Cell and Gene Therapy Manufacturing Services Market Size - Industry Trends & Outlook

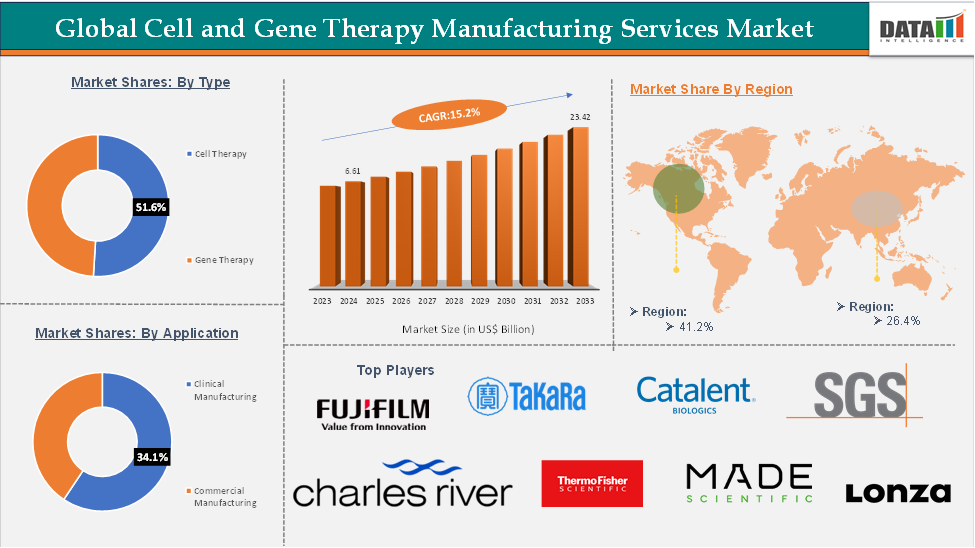

Cell and Gene Therapy Manufacturing Services Market size reached US$ 6.61 Billion in 2024 and is expected to reach US$ 23.42 Billion by 2033, growing at a CAGR of 15.2% during the forecast period 2025-2033.

The cell and gene therapy manufacturing services market is experiencing robust growth, driven by the rising prevalence of cancer and other chronic diseases that demand advanced, personalized treatment options. A significant surge in pharmaceutical R&D spending, aimed at developing innovative therapies, is further propelling demand for specialized manufacturing capabilities.

Additionally, strategic partnerships and agreements between pharmaceutical companies and contract development and manufacturing organizations (CDMOs) are accelerating the development and commercialization of complex therapies. As the pipeline for cell and gene therapies expands globally, the need for scalable, compliant, and efficient manufacturing solutions is creating substantial opportunities for service providers in this space.

Executive Summary

For more details on this report – Request for Sample

Cell and Gene Therapy Manufacturing Services Market Dynamics: Drivers & Restraints

Surge in biopharmaceutical R&D investment is expected to drive the cell and gene therapy manufacturing services market

The surge in biopharmaceutical R&D investment is playing a pivotal role in accelerating the growth of the cell and gene therapy manufacturing services market, driven by the urgent need for scalable, innovative treatments and rapid advancements in gene editing technologies.

In 2024 alone, companies like Insmed raised $650 million for autoimmune cell therapy programs, Kyverna Therapeutics secured $319 million through an IPO, and ArsenalBio attracted $325 million in Series C funding. This influx of capital is largely fueled by the rising demand for personalized medicine, recent regulatory approvals, and breakthroughs in technologies like CRISPR.

Moreover, strategic acquisitions, such as AstraZeneca’s $1 billion deal to acquire EsoBiotec in March 2025. These investments are directly boosting the need for specialized manufacturing services, as biotech and pharma companies increasingly rely on CDMOs to support the complex production and commercialization of next-generation therapies.

High costs of specialized services

The high costs of specialized services are significantly hindering the growth of the cell and gene therapy manufacturing services market, as the production of these therapies requires cutting-edge technology, highly skilled labor, and compliance with stringent regulatory standards. The complex and custom nature of cell and gene therapies, including processes like gene editing, viral vector production, and cell harvesting, leads to high operational expenses for contract development and manufacturing organizations (CDMOs).

For instance, manufacturing autologous cell therapies, which involve using a patient’s cells, requires personalized production facilities and longer timelines, raising costs further. These elevated costs can limit access to cell and gene therapies, especially for smaller biotech firms with limited funding, and can also lead to higher prices for end-users, restricting the broader adoption of these therapies in the healthcare market.

Cell and Gene Therapy Manufacturing Services Market Segment Analysis

The global cell and gene therapy manufacturing services market is segmented based on type, indication, application, end user, and region.

Type:

The cell therapy segment is expected to hold 51.6% of the global cell and gene therapy manufacturing services market

The cell therapy segment is poised to dominate the cell and gene therapy manufacturing services market, driven by significant advancements and investments. Major pharmaceutical companies such as Gilead Sciences, Novartis, Johnson & Johnson, and Bristol Myers Squibb are working to reduce the manufacturing turnaround time for CAR-T therapies, personalized treatments for blood cancer, by up to half to deliver them more rapidly in a patient's disease course.

Additionally, in February 2024, AstraZeneca announced an investment of USD 300 million in the Roseville cell therapy manufacturing facility to focus on producing and launching T-cell therapies for oncology indications. These developments underscore the growing demand for specialized manufacturing services to support the production of both autologous and allogeneic cell therapies. The increasing number of clinical trials and regulatory approvals further contributes to the expansion of the cell therapy manufacturing services market.

Cell and Gene Therapy Manufacturing Services Market Geographical Analysis

North America is expected to hold 41.2% of the global cell and gene therapy manufacturing services market

North America is expected to hold a large share in the global cell and gene therapy manufacturing services market due to a combination of a robust biopharmaceutical ecosystem, significant R&D investments, and a favorable regulatory environment. The U.S. has become a global hub for biotechnology, with leading companies like Gilead Sciences, Novartis, and Amgen driving innovation in cell and gene therapies.

Furthermore, the U.S. Food and Drug Administration (FDA) has approved several cell and gene therapies, including CAR-T cell therapies, which are boosting demand for manufacturing services. For instance, in October 2023, Bayer AG opened its first Cell Therapy Launch Facility in Berkeley, California, with a $250 million investment in a 100,000-square-foot space.

The facility will support late-stage clinical trials and potential commercialization of BlueRock Therapeutics’ investigational cell therapy, bemdaneprocel (BRT-DA01), for Parkinson’s disease. Additionally, the facility includes space for expanding production to support other cell therapies in Bayer's growing portfolio. The region’s established infrastructure, combined with a highly skilled workforce and a favorable regulatory framework, positions North America to dominate the market in the forecast period.

Cell and Gene Therapy Manufacturing Services Market Top Companies

The top companies in the cell and gene therapy manufacturing services market include Charles River Laboratories, Thermo Fisher Scientific Inc., Lonza, Merck KGaA, Catalent, Inc, Takara Bio Inc., FUJIFILM Irvine Scientific, Oxford Biomedica plc, SGS SA, and Made Scientific, among others.

Market Scope

Metrics | Details | |

CAGR | 15.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Cell Therapy, Gene Therapy |

Indication | Oncology Diseases, Cardiovascular Diseases, Orthopedic Diseases, Ophthalmology Diseases, Central Nervous System Disorders, Infectious Diseases, Others | |

Application | Clinical Manufacturing, Commercial Manufacturing | |

End User | Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global cell and gene therapy manufacturing services market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.