Cardiovascular Therapeutics Drugs Market Size & Industry Outlook

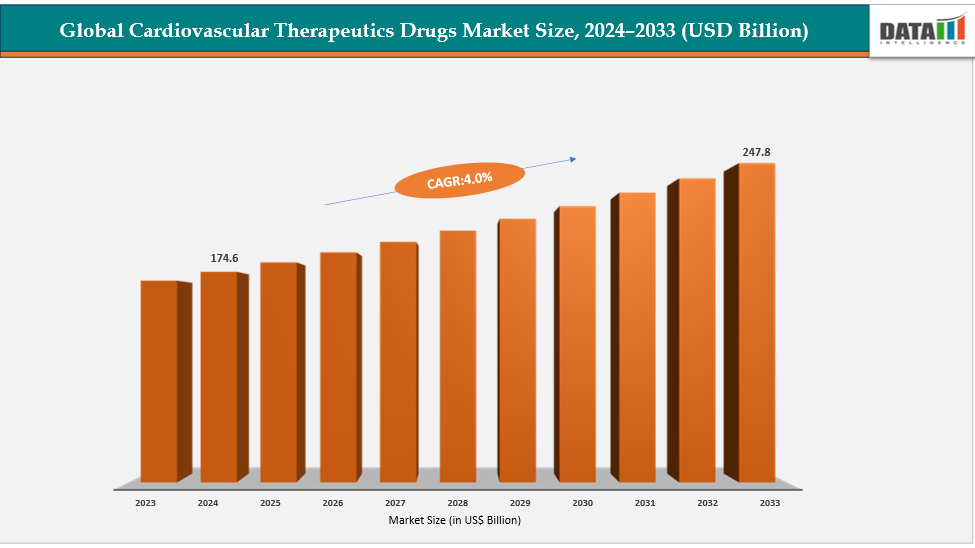

The global cardiovascular therapeutics drugs market size reached US$ 174.6 billion in 2024 is expected to reach US$ 247.8 billion by 2033, growing at a CAGR of 4.0% during the forecast period 2025-2033. One of the strong driver of the global cardiovascular therapeutics drugs market is the growing emphasis on preventive healthcare and early intervention for heart-related conditions. With rising awareness about the risks of hypertension, high cholesterol, and diabetes, more patients and healthcare providers are focusing on preventive cardiovascular drug therapies, such as statins, beta-blockers, and ACE inhibitors, to reduce the likelihood of severe cardiac events.

Government and private health programs promoting regular heart health checkups, along with reimbursement support for chronic disease management, have further boosted the adoption of these medications. The availability of cost-effective generic drugs and patient education initiatives by healthcare organizations have also encouraged adherence to long-term cardiovascular treatment regimens, collectively propelling market growth through proactive disease management rather than reactive treatment.

Key Highlights

- North America dominates the cardiovascular therapeutics drugs market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

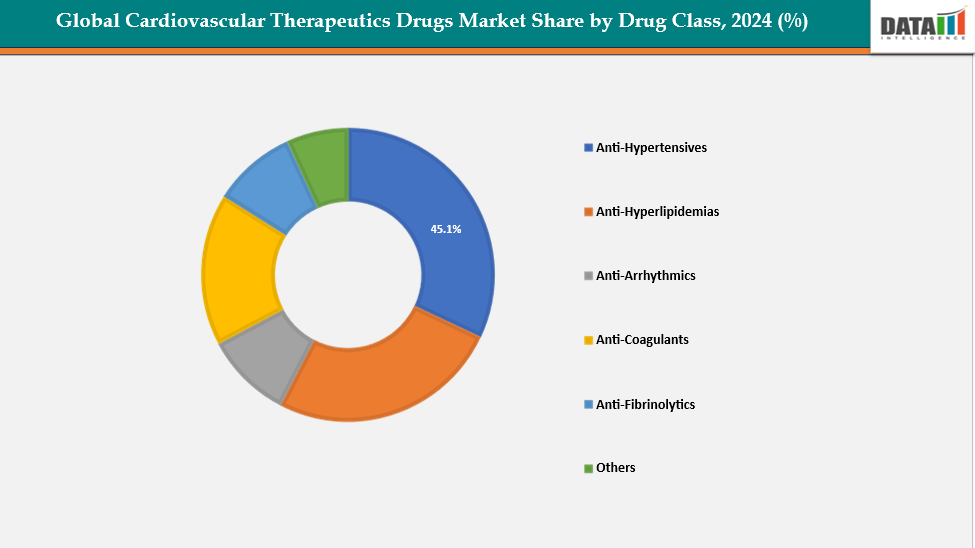

- Based on drug class, Anti-Hypertensives segment led the market with the largest revenue share of 45.1% in 2024.

- The major market players in the cardiovascular therapeutics drugs market includes AstraZeneca, Pfizer Inc, Novartis, Bristol Myer Squibb, Bayer, Merck, Sanofi, Boehringer Ingelhein, Roche and among others.

Market Dynamics

Drivers: Rising prevalence of cardiovascular disease (CVD) significantly driving the cardiovascular therapeutics drugs market growth

The rising prevalence of cardiovascular diseases (CVDs) remains one of the primary drivers of growth in the global cardiovascular therapeutics’ drugs market. The increasing incidence of conditions such as hypertension, coronary artery disease, stroke, heart failure, and arrhythmias has significantly expanded the patient population requiring continuous medical management. Factors such as sedentary lifestyles, unhealthy dietary patterns, obesity, diabetes, stress, and aging populations have contributed to the global surge in CVD cases. This escalating disease burden is driving strong demand for advanced therapeutic drugs, including antihypertensives, antiplatelets, anticoagulants, lipid-lowering agents, and novel biologics targeting cardiovascular pathways.

For instance, as of 2024, cardiovascular disease (CVD) remains the leading cause of death globally, affecting over 600 million people and accounting for nearly 19 million deaths each year. The rising prevalence is driven by factors such as hypertension, obesity, diabetes, sedentary lifestyles, and aging populations. Increasing exposure to risk factors like unhealthy diets and stress has also contributed to the global burden. This growing incidence continues to fuel the demand for advanced cardiovascular therapeutics, preventive care, and early diagnosis initiatives worldwide.

Restraints: Patent expiries and intense generic competition are hampering the growth of the cardiovascular therapeutics drugs market

Patent expiries and intense generic competition pose significant challenges in the global cardiovascular therapeutics drugs market. As many leading cardiovascular drugs approach or have already reached the end of their patent protection, market exclusivity for major pharmaceutical companies has diminished. This has opened the door for low-cost generic alternatives, leading to substantial price erosion and revenue decline for branded products. The influx of generics has intensified market competition, forcing companies to lower prices and reduce profit margins. Moreover, patients and healthcare systems increasingly prefer generics due to their affordability and comparable efficacy, further constraining brand performance.

For more details on this report – Request for Sample

Segmentation Analysis

The global cardiovascular therapeutics drugs market is segmented based on drug class, indication, route of administration, distribution channel, and region.

Drug Class: The anti-hypertensives from drug class segment to dominate the cardiovascular therapeutics drugs market with a 45.1% share in 2024

The antihypertensive drug segment is a key growth driver in the global cardiovascular therapeutics market, primarily fueled by the rising prevalence of hypertension worldwide and the growing awareness of its link to severe cardiovascular complications such as stroke, heart attack, and kidney failure. Increasing screening rates, improved diagnostic capabilities, and government-led public health initiatives promoting blood pressure control have significantly boosted treatment adoption. The availability of multiple effective drug classes including ACE inhibitors, angiotensin receptor blockers (ARBs), calcium channel blockers, beta-blockers, and diuretics provides physicians with a wide range of therapeutic options for personalized care.

For instance, in June 2025, George Medicines, a biopharmaceutical company specializing in therapies for cardiometabolic diseases, has received approval from the US Food and Drug Administration (FDA) for its product WIDAPLIK. This medication, which combines telmisartan, amlodipine, and indapamide, is indicated for the treatment of hypertension in adult patients. The FDA's endorsement allows for its use not only as a subsequent treatment option but also as an initial therapy aimed at reducing blood pressure levels in patients diagnosed with hypertension.

Route of Administration: The oral segment is estimated to have a 42.1% of the cardiovascular therapeutics drugs market share in 2024

The oral route segment is a major driver in the global cardiovascular therapeutics drugs market due to its convenience, cost-effectiveness, and high patient compliance. Oral formulations, including tablets, capsules, and sustained-release forms, are widely preferred for the long-term management of chronic cardiovascular conditions such as hypertension, heart failure, and hyperlipidemia. The ease of administration without medical supervision, coupled with consistent dosing and improved bioavailability through advanced formulation technologies, further enhances their adoption.

Additionally, the growing development of novel oral drugs with better safety profiles, reduced side effects, and improved therapeutic efficacy has strengthened the dominance of this segment. The increasing availability of combination oral therapies that target multiple cardiovascular risk factors simultaneously also supports its strong market growth, making the oral route a preferred and expanding mode of drug delivery in cardiovascular care.

Geographical Analysis

North America dominates the global Cardiovascular Therapeutics Drugs market with a 43.5% in 2024

The cardiovascular therapeutics drugs market in North America is primarily driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and strong adoption of innovative treatment options. Continuous product approvals by the U.S. FDA, a strong presence of leading pharmaceutical companies, and high healthcare expenditure contribute to sustained market expansion.

In the U.S., growth in the cardiovascular therapeutics market is supported by a growing patient pool with hypertension, heart failure, and dyslipidemia, coupled with rapid technological and clinical innovation. The presence of key players engaged in R&D, such as George Medicines and other biopharmaceutical companies, enhances the market’s competitiveness.

For instance, in October 2025, Amgen announced that its Phase 3 VESALIUS-CV clinical trial achieved its dual primary endpoints, showing that Repatha(evolocumab) significantly lowered the risk of major adverse cardiovascular events (MACE) in patients without a previous history of heart attack or stroke.

Europe is the second region after North America which is expected to dominate the global Cardiovascular Therapeutics Drugs market with a 34.5% in 2024

The European cardiovascular therapeutics market is driven by the rising incidence of lifestyle-related cardiovascular diseases, aging populations, and government-backed initiatives promoting early detection and treatment. The region’s regulatory support for generic and novel therapies, growing preference for evidence-based medicine, and the introduction of fixed-dose combination drugs are further strengthening market growth.

In the U.K., market growth is supported by initiatives, strong national healthcare policies emphasizing cardiovascular disease prevention and management under the NHS framework. The implementation of public health programs aimed at controlling hypertension and cholesterol levels has improved awareness and diagnosis rates.

For instance, RDRUK has launched a Cardiovascular Initiative aimed at patients and families impacted by inherited cardiovascular conditions (ICCs) in the UK. This initiative includes the establishment of the Cardiovascular Rare Disease Node, which will facilitate research by consolidating genetic and heart-related data from individuals suffering from rare cardiovascular diseases.

The Asia Pacific region is the fastest-growing region in the global Cardiovascular Therapeutics Drugs market, with a CAGR of 8.1% in 2024

The Asia-Pacific region is witnessing rapid market growth driven by a surge in cardiovascular disease prevalence due to urbanization, sedentary lifestyles, and dietary changes. Expanding healthcare access, rising income levels, and greater awareness of chronic disease management are improving drug uptake.

In Japan, the cardiovascular therapeutics market is driven by a rapidly aging population and a high incidence of hypertension and heart failure among elderly patients. The country’s strong focus on precision medicine, favorable regulatory environment, and quick adoption of novel therapies contribute to steady growth.

Competitive Landscape

Top companies in the cardiovascular therapeutics drugs market include AstraZeneca, Pfizer Inc, Novartis, Bristol Myer Squibb, Bayer, Merck, Sanofi, Boehringer Ingelhein, Roche and among others.

AstraZeneca:- AstraZeneca holds a significant position in the global cardiovascular therapeutics market through its innovative portfolio and strategic initiatives targeting cardiovascular, renal, and metabolic diseases. Its CVRM division focuses on conditions like hypertension, heart failure, and chronic kidney disease, with key developments including the experimental drug baxdrostat, which has shown strong efficacy in treating treatment-resistant hypertension and is expected to reach regulatory approval by 2025.

Market Scope

| Metrics | Details | |

| CAGR | 4.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | Anti-Hypertensives, Anti-Hyperlipidemias, Anti-Arrhythmics, Anti-Coagulants, Anti-Fibrinolytics, Others |

| Indication | Hypertension, Coronary Artery Disease (CAD), Heart Failure, Arrhythmia, Stroke, Peripheral Artery Disease, Others | |

| Route of Administration | Oral, Parenteral | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global cardiovascular therapeutics drugs market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here