Global Continuous Glucose Monitoring Devices Market – Industry Trends & Outlook

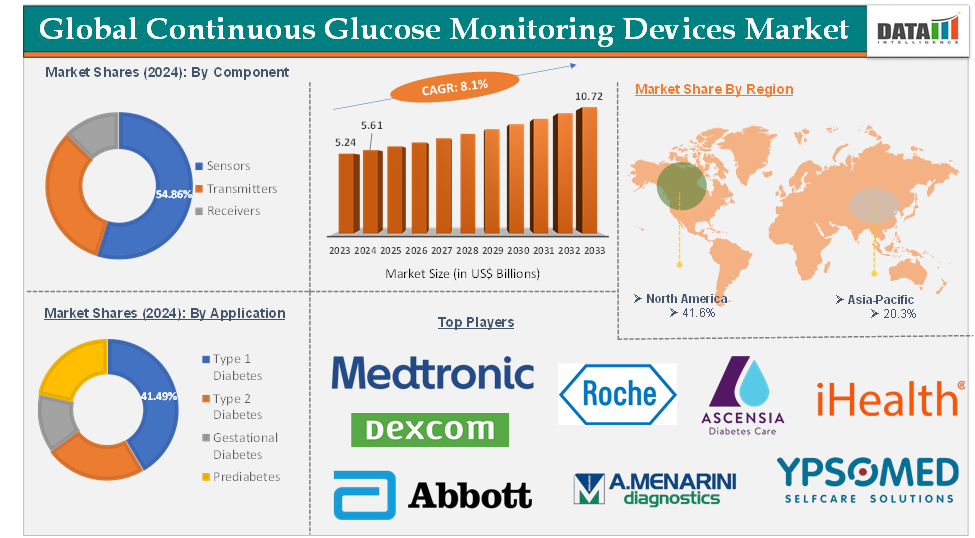

The global continuous glucose monitoring devices market was valued at US$ 5.24 Billion in 2023. The market size reached US$ 5.61 Billion in 2024 and is expected to reach US$ 10.72 Billion by 2033, growing at a CAGR of 8.1% during the forecast period 2025-2033.

The global continuous glucose monitoring (CGM) devices market is primarily driven by the rising prevalence of diabetes worldwide, which increases demand for effective blood glucose management solutions. Growing clinical evidence supports the benefits of real-time glucose monitoring in reducing complications, leading to greater adoption among healthcare providers and patients. Additionally, advances in sensor accuracy, longer wear duration, and improved integration with insulin delivery systems have enhanced both patient adherence and clinician confidence in these technologies.

Key trends shaping the CGM market include the shift toward digital health platforms and integration of CGM data with mobile apps and remote care systems, strengthening user engagement, and enabling telemedicine. Technological innovations, such as longer-lasting sensors, improved accuracy, and seamless interoperability with smart insulin pens and pumps, are driving ongoing product development and differentiation.

Significant opportunities exist in expanding access to CGMs in low- and middle-income countries, where diabetes prevalence is rising but device penetration remains low due to cost and awareness barriers. The growing trend of personalized healthcare and preventive wellness is expected to drive demand for CGMs beyond traditional diabetes management, tapping into markets for fitness, sports, and general health monitoring.

Companies can capitalize on the increasing acceptance of digital health tools by developing user-friendly, AI-powered analytics and coaching platforms that enhance the value proposition of CGM devices. Furthermore, as healthcare systems globally move toward value-based care, CGMs are well-positioned to play a central role in remote patient monitoring and chronic disease management programs, creating new revenue streams and partnership opportunities for manufacturers.

Global Continuous Glucose Monitoring Devices Market – Executive Summary

Global Continuous Glucose Monitoring Devices Market Dynamics: Drivers

Technological advancements

Technological advancements are a major driver propelling the growth of the global continuous glucose monitoring (CGM) devices market. Innovations in sensor technology have significantly improved the accuracy, reliability, and lifespan of CGM devices. Modern sensors can now provide real-time glucose readings with minimal lag and can be worn for extended periods, sometimes up to several months, reducing the need for frequent replacements and enhancing user convenience.

Key advancement is the integration of CGM systems with wireless connectivity features such as Bluetooth and NFC. This allows CGMs to automatically sync data with smartphones, smartwatches, and cloud-based health platforms, enabling users and healthcare providers to access glucose data anytime and anywhere. Such seamless connectivity supports remote patient monitoring, telemedicine, and timely clinical interventions, which are especially valuable for people managing diabetes in rural or underserved areas.

Furthermore, the integration of artificial intelligence (AI) and advanced data analytics into CGM apps has transformed the user experience. These technologies can analyze glucose trends, predict potential highs and lows, and provide personalized recommendations for diet, exercise, and medication. This not only empowers users to make informed decisions but also helps healthcare professionals deliver more precise and proactive care.

For instance, in June 2025, Tracky, a healthtech brand by DrStore Healthcare Services, launched India’s first Bluetooth-connected continuous glucose monitor (CGM), marking a significant advancement in diabetes care and preventive health management in the country. All these factors demand the global continuous glucose monitoring devices market.

Global Continuous Glucose Monitoring Devices Market Dynamics: Restraints

High cost of devices

The high cost of continuous glucose monitoring (CGM) devices is a significant restraint on the global market, limiting access and adoption, especially among lower-income populations and in low- and middle-income countries (LMICs).

CGM systems require users to purchase not only the initial device but also recurring consumables such as sensors and transmitters, which need frequent replacement. For example, the monthly cost for a CGM system typically ranges from $100 to $300, with some estimates placing annual costs even higher due to the need for a continuous supply of ancillary components. In LMICs, this cost is often prohibitive, as most people must pay out-of-pocket with minimal public financing or insurance support, leading to inequitable access and health disparities.

The high cost of CGMs not only affects individual patients but also has broader public health implications. People unable to afford these devices may experience poorer diabetes management, leading to higher rates of complications and increased long-term healthcare costs. This financial barrier is a key reason why CGM adoption remains suboptimal, despite clear evidence of the technology's benefits for glycemic control and quality of life. Thus, the above factors could be limiting the global continuous glucose monitoring devices market's potential growth.

Global Continuous Glucose Monitoring Devices Market Dynamics: Opportunities

Expanding use in non-insulin and pre-diabetic populations

The expanding use of continuous glucose monitoring (CGM) devices in non-insulin and pre-diabetic populations represents a significant growth opportunity for the global CGM market. Traditionally, CGMs were primarily used by people with diabetes who required insulin therapy. However, recent trends show increasing adoption among individuals with type 2 diabetes managed by oral medications, people with prediabetes, and even health-conscious individuals without a diabetes diagnosis.

This shift is driven by the need for early detection and proactive intervention. CGMs provide real-time, detailed glucose data that can reveal abnormal patterns such as postprandial hyperglycemia or the dawn phenomenon, often before traditional diagnostic tests would indicate a problem. For pre-diabetic individuals, this early insight enables timely lifestyle changes, such as dietary adjustments and increased physical activity, which can delay or prevent the progression to type 2 diabetes.

For more details on this report, Request for Sample

Global Continuous Glucose Monitoring Devices Market - Segment Analysis

The global continuous glucose monitoring devices market is segmented based on component, connectivity, application, end-user, and region.

Component:

The sensors component segment in the continuous glucose monitoring devices market was valued at US$ 3.08 Billion in 2024

The sensors component segment in the continuous glucose monitoring (CGM) devices market refers to the tiny, minimally invasive sensors that are inserted just under the skin, typically on the arm or abdomen, to continuously measure glucose levels in the interstitial fluid. These sensors are the core functional element of a CGM system, detecting and quantifying glucose concentrations in real time or at frequent intervals (such as every 5 minutes), and transmitting this data to a receiver, smartphone, or insulin pump for monitoring and analysis.

Applications of CGM sensors extend across various user groups. They are widely used by people with type 1 and type 2 diabetes for ongoing glucose management, allowing for more precise insulin dosing and better glycemic control. Increasingly, sensors are also being adopted by pre-diabetic individuals, people using oral diabetes medications, and even those interested in wellness or athletic performance, as they provide actionable insights into how diet, exercise, and lifestyle impact glucose levels.

Drivers for the growth of the sensors segment include continuous technological advancements that have improved sensor accuracy, comfort, and longevity. Some sensors now last up to 14 days or even several months before needing replacement. The trend toward miniaturization and user-friendly designs has made sensors less intrusive and easier to apply, broadening their appeal. Additionally, the integration of sensors with digital health platforms, wireless connectivity (Bluetooth/NFC), and automated insulin delivery systems has expanded their utility and market reach.

For instance, in August 2024, Abbott, a global leader in continuous glucose monitoring (CGM) technology, announced a major partnership with Medtronic, a leading company in insulin delivery devices. This collaboration will allow Abbott’s FreeStyle Libre CGM sensors to integrate directly with Medtronic’s insulin pumps and automated insulin delivery systems. These factors have solidified the segment's position in the global continuous glucose monitoring devices market.

Global Continuous Glucose Monitoring Devices Market – Geographical Analysis

North America's continuous glucose monitoring devices market was valued at US$ 2.33 Billion in 2024

North America, particularly the United States and Canada, has a high and rising prevalence of diabetes, with Billions of individuals requiring effective glucose management solutions. This has increased public and clinical awareness about the importance of tight glycemic control and the benefits of real-time glucose monitoring, fueling demand for CGM devices.

The US continuous glucose monitoring devices market was valued at US$ 1.79 Billion in 2024

The region benefits from highly developed healthcare systems, widespread access to advanced medical technologies, and a robust digital health ecosystem. This environment supports rapid adoption of new CGM technologies, including sensors with improved accuracy, longer wear times, and seamless integration with digital platforms and insulin delivery systems.

Major CGM manufacturers such as Dexcom, Abbott, Medtronic, and Senseonics have operational headquarters or significant market presence in North America. Their ongoing investment in research and development, frequent product launches, and strategic partnerships drive both innovation and market expansion.

Rapid advancements in sensor technology, data analytics, and artificial intelligence have improved the accuracy, usability, and clinical value of CGMs. Integration with smartphones and cloud-based platforms enhances patient engagement and enables remote monitoring by healthcare providers, further supporting adoption.

For instance, in March 2024, the U.S. Food and Drug Administration authorized the first over-the-counter (OTC) continuous glucose monitor (CGM) for sale in the United States. The Dexcom Stelo Glucose Biosensor System is an integrated CGM designed for adults aged 18 and older who do not use insulin. This includes people with diabetes who manage their condition with oral medications, as well as individuals without diabetes who are interested in tracking how their diet and physical activity affect their blood sugar levels. Thus, the above factors are consolidating the region's position as a dominant force in the global continuous glucose monitoring devices market.

Asia-Pacific continuous glucose monitoring devices market was valued at US$ 1.14 Billion in 2024

Asia-Pacific is home to the world’s largest diabetic populations, particularly in China and India, where urbanization, sedentary lifestyles, and aging demographics are fueling a surge in type 2 diabetes cases. The region’s rapidly aging population is especially vulnerable, creating an urgent need for effective, continuous glucose monitoring solutions to manage and prevent diabetes-related complications.

India's continuous glucose monitoring devices market was valued at US$ 0.22 Billion in 2024

Advances in sensor technology, such as improved accuracy, longer sensor wear duration, and integration with smartphones and digital health platforms, are making CGMs more attractive and accessible to consumers. The widespread adoption of smartphones and better internet connectivity across the region has facilitated real-time data sharing, remote monitoring, and integration with mobile health applications, supporting proactive and personalized diabetes management.

Governments across Asia-Pacific are increasingly prioritizing diabetes management, launching public health campaigns, expanding insurance coverage, and implementing supportive reimbursement policies for CGM devices. For example, Japan’s national insurance coverage for CGMs has grown significantly, and similar trends are emerging in China and other countries, making these devices more affordable and accessible to a broader patient base.

For instance, in September 2024, Trinity Biotech plc, a company specializing in human diagnostics and diabetes management solutions, announced plans to conduct an in-country study in India as part of its global launch strategy for its next-generation continuous glucose monitoring (CGM) technology. Thus, the above factors are consolidating the region's position as a dominant force in the global continuous glucose monitoring devices market.

Global Continuous Glucose Monitoring Devices Market – Competitive Landscape

The major global players in the continuous glucose monitoring devices market include Abbott, Dexcom, Inc., Medtronic Pvt. Ltd., Ascensia Diabetes Care Holdings AG., F. Hoffmann-La Roche Ltd, iHealth Labs Inc., Ypsomed AG, Medtrum Technologies Inc., Menarini Diagnostics s.r.l Nemaura, Senseonics, Glucovation, Inc., Afon Technology, and Signos Inc., among others.

Global Continuous Glucose Monitoring Devices Market – Key Developments

In September 2024, Senseonics Holdings, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved the next-generation Eversense 365 CGM system. This innovative system is designed for adults aged 18 and older with Type 1 or Type 2 diabetes. Eversense 365 is the world’s first CGM system that lasts for a full year, marking a major advancement in diabetes management and technology.

In August 2024, Dexcom introduced the first over-the-counter (OTC) continuous glucose monitor (CGM) in the United States, called the Stelo Glucose Biosensor System. This device is significant because it is the first CGM cleared by the U.S. Food and Drug Administration (FDA) that does not require a prescription, making it more accessible to adults aged 18 and older who do not use insulin such as those with type 2 diabetes managed by oral medications or people without diabetes who want to monitor how diet and exercise affect their blood sugar

Global Continuous Glucose Monitoring Devices Market – Scope

Metrics | Details | |

CAGR | 8.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component | Sensors, Transmitters, Receivers |

Connectivity | Bluetooth, Wi-Fi | |

Application | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes | |

End-User | Hospitals & Clinics, Homecare Settings, Diagnostic Centers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

Our research indicates that the market for continuous glucose monitoring devices is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2033. This expansion is driven by the increasing prevalence of diabetes, demand for real-time and less invasive glucose monitoring, and advances in sensor technology and digital health integration. CGM systems are becoming a cornerstone of modern diabetes management, offering improved patient outcomes, enhanced remote monitoring, and strong adoption across both clinical and home settings worldwide

The global continuous glucose monitoring devices market report delivers a detailed analysis with 87 key tables, more than 67 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click herere