Wearable Continuous Glucose Monitoring Devices Market Overview

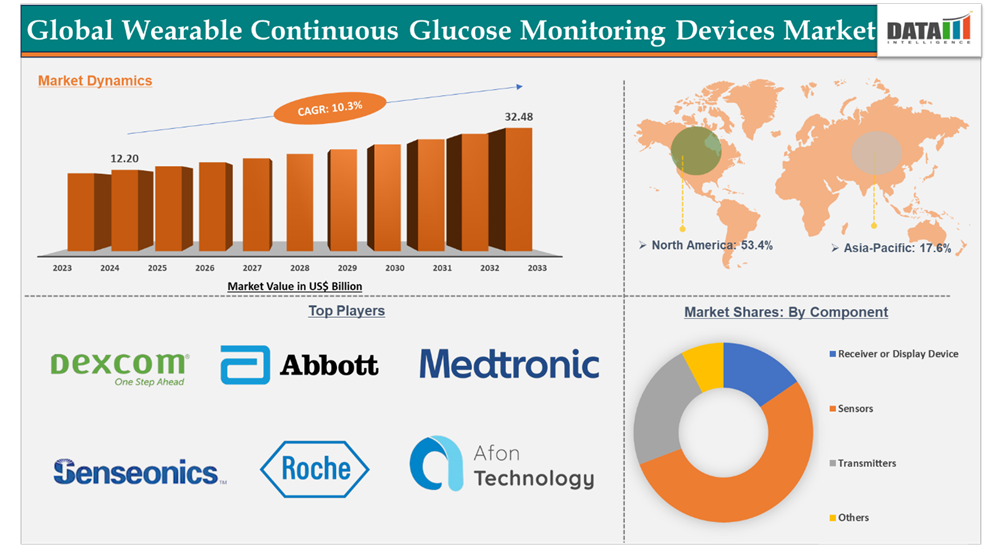

Wearable Continuous Glucose Monitoring Devices Market reached US$12.20 billion in 2024 and is expected to reach US$32.48 billion by 2033, growing at a CAGR of 10.3% during the forecast period 2025-2033, according to DataM intelligence research.

As per our analysis, the wearable continuous glucose monitoring devices market is experiencing lucrative growth due to the rising prevalence of diabetes, increasing awareness among the diabetes population on disease management, and rising innovations from key market players. However, the affordability issues in the low and middle-income countries, accuracy, and calibration issues can hinder the adoption of CGMs at the anticipated rate.

Executive Summary

For more details on this report – Request for Sample

Wearable Continuous Glucose Monitoring Devices Market Dynamics: Drivers & Restraints

The growing prevalence of diabetes is driving the market growth

Wearable glucose monitoring devices are gaining huge popularity due to their ability to track the patient's glucose levels continuously and enable the physician/patient to make timely decisions. With the rising prevalence of diabetes and increasing awareness of disease management, the demand for continuous glucose monitoring devices is on the rise.

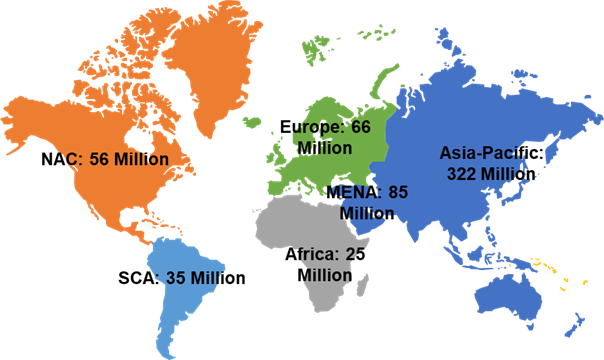

For instance, according to the International Diabetes Federation, in 2024, globally, 588.71 million people are living with diabetes, and by 2050, this number is expected to reach 852.47 million. Among these people, the adoption of wearable continuous glucose monitoring devices is rapidly growing. The presence of key market players such as Abbott, Dexcom, Inc., who have gained popularity in the diabetes devices landscape, and their constant innovations to fulfill the high unmet needs are expected to further boost the market growth.

Accuracy and calibration issues may restrain the market growth

The continuous glucose monitoring systems are gaining huge popularity these days, however, they often have accuracy and calibration issues. These devices can sometimes produce deviated results from the actual blood glucose levels. As CGMs primarily rely on interstitial fluid glucose measurement, which can lag behind blood glucose changes by several minutes. As a result, users may experience discrepancies during rapid glucose fluctuations, such as after meals or exercise. Moreover, faulty sensors or transmitter components can hinder the device readings. These devices have to be calibrated on a timely basis to ensure their proper functioning. This can be a cumbersome activity for users and may lead to decreased adoption.

Wearable Continuous Glucose Monitoring Devices Market Segment Analysis

The global wearable continuous glucose monitoring devices market is segmented based on component, indication, age group, and region.

Sensors in the component segment accounted for 71.4% of the market share in 2024 in the global wearable continuous glucose monitoring devices market

The sensors component plays a crucial role in wearable continuous glucose monitoring (CGM) devices, as they provide real-time, accurate glucose measurements. Sensors are the core technology behind CGMs, as they continuously monitor blood glucose levels in interstitial fluid, offering users detailed and up-to-date information. With the increasing demand for more precise, real-time monitoring, advancements in sensor technology have enabled the development of more accurate, smaller, and longer-lasting devices.

Patients who are using continuous glucose monitoring devices must buy sensors regularly, as they are intended to be used for once. Several sensors from different manufacturers have varying lifespans, which can range from days to weeks. For instance, Abbott FreeStyle Libre 2, Abbott FreeStyle Libre 14-day, Abbott FreeStyle Libre 3 sensors have a lifespan of 14 days, Abbott FreeStyle Libre 2 Plus, Abbott FreeStyle Libre 3 Plus sensors have a lifespan of 15 days, Dexcom G6, Dexcom G7 sensors have a lifespan of 10 days, Medtronic Guardian Connect sensors have a lifespan of 7 days, whereas Eversense 365 CGM System sensors have a lifespan of 365 days. Once the sensors are utilized for a designated period, they must be replaced with new ones. Hence, a major portion of the overall spending of consumers on a CGM system goes to sensors. Moreover, key manufacturers in the market generate a major portion of their revenue from the sale of sensors.

Moreover, innovations in sensor design, such as improved accuracy, reduced size, and extended wear times, are driving the segment's growth. For instance, in August 2024, Dexcom launched Stelo, a new biosensor for adults with prediabetes and type 2 diabetes who do not use insulin. This is the first glucose measuring biosensor to be available in the United States over the counter. As people with diabetes seek more efficient and convenient ways to manage their condition, the demand for CGM systems with advanced sensors is growing. This makes the sensors segment a key driver in the wearable CGM market, as it directly impacts the overall performance and reliability of these devices.

Wearable Continuous Glucose Monitoring Devices Market Geographical Analysis

North America dominated the wearable continuous glucose monitoring devices market with the highest share of 53.4% in 2024

The North America region dominates the wearable continuous glucose monitoring devices due to various factors such as higher prevalence of diabetes, strong availability of advanced CGM systems, high purchasing power of consumers, favourable reimbursement policies, and constant innovations and product launches from market players.

For instance, according to International Diabetes Federation statistics, nearly 38 million people in the United States were living with diabetes in 2024, and by 2050, the diabetes population is expected to reach 42 million. This rising prevalence of diabetes drives the demand for advanced monitoring devices like continuous monitoring systems.

Additionally, market players are constantly innovating the advanced wearable CGMs that are gaining approvals from the Food and Drug Administration (FDA). For instance, in April 2025, the U.S. FDA approved DexCom, Inc.’s G7 15-Day continuous glucose monitoring system, designated for use in people over the age of 18 with diabetes in the United States. In March and June 2024, Dexcom and Abbott received clearance from the Food and Drug Administration (FDA) for their over-the-counter (OTC) continuous glucose monitors. Increasing approvals for products, such as over-the-counter continuous glucose monitors, are expected to drive the region’s market by expanding accessibility to glucose monitoring solutions. This will cater to a broader range of users, including those without insulin dependence. Thus, the above factors are expected to hold the region in the dominant position.

Wearable Continuous Glucose Monitoring Devices Market Major Players

The major players in the Wearable continuous glucose monitoring devices market are Dexcom, Inc., Abbott., Medtronic, Senseonics, F. Hoffmann-La Roche Ltd, and Afon Technology., among others.

Key Development

- In September 2024, Senseonics Holdings, Inc., and Ascensia Diabetes Care announced that the U.S. Food and Drug Administration (FDA) approved the Eversense 365 CGM system. This is a next-generation 1-year continuous glucose monitoring device designed for patients aged 18 years or older with type 1 or type 2 diabetes.

- In September 2024, Abbott announced the availability of Lingo, a prescription-free continuous glucose monitoring device in the U.S. market. Lingo system is based on Abbott’s FreeStyle Libre continuous glucose monitoring technology and consists of a biosensor and a mobile app.

Market Scope

| Metrics | Details | |

| CAGR | 10.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Component | Receiver or Display Device, Sensors, Transmitters, and Others |

| Indication | Type 1 Diabetes and Type 2 Diabetes | |

| Age Group | Children, Adults, and Geriatrics | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |