japanforces companies to conduct duplicative trials or adapt to varying safety endpoints, adding years and significant costs to development timelines. These hurdles not only slow patient access to life-saving therapies but also limit the scalability of biotech innovations, ultimately hampering the sector’s global growth despite its scientific breakthroughs.

For more details on this report – Request for Sample

Segmentation Analysis

The global biotechnology market is segmented based on technology, application, and region.

Application:

The healthcare therapeutics & diagnostics segment is dominating the biotechnology market with a 44.57% share in 2024

The healthcare therapeutics & diagnostics segment is the dominant force in the biotechnology market, accounting for the largest share of revenues and driving most of the industry’s innovation pipeline. This dominance is fueled by the rising global burden of chronic and rare diseases, increasing demand for targeted therapies, and advancements in precision medicine. Breakthrough therapeutics such as monoclonal antibodies like AbbVie’s Humira and Merck’s Keytruda have become blockbusters.

Gene and cell therapies are another growth driver with products such as Novartis’ Zolgensma for spinal muscular atrophy and Gilead’s Yescarta CAR-T therapy for lymphoma exemplifying how advanced biologics are setting new standards in curative treatment, despite their premium pricing. Similarly, in July 2025, Myrtelle Inc., a pioneering clinical-stage gene therapy company dedicated to revolutionizing treatment for neurodegenerative diseases, announced the official launch of commercial-stage manufacturing for its first-in-class oligotrophic recombinant adeno-associated virus (rAAV) gene therapy product, developed specifically for Canavan disease (CD).

On the diagnostics front, next-generation sequencing (NGS) platforms, PCR-based tests, and companion diagnostics are becoming indispensable for tailoring therapies to patient subgroups, with companies like Illumina leading in genomics-driven diagnostics. mRNA vaccines such as Pfizer-BioNTech’s Comirnaty and Modern's Spike ax, proving biotechnology’s ability to deliver scalable, life-saving solutions at record speed. Beyond infectious diseases, diagnostics are now essential in oncology, rare genetic conditions, and even preventive healthcare, supported by regulatory frameworks like the FDA’s Breakthrough Therapy Designation and Companion Diagnostics approvals.

The bioinformatics segment is the fastest-growing in the biotechnology market, with a 22.51% share in 2024

The bioinformatics segment is emerging as the fastest-growing area in the biotechnology market, fueled by the convergence of life sciences, computational biology, and artificial intelligence. The growth is largely driven by the massive increase in genomic and proteomic data, which requires sophisticated computational tools for storage, analysis, and interpretation. For instance, the Human Genome Project generated about 3 billion base pairs of data, but today, next-generation sequencing (NGS) platforms like Illumina’s NovaSeq are producing exponentially larger datasets, making bioinformatics essential for extracting clinically relevant insights. This has transformed drug discovery pipelines, where AI-driven bioinformatics platforms such as DeepMind’s AlphaFold have revolutionized protein structure prediction, dramatically accelerating target identification for biotech and pharma companies.

In healthcare, bioinformatics underpins personalized medicine, enabling companion diagnostics for cancer drugs and biomarker-based approvals for immunotherapies. Beyond therapeutics, bioinformatics is also vital in agriculture, where CRISPR-based genome editing relies on computational tools to design precise edits for drought-resistant or pest-resistant crops, and in industrial biotechnology, where it aids enzyme optimization for biofuels and sustainable materials. Its ability to shorten R&D timelines, reduce costs, and enable cross-disciplinary applications makes it the fastest-growing segment of the industry, ensuring exponential demand in therapeutics, diagnostics, agriculture, and beyond.

Geographical Analysis

North America is expected to dominate the global biotechnology market with a 43.68% in 2024

North America stands as the dominant region in the global biotechnology market, contributing the largest share of industry revenues, primarily due to its strong R&D ecosystem and presence of major market players. With its unique blend of capital investment, scientific talent, and regulatory agility, North America remains the undisputed hub of biotechnology, setting global benchmarks for therapeutic and diagnostic innovation.

US Biotechnology Market Trends

The United States alone accounts for high share in the North America, supported by companies like Amgen, Gilead Sciences, Biogen, Moderna, and Regeneron, which consistently drive innovation. A key strength lies in its favorable regulatory environment, the USFood and Drug Administration (FDA) has established fast-track designations, breakthrough therapy pathways, and orphan drug incentives, enabling quicker approvals for novel therapies. For instance, the FDA approved Novartis’ Kymriah, the world’s first CAR-T cell therapy, in 2017, followed by several other landmark products such as Gilead’s Yescarta (CAR-T for lymphoma), Biogen’s Spinraza (for spinal muscular atrophy), and Novartis’ Zolgensma.

The US also led the global response to COVID-19 with FDA approvals for the first mRNA vaccines such as Pfizer-BioNTech’s Comirnaty and Moderna’s Spikevax. Additionally, the US invests heavily in genomics and diagnostics, with Illumina leading advancements in next-generation sequencing (NGS), while precision medicine initiatives like the U.S. “All of Us” research program further expand opportunities for personalized therapies.

The Asia Pacific region is the fastest-growing region in the global biotechnology market, with a CAGR of 12.9% in 2024

The Asia-Pacific region is the fastest-growing in the global biotechnology market, fueled by rapidly increasing investments in R&D, supportive government policies, and expanding patient populations. Countries like Japan, China, India, South Korea, and Singapore are emerging as biotechnology powerhouses, with China at the forefront due to heavy state-backed investments and strong pipelines in oncology, vaccines, and biosimilars. China-based companies like BeiGene have gained global recognition with FDA- and EMA-approved products such as Brukinsa (zanubrutinib) for B-cell malignancies, while India has established itself as a global hub for biosimilar and vaccine production, with firms like Biocon and Serum Institute of India supplying affordable biologics and vaccines worldwide.

Japan is advancing in regenerative medicine and stem-cell therapies, supported by favorable regulatory reforms, such as Japan’s fast-track approval pathways enabled the early launch of regenerative products. The COVID-19 pandemic accelerated regional biotech growth, with India producing billions of vaccine doses (Covishield, Covaxin) and China’s Sinovac and Sinopharm vaccines being distributed across Asia, Africa, and Latin America. Moreover, collaborations between global pharma and regional biotech firmsare accelerating knowledge transfer and commercialization. With its large, diverse patient base, cost-effective manufacturing, and strong government push, Asia-Pacific is solidifying its position as the fastest-growing biotechnology region, bridging global innovation with accessible healthcare solutions.

Europe Biotechnology Market Trends

The biotechnology market in Europe is witnessing significant growth, driven by strong government support and increasing adoption of innovative therapeutics and diagnostics. Europe hosts leading biotech hubs in Germany, Switzerland, the UK, and France, with companies like Biogen, BioNTech, and Sanofi spearheading the development of high-value biologics, gene therapies, and vaccines. Regulatory support from the European Medicines Agency (EMA) European Commission (EC)is further accelerating the market growth in Europe with novel product launches and rising partnerships and collaborations.

For instance, in August 2025, Eisai Co., Ltd. and Biogen Inc. announced that the anti-amyloid beta (Aβ) monoclonal antibody LEQEMBI launched in Austria in August 2025 and in Germany in September 2025. LEQEMBI received the European Commission (EC) approval in April 2025 as the first therapy that targets an underlying cause of Alzheimer’s disease (AD). It is indicated for the treatment of adult patients with a clinical diagnosis of mild cognitive impairment (MCI) and mild dementia due to AD (collectively referred to as early AD) who are apolipoprotein E ε4 (ApoE ε4) non-carriers or heterozygotes with confirmed amyloid pathology. Germany and Austria will mark the first launches in the EU.

Competitive Landscape

Top companies in the biotechnology market include Amgen Inc., Moderna, Inc., Regeneron Pharmaceuticals Inc., Merck & Co., Inc., Pfizer Inc., AbbVie Inc., AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Sanofi, and Biogen, among others.

Market Scope

| Metrics | Details | |

| CAGR | 13.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Trillion) | |

| Segments Covered | Technology | Nanobiotechnology, Tissue Engineering and Regeneration, DNA Sequencing, Cell-Based Assays, PCR Technology, Chromatography, and Others |

| Application | Healthcare Therapeutics & Diagnostics, Food & Agriculture, Industrial Processing, Bioinformatics, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Biotechnology Market report delivers a detailed analysis with 57 key tables, more than 49visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here