Vaccine Adjuvants Market Size & Industry Outlook

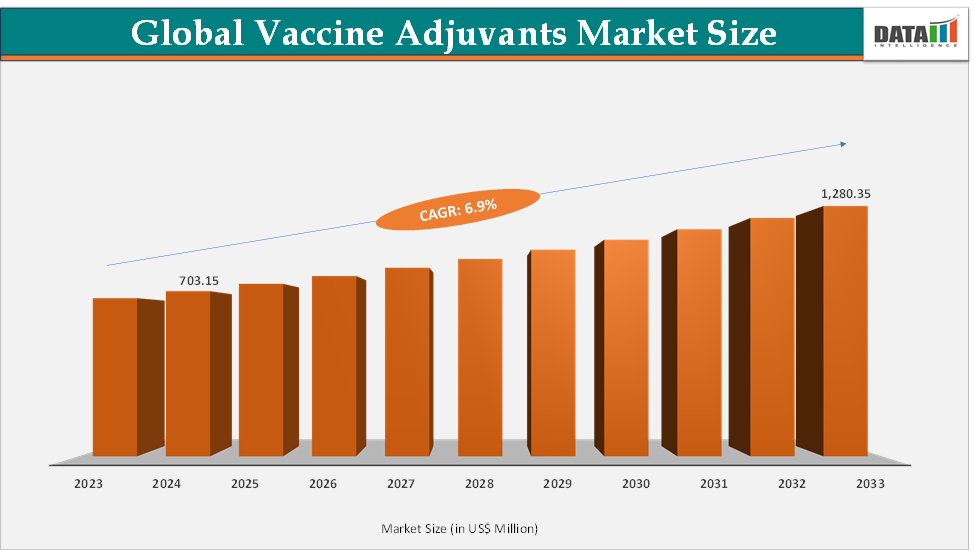

The global vaccine adjuvants market size reached US$ 703.15 Million in 2024 from US$ 661.09 Million in 2023 and is expected to reach US$ 1,280.35 Million by 2033, growing at a CAGR of 6.9% during the forecast period 2025-2033. The market is evolving as a critical enabler of next-generation vaccines, driven by the need to enhance immunogenicity in subunit, recombinant, and emerging mRNA platforms. Traditional mineral salts such as alum remain widely used in pediatric and adult prophylactic vaccines, while advanced systems like MF59, AS03, and AS01 have gained prominence in influenza, shingles, and malaria programs.

Recent approvals, such as CpG 1018 in hepatitis B vaccines, highlight the growing role of TLR agonists in commercial products. Demand is also fueled by oncology and therapeutic vaccine research, where potent adjuvant systems like QS-21 and liposome-based formulations are being tested. North America currently leads adoption due to established vaccine pipelines and regulatory approvals, but emerging markets like APAC are gaining traction through local production and government immunization drives.

Key Market Trends & Insights

Key trends in the vaccine adjuvants market reflect a shift from conventional alum-based systems toward more sophisticated adjuvant platforms that can enhance targeted immune responses. Oil-in-water emulsions such as MF59 and AS03 are increasingly used in seasonal and pandemic influenza vaccines, while liposome-based systems like AS01, used in GSK’s Shingrix and malaria vaccine Mosquirix, set benchmarks for efficacy in older adults and complex pathogens. TLR agonists, exemplified by Dynavax’s CpG 1018 in hepatitis B vaccines, demonstrate the rising acceptance of nucleic acid-based adjuvants in licensed products.

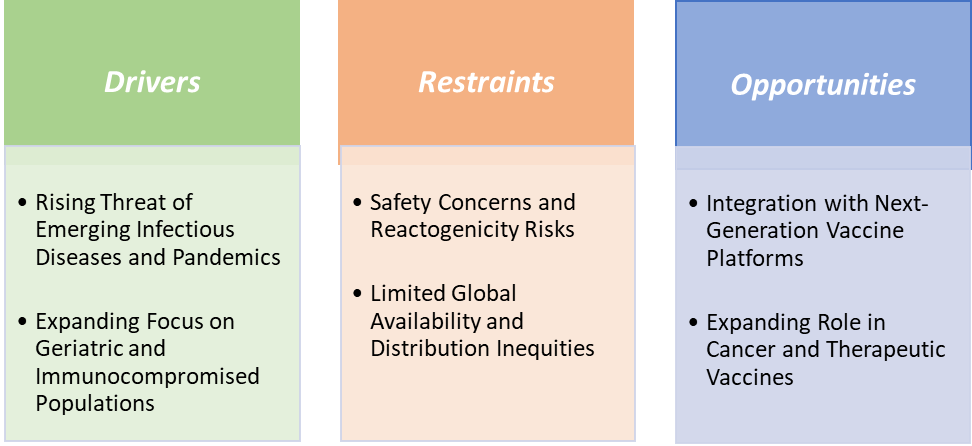

The integration of adjuvants with mRNA and protein subunit platforms, particularly highlighted during COVID-19 vaccine development. Oncology and therapeutic vaccine pipelines are also accelerating demand for potent adjuvants like QS-21 and novel nanoparticles.

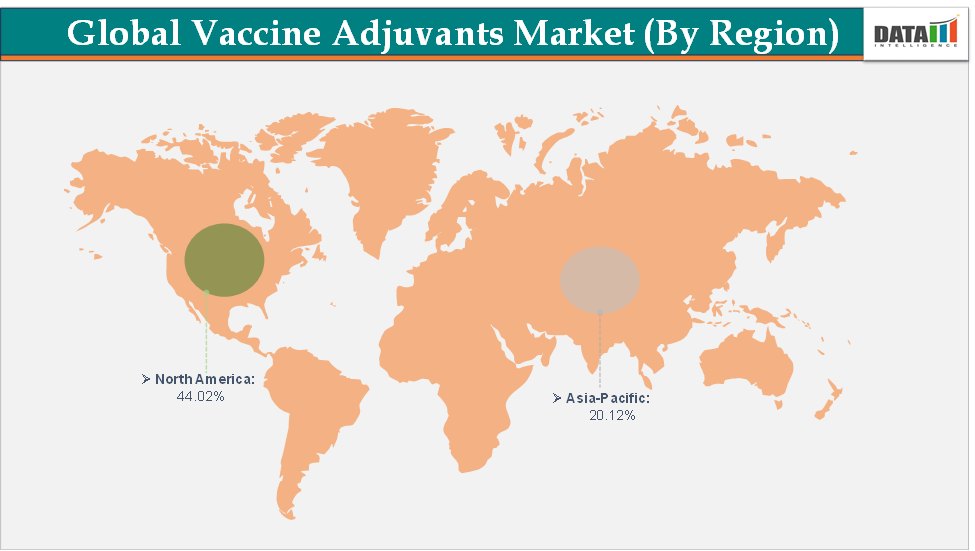

North America dominates the vaccine adjuvants market with the largest revenue share of 44.02% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.8% over the forecast period.

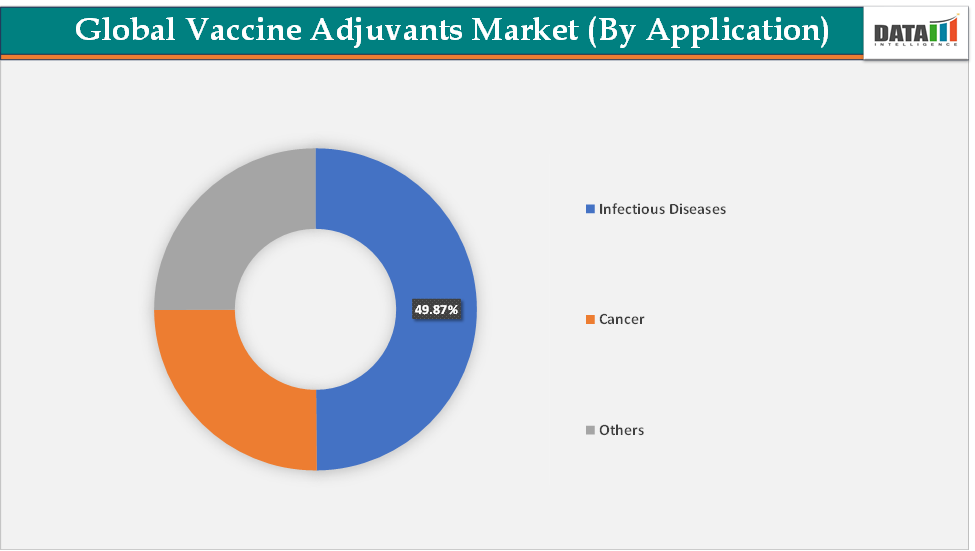

Based on application, the infectious diseases segment led the market with the largest revenue share of 49.87% in 2024.

The major market players in the vaccine adjuvants market are GSK, Dynavax Technologies, Novavax, SPI Pharma, Agenus Inc., CSL, InvivoGen, Brenntag Nicaragua, S.A., and OZ Biosciences, among others

Market Size & Forecast

2024 Market Size: US$ 703.15 Million

2033 Projected Market Size: US$ 1,280.35 Million

CAGR (2025–2033): 6.9%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Market Dynamics

Drivers-The rising threat of emerging infectious diseases and pandemics is significantly driving the vaccine adjuvants market growth

The rising threat of emerging infectious diseases and pandemics is increasingly shaping the vaccine adjuvants market, as global health systems seek technologies that can both accelerate vaccine development and extend protection in high-risk populations. Unlike traditional live or inactivated vaccines, many modern platforms such as protein subunit, recombinant, and mRNA vaccines often produce weaker immune responses and therefore depend on adjuvants to boost efficacy. This became especially evident during the 2009 H1N1 influenza pandemic, when AS03-adjuvanted vaccines like Pandemrix and Arepanrix enabled dose-sparing, allowing more than 90 million doses to be distributed worldwide despite limited antigen supply.

The COVID-19 crisis further underscored the value of adjuvants, with Novavax’s Matrix-M-adjuvanted vaccine earning emergency approvals in multiple countries and demonstrating strong immunogenicity comparable to mRNA platforms. The same R21/MATRIX-M is also central to the R21 malaria vaccine, which recently achieved 77% efficacy (according to the NIH), setting a benchmark for next-generation prophylactic vaccines. Beyond commercial successes, public health organizations like CEPI and BARDA have prioritized adjuvants in their preparedness strategies, funding platforms that can be rapidly adapted to new pathogens.

Additionally, the increasing frequency of zoonotic spillovers such as SARS-CoV-2, avian influenza strains, and Ebola outbreaks keeps the spotlight on technologies that can shorten vaccine timelines. In this context, adjuvants offer clear advantages, they enhance antigen efficiency, provide cross-protective immunity, and extend the durability of protection, all of which are crucial in outbreak settings. Industry leaders like GSK, Novavax, and Dynavax are at the forefront. Taken together, these factors show that the constant threat of pandemics is no longer just a temporary driver but a structural catalyst for sustained investment, innovation, and growth in the vaccine adjuvants market.

Restraints-Safety concerns and reactogenicity risks are hampering the growth of the vaccine adjuvants market

Safety concerns and reactogenicity risks remain among the most significant restraints hampering the growth of the vaccine adjuvants market, as stakeholders struggle to balance the clear benefits of enhanced immunogenicity with the potential for higher rates of side effects. While adjuvants like alum have been used safely for decades, reports of rare but controversial conditions such as macrophagic myofasciitis have fueled lingering skepticism in some populations.

More advanced systems, including AS01 (used in GSK’s Shingrix) and AS03 (used in pandemic influenza vaccines like Pandemrix), have set new efficacy benchmarks but also demonstrated increased rates of local and systemic reactions compared with traditional alum-based formulations. Grade 3 systemic reactions such as fatigue, myalgia, and fever were also significantly more common in adjuvanted arms, with relative risks sometimes up to three times higher than controls, though serious adverse events and deaths were extremely rare (<1%).

Moreover, regulators typically require case-by-case safety validation of each new vaccine–adjuvant pairing, prolonging development timelines and discouraging investment. Collectively, these concerns, ranging from public perception and clinical tolerability to regulatory caution, limit the speed of innovation and adoption, making safety and reactogenicity not just clinical issues but central barriers to market growth.

For more details on this report – Request for Sample

Vaccine Adjuvants Market, Segment Analysis

The global vaccine adjuvants market is segmented based on product type, route of administration, application, end-user, and region.

Application-The infectious diseases segment is dominating the vaccine adjuvants market with a 49.87% share in 2024

The infectious diseases segment dominates the vaccine adjuvants market due to the sheer scale of global immunization needs, the rising burden of communicable diseases, and the reliance on adjuvants to boost efficacy in subunit, recombinant, and inactivated vaccines. The dominance is rooted in the widespread use of adjuvanted vaccines against influenza, hepatitis, HPV, malaria, and COVID-19, where stronger and longer-lasting immune responses are critical.

For instance, MF59, used in seasonal influenza vaccines, has been shown to reduce flu-related hospitalizations in older adults, while AS03 enabled dose-sparing strategies that facilitated the delivery of hundreds of millions of doses during the 2009 H1N1 pandemic. More recently, Matrix-M, the adjuvant in Novavax’s COVID-19 vaccine and the R21 malaria vaccine, has demonstrated not only pandemic preparedness value but also unprecedented efficacy in malaria prevention, achieving 77% efficacy.

Geographical Analysis

North America is expected to dominate the global vaccine adjuvants market with a 44.02% in 2024

North America stands as the dominant region in the global vaccine adjuvants market, driven by its robust R&D ecosystem, early adoption of advanced technologies, and strong institutional support for vaccine development and stockpiling. One key factor is the presence of industry leaders and innovators such as GSK, Novavax, and Dynavax, all of which have launched commercially successful adjuvanted vaccines in the region. For instance, GSK’s Shingrix, powered by the AS01 adjuvant, has seen widespread uptake in older adults, becoming one of the most profitable vaccines in the U.S. market due to its high efficacy against shingles.

Similarly, Novavax’s Matrix-M-adjuvanted COVID-19 vaccine gained FDA authorization, supported by U.S. government contracts, and is now also being used in the R21 malaria vaccine, demonstrating the cross-indication versatility of North American-developed adjuvant systems. Collectively, these factors, ranging from product innovation and government backing to robust healthcare demand, cement North America’s position as the largest and most influential regional market for vaccine adjuvants worldwide.

The Asia Pacific region is the fastest-growing region in the global vaccine adjuvants market, with a CAGR of 6.8% in 2024

The Asia Pacific region is the fastest-growing market for vaccine adjuvants, driven by rising immunization coverage, a high infectious disease burden, expanding domestic vaccine production, and government-backed health initiatives. India and China are the major engines of this growth, fueled by mass immunization campaigns and vaccine innovation by local giants like Serum Institute of India, Bharat Biotech, and Biological E. Biological E’s 2025 partnership with Bavarian Nordic to manufacture a chikungunya vaccine in Hyderabad illustrates how global collaborations are enhancing regional adjuvant-enabled vaccine capacity.

Meanwhile, China’s market with strong investments in next-gen adjuvant technologies, including nanoparticle and CpG-based systems tailored for hepatitis and influenza vaccines. Notably, Dynavax’s CpG 1018 adjuvant is already being used by Sinovac in hepatitis B vaccines, and Chinese biopharma firms are expanding R&D hubs to advance domestic innovation. In addition, SK Bioscience in South Korea has established a state-of-the-art R&D center in Songdo, focusing on developing advanced adjuvant platforms for pandemic preparedness, while Japanese firms are exploring adjuvants for influenza and RSV vaccines to strengthen elderly immunization programs.

The high incidence of endemic diseases such as tuberculosis in India and rising risks of seasonal influenza and dengue across Southeast Asia further underscore the demand for effective adjuvanted vaccines. Together, these factors, large-scale public immunization programs, international technology transfer, and expanding domestic capacity, are positioning Asia Pacific as the fastest-growing region in the global vaccine adjuvants market, with the potential to rival Western markets in innovation and scale within the next decade.

Competitive Landscape

Top companies in the vaccine adjuvants market include GSK, Dynavax Technologies, Novavax, SPI Pharma, Agenus Inc., CSL, InvivoGen, Brenntag Nicaragua, S.A., and OZ Biosciences, among others.

Dynavax Technologies: Dynavax Technologies is a key player in the global vaccine adjuvants market, best known for its proprietary CpG 1018 adjuvant, a synthetic Toll-like receptor 9 (TLR9) agonist that stimulates a strong and durable immune response. CpG 1018 is the critical component in HEPLISAV-B, Dynavax’s FDA-approved hepatitis B vaccine, and has also been licensed for use in multiple COVID-19 vaccines developed by partners. By supplying CpG 1018 globally through partnerships, Dynavax has established itself as a leading innovator shaping both commercial and pandemic-response vaccine landscapes.

Market Scope

Metrics | Details | |

CAGR | 6.9% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Particulate Adjuvants, Adjuvant Emulsions, Pathogen Components, Combination Adjuvants, and Others |

Route of Administration | Intramuscular, Oral, Intradermal, Subcutaneous, and Intranasal | |

Application | Infectious Diseases, Cancer, and Others | |

End-User | Pharmaceutical and Biotech Companies, Research Institutes, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global vaccine adjuvants market report delivers a detailed analysis with 67 key tables, more than 65 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here