Brain Health Supplements Market Overview

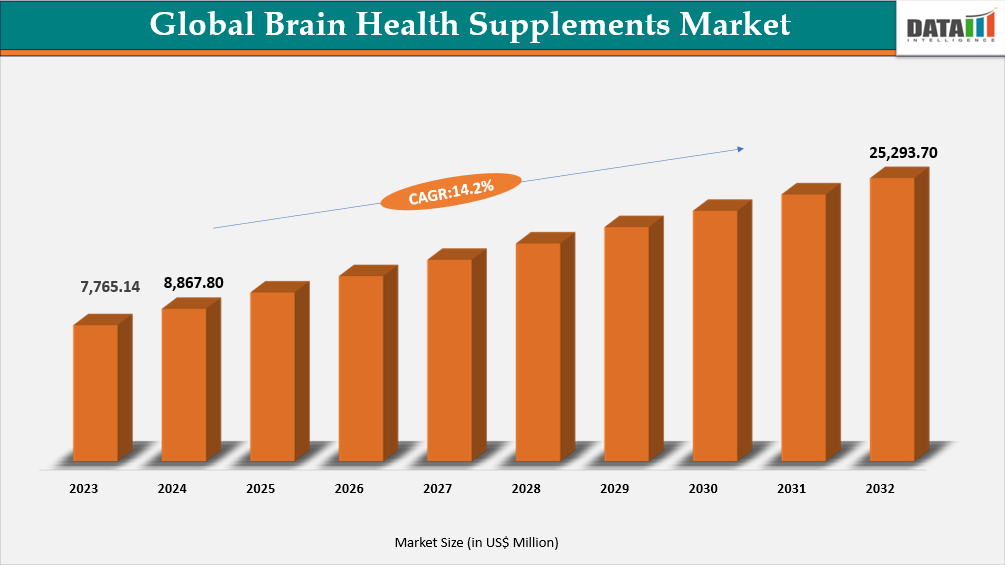

According to DMI analysis, the global brain health supplements market reached US$7,765.14million in 2023, rising to US$8,867.80 million in 2024 and is expected to reach US$25,653.39 million by 2032, growing at a strong CAGR of 14.2% during the forecast period from 2025 to 2032.

The global brain health supplements market is expanding rapidly, supported by significant demographic and epidemiological shifts. The world’s population aged 60+ is projected to grow from 1.1 billion in 2023 to 2.1 billion by 2050, reaching 2.5 billion by the late 2060s, creating sustained demand for memory-support and neuroprotective formulations. Mental-health vulnerability in this group remains high, with 14.1% of adults aged 70+ living with a mental disorder and these conditions account for 6.8% of all years lived with disability, reinforcing the market’s long-term growth foundation.

Younger adults are emerging as a rapidly expanding consumer base. US BRFSS data, covering 4.5 million respondents, shows self-reported cognitive difficulty among adults 18–39 nearly doubled—from 5.1% in 2013 to 9.7% in 2023, while overall cognitive disability increased from 5.3% to 7.4% over the same period. Cognitive disability now affects 14% of US adults, with markedly higher prevalence among American Indian/Alaska Native adults (11.2%), Hispanic and Black populations (approaching 10%), and individuals earning < $35,000, who report nearly 4× higher prevalence than higher-income groups. These disparities are broadening the market toward performance-driven, stress-related, and affordability-focused cognitive solutions.

Market momentum is reinforced by a strong pipeline of clinically positioned innovations. In October 2025, JOURTHON Brain Health Softgel introduced a clinically focused formula featuring L-Ergothioneine, PQQ, and Alpha-GPC, all US FDA GRAS ingredients, designed to enhance memory, focus, and long-term neural protection. Developed under advanced manufacturing and quality standards, the softgel targets consumers seeking reliable, science-backed support for everyday cognitive challenges, positioning JOURTHON as a strong contender in the fast-growing brain health supplements market.

Brain Health Supplements Market Industry Trends and Strategic Insights

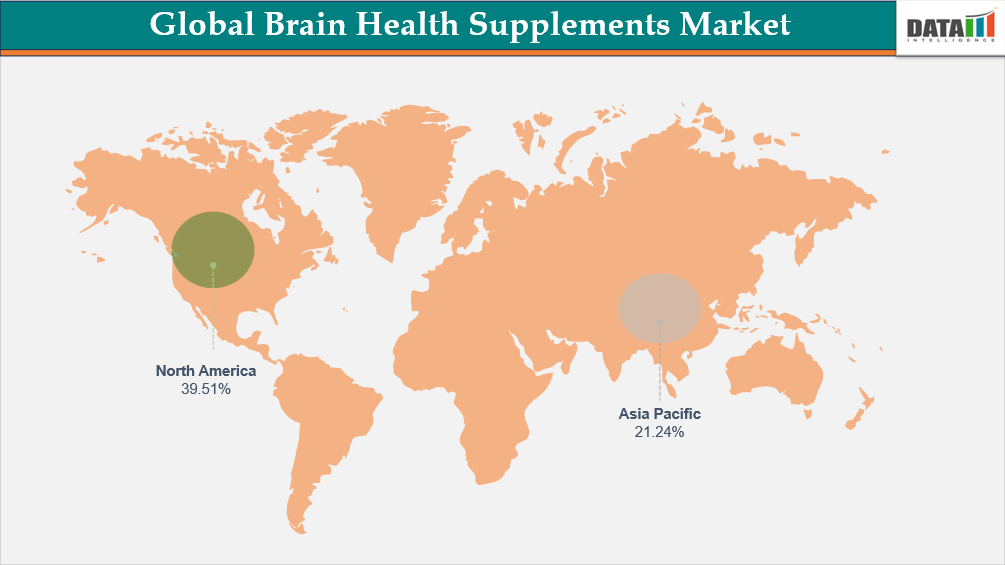

- North America leads the global brain health supplements market, capturing the largest revenue share of 39.51% in 2024.

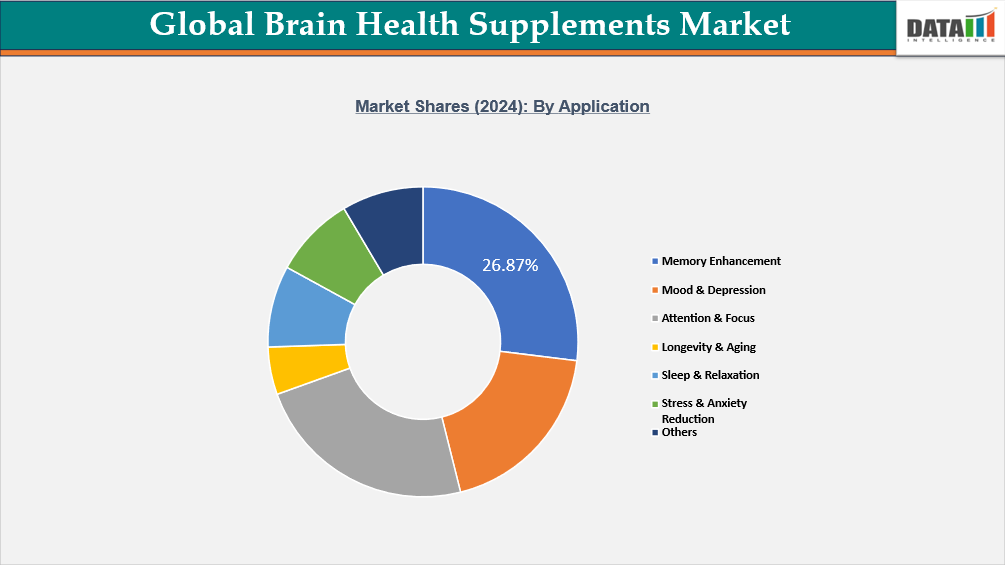

- By application segment, memory enhancement led the global brain health supplements market, capturing the largest revenue share of 21.34% in 2024.

Global Brain Health Supplements Market Size and Future Outlook

- 2024 Market Size: US$8,867.80 million

- 2032 Projected Market Size: US$25,653.39 million

- CAGR (2025–2032): 14.2%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Ingredient | Herbal Extracts, Vitamins & Minerals, Natural Molecules, Others |

| By Form | Capsules and Tablets, Powders, Liquids, Gummies, Softgels, Others |

| By Application | Memory Enhancement, Mood & Depression, Attention & Focus, Longevity & Aging, Sleep & Relaxation, Stress & Anxiety Reduction, Others |

| By Age Group | Adolescents & Teenagers (Ages 13-19 years), Young Adults (Ages 20-39 years), Middle-Aged Adults (Ages 40-64 years), Seniors / Elderly (Ages 65+ years) |

| By Distribution Channel | Pharmacies and Drug Stores, Supermarkets & Hypermarkets, Specialty Health & Wellness Stores, Online Retailers, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detail information Request for Free Sample

Market Dynamics

Rising Prevalence of Cognitive Disorders & Mental Health Issues

The rising prevalence of cognitive disorders and mental health challenges is significantly accelerating demand for brain health supplements worldwide. With 14.1% of adults aged 70+ living with a mental disorder and these conditions accounting for 6.8% of disability, older adults are turning to supplements as accessible, preventive solutions amid rising risks linked to loneliness, social isolation (1 in 4), bereavement, chronic illness, and age-related decline.

In the US, cognitive disability is becoming a major public health issue, with the number of adults living with disabilities increasing from 61 million in 2016 to over 70 million in 2022, now representing more than one in four adults. Cognitive disability has become the most common disability, rising to 14% prevalence in 2022, partially driven by long-term impacts of COVID-19, where 10.8% of individuals with disabilities report long-COVID symptoms compared with 6.6% of those without. These trends highlight a clear shift toward self-directed cognitive support, boosting demand for natural, clinically supported supplements.

A particularly important growth catalyst is the surge in cognitive challenges among younger adults. Between 2013 and 2023, self-reported cognitive disability among adults aged 18–39 nearly doubled from 5.1% to 9.7%, while rates among those 70+ slightly declined from 7.3% to 6.6%. Heightened stress, digital overload, economic instability, and changing social attitudes are encouraging younger consumers to adopt brain health supplements for focus, clarity, and mental performance. This shift is expanding the market from a senior-driven category into a mainstream, multi-generational wellness segment.

Brain Health Supplements Market, Segmentation Analysis

The global brain health supplements market is segmented based on ingredient, form, application, distribution channel, consumer group and region.

Memory Enhancement Leads the Global Brain Health Supplements Market Due to Rising Cognitive Concerns and Strong Consumer Demand for Proven Memory-Boosting Ingredients

The memory enhancement segment of the global brain health supplements market is expanding rapidly, driven by an aging population and rising awareness of cognitive decline. With increasing cases of MCI and dementia among adults over 60, consumers are prioritizing products that improve memory retention, mental clarity, and long-term brain function. This trend is pushing demand toward clinically supported and natural formulations.

For instance, in June 2024, Green Bioactives Limited (GBL) strengthened the category with the launch of GBL-Memory 1 in the UK and Germany. Clinical research published in Food Science and Nutrition demonstrated up to a 10.1% improvement in memory, positioning the product as a credible solution for age-related cognitive decline. The introduction of scientifically validated products like this is enhancing consumer trust and accelerating market adoption.

Premium nootropics are also gaining traction. For instance, in October 2024, MD Logic Health introduced SmartBrain in Europe, a formulation designed to enhance memory, focus, and cognitive performance. Backed by scientifically substantiated ingredients, SmartBrain caters to the growing demand for high-efficacy cognitive solutions that support both immediate mental performance and long-term brain health.

Mood & Depression Drive Brain Health Market with Rising global depression fuels demand.

Mood and depression-focused supplements hold a significant share in the global brain health market, driven by rising awareness of mental health and the growing prevalence of depression. According to WHO, an estimated 332 million people worldwide suffer from depression, making it a leading cause of disability. This widespread mental health burden has boosted demand for natural and clinically supported supplements that support mood regulation, stress relief, and cognitive resilience. Recent reports highlight that consumers increasingly seek nutraceutical solutions alongside conventional therapies, further strengthening this segment’s market position.

Brain Health Supplements Market, Geographical Penetration

Dominating Region: North America Brain Health Supplement Market is Growing Due to an Aging Population and Cognitive Wellness Awareness

The North American brain health supplement market is witnessing steady growth, driven by rising consumer awareness of cognitive wellness and an aging population seeking memory and focus support. Key products include omega-3 fatty acids, herbal nootropics, vitamins, and minerals aimed at improving mental performance and reducing cognitive decline. Increasing stress levels, lifestyle-related cognitive concerns, and a surge in e-commerce channels are further boosting market demand.

US Brain Health Supplements Market Outlook

The US brain health supplement market is expanding rapidly as consumers increasingly focus on cognitive wellness and the prevention of memory decline. Over 7 million Americans are currently living with Alzheimer's, with projections reaching nearly 13 million by 2050, driving demand for supportive supplements. Key products include omega-3s, vitamins, minerals, and herbal nootropics aimed at improving memory, focus, and overall brain function. E-commerce growth and heightened awareness about mental health further accelerate market adoption and innovation.

Canada Brain Health Supplements Market Trends

The Canadian brain health supplement market is witnessing steady growth as consumers increasingly prioritize cognitive wellness amid rising incidences of neurological disorders. In May 2024, the Government of Canada committed $80 million over four years to support Brain Canada’s research programs, with matching funds bringing the total to $160 million, highlighting the national focus on brain health. This investment aims to advance prevention, diagnosis, and treatment of over a thousand brain diseases, including dementia, ALS, and mental health disorders, directly influencing public awareness and demand for supportive supplements. As the population ages and one in three Canadians may face a neurological condition in their lifetime, the market is expected to expand further, driven by innovation and evidence-based product development.

Fastest Growing Region: Asia-Pacific Brain Health Market Soars Fueled by Aging Population and Stress

The Asia-Pacific brain health supplement market is experiencing strong growth, led by countries like India, China, Japan, and Australia, driven by rising mental health awareness and an aging population. Increasing stress, cognitive decline concerns, and lifestyle-related disorders are boosting demand for supplements that enhance memory, focus, and mood. Government initiatives promoting preventive healthcare and wellness further support market expansion. Consequently, nutraceuticals, adaptogens, and mood-boosting formulations are gaining significant popularity across the region.

India Brain Health Supplements Market Insights

India, with 18% of the global population, faces a high mental health burden, reflected in 2443 DALYs per 10,000 people and a suicide rate of 21.1 per 100,000. Economic losses from mental health conditions between 2012–2030 are estimated at US$1.03 trillion. Surveys show 10.6% of adults currently suffer from mental disorders, and 15% need intervention. This rising mental health concern is driving demand for preventive wellness solutions, including brain health supplements and adaptogens.

China Brain Health Supplements Market Industry Growth

China’s brain health supplement market is expanding rapidly due to increasing stress, aging population, and rising awareness of cognitive wellness. A growing number of consumers are seeking supplements to improve memory, focus, and mood, driven by hectic lifestyles and work pressure. Government initiatives promoting mental health awareness and preventive healthcare are further supporting market growth. As a result, demand for nutraceuticals, adaptogens, and mood-supporting supplements is witnessing significant uptake across urban and semi-urban regions.

Consumer Behavior Analysis

Consumer behavior in the Brain Health Supplements market is increasingly driven by transparency, with buyers seeking clear, trustworthy ingredient labels before making purchase decisions. Corbion’s segmentation highlights that Ingredient-Focused Shoppers (33%), largely Millennials, prefer organic supplements with short, clean-label formulations and closely examine full ingredient lists. Nutrition-Focused Shoppers (43%) prioritize macro profiles—such as high protein, low sugar, or added functional benefits—and focus mainly on the first few ingredients. This shift underscores rising demand for supplements that combine simplicity, purity, and targeted nutritional value.

Meanwhile, Less-Engaged Consumers (24%) remain more price-driven and rely on highlighted claims, peer recommendations, or marketing cues rather than detailed label reading. As a result, brands that emphasize transparent labeling, clear functional benefits, and easy-to-understand ingredient profiles gain stronger traction across all consumer types. The trend reflects growing consumer awareness and scrutiny in the wellness space, pushing supplement companies toward cleaner formulations and more truthful communication. This label-centered behavior is reshaping competitive strategy within the Brain Health Supplements market.

Competitive Landscape

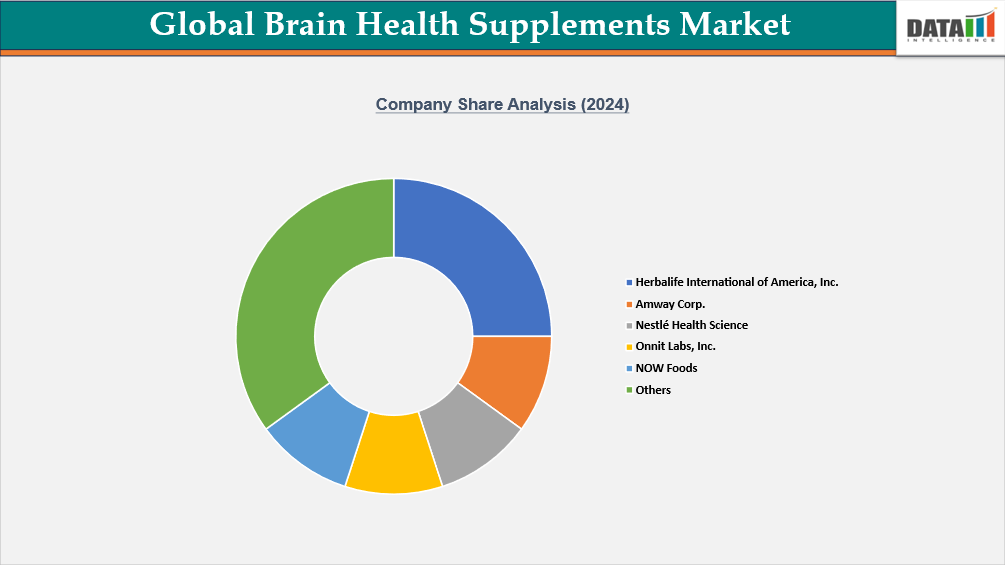

- Global brain health supplements market is highly competitive, owing to the presence of a large number of players in the market.

- The key players that are contributing to the growth of the market include Herbalife International of America, Inc., Amway Corp., Nestlé Health Science, Onnit Labs, Inc., NOW Foods, Pharmavite, Reckitt Benckiser Group plc., Life Extension, Blackmores, Jarrow Formulas, Inc., among others.

- The key players are adopting strategies like partnerships, mergers, acquisitions and regional expansion to stand out as strong competitors in the market.

- Novel products and enhanced focus on research and development are other ways the leading players can improve their market presence.

Key Developments

- In September 2025, Neuriva, the brain health brand by Reckitt, introduced Neuriva Memory 3D, a new supplement designed to support short-term, long-term, and working memory through its clinically tested ingredients Cognicell and Neurofactor. The formula reflects a more complete approach to memory performance and includes vitamins B6, B12, and folic acid for added brain-health support.

- In February 2024, EyePromise introduced BrainPromise, a new brain-health supplement formulated with essential vitamins, minerals, and key carotenoids such as lutein and zeaxanthin. The product combines a wide spectrum of nutrients—including omega-3s, CoQ10, mixed tocotrienols/tocopherols, and targeted antioxidants—to support cognitive performance alongside overall wellness.

Investment & Funding Landscape

Venture capital and private equity have steadily increased funding into brain-health supplements and neuro-focused nutraceutical startups, attracted by strong consumer demand for cognitive wellness and longevity. Strategic investments and partnerships from large supplement companies and pharma accelerate product development, clinical trials, and global distribution, while startups often leverage seed/Series A rounds and crowdfunding for early growth. M&A activity and licensing deals are common as established players acquire innovative brands, proprietary ingredient formulations, or clinical evidence to expand portfolios quickly.

| Company | Investment/Funding | Year | Details | |

| Graymatter Labs Inc. | Funding of ~US$1.3 million | November, 2025 | Graymatter Labs Inc., a plant-based cognitive wellness company, has secured a US$1.3 million seed round led by Venrex and APEX to accelerate the growth of its nootropic drink mix, Bright Mind. The funding will support product expansion and advance the company’s mission to make daily brain supplementation a mainstream habit. | |

What Sets This Global Brain Health Supplements Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by Deployment, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Brain Health Supplements' commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.