Glucose Monitoring Devices Market: Industry Outlook

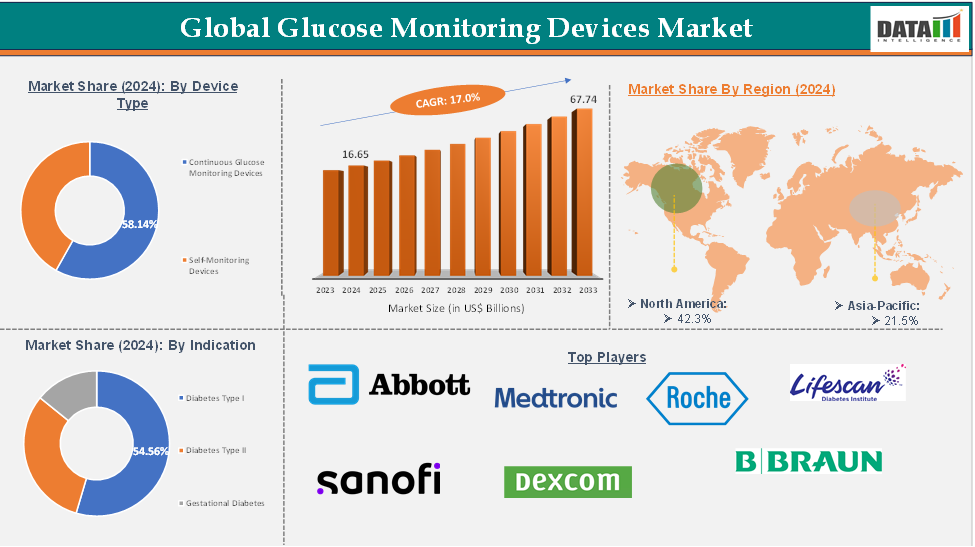

Glucose Monitoring Devices Market reached US$ 16.65 billion in 2024 and is expected to reach US$ 67.74 billion by 2033, growing at a CAGR of 17.0% during the forecast period 2025-2033.

The global glucose monitoring devices market is experiencing significant growth due to demographic, technological, and healthcare trends. The increasing prevalence of diabetes, driven by aging populations, sedentary lifestyles, and unhealthy dietary habits, has led to a demand for efficient blood glucose monitoring solutions.

Continuous Glucose Monitoring (CGM) systems and Self-Monitoring of Blood Glucose (SMBG) devices are becoming essential tools in diabetes management, allowing patients and healthcare providers to track blood sugar levels in real-time. Technological advancements, such as non-invasive wearable sensors, smartphone integration, cloud-based data sharing, and artificial intelligence-driven analytics, are enhancing the functionality, accuracy, and convenience of these devices.

Government policies and healthcare reforms are supporting the market, with reimbursement policies in developed countries and public-private collaborations in emerging economies accelerating the adoption of glucose monitoring technologies.

The North America region is expected to register the highest growth rate due to rising diabetes incidence, increasing healthcare expenditure, expanding middle-class populations, and the rapid adoption of digital health technologies.

Executive Summary

For more details on this report, Request for Sample

Glucose Monitoring Devices Market Dynamics: Drivers & Restraints

Driver: Rising prevalence of diabetes

One of the primary drivers of the global glucose monitoring devices market is the increasing prevalence of diabetes worldwide. The increasing incidence of both type 1 and type 2 diabetes, driven by aging populations, sedentary lifestyles, and unhealthy diets, has significantly heightened the need for effective diabetes management tools. Regular glucose monitoring is essential for maintaining blood sugar levels and preventing long-term complications, which has led to a growing demand for both self-monitoring blood glucose (SMBG) devices and continuous glucose monitoring (CGM) systems. This rising health concern is pushing innovation, expanding user bases, and encouraging adoption in both developed and developing regions.

For instance, according to the International Diabetes Federation, diabetes is a growing global burden, with 11.1% of the adult population (20-79 years) living with the condition, with over 4 in 10 unaware. By 2050, IDF projections show 1 in 8 adults, approximately 853 million, will be affected, an increase of 46%. Over 90% of diabetes patients have type 2 diabetes, driven by socio-economic, demographic, environmental, and genetic factors. Key contributors include urbanization, an aging population, decreasing physical activity, and increasing obesity prevalence.

Restraint: High cost of advanced monitoring devices

The glucose monitoring devices market faces challenges due to the high costs of advanced technologies, particularly continuous glucose monitoring systems. This affordability issue, especially in low- and middle-income countries, hinders widespread adoption. Limited insurance coverage and reimbursement also limit access to these devices. The high upfront costs and recurring expenses for sensors and accessories further slow market penetration in cost-sensitive areas.

Glucose Monitoring Devices Market Segment Analysis

The global glucose monitoring devices market is segmented based on device type, indication, end user, and region.

Device Type

The continuous glucose monitoring devices segment from the product type is expected to hold 58.14% of the glucose monitoring devices market.

The continuous glucose monitoring devices segment is expected to hold the dominant position in the market. This is due to the benefits associated with the devices over other types. Continuous glucose monitoring devices are used to automatically estimate blood glucose levels throughout the day and night. CGM measures glucose levels every few minutes. That data measured by CGM devices shows a more complete picture of how blood sugar levels change over time.

The increasing launches of CGM systems with advanced features are also expected to hold the segment in the dominant position in the market share. For instance, in September 2024, Senseonics Holdings and Ascensia Diabetes Care received FDA clearance for the next-generation Eversense 365 CGM system, the world's first one-year CGM system, for people with type 1 and type 2 diabetes aged 18 and older. The FDA's approval marks a significant breakthrough in diabetes technology and management.

Moreover, in February 2024, Dexcom launched its latest CGM system, Dexcom ONE+, in Ireland. Dexcom ONE+ uses Dexcom’s best-in-class and most accurate sensor design.Additionally, in March 2024, Roche announced that it is set to introduce an AI-powered diabetes tracker to predict blood sugar highs and lows.

Thus, the increasing technological advancements and the increasing launches of the advanced CGM, and the benefits associated with the devices are expected to hold the segment in the dominant position throughout the forecast period.

Glucose Monitoring Devices Market - Geographical Analysis

North America dominated the global glucose monitoring devices market with the highest share of 42.3% in 2024

North America leads the global glucose monitoring devices market due to its established healthcare infrastructure, high diabetes prevalence, and strong awareness among patients and healthcare professionals. The region benefits from advanced medical technologies like continuous glucose monitoring systems and digital health platforms. Government support, research investments, and a focus on personalized healthcare and remote monitoring solutions contribute to its market leadership.

For instance, in April 2025, Dexcom received FDA clearance for its Dexcom G7 15-Day continuous glucose monitoring system, designed for adults aged 18 and older. The device, which has a wear time of 15.5 days and a mean absolute relative difference of 8.0%, is expected to launch in the second half of 2025. It offers advantages in wearability, accuracy, and integration, impacting clinical care, payer coverage, and digital health ecosystems.

Asia-Pacific is the global glucose monitoring devices market with a market share of 21.5% in 2024

The Asia-Pacific region is experiencing the fastest growth in the market for glucose monitoring devices due to rising diabetic populations, urbanization, and lifestyle changes. Healthcare awareness and government initiatives are boosting demand for glucose monitoring solutions. Economic development in China, India, and Southeast Asia is enabling increased investment in healthcare infrastructure. Smartphone penetration and mobile health apps are also driving the adoption of digital and wearable glucose monitoring devices.

For instance, in May 2025, Kakao Healthcare Corp. introduced its artificial intelligence-powered continuous glucose monitoring (CGM) application, PASTA Search, drug enhances diabetes disease management through AI-driven analysis of glucose data. The mobile application is compatible with two leading CGM sensor systems: I-sens' Caresens Air Search drug and Excom's G7 system Search drug.

Glucose Monitoring Devices Market Key Players

The major global players in the glucose monitoring devices market include Abbott Laboratories, Medtronic, F. Hoffmann-La Roche Ltd, LifeScan IP Holdings, LLC, Sanofi SA, B Braun Melsungen AG, Dexcom, Senseonics, Inc., Nova Biomedical Corporation, and Omnis Health LLC, among others.

Key Developments

In November 2024, Beurer India Pvt. Ltd. launched the GL 22 Blood Glucose Monitor, a user-friendly health monitoring solution, marking the company's commitment to providing innovative health monitoring solutions for the Indian market.

In September 2024, Abbott launched Lingo, its first continuous glucose monitoring system without a prescription in the US. The system, which includes a biosensor and a mobile app, is based on Abbott's FreeStyle Libre technology, used by over 6 million people with diabetes globally.

Market Scope

Metrics | Details | |

CAGR | 17.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Device Type | Continuous Glucose Monitoring Devices, Self-Monitoring Devices |

Indication | Diabetes Type I, Diabetes Type II, Gestational Diabetes | |

End User | Hospitals, Clinics, and Diagnostic Centers, Home Setting, Ambulatory Settings | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |