Bio betters Market Size & Industry Outlook

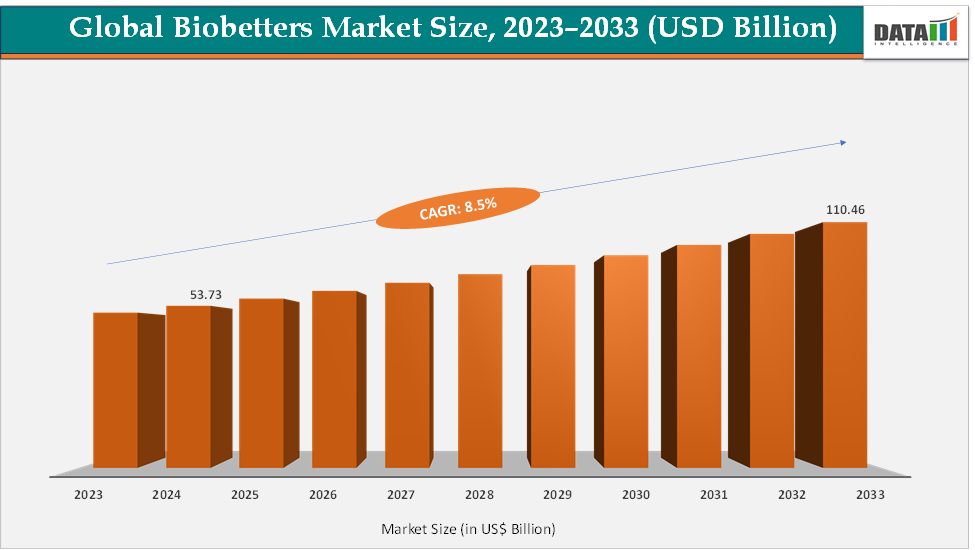

The global bio betters market size reached US$ 53.73 Billion in 2024 from US$ 49.87 Billion in 2023 and is expected to reach US$ 110.46 Billion by 2033, growing at a CAGR of 8.5% during the forecast period 2025-2033. The market is being driven by the growing demand for more effective and safer biologic therapies across chronic and complex diseases. Unlike biosimilars, bio betters offer enhanced efficacy, longer half-life, reduced side effects, or improved patient convenience, making them attractive to both patients and healthcare providers.

For instance, Novo Nordisk’s Tresiba provides a long-acting insulin option requiring fewer daily injections, while Amgen’s Aimovig offers superior migraine prevention over earlier therapies. Advances in protein engineering, antibody modification, and drug delivery technologies are accelerating bio better development. Additionally, the rising prevalence of diabetes, cancer, and autoimmune disorders globally has expanded the market opportunity. Overall, the market growth is fueled by the intersection of clinical innovation and patient-centric treatment improvements.

Key Market Highlights

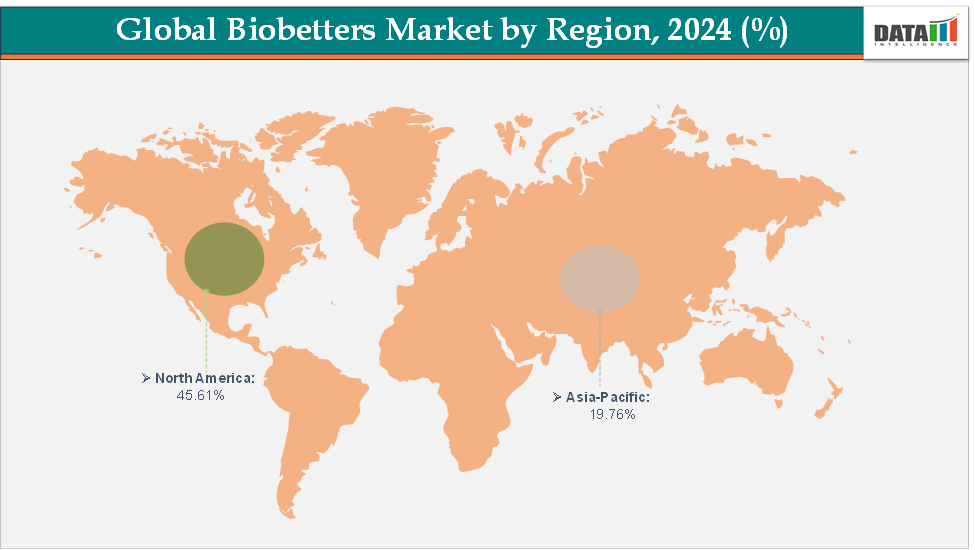

North America dominates the bio betters market with the largest revenue share of 45.61% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.7% over the forecast period.

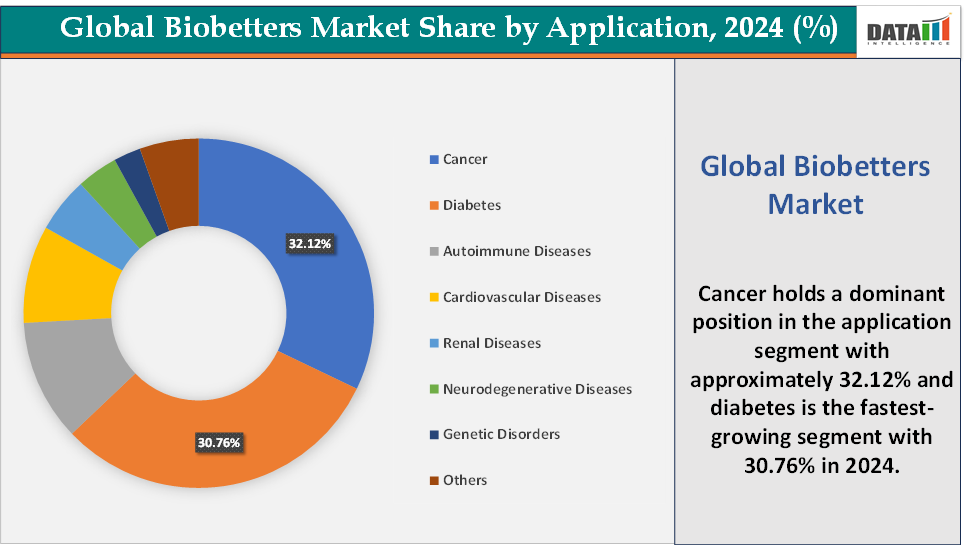

Based on application, the cancer segment led the market with the largest revenue share of 32.12% in 2024.

The major market players in the bio betters market are Celltrion, Inc., Altos Biologics Co., Ltd., Amgen Inc., Novo Nordisk A/S, Eli Lilly and Company, Sanofi SA, and Genentech USA, Inc., among others

Market Dynamics

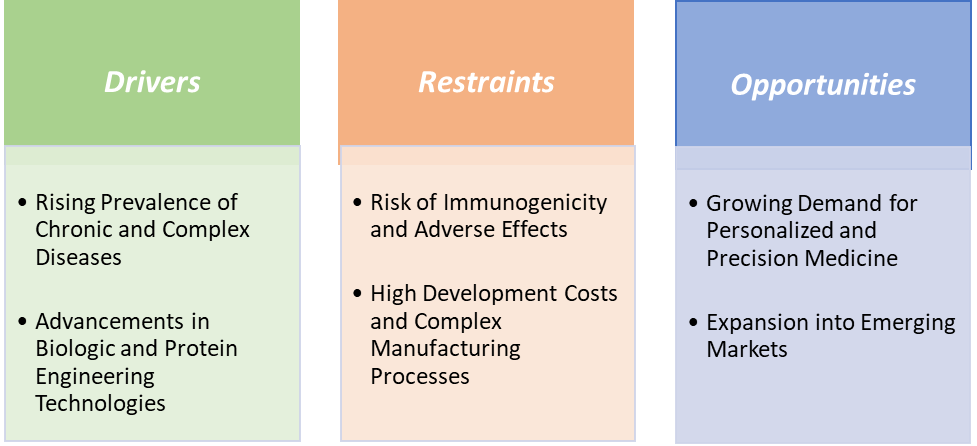

Drivers:The rising prevalence of chronic and complex diseases is significantly driving the bio betters market growth

The rising prevalence of chronic and complex diseases is one of the most significant drivers of the global bio betters market, as these conditions create an ever-increasing demand for innovative and more effective therapies. Chronic diseases such as diabetes, cancer, cardiovascular disorders, autoimmune conditions, and renal diseases have seen a sharp rise in incidence worldwide, creating a substantial patient pool that requires long-term, reliable treatment options. For instance, over 800 million adults globally are affected by diabetes, a number that has doubled over the past three decades, highlighting the growing need for advanced glycemic management therapies.

Similarly, cardiovascular diseases account for approximately 19 million deaths annually, representing around 32% of all global deaths, emphasizing the urgent requirement for treatments that can manage disease progression and associated complications. This rising disease burden directly fuels demand for bio betters, which are engineered to enhance the efficacy, safety, and convenience of existing biologics. By offering improved pharmacokinetic profiles, longer half-lives, reduced immunogenicity, and optimized dosing schedules, bio betters are particularly suited for chronic conditions that require long-term therapy and adherence.

As populations age and lifestyle-related health issues continue to escalate, the demand for next-generation biologics that can address long-term treatment challenges is expected to grow, making bio betters an essential component of modern therapeutic strategies. Consequently, the combination of rising disease prevalence, patient demand for improved treatments, and advancements in biologic engineering positions the bio betters market for sustained growth, underscoring its crucial role in addressing the global healthcare burden associated with chronic and complex diseases.

Restraints: Risk of immunogenicity and adverse effects is hampering the growth of the market

The risk of immunogenicity and adverse effects is a major factor restraining the growth of the global bio betters market, as even minor modifications in biologic molecules can trigger unwanted immune responses. bio betters, by design, involve structural or functional enhancements to existing biologics, such as glycoengineering, PEGylation, or Fc modifications, which can inadvertently alter the immune system’s recognition of the molecule. This can lead to antibody formation against the therapeutic protein, reduced efficacy, allergic reactions, or severe adverse events, creating significant clinical and regulatory challenges.

For instance, some patients treated with recombinant erythropoietin analogs developed anti-erythropoietin antibodies, leading to pure red cell aplasia, a serious hematologic condition. Similarly, monoclonal antibody bio betters like modified anti-TNF therapies, while improving dosing schedules or efficacy, have occasionally been associated with infusion-related reactions, hypersensitivity, or immunogenicity that compromises safety. These risks necessitate extensive preclinical and clinical testing to ensure safety and tolerability, significantly increasing development timelines and costs.

The immunogenic potential also limits physician and patient confidence, which may slow adoption despite the therapeutic advantages of bio betters. Consequently, the fear of immune-mediated complications and adverse effects acts as a critical barrier, impacting investment decisions, pricing strategies, and overall market expansion. This restraint emphasizes the need for robust immunogenicity screening, optimized protein engineering, and patient monitoring to mitigate risks and ensure the successful commercialization of bio betters.

For more details on this report – Request for Sample

Bio betters Market, Segment Analysis

The global bio betters market is segmented based on type, application, distribution channel, and region.

Application: The cancer segment is dominating the bio betters market with a 32.12% share in 2024

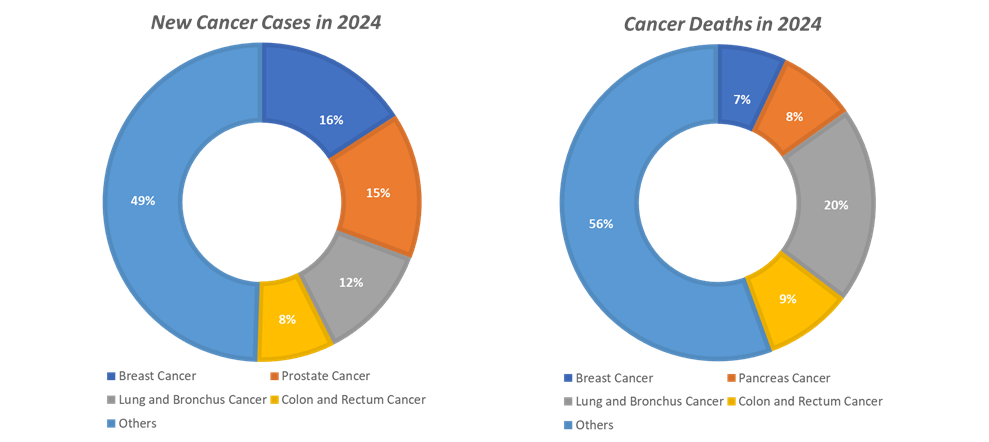

The cancer segment is currently the dominant force in the global bio betters market, largely driven by the rising global burden of oncology-related diseases and the increasing demand for more effective, targeted, and patient-friendly therapies. Cancer remains one of the leading causes of mortality worldwide, with millions of new cases diagnosed each year, creating a substantial and growing patient population that requires innovative treatment options.

Monoclonal antibody (mAb) bio betters are at the forefront of this expansion, representing a substantial portion of the market due to their enhanced specificity, improved pharmacokinetics, and reduced immunogenicity compared to conventional biologics. For instance, products such as Herceptin Hylecta, a subcutaneous formulation of trastuzumab, provide the same therapeutic efficacy as the intravenous version but with greater convenience, shorter administration times, and improved patient adherence.

Similarly, Perjeta (pertuzumab) and Tecentriq (atezolizumab) are engineered to improve survival outcomes in HER2-positive breast cancer and various solid tumors, demonstrating how bio betters are addressing critical unmet medical needs in oncology. This expansive market, coupled with the increasing prevalence of cancer worldwide, creates substantial opportunities for bio betters to deliver clinical improvements, enhanced patient quality of life, and convenience in long-term treatment regimens. Given the combination of high unmet need, technological advancements, and patient-centric benefits, the oncology segment is expected to maintain its leading position in the bio betters market for the future.

Diabetes is the fastest-growing segment in the bio betters market, with a 30.76% share in 2024

The diabetes segment is currently the fastest-growing area in the global bio betters market, primarily driven by the rapidly increasing prevalence of diabetes worldwide and the growing demand for more effective, convenient, and patient-friendly insulin therapies. Diabetes has become a major public health concern, with the International Diabetes Federation reporting that approximately 537 million adults were living with diabetes in 2021, a figure projected to rise to 783 million by 2045, reflecting a substantial and expanding patient population that requires long-term disease management. This surge has created an urgent need for innovative therapies that not only control blood glucose levels effectively but also improve patient adherence and quality of life.

Insulin bio betters are at the forefront of this growth, offering enhanced pharmacokinetic and pharmacodynamic profiles, longer half-lives, and reduced risk of hypoglycemia compared to conventional insulin formulations. Products such as Tresiba (insulin degludec) provide ultra-long-acting insulin with a half-life exceeding 25 hours, allowing for flexible dosing schedules and minimizing the number of daily injections required, thereby improving compliance. Similarly, Toujeo (insulin glargine U300) offers a concentrated formulation that reduces injection volume and provides more stable glycemic control, making it easier for patients to manage their condition.

The convenience of subcutaneous administration and the potential for at-home dosing further contribute to the appeal of insulin bio betters, addressing both patient preferences and healthcare system burdens. Overall, the combination of a growing patient population, technological advancements in insulin formulations, patient-centric innovations, and clinical advantages positions the diabetes segment as the fastest-growing and most promising area in the bio betters market, with substantial opportunities for continued expansion and adoption worldwide.

Geographical Analysis

North America is expected to dominate the global bio betters market with a 45.61% in 2024

North America is the dominant region in the global bio betters market, accounting for approximately 45.61% of the market share in 2024, reflecting its leading role in the development, commercialization, and adoption of next-generation biologics. This dominance is driven by a combination of factors, including the presence of a well-established pharmaceutical and biotechnology sectors, and a regulatory environment that encourages innovation while ensuring patient safety. With the combination of technological expertise, financial resources, regulatory support, and patient-centric healthcare approaches, North America is expected to maintain its leadership position in the bio betters market for the foreseeable future.

US bio betters Market Trends

The United States, in particular, is home to many of the world’s leading biopharmaceutical companies, such as Amgen, Eli Lilly, and other emerging players, which create bio betters with improved efficacy, safety, and patient convenience. Products such as Humira (adalimumab) for autoimmune disorders and Herceptin (trastuzumab) for HER2-positive breast cancer exemplify the region’s leadership in bio betters, offering enhanced pharmacokinetic profiles, reduced side effects, and improved patient adherence compared to earlier biologics.

Additionally, the US benefits from rapid adoption of digital health technologies, continuous monitoring, and personalized medicine, which enhance the integration and effectiveness of bio better treatments. Strong government support, high healthcare expenditure, and patient awareness contribute to sustained market growth, making the US the largest and most lucrative region in the bio betters landscape.

The Asia Pacific region is the fastest-growing region in the global bio betters market, with a CAGR of 8.7% in 2024

The Asia Pacific (APAC) region is currently the fastest-growing market for bio betters, driven by a combination of rising healthcare needs, rapid economic growth, expanding biopharmaceutical infrastructure, and supportive regulatory environments. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, driven by novel product launches in APAC countries, government initiatives and a rising prevalence of chronic and complex diseases like diabetes, cancer, and autoimmune disorders.

For instance, in May 2025, Altos Biologics completed global Phase 3 clinical trials of its Aflibercept biosimilar (a generic version of a biopharmaceutical) and is undergoing approval processes in Korea. Aflibercept, which treats age-related macular degeneration, generated sales of over 13 trillion won last year, making it a global blockbuster. The company is also developing a dual-antibody-based ophthalmic disease bio better, 'OP-01’. The company is expected to accelerate its new drug development.

The growing prevalence of chronic diseases in the region, combined with increasing patient awareness and demand for therapies that offer enhanced efficacy, longer half-life, reduced side effects, and improved convenience, is fueling the adoption of bio betters. bio betters such as long-acting insulin analogs for diabetes and monoclonal antibodies for cancer and autoimmune disorders are witnessing rapid uptake, demonstrating the market’s potential. Overall, the Asia Pacific region’s dynamic combination of technological advancement, increasing disease burden, and supportive regulatory policies positions it as the fastest-growing market for bio betters, with significant opportunities for pharmaceutical companies to expand their presence and capture market share in the coming years.

Europe bio betters Market Trends

Europe is steadily driving growth in the bio betters market, fueled by a mix of supportive regulatory frameworks, patient-centric healthcare systems, and rising demand for improved biologic therapies. The European Medicines Agency (EMA) has been at the forefront of biologic regulation, building on its leadership in biosimilars to create flexible approval pathways that encourage innovation in bio betters while maintaining safety and efficacy standards. This regulatory support reduces uncertainty for developers and accelerates time to market.

At the same time, European healthcare systems prioritize therapies that demonstrate added clinical value, which allows bio betters with superior efficacy, longer duration of action, fewer side effects, or more convenient dosing to gain favorable reimbursement and adoption compared to older biologics. Together, these factors position Europe as a strategically important region where bio betters are not only accepted but increasingly expected as the natural progression of biologic therapy.

Competitive Landscape

Top companies in the bio betters market include Celltrion, Inc., Altos Biologics Co., Ltd., Amgen Inc., Novo Nordisk A/S, Eli Lilly and Company, Sanofi SA, and Genentech USA, Inc., among others.

Market Scope

Metrics | Details | |

CAGR | 8.5% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Monoclonal Antibodies, Insulin bio betters, Erythropoietin bio betters, Granulocyte-Colony Stimulating Factor (G-CSF) bio betters, Anti-Hemophilic Factor bio betters, and Others |

Application | Cancer, Diabetes, Autoimmune Diseases, Cardiovascular Diseases, Renal Diseases, Neurodegenerative Diseases, Genetic Disorders, and Others | |

Distribution Channel | Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global bio betters market report delivers a detailed analysis with 53 key tables, more than 58 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here