Global Biologics Market: Industry Outlook

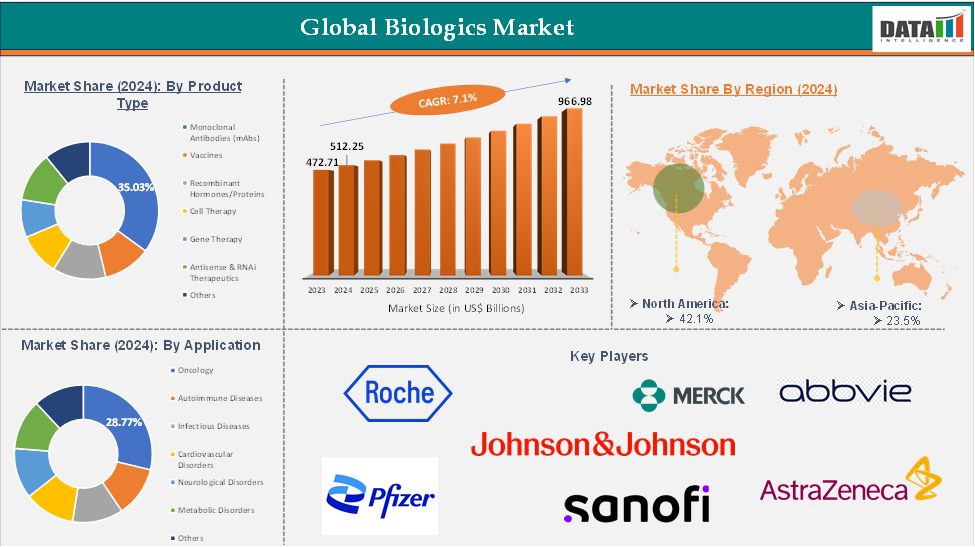

The global biologics market reached US$ 472.71 billion in 2023, with a rise of US$ 512.25 billion in 2024, and is expected to reach US$ 966.98 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2025-2033.

The global biologics market is experiencing significant growth due to the increasing burden of chronic and rare diseases, targeted therapies, and biotechnology advancements. Key players include monoclonal antibodies, vaccines, recombinant proteins, and cell and gene therapies. Despite challenges like high development costs and stringent regulatory requirements, the market is poised for significant growth in the biosimilars sector and personalized medicine. Major pharmaceutical and biotech companies are investing heavily in R&D, making the biologics market a cornerstone of modern therapeutics.

Global Biologics Market: Executive Summary

Global Biologics Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Chronic and Rare Diseases

The global biologics market is growing due to the increasing prevalence of chronic and rare diseases, such as cancer, autoimmune disorders, diabetes, and rare genetic conditions. These conditions require advanced treatment options that traditional small-molecule drugs cannot. Biologics, including monoclonal antibodies, recombinant proteins, and gene and cell therapies, offer high specificity, improved efficacy, and reduced side effects compared to conventional therapies. This growing patient population accelerates innovation in biologics development and encourages healthcare systems and biopharma companies to invest in expanding access and availability.

For instance, the US has 129 million people with at least one major chronic disease, including heart disease, cancer, diabetes, obesity, and hypertension. Five of the top 10 leading causes of death in the US are associated with preventable and treatable chronic diseases. Over the past two decades, prevalence has steadily increased, and this trend is expected to continue. An increasing proportion of Americans are dealing with multiple chronic conditions, with 42% having two or more and 12% having at least five. Chronic diseases also significantly impact the US healthcare system, accounting for 90% of annual $4.1 trillion expenditure.

Restraint: High Cost of Biologics Development and Treatment

The global biologics market faces significant challenges due to the high cost of development and treatment. Developing biologics is more expensive than conventional small-molecule drugs, with R&D costs often exceeding USD 1.2-2.5 billion. Treatments are among the most expensive therapies available, with monoclonal antibodies and gene therapies costing patients between USD 15,000-200,000 annually. Advanced cell and gene therapies can cost over USD 2 million per dose. These high costs restrict widespread adoption, especially in low- and middle-income countries, and put pressure on payers and healthcare systems to balance innovation with affordability.

For more details on this report, Request for Sample

Global Biologics Market Segment Analysis

The global biologics market is segmented based on product type, application, manufacturing, end user, and region.

Product Type:

The monoclonal antibodies (mAbs) from the product type segment the expected to have 35.03% of the biologics market share.

Monoclonal Antibodies (mAbs) are a rapidly growing segment in the global biologics market due to their high therapeutic efficacy, precision targeting, and expanding indications across various diseases. The increasing prevalence of cancer, autoimmune disorders, and infectious diseases has driven demand for mAbs, offering targeted mechanisms with fewer off-target effects. Advancements in antibody engineering, strong R&D investments, regulatory approvals, and the availability of biosimilar antibodies support market growth, making mAbs a cornerstone of modern therapeutics and a primary revenue driver in the biologics market.

For instance, in June 2025, Bio-Techne Corporation has signed a distribution agreement with the U.S. Pharmacopeia, allowing the company to sell USP monoclonal antibody and recombinant AAV reference standards alongside its analytical solutions, including the Maurice system, for worldwide monoclonal antibody and gene therapy development.

Global Biologics Market - Geographical Analysis

The North America global biologics market was valued at 42.1% market share in 2024

The North American biologics market is fueled by robust healthcare infrastructure, high healthcare spending, and early adoption of advanced therapies. The US, with leading biopharmaceutical companies and research institutions, drives innovation in monoclonal antibodies, cell therapies, and gene therapies. The FDA's favorable regulatory support and accelerated approval pathways for breakthrough biologics further strengthen market growth.

For instance, in June 2025, UCB invested in a new biologics manufacturing facility in the US, serving its growing number of patients and generating an estimated $5 billion economic impact. The company is also expanding its partnerships with US CMOs to ensure support for growth drivers and future pipeline production.

Moreover, the rising prevalence of chronic conditions and demand for personalized medicine also boost biologics uptake. High awareness among physicians and patients and growing biosimilar penetration contribute to the region's global biologics market leadership.

Global Biologics Market – Major Players

The major players in the biologics market include Roche, Merck & Co., AbbVie, Pfizer, AstraZeneca, Sanofi, Johnson & Johnson’s, Bristol-Myers Squibb, Novartis, and Eli Lilly and among others.

Key Developments

In June 2025, WuXi Biologics has launched WuXiHigh 2.0, a high-throughput formulation development platform for high concentration biologics, capable of achieving protein concentrations of up to 230 mg/mL and achieving viscosity reduction of up to 90%.

In May 2024, Commit Biologics, a stealth company, raised €16 million ($17.2 million) to develop antibody therapies for cancer and autoimmune diseases using their bispecific complement engaging (BiCE) technology, with primary investors being Novo Nordisk's holding and investment business, Novo Holdings, and European venture capital firm Bioqube Ventures.

Report Scope

Metrics | Details | |

CAGR | 7.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Product Type | Monoclonal Antibodies (mAbs), Vaccines, Recombinant Hormones/Proteins, Cell Therapy, Gene Therapy, Antisense & RNAi Therapeutics, Others |

Application | Oncology, Autoimmune Diseases, Infectious Diseases, Cardiovascular Disorders, Neurological Disorders, Metabolic Disorders, Others | |

Manufacturing | In-house Manufacturing, Outsourced/Contract Manufacturing | |

End User | Pharmaceutical and Biotechnology Companies, Hospitals, Research & Academic Institutes, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global biologics market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here