Alopecia Medication Market Size

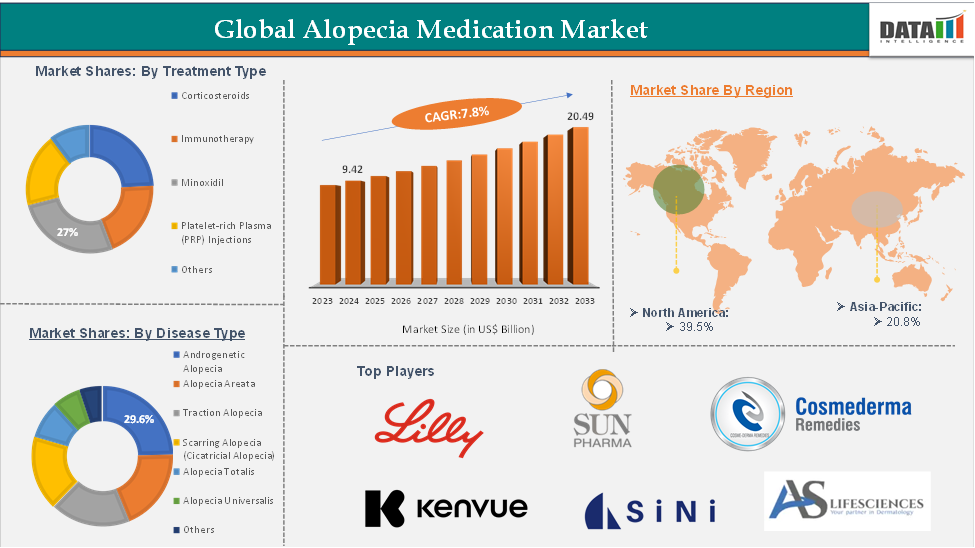

In 2023, the global alopecia medication was valued at US$ 8.7 Billion. The global alopecia medication market size reached US$ 9.42 Billion in 2024 and is expected to reach US$ 20.49 Billion by 2033, growing at a CAGR of 7.8% during the forecast period 2025-2033.

Alopecia Medication Market Overview

Alopecia, a condition characterized by hair loss, can be treated with various medications depending on its type and severity. Common treatments include minoxidil, a topical solution that helps stimulate hair growth, and finasteride, an oral medication primarily used for male-pattern baldness by preventing the conversion of testosterone to DHT, a hormone linked to hair loss. In more severe cases, such as alopecia areata, corticosteroids are used to reduce inflammation and suppress the immune system's attack on hair follicles.

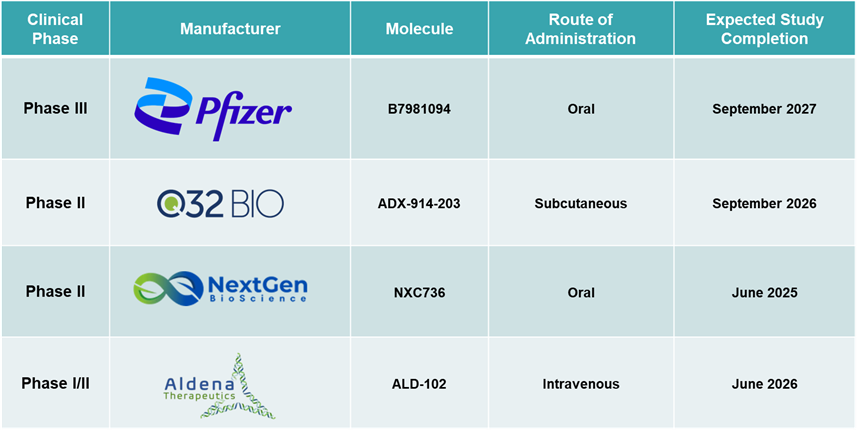

Newer treatments, such as JAK inhibitors (e.g., baricitinib), have shown promising results for autoimmune-related hair loss. While these medications can help manage or reverse hair loss, their effectiveness varies, and they may have side effects.

Alopecia Medication Market Executive Summary

Alopecia Medication Market Dynamics: Drivers & Restraints

Rising prevalence of alopecia is significantly driving the alopecia medication market growth

For instance, Alopecia areata, a condition marked by hair loss, impacts approximately 700,000 individuals in the United States, with around 300,000 suffering from its more severe forms. Due to the limited effectiveness and slow progress of existing treatments, many patients are turning to alternative options in search of better results.

Meanwhile, alopecia areata, an autoimmune disorder that causes patchy hair loss, affects approximately 2% of the global population at some point in their lives.

Factors such as increasing stress levels, hormonal imbalances, poor dietary habits, and rising pollution are further contributing to hair loss issues across all age groups. This growing patient population is creating a larger demand for effective and long-term treatment options, which in turn is encouraging pharmaceutical companies to invest in research and development of advanced alopecia medications. As awareness continues to increase, more individuals are actively seeking medical help, further boosting market potential.

Increasing innovation in medication is significantly driving the alopecia medication market growth

Increasing innovation in alopecia medication is significantly transforming the treatment landscape and supporting the market’s growth. While traditional therapies like minoxidil and finasteride have been mainstays for years, recent advancements have introduced more precise and effective options. For instance, the emergence of Janus kinase (JAK) inhibitors has provided new possibilities for treating alopecia areata, a type of autoimmune hair loss that was previously difficult to manage.

For instance, in June 2022, Eli Lilly and Company and Incyte (NASDAQ: INCY) announced that the U.S. Food and Drug Administration (FDA) had approved OLUMIANT (baricitinib), a once-daily oral tablet, as the first systemic treatment specifically for adults with severe alopecia areata (AA).

These drugs work by targeting specific immune pathways, offering better results for patients with severe or treatment-resistant cases. In parallel, ongoing research into stem cell therapy, gene-based treatments, and advanced drug delivery systems is improving the safety and effectiveness of interventions.

Restraint:

The high treatment costs are hampering the growth of the Alopecia Medication market

High treatment costs are expected to significantly hamper the growth of the alopecia medication market. Many of the effective treatments, such as JAK inhibitors or platelet-rich plasma (PRP) therapy, come with a high price tag, making them less accessible to a large portion of the population. In addition, alopecia treatments often require long-term or even lifelong use to maintain results, which can substantially increase the overall financial burden on patients. This long-term commitment to expensive therapies discourages consistent use and limits patient adherence, ultimately affecting market expansion despite rising awareness and demand for solutions.

Opportunity:

Over-the-counter (OTC) product expansion is expected to create a lucrative opportunity for the growth of the alopecia medication market

The expansion of over-the-counter (OTC) products presents a significant opportunity for growth in the alopecia medication market. Unlike prescription treatments, OTC options are more accessible and affordable, allowing individuals to begin treatment without the need for a medical consultation. This convenience appeals especially to people in the early stages of hair loss who may be hesitant to seek professional help or are looking for discreet solutions. Products like minoxidil-based topical solutions, hair regrowth serums, and fortified shampoos are increasingly available in pharmacies and online, making them easier to incorporate into daily routines.

As consumer interest in self-care and preventative health continues to grow, so does the demand for effective OTC hair loss treatments. Additionally, the expansion of e-commerce platforms has made it possible for companies to reach a wider, global customer base. This not only boosts product visibility but also encourages brand loyalty through subscription models and personalized product bundles. Overall, the growth of the OTC segment is broadening market reach and driving steady, long-term consumer engagement.

Pipeline Analysis:

For more details on this report – Request for Sample

Alopecia Medication Market, Segment Analysis

The global alopecia medication market is segmented based on treatment type, disease type, route of administration, and region.

The Minoxidil from the treatment type segment are expected to hold 27% of the market share in 2024 in the alopecia medication market

Minoxidil is anticipated to lead the alopecia medication market, driven by its long-established use, proven effectiveness, and easy availability as an over-the-counter treatment. As one of the earliest FDA-approved solutions for hair loss, it has earned widespread consumer confidence and strong brand recognition. Its non-invasive, topical form is generally well-tolerated, making it a popular option among both men and women, especially for treating androgenetic alopecia. The availability of low-cost generic versions has significantly improved access in both developed and emerging markets.

Moreover, growing interest in combination therapies involving minoxidil and increasing awareness about hair loss are further fueling its adoption. Supported by expanding distribution networks and frequent recommendations from healthcare professionals, minoxidil is well-positioned to maintain a dominant role in the global alopecia treatment market.

Alopecia Medication Market, Geographical Analysis

North America is expected to dominate the global alopecia medication market with a 39.5% share in 2024

North America is expected to dominate the alopecia medication market due to a combination of strong healthcare infrastructure, high consumer awareness, and significant investment in research and development. The region has a well-established pharmaceutical industry, with key players actively engaged in the development and commercialization of advanced hair loss treatments, including innovative therapies like JAK inhibitors. For instance, in July 2024, Sun Pharmaceutical Industries obtained approval from the U.S. Food and Drug Administration (FDA) for LEQSELVI (deuruxolitinib), a medication used to treat autoimmune disorders in adults. Additionally, the high prevalence of androgenetic alopecia and alopecia areata among both men and women in the U.S. and Canada contributes to sustained demand for effective treatment options.

The North American market also benefits from a rising focus on aesthetic health and personal grooming, which drives consumer willingness to spend on hair restoration products and services. Furthermore, strong marketing strategies and the popularity of over-the-counter brands in the region contribute to greater product penetration.

Asia-Pacific is growing at the fastest pace in the alopecia medication market, holding 20.8% of the market share

The Asia-Pacific region is experiencing the fastest growth in the alopecia medication market, driven by several key factors. One of the primary drivers is the rising prevalence of hair loss conditions due to increasing stress levels, changing lifestyles, urban pollution, and dietary habits across countries like China, India, Japan, and South Korea. As awareness about alopecia and its treatment options improves, more individuals are seeking medical and cosmetic solutions to manage hair loss.

Alopecia Medication Market Competitive Landscape

Top companies in the alopecia medication market include Pfizer Inc., Sanofi, Merck & Co., Takeda Pharmaceutical Company Limited, Indian Immunological Limited, Bharat Biotech, Panacea Biotec, Sinovac Biotech, AstraZeneca, Novartis AG, among others.

Alopecia Medication Market Scope

Metrics | Details | |

CAGR | 7.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Treatment Type | Corticosteroids, Immunotherapy, Minoxidil, Platelet-rich Plasma (PRP) Injections, Others |

Disease Type | Androgenetic Alopecia, Alopecia Areata, Traction Alopecia, Scarring Alopecia (Cicatricial Alopecia), Alopecia Totalis, Alopecia Universalis, Others | |

Route of Administration | Oral, Topical, Injectable | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global alopecia medication market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.