Diabetes Devices Market Overview

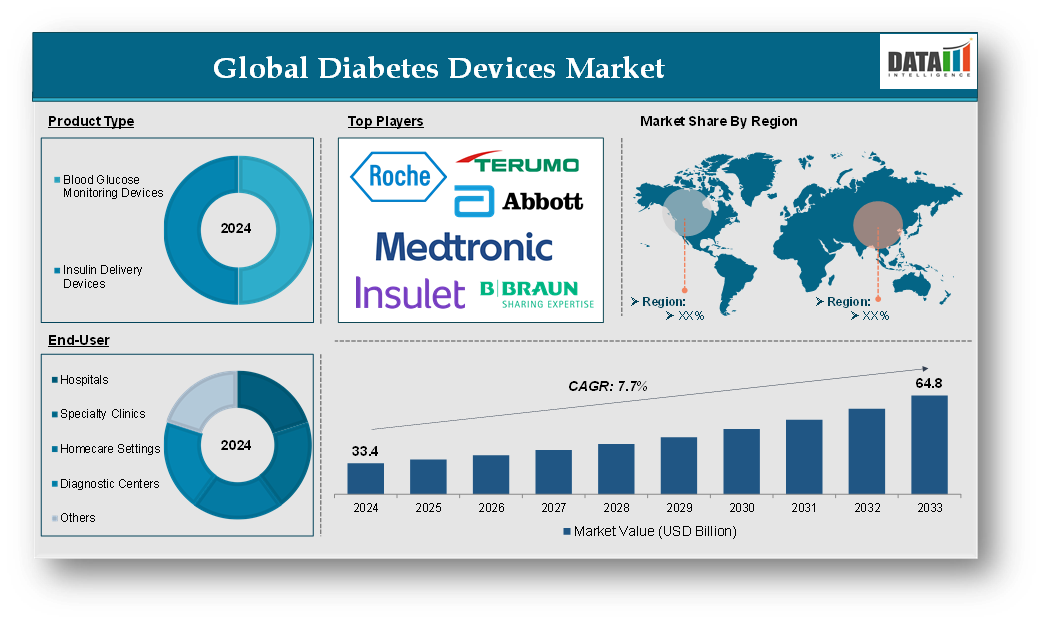

Diabetes Devices Market reached US$ 33.4 billion in 2024 and is expected to reach US$ 64.8 billion by 2033, growing at a CAGR of 7.7% during the forecast period 2025-2033.

In 2022, the Diabetes Devices Market was at US$ 29.39 Billion, and by 2023, it had reached US$ 31.24 Billion, marking a significant growth in market value.

Diabetes devices are the medical devices used to manage and monitor diabetes. These devices help individuals with diabetes control their blood glucose levels, deliver insulin and improve overall management of the condition, thus reducing the risks of complications such as cardiovascular diseases, kidney failure and neuropathy. The main functions diabetes devices serve include monitoring blood glucose levels, administering insulin or other medications, and providing continuous real-time data for more informed decision-making.

The diabetes devices market has seen significant growth in recent years, driven by the increasing prevalence of diabetes worldwide, technological advancements in diabetes devices and rising awareness about the importance of managing the disease. Advancements especially in continuous glucose monitoring devices have seen a surge in demand as they allow patients to continuously track their blood glucose levels in real time. These rising advancements expected to boost the market demand.

“Abbott, Tandem Diabetes, and Sequel lead breakthroughs in continuous glucose monitoring and insulin delivery systems as global diabetes devices market continues to surge”

Recent FDA Approvals and Innovations

As the demand for cutting-edge diabetes management solutions increases, several major companies are setting new standards with groundbreaking products:

- Abbott Receives FDA Clearance (June, 2024): Abbott has received FDA clearance for two new over-the-counter continuous glucose monitoring systems, marking a significant step in making diabetes management more accessible to the public.

- Tandem Mobi Insulin Pump Compatibility (May, 2024): Tandem Diabetes Care’s Tandem Mobi Insulin Pump is now compatible with Dexcom G7 CGM, offering enhanced real-time monitoring and insulin delivery to improve patient control.

- FDA Approves Hybrid Closed-Loop Insulin Delivery App (May, 2024): CamDiab’s innovative app has gained FDA approval for hybrid closed-loop insulin delivery, revolutionizing diabetes care by automating insulin adjustments based on real-time glucose data.

- Sequel’s twiist Automated Insulin Delivery System (March, 2024): Sequel has received FDA 510(k) clearance for its twiist automated insulin delivery system, bringing more efficient insulin delivery technology to patients.

- FDA Clears First Over-the-Counter Continuous Glucose Monitor (March, 2024): A groundbreaking achievement as the first over-the-counter continuous glucose monitor received FDA clearance, giving individuals greater autonomy in managing their blood glucose levels.

- Tandem Mobi Launch (February 2024): Tandem Diabetes Care introduces Tandem Mobi, the world’s smallest and most durable automated insulin delivery system, setting a new standard in patient-friendly insulin management.

Executive Summary

For more details on this report – Request for Sample

Diabetes Devices Market Dynamics: Drivers & Restraints

Rising prevalence of diabetes and novel product launches

The rising prevalence of diabetes and novel product launches is significantly driving the growth of the diabetes devices market and is expected to drive the market over the forecast period. The global prevalence of diabetes has risen dramatically over the past few decades. For instance, according to the International Diabetes Federation, in 2021, 536.6 million adults (20-79 years) are living with diabetes i.e., 1 in 10 people. This number is predicted to rise to 642.8 million by 2030 and 783.7 million by 2045. Over 3 in 4 adults with diabetes live in low- and middle-income countries. This escalating prevalence highlights the urgent need for diabetes devices.

Novel product launches in the diabetes devices market are revolutionizing diabetes management, making it more efficient, personalized and accessible. These innovations are making continuous glucose monitoring and insulin delivery systems more user-friendly, accurate and cost-effective. The launch of advanced CGM systems has significantly changed how patients with diabetes manage their condition. These devices continuously measure blood glucose levels, offering real-time data and reducing the need for frequent finger-prick tests.

For instance, in September 2024, Senseonics Holdings, Inc. and Ascensia Diabetes Care, received the U.S. Food and Drug Administration (FDA) clearence for the next-generation Eversense 365 CGM system for people with Type 1 and Type 2 diabetes aged 18 years and older. Eversense 365 is the world’s first One Year CGM system, representing a significant breakthrough in diabetes technology and management.

Novel product launches such as smart insulin pens, CGMs and insulin pumps are offering greater convenience and accuracy in managing diabetes. This increases patient adherence and improves long-term disease management, leading to higher demand for these products. For instance, in September 2024, Embecta Corp. received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its proprietary disposable insulin delivery system, indicated for adults who require insulin to manage diabetes, including both type 1 (T1D) and type 2 (T2D), the system includes a tubeless patch pump design with a 300-unit insulin reservoir that was informed by feedback from people with T2D and their healthcare providers.

High cost of the devices

The high cost of diabetes devices is a significant factor that is hampering the growth of the market. While technological advancements in the industry have led to more accurate, efficient and user-friendly devices, their high price limits accessibility, particularly in developing countries or for low-income populations. For instance, according to the National Institute of Health, the costs with CGM are substantially offset if device costs are added, with an average of $4,431 during the 12-month follow-up versus $319 for blood glucose monitor.

Devices such as Continuous Glucose Monitors (CGMs), insulin pumps and closed-loop systems tend to have high upfront costs, making them out of reach for many diabetes patients. For instance, a Dexcom G6 transmitter costs $366 without insurance for one device that lasts 90 days. The Dexcom G6 CGM system can cost around $8,000 annually out-of-pocket, excluding a receiver for non-smartphone users ($540) and a compatible phone. The high cost limits the adoption of CGM systems, particularly in low- and middle-income countries. This high price is a major barrier to the widespread use of CGMs and insulin pumps.

Diabetes Devices Market Segment Analysis

The global diabetes devices market is segmented based on product type, end-user and region.

Product Type:

The blood glucose monitoring devices segment is expected to dominate the diabetes devices market share

The blood glucose monitoring devices segment expanded from US$ 11.99 billion in 2022 to US$ 12.78 billion in 2023, owing to rising adoption in the global market.

Blood glucose monitoring is fundamental to diabetes management. Both Type 1 and Type 2 diabetes require regular monitoring of blood glucose levels to avoid complications such as hypoglycemia, hyperglycemia and long-term damage to organs. Blood glucose monitoring devices, particularly self-monitoring blood glucose meters, are essential because they allow patients to track their glucose levels multiple times a day, ensuring more effective and personalized management of their condition.

There has been a significant shift towards home-based healthcare and self-care in diabetes management. With rising diabetes prevalence and increasing awareness, more patients are managing their diabetes at home, which has increased the demand for affordable and easy-to-use glucose meters. For instance, products like Accu-Chek by Roche and OneTouch by LifeScan are among the most popular self monitoring devices worldwide. These meters have gained significant market traction because of their user-friendly designs, quick results and cost-effectiveness, allowing patients to easily manage their diabetes from home. For instance, in November 2024, Medtronic announced the U.S. Food and Drug Administration (FDA) clearance for its new InPen smartphone app and announced the launch of its new Smart MDI system. Smart MDI especially designed to provide real-time insights to users on multiple daily injection (MDI) therapy. It includes the InPen smart insulin pen, the InPen app and Medtronic’s disposable, all-in-one Simplera continuous glucose monitor (CGM), which received U.S. Food and Drug Administration approval.

Additionally, in May 2024, Smart Meter introduced a new version of the iGlucose, its patented cellular-connected glucose meter used by over 200,000 people with diabetes since 2019. The redesigned model, branded iGlucose Plus, has many unique, advanced features that disrupt the remote blood glucose monitoring market and improves access for millions of patients to highly accurate diabetes management technology.

Diabetes Devices Market Geographical Analysis

North America is expected to hold a significant position in the diabetes devices market share

North America led the Diabetes Devices Market in 2022 with a market size of US$ 11.10 billion and expanded further to US$ 11.80 billion in 2023.

North America, particularly the United States, has one of the highest rates of diabetes in the world. According to the Centers for Disease Control and Prevention (CDC), over 38.4 million people in the U.S. have diabetes, which represents around 11.6% of the population. The majority of these individuals rely on various diabetes devices, such as blood glucose monitors, insulin pumps and continuous glucose monitors, to manage their condition.

North America is home to many of the leading manufacturers of diabetes devices, such as Medtronic, Dexcom, Abbott, Roche and Johnson & Johnson. These companies heavily invest in research, development, and innovation in diabetes devices, leading to the launch of newer technologies like smart insulin pumps, continuous glucose monitoring systems and closed-loop systems. For instance, in July 2024, Roche received the CE Mark for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) solution. This significant milestone paves the way for the solution to be made available to people living with type 1 and type 2 diabetes over the age of 18 on flexible insulin therapy.

Additionally, in August 2024, Abbott revealed a unique global partnership with Medtronic to collaborate on an integrated continuous glucose monitoring (CGM) system based on Abbott's most advanced, world-leading FreeStyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems.

Asia-Pacific is growing at the fastest pace in the diabetes devices market

The Asia-Pacific region has seen a dramatic increase in diabetes prevalence due to lifestyle changes such as poor diet, sedentary habits and urbanization. According to the National Institute of Health, more than 60% of the people with diabetes live in Asia, with almost one-half in China and India combined. The Western Pacific, the world's most populous region, has more than 138.2 million people with diabetes and the number may rise to 201.8 million by 2035. The increasing diabetes burden is one of the key drivers of the high demand for diabetes devices.

The adoption of advanced diabetes management devices, including continuous glucose monitoring systems (CGMs), insulin pumps and smart insulin pens, is growing in the APAC region. These technologies are providing better accuracy, convenience and ease of use, which appeal to both healthcare providers and patients.

For instance, in November 2024, Beurer India Pvt. Ltd. launched the GL 22 Blood Glucose Monitor, the launch marks Beurer’s commitment to providing innovative and user-friendly health monitoring solutions tailored for the Indian market, aligning with its ambitious expansion plans across the country. The device features comprehensive monitoring capabilities, including average readings for 7, 14, 30, and 90 days, offering crucial insights into blood glucose trends. These features closely align with HbA1c levels, a critical marker for long-term blood sugar control, ensuring users and healthcare providers can manage diabetes more effectively.

Diabetes Devices Market Major Players

The major global players in the diabetes devices market include F. Hoffmann-La Roche Ltd, Abbott Laboratories, Medtronic plc, Terumo Corporation, B. Braun SE, Insulet Corporation, Nipro Corporation, Johnson & Johnson Services, Inc., Senseonics, Inc., Tandem Diabetes Care, Inc. and among others.

Market Scope

| Metrics | Details | |

| CAGR | 7.7% | |

| Market Size Available for Years | 2018-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Volume (Units) | ||

| Segments Covered | Product Type | Blood Glucose Monitoring Devices and Insulin Delivery Devices |

| End-User | Hospitals, Specialty Clinics, Homecare Settings, Diagnostic Centers and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |