Anti-Hypertension Drugs Market Size

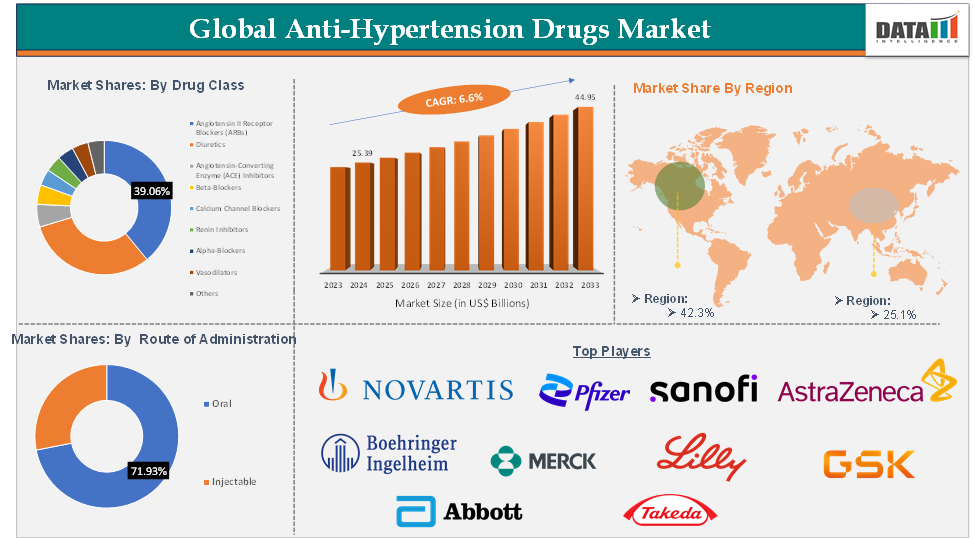

Anti-Hypertension Drugs Market Size reached US$ 25.39 Billion in 2024 and is expected to reach US$ 44.95 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033.

Anti-hypertension drugs are medications designed to lower blood pressure in individuals with hypertension, a risk factor for cardiovascular diseases like heart attack, stroke, and heart failure.

The global anti-hypertension drugs market is experiencing significant growth due to the increasing prevalence of hypertension, especially in developed countries with lifestyle-related diseases like obesity and diabetes. Factors driving this growth include the aging population, preventive healthcare focus, and drug formulation advances. Angiotensin II Receptor Blockers and diuretics are leading segments, with combination therapies also bolstering the market. North America, Europe, and Asia-Pacific are key regional markets, with demand for innovative and affordable anti-hypertension drugs expected to grow.

Market Infographics

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | Angiotensin II Receptor Blockers (ARBs), Diuretics, Angiotensin-Converting Enzyme (ACE) Inhibitors, Beta-Blockers, Calcium Channel Blockers, Renin Inhibitors Alpha-Blockers, Vasodilators, Others |

| Route of Administration | Oral, Injectable | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Anti-Hypertension Drugs Market Dynamics: Drivers & Restraints

Rising prevalence of hypertension is driving the market growth

The global prevalence of hypertension, a condition affecting over 1.28 billion adults aged 30-79, is escalating due to sedentary lifestyles, unhealthy diets, obesity, and stress. This has led to a surge in demand for anti-hypertension drugs, thereby boosting market growth and ensuring effective and accessible treatment.

For instance, according to WHO, an estimated 1.28 billion adults aged 30–79 years worldwide have hypertension, most (two-thirds) living in low- and middle-income countries. An estimated 46% of adults with hypertension are unaware that they have the condition. Less than half of adults (42%) with hypertension are diagnosed and treated. Approximately 1 in 5 adults (21%) with hypertension have it under control. Hypertension is a major cause of premature death worldwide. One of the global targets for noncommunicable diseases is to reduce the prevalence of hypertension by 33% between 2010 and 2030.

Side effects and poor patient adherence restrain the market growth

The global anti-hypertension medication market is hindered by side effects of drugs (ADRs) and patient non-compliance with long-term drug regimens. Anti-hypertensive agents, including beta-blockers, ACE inhibitors, calcium channel blockers, and diuretics, are meant for lifelong use but tend to have undesirable side effects such as dizziness, weakness, frequent urination, edema, and sexual dysfunction.

These side effects impair quality of life and result in high rates of discontinuation. Also, the hypertension can be asymptomatic in its initial stages, which results in almost 50% of the patients stopping their medications within the first year, making treatment less effective and higher risks for severe consequences such as stroke or heart failure.

Anti-Hypertension Drugs Market Segment Analysis

The global anti-hypertension drugs market is segmented based on drug class, route of administration, distribution channel, and region.

Drug Class:

The angiotensin II receptor blockers (ARBs) segment of the drug class is expected to hold 39.0% in the anti-hypertension drugs market

Angiotensin II Receptor Blockers (ARBs) are the drugs used in the treatment of hypertension, blocking the hormone's action at the blood vessel level, which results in their constriction and an elevation in blood pressure. ARBs cause blood vessels to relax and dilate and thus lowering the blood pressure. They are generally recommended for hypertensive patients, patients with chronic kidney disease, and heart failure. The most important ARBs are Losartan, Valsartan, and Irbesartan, all are well-tolerated with fewer adverse effects compared to other classes of antihypertensives like ACE inhibitors.

Angiotensin II Receptor Blockers (ARBs) are increasingly growing in the antihypertension drugs market because of their improved side effect profile, absence of chronic cough, and efficacy in the treatment of comorbid conditions such as chronic kidney disease, heart failure, and complications of diabetes. Increased demand for ARBs comes as a result of the worldwide ageing population, as older people are more prone to developing hypertension.

Anti-Hypertension Drugs Market - Geographical Analysis

North America dominated the global anti-hypertension drugs market with the highest share of 42.3% in 2024

North America region is expected to be the dominating region in the global anti-hypertension drugs market, owing to factors like a high level of hypertension leading to demand for therapeutic measures, mainly because of lifestyle factors such as diet, lack of proper exercise, and stress. Also, FDA approvals, the advanced clinical facilities in the area enable access by large segments of the population to newly innovated drugs and technologies, an increased level of healthcare expenditure, especially through the United States' government funding programs such as Medicare and private insurance funding, allows a greater percentage of the population to seek treatment for hypertension help the region witness the growth during the forecast period.

For instance, in March 2024, the U.S. FDA has recently approved TRYVIO (aprocitentan) in the treatment of hypertension when given along with other antihypertensive drugs for patients whose blood pressure control was found to be inappropriately poor on other drugs.1 Lowering blood pressure is thus helpful in reducing the risks of both fatal and non-fatal cardiovascular events, especially strokes and myocardial infarctions.1 This may be given as 12.5 mg once daily orally, with or without food, as per the recommended dosing of TRYVIO.

Asia-Pacific region in the global anti-hypertension drugs market is expected to grow with the highest CAGR of 18.5% in the forecast period of 2025 to 2033

The Asia-Pacific region's growth in the global anti-hypertension drugs market is driven by various factors, like hypertension rates are on the rise, mainly because of sedentary lifestyle patterns and unhealthy eating habits, causing stress alongside an aging population. Also, a rise in partnerships & collaborations, regulatory approvals, rising hospital infrastructure, and increasing healthcare expenditure in emerging economies such as China, India, and those in Southeast Asia, the region is witnessing economic growth of the region.

For instance, Japan has 43 million hypertensive individuals, with only 50% treated and 25% controlled. This high number and poor control rate make hypertension one of the leading causes of death in Japan, second only to smoking.

Moreover, government initiatives related to awareness of cardiovascular health and early-level diagnosis have equally lent their supporting hands. On another note, the growing middle-class population and the increasing availability of modern treatment facilities will continue supporting market growth across the region.

Anti-Hypertension Drugs Market Key Players

The major global players in the anti-hypertension drugs market include Novartis AG, Pfizer Inc., Sanofi SA, AstraZeneca, Boehringer Ingelheim, Merck & Co., Inc., Eli Lilly and Company, GlaxoSmithKline (GSK), Abbott Laboratories, and Takeda Pharmaceutical Company Limited, among others.

Industry Trends

- In March 2025, Mineralys Therapeutics, a biopharmaceutical company, announced positive results from its Launch-HTN Phase 3 and Advance-HTN Phase 2 trials evaluating the efficacy and safety of lorundrostat for treating uncontrolled hypertension (uHTN) or resistant hypertension (rHTN). Both trials achieved statistical significance, were clinically meaningful, and demonstrated a favorable safety and tolerability profile, indicating the potential of lorundrostat in treating various diseases driven by dysregulated aldosterone.