Diabetic Neuropathy Market Size and Growth

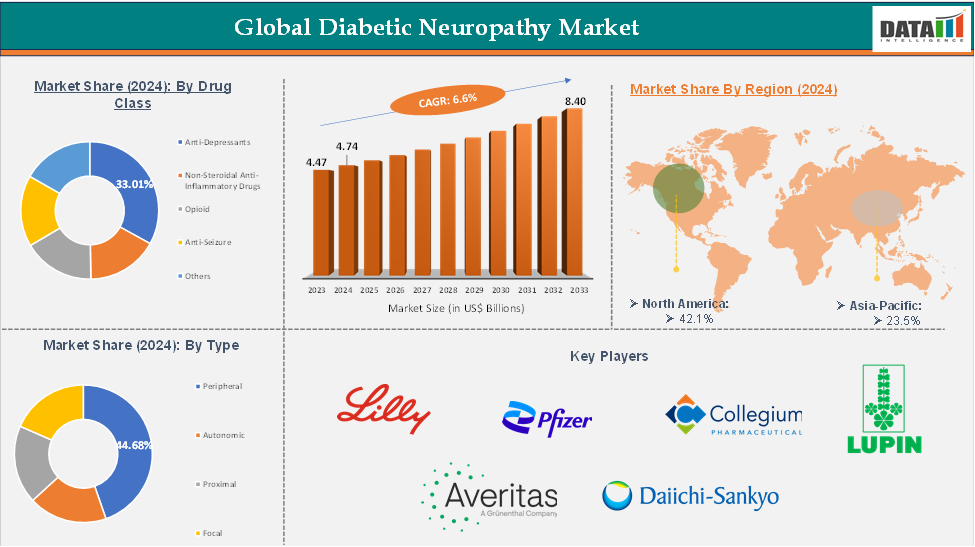

The global diabetic neuropathy market reached US$ 4.47 billion in 2023, with a rise of US$ 4.74 billion in 2024, and is expected to reach US$ 8.40 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033.

Diabetic Neuropathy Market Key Trends and Insights

- The Diabetic Neuropathy market growth is driven by the rising prevalence of diabetes worldwide, increasing demand for effective neuropathic pain management therapies, and ongoing advancements in drug formulations and neuromodulation approaches.

- North America is expected to dominate the diabetic neuropathy market with the largest revenue share due to the high diabetes burden, strong presence of leading pharmaceutical companies, and advanced healthcare infrastructure.

- The Asia Pacific region is the fastest-growing market, projected to expand at the highest CAGR over the forecast period, supported by rising diabetes incidence, increasing healthcare spending, and greater availability of generic drugs.

- Based on drug class, the anticonvulsant segment leads the market with the largest revenue share, driven by the widespread use of pregabalin and similar agents for neuropathic pain relief.

- The major market players in the Diabetic Neuropathy market are Eli Lilly and Company, Pfizer Inc., Collegium Pharmaceutical, Inc., Lupin Pharmaceuticals, Averitas Pharma, Inc., and Daiichi Sankyo among others.

Market Size and Forecast Analysis

- Historical Year:2023: 4.47

- Base Year:2024: 4.74

- Forecast Year:2033: 8.40

- CAGR: 6.6%

- Largest Region: North America

Diabetic Neuropathy Market Executive Summary

Diabetic Neuropathy Market Dynamics: Drivers & Restraints

Driver: Rising Prevalence of Diabetes Worldwide

The diabetic neuropathy market is growing due to the increasing prevalence of diabetes worldwide, which leads to complications like peripheral neuropathy. This demand for preventive care, symptom management, and long-term pharmacological therapies is a major factor in market expansion. Healthcare systems are prioritizing early diagnosis and management of diabetic neuropathy, accelerating the uptake of approved drugs and supportive treatments.

For instance, according to the International Diabetes Federation (IDF) Diabetes Atlas 2025, approximately 11.1% of adults (1 in 9) between the ages of 20–79 years are living with diabetes, and more than 40% of these cases remain undiagnosed. This means hundreds of millions of individuals worldwide are at risk of developing neuropathic complications, creating an expanding patient pool that ensures continued demand for effective therapies in the global diabetic neuropathy market.

Restraint: High Cost of Treatment and Branded Drugs

The high cost of treatment and branded drugs in the Diabetic Neuropathy market is a significant challenge, particularly in low- and middle-income regions. Branded therapies like pregabalin, duloxetine, and tapentadol can be expensive for long-term management, leading to poor treatment adherence and unmet medical needs. This financial burden is particularly prevalent in countries with limited healthcare reimbursement policies.

For instance, the average annual cost of branded pregabalin therapy in the United States can exceed USD 3,000-4,000 per patient, while generic versions may cost less than a quarter of that price. These disparities in affordability highlight how drug pricing acts as a barrier to market growth, limiting adoption despite the rising disease burden. The high cost of these treatments and branded drugs further restricts access for a large segment of patients, particularly in countries with limited healthcare reimbursement policies.

For more details on this report, Request for Sample

Diabetic Neuropathy Market Segment Analysis

The global diabetic neuropathy market is segmented by type, drug class, distribution channel, and region.

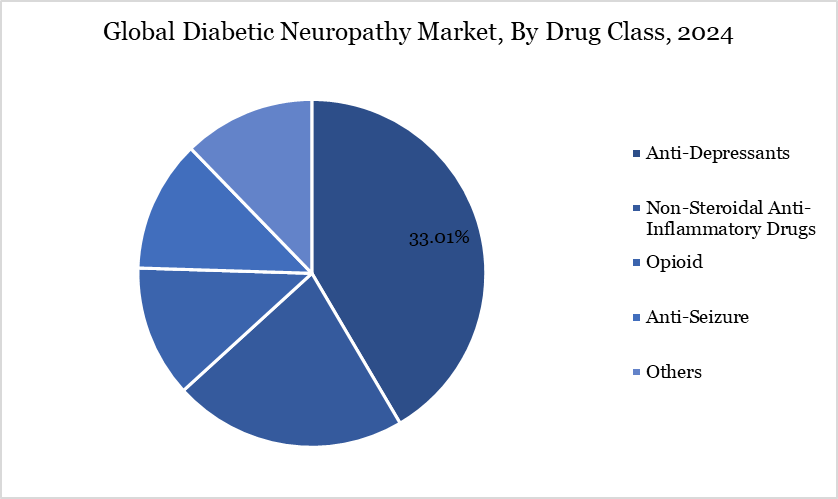

Drug Class—The antidepressants from the drug class segment the expected to have 33.01% of the diabetic neuropathy market share.

The anti-depressants segment is a key growth driver in the Diabetic Neuropathy market, largely due to the widespread clinical acceptance of serotonin-norepinephrine reuptake inhibitors (SNRIs) such as duloxetine, which are among the first-line therapies recommended for painful diabetic peripheral neuropathy.

These agents not only relieve neuropathic pain but also address comorbid depression and anxiety, which are highly prevalent in diabetic neuropathy patients, thereby improving overall quality of life. Duloxetine, marketed by Eli Lilly as Cymbalta and widely available in generic forms through companies like Lupin, has demonstrated strong efficacy and tolerability, making it a cornerstone therapy in this space.

Type—The peripheral from the type segment is expected to have 44.68% of the diabetic neuropathy market share.

The peripheral diabetic neuropathy segment is a significant growth driver in the diabetic neuropathy market, affecting nearly half of long-standing diabetic patients. This condition causes severe pain, numbness, and impaired quality of life, necessitating continuous pharmacological interventions. The increasing prevalence of type 2 diabetes and aging global population are increasing peripheral neuropathy cases globally. Awareness about early detection and management is accelerating treatment adoption. The availability of approved therapies like duloxetine, pregabalin, and tapentadol, along with newer modalities like capsaicin patches and spinal cord stimulation devices, strengthens this segment.

For instance, in January 2024, Neuralace Medical, Inc. has received FDA clearance for its innovative product, Axon Therapy (mPNS), for treating chronic Painful Diabetic Neuropathy (PDN). This marks the first FDA approval for a non-invasive magnetic peripheral nerve stimulation treatment, providing hope to millions of patients suffering from this debilitating condition.

Diabetic Neuropathy Market Geographical Share

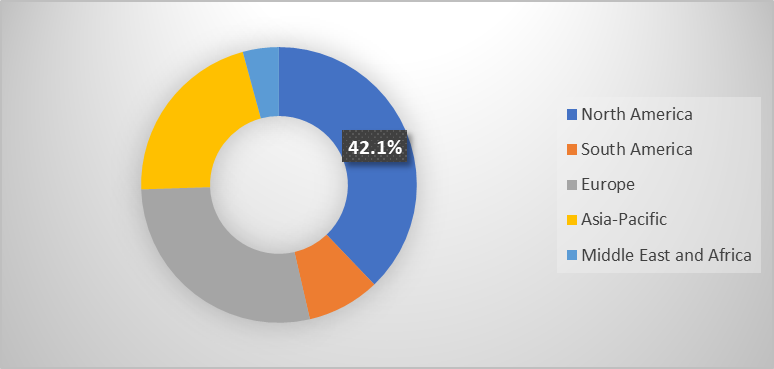

The North America global diabetic neuropathy market was valued at 42.1% market share in 2024

North America is expected to dominate the global diabetic neuropathy market due to high diabetes prevalence, advanced healthcare infrastructure, and innovative therapies. With over 38 million adults in the US, nearly half at risk of neuropathic complications, the availability of FDA-approved therapies and cutting-edge spinal cord stimulation devices from companies like Abbott, Boston Scientific, and Nevro ensures wide treatment adoption. Strong reimbursement systems, patient awareness, and ongoing clinical trials further strengthen market growth in this region.

Moreover, various advancements, launches also one of the significant factor driving the region. For instance, in May 2024, Lexicon Pharmaceuticals has chosen Medidata to assist in the PROGRESS Phase 2b study of LX9211, a non-opioid drug for diabetic peripheral neuropathic pain. Medidata will help accelerate patient enrollment and clinical trials for LX9211, aiming to address the high unmet need for chronic neuropathic pain therapies. The company will leverage Medidata's clinical trial solutions to accelerate the development of this new, non-opioid drug.

The Asia Pacific global diabetic neuropathy market was valued at 42.1% market share in 2024

The Asia Pacific region is the fastest-growing market for diabetic neuropathy due to the increasing incidence of type 2 diabetes, especially in countries like India and Japan. With over 100 million diabetic patients, the region is expanding the risk pool for neuropathy. Rising healthcare expenditure, access to generics, and government-led diabetes management initiatives are accelerating treatment uptake. Innovation in therapies like Mirogabalin in Japan demonstrates the region's focus on innovation. The region's large patient base, affordable drugs, and healthcare infrastructure investments make it an attractive high-growth market.

Diabetic Neuropathy Market Major Players

The major players in the diabetic neuropathy market include Eli Lilly and Company, Pfizer Inc., Collegium Pharmaceutical, Inc, Lupin Pharmaceuticals, Averitas Pharma, Inc, Daiichi Sankyo and among others.

Key Developments

In May 2025, A new study from The University of Texas at Dallas' Center for Advanced Pain Studies (CAPS) has found that Nageotte nodules, cell clusters that indicate nerve cell death in human sensory ganglia, are a crucial component of diabetic pain. The findings could potentially be a target for drugs that protect these nerves or help manage diabetic neuropathy. The study's key finding is a new view of diabetic neuropathic pain, demonstrating that neurodegeneration in the dorsal root ganglion is a critical aspect of the disease. This should prompt a new and urgent approach to understanding the disease.

Diabetic Neuropathy Market Scope

Metrics | Details | |

CAGR | 6.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segmentation | Type | Peripheral, Autonomic, Proximal, Focal |

Drug Class | Anti-Depressants, Non-Steroidal Anti-Inflammatory Drugs Opioid, Anti-Seizure, Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies , Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global diabetic neuropathy market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here