US Medical Device Packaging Market Size

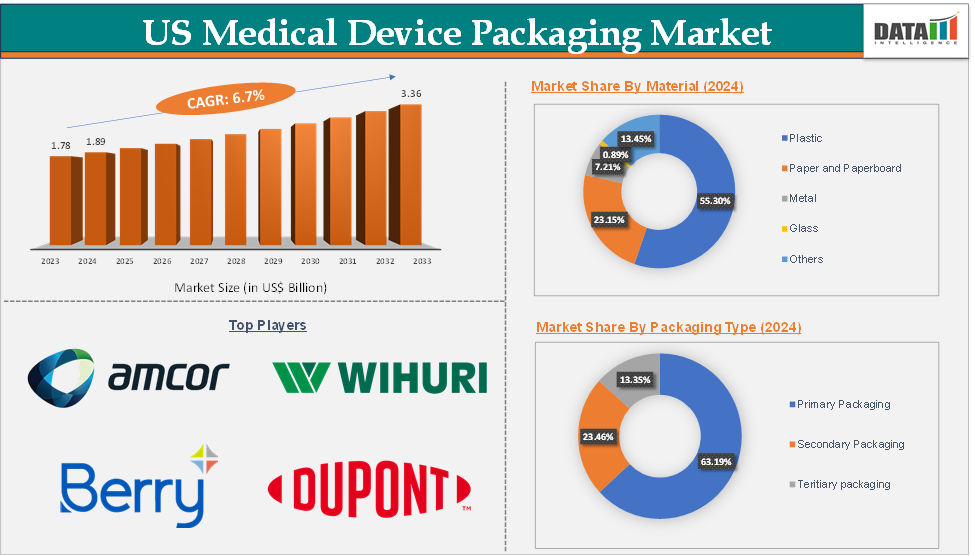

The US medical device packaging market size reached US$ 1.89 Billion in 2024 from US$ 1.78 Billion in 2023 and is expected to reach US$ 3.36 Billion by 2033, growing at a CAGR of 6.7% during the forecast period 2025-2033.

US Medical Device Packaging Market Overview

The US medical device packaging market plays a critical role in ensuring the safety, sterility, and integrity of medical devices throughout their lifecycle. Medical device packaging encompasses a wide range of materials and formats, such as pouches, trays, and clamshells, designed to protect devices ranging from surgical implants to in vitro diagnostic kits. As healthcare systems across the United States continue to evolve, packaging solutions must satisfy stringent regulatory mandates, maintain product efficacy, and accommodate innovations in device design.

Original equipment manufacturers increasingly outsource to specialized contract packaging organizations to navigate regulatory complexity, ensure agility, and leverage expertise in sterile barrier systems. The growth in contract services represents a lucrative segment for contract packaging organizations offering turnkey solutions. Advances in 3D printing for personalized implants and devices require bespoke packaging. Short-run digital printing and flexible packaging lines can address the growing demand for customized, patient-specific solutions.

US Medical Device Packaging Market Executive Summary

US Medical Device Packaging Market Dynamics

Drivers:

Rising demand for sustainable medical device packaging is significantly driving the medical device packaging market growth

As sustainability moves from a “nice-to-have” to a “must-have,” multiple stakeholders, US regulators, hospital procurement teams, and payors are collectively rewarding suppliers who can demonstrate real, end-of-life recyclability and reduced carbon footprints. Thus, market players are focusing on the development of sustainable medical device packaging, which is driving the market growth.

For instance, in October 2024, Klöckner Pentaplast launched kpNext MDR1, a single-polymer (polypropylene) barrier film that replaces traditional PET/foil/PE laminates. Because kpNext MDR1 can be recycled with standard PP waste, OEMs see a two-fold benefit: compliance with sustainability mandates and reduced waste-handling costs.

Similarly, in October 2023, Coveris introduced Formpeel P (a PET/PE blend) specifically designed for medical trays and pouches. Rather than forcing hospitals to separate layers, Formpeel P goes directly into municipal PET or PE recycling streams. Major CPOs (contract packaging organizations) quickly incorporated Formpeel P into their sterile barrier lines, unlocking new contracts with hospital groups that had previously declined to switch away from legacy films.

Restraints:

Stringent regulatory requirements are hampering the growth of the medical device packaging market

Every new packaging material or format must undergo rigorous validation, such as microbial challenge tests, physical integrity testing to prove it maintains sterility through the device’s shelf life. For a small contract packager, establishing a new peel-pouch laminate can take over 9–12 months and is costly, delaying revenue and discouraging material innovation.

If a device manufacturer switches from rigid trays to a flexible pouch, the entire sterilization cycle must be requalified. Any change in film thickness or seal parameters triggers revalidation, often requiring third‐party testing laboratories. This adds 4–6 weeks with extra expense each time the packaging specifications change.

Since 2014, all medical device packaging sold in the U.S. must carry a UDI barcode that ties directly into the Global UDI Database. For multi‐component kits, such as a sterile surgical tray with 12 instruments, each piece and the overall kit require separate UDI labeling. Smaller OEMs frequently struggle with label-printer qualification, leading to higher scrap rates and slower product launches.

Opportunities:

Growth of wearable and implantable devices create a market opportunity for the medical device packaging market

Wearables like continuous glucose monitors or smart patches require compact pouches and trays that protect sensitive electronics and sensors from moisture, dust, and mechanical shock. Implantables such as pacemakers and insulin pumps must be packaged in hermetically sealed, gamma‐sterilizable trays or blister packs to maintain sterility without leaching harmful chemicals. A typical example is a titanium‐casing pacemaker that’s placed in a vacuum‐sealed, medical‐grade Tyvek pouch, complete with a peel‐seal interface and a printed UDI barcode, guaranteeing the device is sterile, traceable, and ready for immediate surgical use.

By addressing these unique requirements, such as miniaturization, biocompatibility, cushioning, cold‐chain control, and tamper-evident packaging, suppliers can capture a larger share of the growing wearable and implantable device market, where every millimeter of space and every fraction of a gram of weight can make a critical difference in patient outcomes.

US Medical Device Packaging Market Trends

For more details on this report – Request for Sample

US Medical Device Packaging Market, Segment Analysis

The US medical device packaging market is segmented based on product type, material, packaging type, application, and end-user.

The primary packaging segment from the packaging type reached US$ 1.19 Billion in 2024 in the medical device packaging market

Primary packaging is a critical component in the medical device packaging market, serving as the first layer of protection that comes into direct contact with the medical device or therapy. Its primary functions are to establish a sterile barrier, preserve product integrity throughout its shelf life, and ensure contamination-free delivery to the end user. Given the sensitive nature of medical devices, primary packaging must meet stringent regulatory and performance standards to ensure patient safety and product efficacy.

There are three main categories of primary packaging used in the industry. flexible packaging, rigid packaging, and semi-rigid packaging.

An essential consideration in primary packaging selection is its compatibility with various sterilization methods, such as steam (autoclave), ethylene oxide (EtO), gamma radiation, and electron beam (E-beam), each of which requires specific material properties to maintain package integrity. Furthermore, compliance with international standards such as ISO 11607 is mandatory, ensuring that packaging systems meet defined safety, sterility, and performance criteria.

In 2023, the Food and Drug Administration (FDA) authorized a record-breaking 124 new medical devices, contributing to a global market that now includes an estimated 2 million unique medical device types across more than 7,000 generic device categories. This rapid growth in medical device manufacturing is driving a corresponding increase in demand for high-quality primary packaging solutions. As the variety and volume of devices expand, the need for reliable, sterile, and compliant primary packaging becomes even more critical to ensure product safety, maintain sterility, and meet stringent regulatory standards throughout the product lifecycle.

US Medical Device Packaging Market Competitive Landscape

Top companies in the US medical device packaging market include Amcor plc, Wihuri Group, Berry Global Inc., DuPont, Oliver, Printpack, Dordan Manufacturing Company, Incorporated, Placon, Solventum, and Smurfit Westrock, among others.

US Medical Device Packaging Market, Key Developments

In March 2024, Winpak introduced its WINSPEED Pouch Stock Program, aimed at streamlining and speeding up the packaging process for medical device manufacturers across North America. This new program offers immediate access to a range of high-quality, pre-stocked medical pouches, helping customers reduce lead times and accelerate product development.

US Medical Device Packaging Market Scope

Metrics | Details | |

CAGR | 6.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Pouches and Bags, Boxes, Films, Trays, Clamshell Packs, Blisters, and Others |

Material | Plastic, Paper and Paperboard, Metal, Glass, and Others | |

Packaging Type | Primary Packaging, Secondary Packaging, and Tertiary packaging | |

Application | Sterile Packaging and Non-Sterile Packaging | |

End-User | Medical Device Manufacturers and Contract Manufacturing Organizations | |

DMI Insights on the US Medical Device Packaging Market

According to DMI analysis, the US medical device packaging market is poised for continued growth, with projections indicating a market size of approximately USD 3.36 billion by 2033, expanding at a CAGR of 6.7%. Key factors contributing to this growth include the increasing demand for specialized and sterile packaging solutions, advancements in packaging technologies, and a strong focus on sustainability and regulatory compliance. There is a growing emphasis on eco-friendly packaging materials. Manufacturers are increasingly adopting biodegradable plastics and recyclable materials to reduce environmental impact and align with sustainability goals.

The US medical device packaging market is integral to the healthcare industry, ensuring the safety, efficacy, and integrity of medical devices. While challenges such as rising material costs and complex regulations persist, the market's trajectory remains positive, driven by technological innovations and a commitment to sustainability. Stakeholders in the industry must navigate these dynamics to capitalize on emerging opportunities and address potential obstacles effectively.

The US medical device packaging market report delivers a detailed analysis with 45 key tables, more than 40 visually impactful figures, and 125 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more Packaging-related reports, please click here