Single-use Bioreactors Market Size and Trends

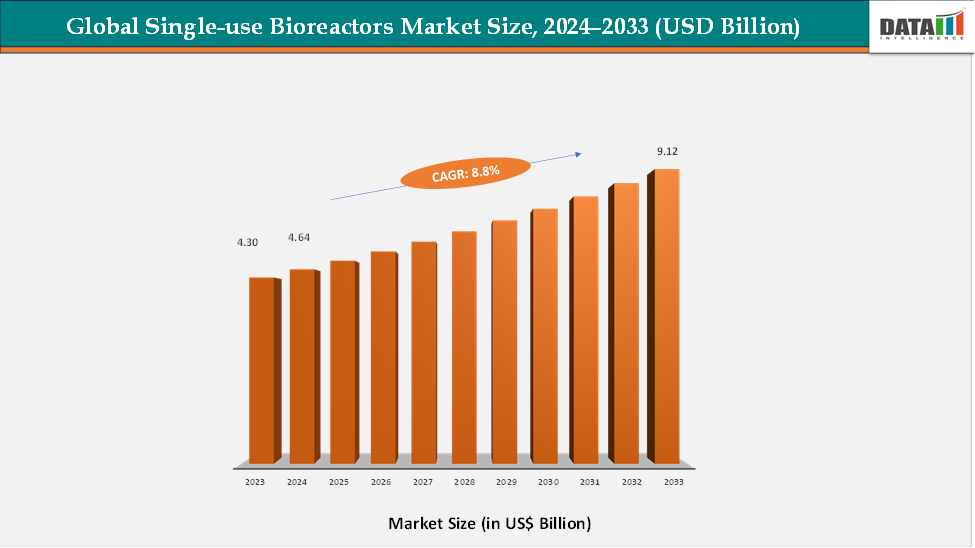

The global single-use bioreactors market reached US$ 4.30 billion in 2023, with a rise to US$ 4.64 billion in 2024, and is expected to reach US$ 9.12 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025–2033. The global single-use bioreactors market is witnessing consistent growth, driven by the rising demand for biologics, vaccines, and advanced cell and gene therapies, along with the increasing number of contract manufacturing organizations (CDMOs) and biopharmaceutical R&D facilities. Greater emphasis on flexible, scalable, and contamination-free production processes is accelerating the adoption of single-use bioreactors across laboratories, pilot plants, and commercial-scale manufacturing facilities. Technological advancements, such as integrated sensors, automated control systems, and larger-volume disposable reactors, are enhancing process efficiency, reproducibility, and product safety.

The shift toward modular and flexible manufacturing, combined with the need to rapidly scale production for emerging therapies, has further elevated the preference for single-use bioreactor systems. Additionally, sustainability trends and the development of recyclable or low-waste disposable materials are creating new opportunities for innovation. With continuous product improvements, increasing biologics production, and expanding global biopharma infrastructure, the Single-use Bioreactors market is set to strengthen its position as a critical component of modern biomanufacturing.

Key Market highlights

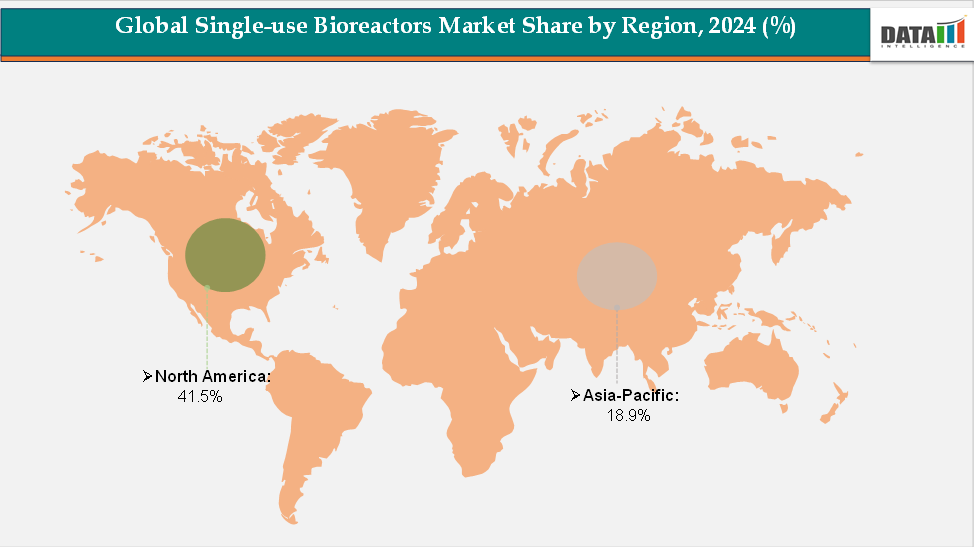

- North America accounted for approximately 41.5% of the global Single-use Bioreactors market in 2024 and continues to hold the leading position. The region’s dominance is driven by the strong presence of key biopharmaceutical companies, advanced manufacturing infrastructure, and high investment in biologics and vaccine production. In addition, the United States and Canada benefit from favorable regulatory frameworks, robust R&D activities, and a growing number of contract manufacturing organizations (CDMOs), all of which support widespread adoption of single-use bioreactor technologies. The increasing demand for flexible, contamination-free production processes for monoclonal antibodies, vaccines, and cell and gene therapies further strengthens market growth in North America.

- The Asia-Pacific region held around 18.9% of the global market in 2024 and is projected to be the fastest-growing region. Market expansion is fueled by rising healthcare expenditure, expanding biopharmaceutical infrastructure, and increased biologics manufacturing in countries such as China, India, Japan, and South Korea. The region is witnessing significant adoption of single-use technologies in both greenfield and existing facilities due to their cost-effectiveness, scalability, and reduced contamination risk. The rapid growth of contract manufacturing, biosimilars, and vaccine production is also contributing to the rising demand for single-use bioreactor systems in Asia-Pacific.

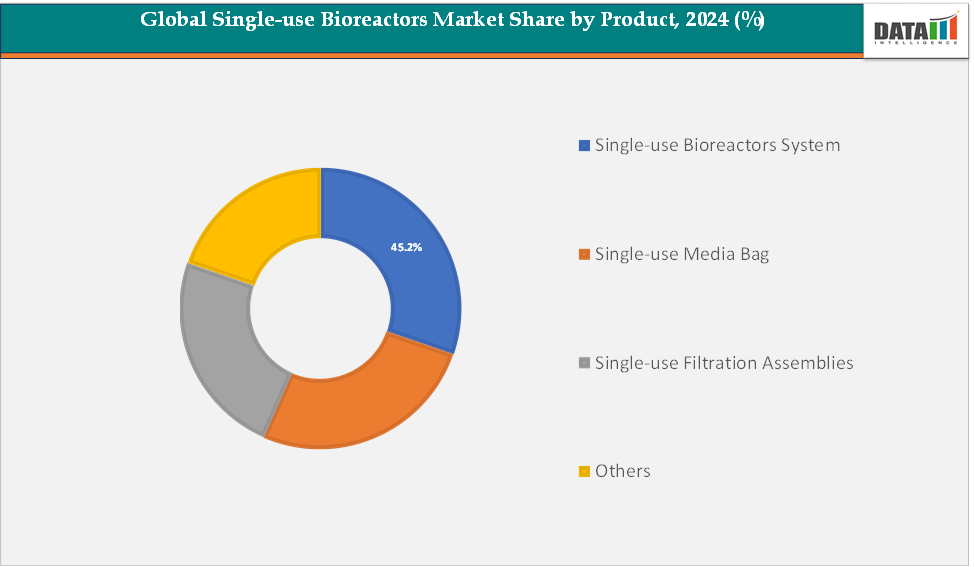

- By product, the single-use bioreactor system segment dominated the global single-use bioreactors market, accounting for a significant share of total revenue in 2024. This dominance is attributed to the integrated nature of single-use systems, which combine reactor vessels, control modules, sensors, and accessories into a ready-to-use platform. These systems offer enhanced process efficiency, scalability, and reproducibility, making them ideal for commercial-scale production of monoclonal antibodies, vaccines, and advanced cell therapies.

Market Size & Forecast

- 2024 Market Size: US$4.64 Billion

- 2033 Projected Market Size: US$9.12 Billion

- CAGR (2025–2033): 8.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Global Single-use Bioreactors Market Dynamics: Drivers & Restraints

Driver: Growing Demand for Biologics

The growing demand for biologics is a major factor driving the expansion of the single-use bioreactors (SUB) market. As biopharmaceutical companies increasingly develop complex biologic therapies, they require production systems that are flexible, scalable, and safe. SUBs meet these needs because they reduce the risk of cross-contamination, enable rapid scale-up, and avoid the high capital and maintenance costs associated with traditional stainless-steel bioreactors.

For instance, as monoclonal antibody (mAb) therapeutics proliferate (driven by their broad use in oncology and immunology), CDMOs and biomanufacturers increasingly prefer single-use bioreactors optimized for mammalian cell cultures.

Moreover, SUBs like 5,000 L single-use bioreactors now bridge the gap between lab-scale and commercial-scale biologic production, giving companies flexibility to scale up or down based on fluctuating demand without major infrastructure changes. In addition, single-use bioreactors are being adopted more by CDMOs, which are scaling up biologics manufacturing to support both emerging biotech firms and large pharma.

This trend is underscored by rising partnerships: over 50% of single-use bioreactor deals reportedly involve stirred-tank configurations, reflecting the strong alignment with commercial biologics production. Overall, the surge in biologics is pushing companies to choose single-use bioreactors for their speed, flexibility, and cost effectiveness, thereby fueling strong growth in the SUB market..

Restraint: Extractables & Leachables Risk

The risk of extractables and leachables poses a significant challenge for the single‑use bioreactors market because materials used in disposables (like plastic films, tubing, and connectors) can release chemical compounds into the cell culture. These contaminants may affect product quality, safety, and regulatory compliance, particularly for sensitive biologics such as monoclonal antibodies or cell therapies. As a result, manufacturers may hesitate to scale up with single-use systems unless they can rigorously validate and control for leachables, increasing development costs and slowing adoption.

For more details on this report, Request for Sample

Global Single-use Bioreactors Market, Segmentation Analysis

The global single-use bioreactors market is segmented by product, type, molecule type, cell type, application, end-user and region.

Product: The single-use bioreactors system segment is estimated to have 29.4% of the single-use bioreactors market share.

The single‑use bioreactor systems segment is expected to remain dominant in the market because these systems offer the most complete, scalable, and flexible solutions for biomanufacturing. Unlike standalone components such as media bags or filtration assemblies, whole single‑use systems integrate the reactor vessel, control modules, sensors, and other accessories into one ready-to-use platform. This helps biopharma companies reduce capital costs, minimize cross-contamination risk, and eliminate the need for time‑consuming cleaning and sterilization procedures.

For instance, many manufacturers favor these systems for commercial-scale production of monoclonal antibodies and vaccines, because they can scale up easily from lab to large volumes while maintaining process control and reproducibility. Additionally, the modular nature of these systems, combined with advances such as integrated sensors and automated control, makes them highly attractive for CDMOs and biotech firms that need to switch rapidly between products.

Global Single-use Bioreactors Market - Geographical Analysis

The North America single-use bioreactors market was valued at 41.5% market share in 2024

North America stands as the largest and most advanced market for single-use bioreactors, driven by its long-established biopharmaceutical ecosystem, extensive R&D spending, and the presence of major biologics manufacturers and CDMOs. The United States contributes the majority share due to its concentration of biotech hubs such as Boston–Cambridge, San Diego, the San Francisco Bay Area, and Research Triangle Park, where companies rely heavily on single-use systems to enhance production flexibility, reduce cross-contamination risks, and accelerate scale-up timelines.

Regulatory agencies like the FDA also encourage manufacturing practices that align well with disposable systems, making single-use technologies increasingly attractive for both clinical and commercial manufacturing. For instance, companies such as Thermo Fisher Scientific, Cytiva, and Sartorius have expanded their U.S. production capacity with large-scale SUB lines, while investments like Fujifilm Diosynth’s expansion in North Carolina illustrate how manufacturers are shifting toward modular, single-use–driven facilities to meet rising demand for monoclonal antibodies, vaccines, and gene therapy materials.

The European Single-use Bioreactors market was valued at 20.4% market share in 2024

Europe holds a significant and highly sophisticated share of the global single-use bioreactors market, supported by a strong network of biotech companies, biosimilar developers, and pharmaceutical giants that operate within stringent regulatory and quality frameworks. Countries such as Germany, the UK, Switzerland, and the Netherlands serve as major biotechnology clusters, where manufacturers increasingly adopt single-use bioreactors to improve operational flexibility, reduce cleaning and validation burdens, and enable faster changeovers in multiproduct facilities.

Europe is also distinctive for its strong emphasis on sustainability and environmental stewardship, which drives the development and adoption of recyclable or lower-waste single-use materials. This has led to a rise in hybrid manufacturing models, where companies combine stainless-steel reactors for large-scale operations with single-use bioreactors for clinical or mid-scale production. For instance, Boehringer Ingelheim’s facilities in Germany incorporate advanced disposable bioreactors alongside digital manufacturing tools, reflecting Europe’s commitment to technologically sophisticated but eco-conscious production environments. This puts Europe in a unique position, balancing innovation, regulatory rigor, and sustainability while maintaining strong adoption of single-use platforms across various biologics segments.

The Asia-Pacific single-use bioreactors market was valued at 18.9% market share in 2024

The Asia-Pacific region is the fastest-growing and most rapidly transforming market for single-use bioreactors, propelled by massive expansions in biopharmaceutical manufacturing across China, India, South Korea, Singapore, and Japan. Unlike North America and Europe APAC is building a large number of greenfield biomanufacturing plants, which makes it easier to integrate single-use systems from the beginning. This reduces capital expenditure, shortens construction time, and gives manufacturers greater flexibility to produce diverse biologics including biosimilars, vaccines, and novel cell therapies.

China and India in particular are driving large-scale adoption, as local CDMOs increasingly rely on disposable bioreactors to meet global outsourcing demand while avoiding the high costs and maintenance requirements of stainless-steel infrastructure. At the same time, South Korea and Japan are using single-use technologies to support advanced biologics pipelines such as cell therapy, CAR-T production, and regenerative medicine. For instance, many Chinese and Indian facilities now operate large-volume single-use reactors for rapid biosimilar manufacturing, while Japanese companies leverage SUBs to maintain strict sterility and agility in cell-based products. With strong government support, increasing R&D investment, and rapid infrastructure growth, APAC is evolving into a major global hub for flexible, cost-efficient biomanufacturing through widespread single-use adoption.

Global Single-use Bioreactors Market – Competitive Landscape

The major players in the single-use bioreactors market include ABEC, Thermo Fisher Scientific, Inc., Sartorius AG, Celltainer, Distek, Inc., Merck KGaA, PBS Biotech, Inc., Cytiva, Eppendorf SE, Getinge AB, among others.

Market Scope

| Metrics | Details | |

| CAGR | 8.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$Bn) | |

| Segments Covered | Product | Single-use Bioreactors System, Single-use Media Bag, Single-use Filtration Assemblies, Others |

| Type | Bubble Column Single-use Bioreactors, Stirred Tank Single-use Bioreactors, Wave Induced Single-use Bioreactors | |

| Molecule Type | Monoclonal Antibodies (MABs), Vaccines, Stem Cells, Gene–Modified Cells, Other Molecules | |

| Cell Type | Mammalian Cells, Bacteria Cells, Yeast Cells, Other Cells | |

| Application | Research and Development, Process Development, Bio production | |

| End-User | Hospital, Specialty Clinic, Emergency Centre, Ambulatory Surgical Centers, Other | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global single-use bioreactors market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

- Global Viral Vector and Plasmid DNA Testing Services Market

- Viral Vector and Plasmid DNA Manufacturing Market

For more biotechnology-related reports, please click here