Global Biologics Outsourcing Market: Industry Outlook

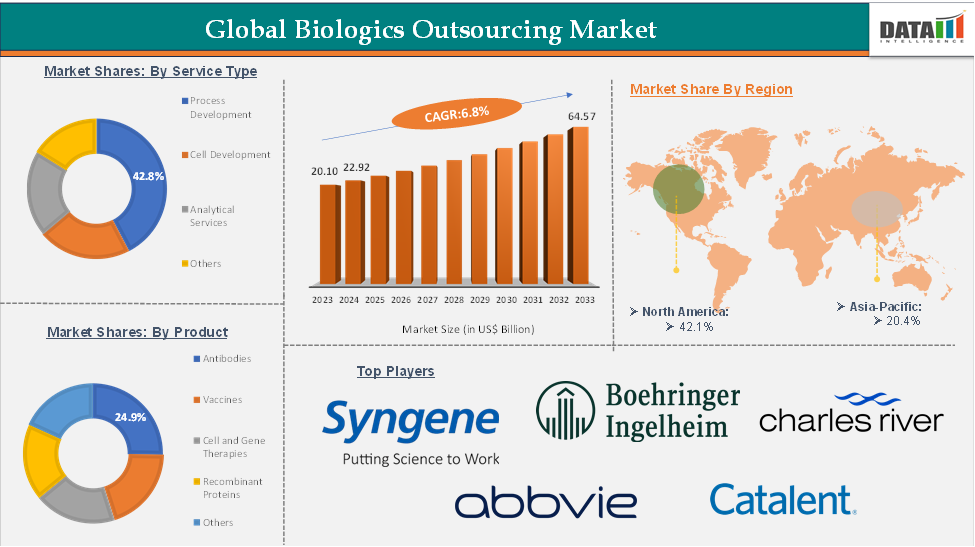

The global biologics outsourcing market reached US$ 20.10 billion in 2023, with a rise of US$ 22.92 billion in 2024, and is expected to reach US$ 64.57 billion by 2033, growing at a CAGR of 12.1% during the forecast period 2025-2033.

The biologics outsourcing market is experiencing steady growth, driven by the increasing complexity of biologic drugs, the expansion of biosimilars, and the rising demand for cost-efficient, specialized manufacturing capabilities. Contract development and manufacturing organizations (CDMOs) are becoming integral partners as pharmaceutical companies seek to accelerate pipelines, reduce capital investment, and leverage advanced technologies such as single-use bioreactors and continuous manufacturing. Monoclonal antibodies and oncology biologics remain the largest contributors, while emerging modalities.

At the same time, the global push for biosimilars is driving large-scale production and analytical support, particularly in regions such as North America, Europe, and the fast-growing Asia-Pacific markets. As regulatory expectations evolve and digital innovations improve efficiency and quality control, biologics outsourcing is positioning itself as a critical growth engine for the life sciences industry, offering end-to-end solutions that enhance speed-to-market, resilience, and patient access worldwide.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Expanding Biologics Pipeline

The accelerating expansion of the global biologics pipeline, with over 6,000 active drug candidates in development as of 2021, underpins robust demand for outsourcing to specialized CDMOs and CMOs. This surge encompasses advanced biologic modalities like monoclonal antibodies, bispecifics, cell and gene therapies, and ADCs, all requiring complex manufacturing, analytical capabilities, and stringent regulatory compliance.

Outsourcing partners not only enable sponsors to scale rapidly and deploy advanced technologies but also deliver strategic agility, reducing capital commitments while meeting the growing volume, diversity, and technical demands of biologic R&D. In this way, the expanding biologics pipeline directly fuels the growth of the biologics outsourcing market by creating sustained, high-complexity manufacturing needs.

Restraint: Supply-chain/Geopolitical Risks

The biologics outsourcing market faces mounting challenges from supply-chain disruptions and geopolitical risks, which threaten reliability, cost structures, and long-term strategic planning. Heavy dependence on globalized networks has exposed vulnerabilities, with events such as pandemic-era shortages, trade restrictions, and the U.S. Biosecure Act intensifying scrutiny. Rising geopolitical tensions are pushing pharma companies to diversify or “de-risk” supply chains by shifting production to domestic or regional CDMOs, but such transitions add complexity, regulatory hurdles, and higher operational costs. These risks can lead to delays in drug development and commercialization, reduced flexibility for sponsors, and pricing pressures on CDMOs.

For more details on this report, Request for Sample

Segment Analysis

The global biologics outsourcing market is segmented based on service type, product, process stage, source, outsourcing model end-user, and region.

Service Type:

The process development segment is estimated to have 42.8% of the biologics outsourcing market share.

The process development segment is emerging as the backbone of the biologics outsourcing market because it provides the essential bridge between early-stage discovery and full-scale manufacturing. With biologics becoming increasingly complex, companies are relying heavily on CDMOs to design, optimize, and validate robust upstream and downstream processes. Effective process development ensures scalability, regulatory compliance, and cost efficiency, while reducing risks during technology transfer and commercial production.

As pharmaceutical companies prioritize speed-to-market and asset-light strategies, the demand for specialized process development services is expected to dominate outsourcing partnerships, reinforcing this segment’s central role in driving market growth. Furthermore, advancements in single-use technologies, high-throughput process optimization, and digital bioprocessing tools are expanding CDMOs’ capabilities, enabling faster development timelines and more reliable outcomes. The increasing emphasis on quality by design (QbD) and regulatory expectations for well-characterized processes further amplify the importance of process development as the cornerstone of biologics outsourcing.

Geographical Share Analysis

The North America biologics outsourcing market was valued at 42.1% market share in 2024

North America is dominating the biologics outsourcing market due to its well-established biopharmaceutical ecosystem, strong presence of leading CDMOs, and continuous investment in advanced manufacturing capabilities. The region benefits from a large pipeline of biologics and biosimilars, particularly in oncology and immunology, supported by a highly skilled workforce and strong regulatory frameworks such as the FDA’s robust oversight of biologics manufacturing. Major pharmaceutical companies headquartered in the U.S. increasingly rely on outsourcing to accelerate development and reduce costs, while CDMOs in the region continue to expand facilities, adopt cutting-edge technologies like single-use systems and continuous bioprocessing, and integrate digital and AI-driven process optimization.

Additionally, the rising trend of nearshoring to strengthen supply-chain resilience further reinforces North America’s leadership, making it the hub for innovation, quality, and large-scale biologics production in the global outsourcing landscape.

Competitive Landscape

The major players in the biologics outsourcing market include AbbVie Inc., Boehringer Ingelheim International GmbH, Catalent, Inc. (Novonordisk), Charles River Laboratories, WuXi Biologics, CordenPharma, Rentschler Biopharma SE, Syngene International Limited, among others.

Key Developments

In June 2024, Aurigene Pharmaceutical Services inaugurated a state-of-the-art biologics facility in Hyderabad, spanning 70,000 square feet. The new center is designed to provide comprehensive process and analytical development services, along with small-scale manufacturing of antibodies and recombinant proteins. With a focus on supporting preclinical studies and early-phase clinical trials, the facility strengthens Aurigene’s capabilities in advancing innovative biologics from development to the clinic.

In October 2023, Tanvex BioPharma USA Inc. launched Tanvex CDMO to provide comprehensive biologic contract development and manufacturing services, offering its experience and expertise to the biopharmaceutical industry.

Report Scope

Metrics | Details | |

CAGR | 12.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Service Type | Process Development, Cell Development, Analytical Services, Others |

Product | Antibodies, Vaccines, Cell and Gene Therapies, Recombinant Proteins, Others | |

| Process Stage | Clinical, Commercial, Research |

| Source | Mammalian, Microorganisms |

| Outsourcing Model | CDMO, CMO, CRO |

| End-User | Biotech Companies, Pharmaceutical Companies, Research Organizations, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global biologics outsourcing market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here