Gout Therapeutics Market: Industry Outlook

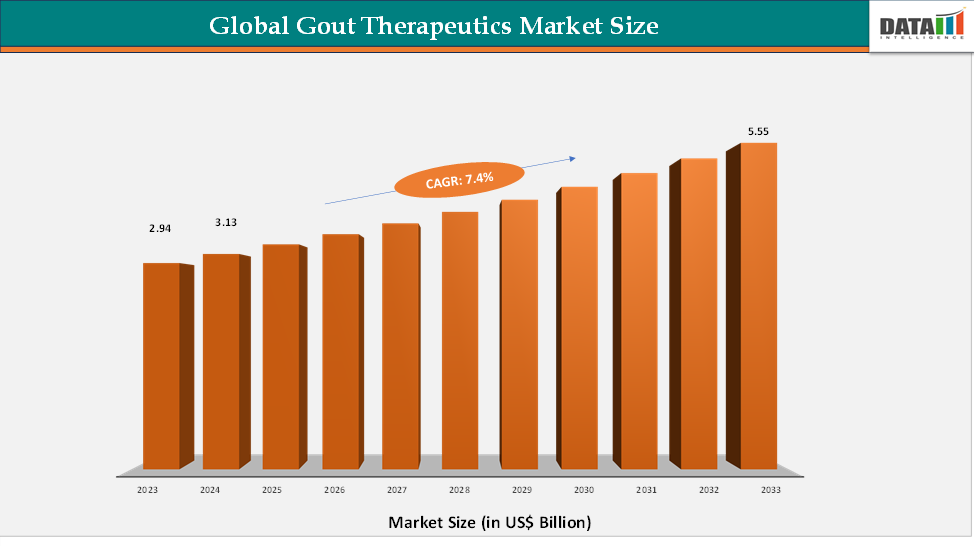

The global gout therapeutics market reached US$ 2.94 billion in 2023, with a rise to US$ 3.13 billion in 2024, and is expected to reach US$ 5.55 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2025–2033.

The gout therapeutics market is witnessing consistent growth, fueled by the rising global prevalence of gout and increasing awareness of lifestyle-related and metabolic disorders. Market expansion is further supported by advancements in rheumatology research, particularly in urate-lowering therapies, anti-inflammatory biologics, and novel small-molecule inhibitors. Emerging innovations such as next-generation xanthine oxidase inhibitors, biologics targeting interleukin-1 (IL-1), and personalized treatment approaches are improving disease management, reducing flare frequency, and enhancing patient outcomes.

Key Market Trends & Insights

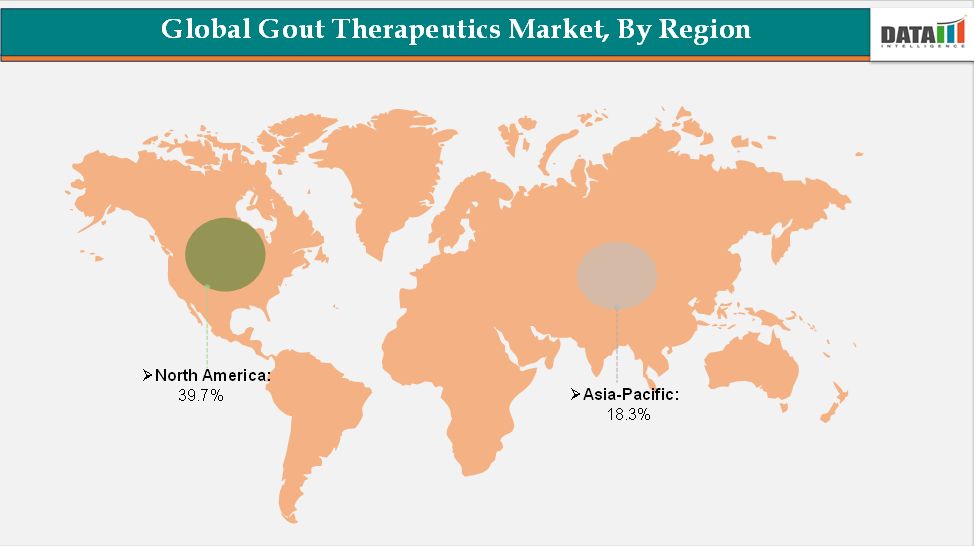

North America accounted for approximately 39.7% of the global Gout Therapeutics market in 2024 and is expected to retain its leading position throughout the forecast period. This dominance is driven by high diagnosis and treatment rates, substantial R&D investments in urate-lowering therapies and biologics, and strong regulatory support enabling faster approvals of novel therapeutics.

Asia-Pacific is projected to be the fastest-growing region, propelled by the rising prevalence of gout linked to changing dietary habits and sedentary lifestyles, expanding healthcare access, growing patient awareness, and increasing government initiatives to improve management of chronic diseases.

NSAIDs remain the dominant treatment segment, owing to their widespread use as first-line therapy for acute gout flares.

Market Size & Forecast

2024 Market Size: US$ 2.94 Billion

2033 Projected Market Size: US$ 5.55 Billion

CAGR (2025–2033): 7.4%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

For more details on this report, Request for Sample

Gout Therapeutics Market Dynamics: Drivers & Restraints

Driver: Rising prevalence of gout worldwide

The rising prevalence of gout worldwide is expected to be a significant driver of the gout therapeutics market, as the disease is increasingly linked to modern lifestyle factors such as obesity, high-purine diets, alcohol consumption, and sedentary behavior. For instance, according to the National Kidney Foundation, In the United States, the prevalence of gout more than doubled between the 1960s and 1990s, and it is now estimated to affect 3.9% of the adult population, equivalent to approximately 8.3 million individuals, including 6.1 million men and 2.2 million women. The growing burden of comorbidities like hypertension, diabetes, and cardiovascular disorders further exacerbates hyperuricemia, leading to a higher incidence of recurrent gout flares.

With aging populations particularly vulnerable, the patient pool requiring both acute and long-term management continues to expand rapidly. This surge in cases is driving strong demand for effective treatment options, ranging from widely used NSAIDs to advanced urate-lowering therapies and biologics, thereby propelling growth in the global market.

Restraint: Side effects and safety concerns

Side effects and safety concerns pose a significant challenge to the growth of the gout therapeutics market, as they directly impact patient compliance and physician prescribing patterns. Long-term use of commonly prescribed treatments such as NSAIDs, corticosteroids, and urate-lowering therapies is often associated with adverse effects, including gastrointestinal complications, cardiovascular risks, kidney impairment, and liver toxicity.

Gout Therapeutics Market Segment Analysis

The global gout therapeutics market is segmented by disease type, drug class, distribution channel, and region.

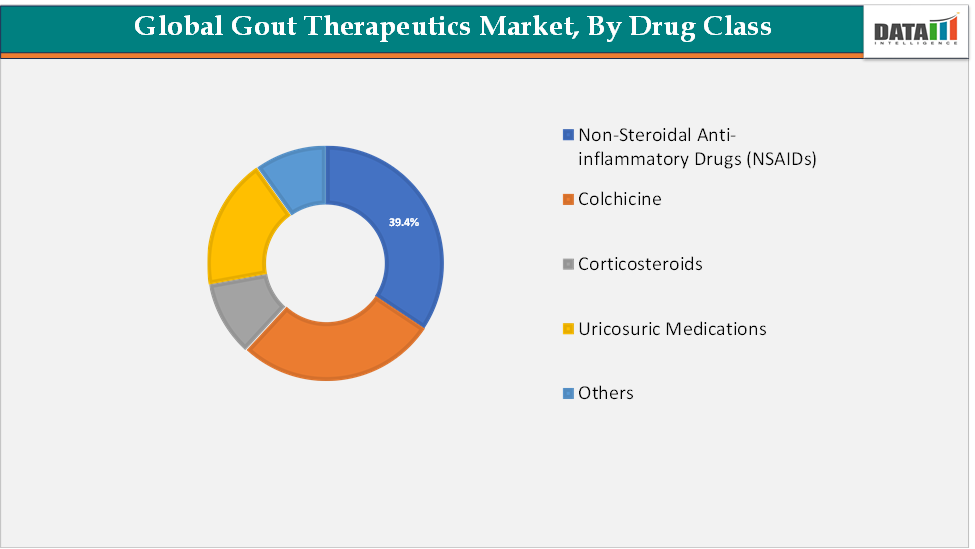

Drug Class:

The non-steroidal anti-inflammatory drugs (NSAIDs) segment is estimated to have 39.4% of the gout therapeutics market share.

Non-steroidal anti-inflammatory drugs (NSAIDs) are expected to remain the dominant segment in the gout therapeutics market, primarily due to their widespread use as the first-line treatment for managing acute gout flares. Their rapid ability to relieve pain and inflammation, combined with broad availability, low cost, and established physician familiarity, makes them the most prescribed option across both developed and emerging markets.

Despite the growing adoption of biologics and advanced urate-lowering therapies for long-term disease management, NSAIDs continue to be favored for immediate symptom control, ensuring their strong market presence. The segment’s dominance is further supported by the availability of multiple generic options, strong patient accessibility through retail and hospital pharmacies, and ongoing demand in regions with limited access to advanced biologics.

Gout Therapeutics Market - Geographical Analysis

The North America gout therapeutics market was valued at 39.7% market share in 2024

North America dominates the gout therapeutics market, accounting for the largest revenue share, and is expected to maintain its leadership throughout the forecast period. This dominance is underpinned by a high prevalence of gout linked to hypertension and metabolic syndrome, coupled with strong awareness and high diagnosis rates across the region. Substantial R&D investments and the presence of leading pharmaceutical companies have accelerated the development and commercialization of innovative urate-lowering therapies, biologics, and anti-inflammatory drugs.

Additionally, favorable regulatory frameworks, including expedited approval pathways and Orphan Drug designations, support faster market entry for novel treatments. For instance, in August 2024, Scilex Holding Company announced that the U.S. Food and Drug Administration (FDA) had approved a Supplemental New Drug Application (sNDA) for label updates to GLOPERBA. Widespread access to health insurance, early adoption of advanced therapeutics, and strong physician and patient awareness further reinforce North America’s position as the most established and lucrative market for gout therapeutics.

The Asia-Pacific gout therapeutics market was valued at 18.30% market share in 2024

Asia-Pacific is expected to be the fastest-growing region in the gout therapeutics market, driven by the rising prevalence of gout due to lifestyle changes, aging populations, and increasing dietary risk factors in countries such as China, India, and Japan.

Greater access to diagnostic tools and growing government initiatives to improve chronic disease management are further accelerating treatment adoption. The rapid expansion of retail and online pharmacy networks is enhancing drug accessibility, while pharmaceutical companies are investing in clinical trials and local partnerships to introduce innovative urate-lowering therapies and biologics. For instance, in December 2024, the National Medical Products Administration (NMPA) in China approved URECE for the treatment of gout patients with hyperuricemia. Developed by FUJI YAKUHIN, URECE represents a novel therapeutic option designed to address the growing need for effective management of gout and hyperuricemia.

Gout Therapeutics Market Major Players

The major players in the gout therapeutics market include Takeda Pharmaceutical Company Limited, Novartis Pharmaceuticals Corporation, Amgen Inc., Lupin, AstraZeneca, among others.

Global Gout Therapeutics Market: Scope

Metrics | Details | |

CAGR | 7.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Disease Type | Primary Gout, Secondary Gout |

Drug Class | Non-Steroidal Anti-inflammatory Drugs (NSAIDs), Colchicine, Corticosteroids, Uricosuric Medications, Others | |

Distribution Channel | Hospital Pharmacies, Drug Stores, E-commerce, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global gout therapeutics market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.