Market Size

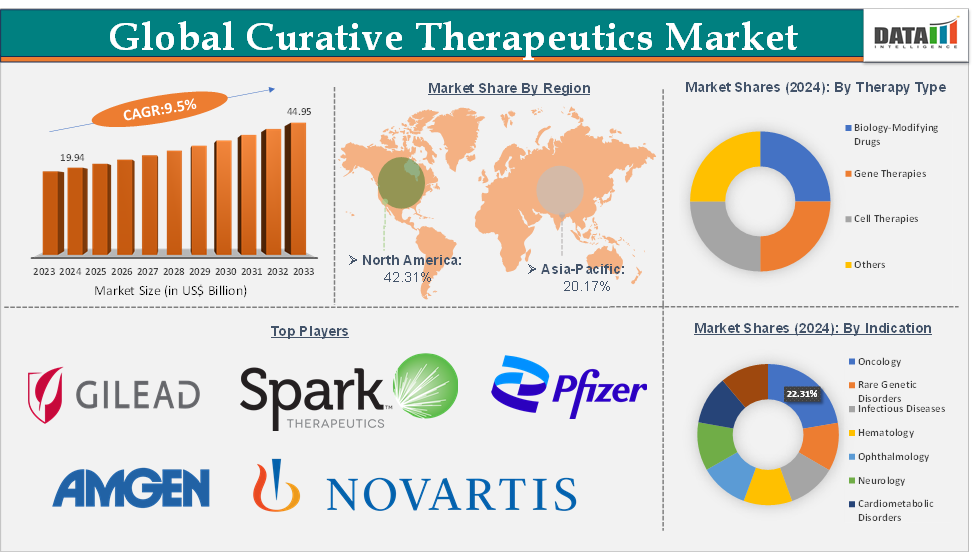

The global curative therapeutics market size reached US$ 19.94 Billion in 2024 from US$ 18.34 Billion in 2023 and is expected to reach US$ 44.95 Billion by 2033, growing at a CAGR of 9.5% during the forecast period 2025-2033.

Market Overview

The curative therapeutics market is emerging as one of the most transformative segments in modern medicine, driven by therapies designed to correct or permanently resolve the underlying cause of disease rather than manage symptoms. It encompasses biology-modifying drugs, gene therapies, and genetically engineered cell therapies that offer the potential for one-time interventions with long-lasting or lifelong benefits. Oncology remains the largest application area, especially through CAR-T and other advanced cell therapies, while rare genetic disorders and certain infectious diseases represent fast-growing opportunities. Despite challenges related to affordability, durability of effect, and access, the sector is expected to remain a strategic focus for industry stakeholders, given its potential to redefine standards of care and deliver curative outcomes across multiple disease areas.

Curative Therapeutics Market Executive Summary

Curative Therapeutics Market Dynamics

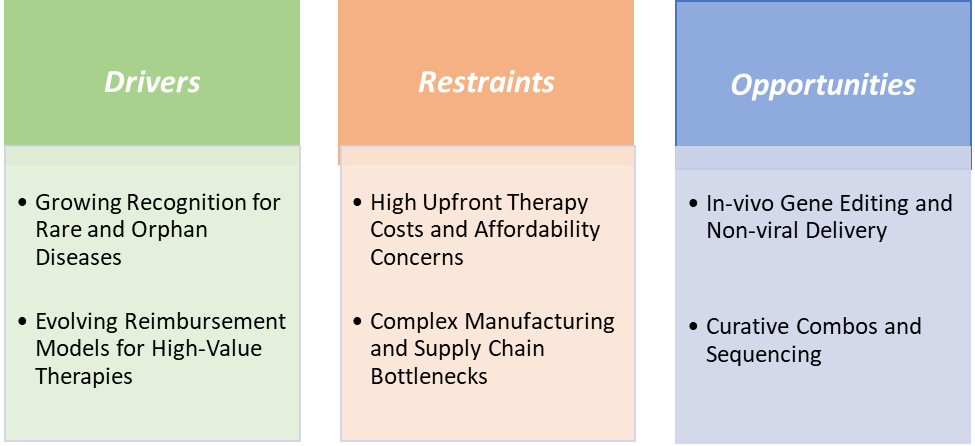

Drivers:

Growing recognition for rare and orphan diseases is significantly driving the curative therapeutics market growth

The growing recognition of rare and orphan diseases is one of the most significant drivers of the curative therapeutics market, as it creates both an urgent medical need and a supportive policy environment for innovation. Rare diseases, by definition, affect small patient populations, yet collectively they represent millions of individuals worldwide who often lack effective treatment options. For many of these conditions, traditional therapies provide only symptomatic relief, whereas curative approaches such as gene and cell therapies can directly target the genetic or molecular root cause. This alignment of unmet need with scientific feasibility has made orphan diseases a natural entry point for curative technologies.

Regulatory agencies have amplified this momentum by offering orphan drug designations and fast-track approvals to developers working in this space. For instance, Novartis’s Zolgensma, approved for spinal muscular atrophy, and bluebird bio’s Zynteglo for beta-thalassemia, demonstrate how gene therapies can achieve transformative clinical outcomes in previously untreatable populations. Beyond these high-profile cases, curative pipelines are expanding into hemophilia, sickle cell disease, and inherited retinal disorders, with each success story reinforcing investor and payer confidence.

Restraints:

High upfront therapy costs and affordability concerns are hampering the growth of the curative therapeutics market

High upfront therapy costs and affordability concerns remain one of the most pressing restraints on the curative therapeutics market, as they create significant barriers for patients, healthcare systems, and payers. Unlike traditional treatments that spread costs over time, many curative therapies are priced in the range of hundreds of thousands to millions of dollars for a single administration, creating what is often termed a “sticker shock” effect.

For instance, Novartis’s gene therapy Zolgensma for spinal muscular atrophy is priced at over $2.1 million, making it one of the most expensive treatments globally, while bluebird bio’s Zynteglo for beta-thalassemia carries a price tag of $2.8 million in the U.S. Although these therapies can offer lifelong benefits and offset the costs of chronic care, payers face challenges in absorbing such high upfront expenditures within annual budgets. This issue is particularly pronounced in countries with fragmented healthcare systems or limited insurance coverage, where access is restricted to only a fraction of eligible patients.

Affordability concerns exacerbate health inequities, as patients in low- and middle-income countries are largely excluded from access to these life-changing interventions. The result is a paradox, while curative therapeutics promise to revolutionize healthcare by addressing the root causes of diseases, their high price points slow adoption, limit reimbursement, and raise ethical concerns about who can truly benefit. Until scalable manufacturing, innovative financing models, and broader payer acceptance are established, high upfront costs will continue to be a major hurdle restraining market growth.

Segmentation Analysis

The global curative therapeutics market is segmented based on therapy type, indication, end-user, and region.

The oncology segment from the indication is dominating the curative therapeutics market with a 22.31% share in 2024

Oncology represents the dominant segment in the curative therapeutics market, largely due to the high global burden of cancer, the urgent need for transformative therapies, and the remarkable clinical successes achieved with advanced modalities such as CAR-T cell therapies and gene editing. Cancer remains one of the leading causes of mortality worldwide, with an expected 35.3 million incidence cases by 2050 according to the WHO, driving into innovative solutions that can move beyond palliative or maintenance care toward long-term remission or cure. The approval of CAR-T therapies like Novartis’s Kymriah and Gilead’s Yescarta for hematologic malignancies has demonstrated the potential of curative approaches, achieving durable remissions in patients who previously had limited or no treatment options.

Major and emerging market players are offering cost-effective solutions, further driving the growth of the market. For instance, in January 2025, Immuneel Therapeutics launched India's second CAR-T cell therapy, Qartemi, to treat patients with B-cell Non-Hodgkin Lymphoma (B-NHL), an aggressive form of blood cancer, at less than one-tenth of the price of similar therapies available in Western countries. The results showed that the efficacy and safety of Qartemi are similar to CAR T-cell therapies approved by the US FDA.

Geographical Share Analysis

North America is expected to dominate the global curative therapeutics market with a 42.31% in 2024

North America stands as the dominant region in the global curative therapeutics market, driven by its strong research ecosystem, favorable regulatory framework, and high levels of investment in advanced therapies. The United States, in particular, has pioneered the approval and commercialization of many landmark curative products. For instance, the FDA approved Novartis’s Zolgensma for spinal muscular atrophy and bluebird bio’s Zynteglo for beta-thalassemia, both of which are considered breakthroughs in gene therapy.

Similarly, in April 2024, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) approved BEQVEZ (fidanacogene elaparvovec-dzkt), a one-time gene therapy for the treatment of adults with moderate to severe hemophilia B who currently use factor IX (FIX) prophylaxis therapy, or have current or historical life-threatening hemorrhage, or have repeated, serious spontaneous bleeding episodes, and do not have neutralizing antibodies to adeno-associated virus serotype Rh74var (AAVRh74var) capsid as detected by an FDA-approved test.

The region leads in cell-based curative treatments, with CAR-T therapies like Kymriah and Yescarta rapidly gaining traction across oncology centers of excellence. Canada is also progressing in this space, with Health Canada streamlining frameworks for advanced therapy medicinal products. Collectively, the combination of scientific leadership, regulatory support, and clinical adoption cements North America’s position as the dominant market for curative therapeutics, setting benchmarks that other regions are striving to emulate.

Competitive Landscape

Top companies in the curative therapeutics market include Gilead Sciences, Inc., Spark Therapeutics, Inc., Pfizer Inc., Amgen, Inc., Novartis Pharmaceuticals Corporation, bluebird bio, Inc. and Sarepta Therapeutics, Inc., among others.

Key Developments

In May 2025, Sarepta Therapeutics, Inc. announced that the Japanese Ministry of Health, Labour, and Welfare (MHLW) approved ELEVIDYS (delandistrogene moxeparvovec) for the treatment of Duchenne muscular dystrophy (DMD) under the conditional and time-limited approval pathway in Japan. ELEVIDYS is approved for individuals aged 3 to less than 8 years old, who do not have any deletions in exon 8 and/or exon 9 in the DMD gene, and who are negative for anti-AAVrh74 antibodies. This is the first global approval to include individuals younger than 4 years of age.

In February 2025, CSL Behring announced the four-year results from the pivotal HOPE-B study, confirming the long-term durability and safety of a one-time infusion of HEMGENIX (etranacogene dezaparvovec-drlb) gene therapy for adults living with hemophilia B.

Report Scope

Metrics | Details | |

CAGR | 9.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Therapy Type | Biology-Modifying Drugs, Gene Therapies, Cell Therapies and Others |

Indication | Oncology, Rare Genetic Disorders, Infectious Diseases, Hematology, Ophthalmology, Neurology, Cardiometabolic Disorders and Others | |

End-User | Hospitals, Specialty Clinics, Academic and Research Institutes and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

For more details on this report – Request for Sample

The global curative therapeutics market report delivers a detailed analysis with 53 key tables, more than 56 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here