Contract Pharmaceutical Packaging Market Size

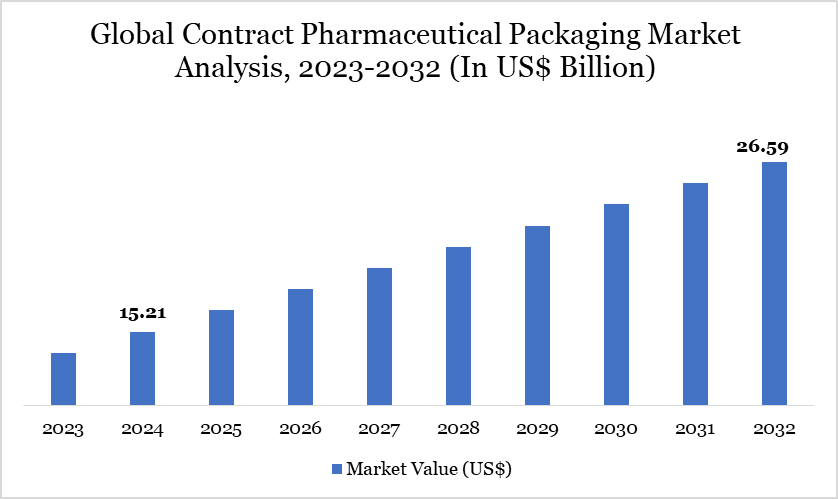

Contract Pharmaceutical Packaging Market Size reached US$ 15.21 billion in 2024 and is expected to reach US$ 26.59 billion by 2032, growing with a CAGR of 7.23% during the forecast period 2025-2032.

The global pharmaceutical sector is expanding at an exponential rate, propelled by global economic growth, an aging and growing population, and new product introductions. According to IQVIA, the worldwide pharmaceutical market's revenue is projected as US$ 1.9 trillion by 2027. Many pharmaceutical vendors understand that outsourcing commercial and clinical packaging to a pharmaceutical contractor boosts earnings, hence the contract packaging in the business is expanding.

In 2025, Europe is expected to hold about 1/4th of the global contract pharmaceutical packaging market. EU regulations require all pharmaceutical firms to follow EU Good Manufacturing Practices if they want to sell their medicines in the EU. In January 2021, Novartis made a strategic investment in drug delivery startup Credence MedSystems. The investment is intended to help advance the development and scalability of Credence's drug delivery systems.

Contract Pharmaceutical Packaging Market Trend

The contract pharmaceutical packaging market is experiencing significant growth, driven by regulatory advancements and government initiatives. In the US, the Food and Drug Administration (FDA) has implemented stringent serialization requirements under the Drug Supply Chain Security Act (DSCSA), mandating traceability of prescription drugs to enhance supply chain security. This has led pharmaceutical companies to increasingly rely on contract packaging organizations (CPOs) equipped with advanced serialization technologies.

For more details on this report, Request for Sample

Market Scope

Metrics | Details |

By Type | Primary Packaging System, Secondary Packaging System, Tertiary Packaging System |

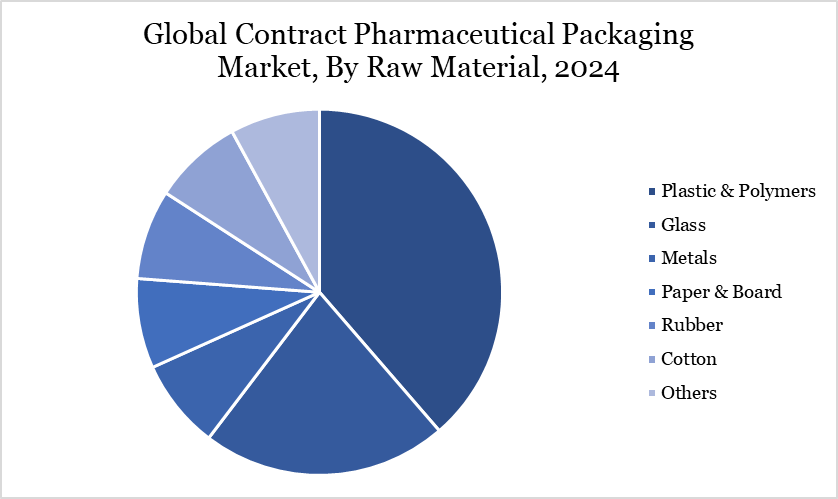

By Raw Material | Plastic and Polymers, Glass, Metals, Paper & Board, Rubber, Cotton, Others |

By Application | Transmucosal Drug Delivery Packaging, Pulmonary Drug Delivery Packaging, Nasal Drug Delivery Packaging, Topical Drug Delivery Packaging, Injectable Packaging, Oral Drug Delivery Packaging, Others |

By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Contract Pharmaceutical Packaging Market Dynamics

Technological Advancements in Packaging

Technological improvements in packaging machinery and materials have helped to shape the worldwide contract pharmaceutical packaging market. The developments, driven by innovations in automation, materials science and sustainability, are expected to open up significant market potential opportunities. Automating packing operations is an important component of technological innovation.

Recent innovations in pharmaceutical contract manufacturing include automation, artificial intelligence (AI), and data analytics. These technologies enhance production efficiency, ensure quality control, and minimize human errors. Advanced robotics and automated packaging systems are reducing contamination risks and improving product consistency.

In June 2024, ChargePoint Technology, a powder and liquid transfer specialist, launched a new robotic material handling solution aimed at increasing safety and efficiency in solid dosage drug manufacturing. The new robotics solution will improve efficiency for manufacturers looking to automate and update their production processes to meet future demand for delivering life-saving drug products to market. This includes revamping portions of existing lines to create semi-continuous cells or developing fully autonomous manufacturing for more advanced facilities.

Sustainability and Alternative Concerns

Consumer tastes may shift due to growing lifestyle trends and cultural developments, affecting contract pharmaceutical packaging demand. Owing to the high market penetration and mature client preferences, the contract pharmaceutical packaging business in industrialized countries has become saturated. Manufacturers may find it difficult to differentiate their products and compete in saturated markets, resulting in pricing pressures and decreased profit margins.

Consumers choose these alternatives because of benefits such as mobility, insulation and convenience, which reduces demand for traditional ceramic or glass contract pharmaceutical packaging. Growing concerns about environmental sustainability have driven consumers to look for eco-friendly alternatives to traditional contract pharmaceutical packaging. As a result, there is a desire for recyclable and biodegradable options, which poses a challenge to producers who rely on non-sustainable types.

Contract Pharmaceutical Packaging Market Segment Analysis

The global contract pharmaceutical packaging market is segmented based on type, raw material, application and region.

Lightweight and Not Prone to Breakage Drives the Segment Growth

Plastics & polymers are expected to be the dominant segment with over 30% of the market during the forecast period 2025-2032. Plastic bottle filling will be expected to increase rapidly over the projection period due to its several benefits, including its light weight, which saves space and transportation, as well as freight costs. Unlike medications contained in glass bottles, plastic bottles are less likely to break and contribute to the necessary cost savings associated with glass bottles.

For example, Aphena Pharma Solutions, a pharmaceutical contract packaging company, said in January 2021 that it had built ten high-speed bottling lines, leveraging a US$ 21 million investment in solid dose contract packaging. The company also wants to add 30 more high-speed lines in its newly purchased 500,000 sq ft facility, increasing the monthly capacity to over 80 million bottles to target the pharmaceutical solid dose packaging market.

Contract Pharmaceutical Packaging Market Geographical Share

Rising Investments in the Pharmaceutical Sector in North America

North America is the dominant region in the global contract pharmaceutical packaging market, covering more than 35% of the market. The presence of multiple pharmaceutical contract packaging service providers in the region increased the overall market size. Many contract packaging companies have made investments in extending their facilities and customer base, as well as increasing their geographical footprint, through acquisitions and collaborations.

In March 2024, Bormioli Pharma, an international manufacturer of pharmaceutical packaging and medical devices, recently announced an increase of 47% in its North American sales for 2023. This notable growth is a direct result of the company’s rapidly evolving infrastructure and expanded capacity, tailored to meet the demands of the North American pharmaceutical market, including an increased need for pharmaceutical glass vials.

Sustainability Analysis

The sustainability analysis of the global contract pharmaceutical packaging market is increasingly influenced by regulatory mandates promoting eco-friendly practices. For instance, the US Environmental Protection Agency (EPA) encourages the use of recyclable and biodegradable materials in pharmaceutical packaging under its Sustainable Materials Management (SMM) program.

Similarly, the European Commission’s Green Deal enforces sustainable packaging guidelines, pushing pharmaceutical companies to adopt low-carbon packaging solutions. These policies are leading contract packagers to invest in renewable materials, energy-efficient processes, and waste minimization strategies. Government-backed sustainability targets are thus accelerating the transition toward greener pharmaceutical packaging operations globally.

Contract Pharmaceutical Packaging Market Major Players

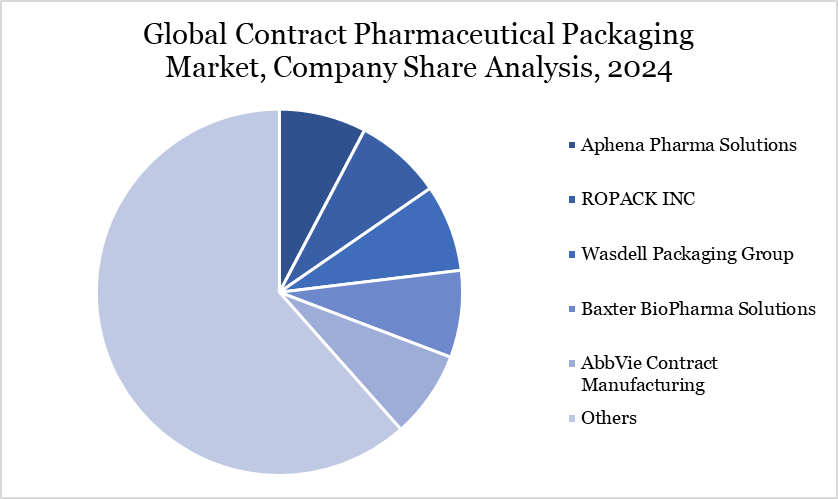

The major global players in the market include Catalent Pharma Solutions, Aphena Pharma Solutions, ROPACK INC, Wasdell Packaging Group, Baxter BioPharma Solutions, AbbVie Contract Manufacturing, Pfizer CentreSource, Daito Pharmaceutical, Nipro Corporation and Becton Dickinson & Company.

Key Developments

In February 2024, Aptar CSP Technologies, part of AptarGroup, Inc., collaborated with ProAmpac, a material science and flexible packaging provider, to develop and launch ProActive Intelligence Moisture Protect (MP-1000). This next-generation platform technology combines Aptar CSP’s 3-Phase Activ-Polymer technology with ProAmpac’s flexible blown film technology to deliver a moisture adsorbing flexible packaging solution.

In December 2022, Nelipak Corporation constructed a cutting-edge flexible packaging production facility in Winston-Salem, North Carolina. The strategic initiative will expand Nelipak's healthcare packaging capabilities across Europe to the Americas, catering to the region's growing need.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies