Sterile Injectables CMO Market – Industry Trends & Outlook

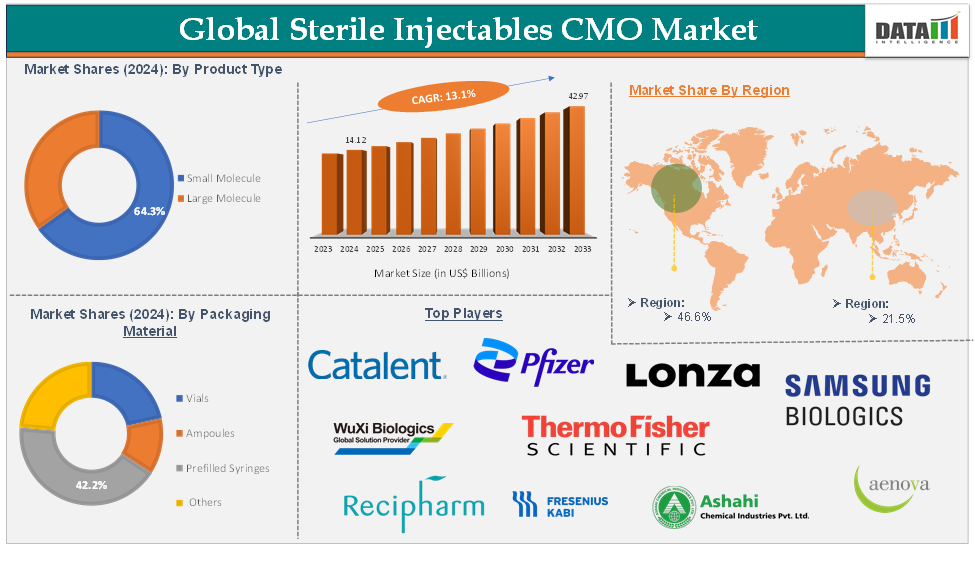

Sterile Injectables CMO Market reached US$ 14.12 Billion in 2024 and is expected to reach US$ 42.97 Billion by 2033, growing at a CAGR of 13.1% during the forecast period of 2025-2033.

Sterile injectables are pharmaceutical drugs administered via injection that must be completely free from any microorganisms. These products are typically delivered directly into the body (such as intravenously, intramuscularly, or subcutaneously), bypassing the digestive system, and therefore require strict manufacturing controls to prevent contamination. The manufacturing process for sterile injectables involves either terminal sterilization or aseptic fill-finish, both of which demand highly controlled environments and procedures to ensure sterility.

A Sterile injectables CMO (contract manufacturing organization) is a specialized company that provides contract-based manufacturing services for sterile injectable drugs to pharmaceutical or biotechnology firms. These CMOs are responsible for the production, aseptic processing, filling, packaging, and quality control of sterile injectable products, often supporting clinical, registration, and commercial supply needs.

Executive Summary

For more details on this report, Request for Sample

Sterile Injectables CMO Market Dynamics: Drivers

Increasing investments and the development of new products by pharmaceutical companies

The increasing investments by pharmaceutical companies in research and development (R&D) and the continuous introduction of new drug products are significant drivers for the global sterile injectables CMO market. As pharma firms focus on innovating novel therapies, especially injectable formulations such as biologics, vaccines, and advanced therapies, the demand for specialized sterile manufacturing capabilities grows.

Developing sterile injectables requires highly controlled environments, sophisticated technology, and strict regulatory compliance, which many companies prefer to outsource to experienced CMOs. This outsourcing strategy allows pharmaceutical companies to accelerate product development timelines, reduce capital expenditure on manufacturing infrastructure, and leverage the technical expertise of CMOs.

For instance, in February 2024, Simtra BioPharma Solutions announced a significant investment of over $250 million to expand its sterile fill/finish manufacturing facility in Bloomington, Indiana. Pharmaceutical companies are increasingly outsourcing sterile manufacturing to CMOs like Simtra to accelerate the development and commercialization of new injectable therapies.

The expansion reflects the growing demand for advanced sterile manufacturing capacity, driven by the surge in biologics, biosimilars, and other injectable drug candidates entering clinical trials and the market. All these factors demand the global sterile injectables CMO market.

Sterile Injectables CMO Market Dynamics: Restraints

High manufacturing costs

The high production costs associated with sterile injectables often result in higher drug prices, which can limit patient access, especially in regions with weaker healthcare infrastructure or limited insurance coverage. This creates a significant barrier for patients in need of these medications, reducing the overall market potential.

Additionally, the high costs of production can cut into profit margins, leaving fewer resources available for investment in research and development (R&D) of new drugs and innovative delivery systems. This can slow the development of new treatment options and hinder the market’s ability to reach new patient populations.

Unlike simpler forms of medication like tablets, sterile injectables require complex manufacturing processes to maintain sterility. This added complexity demands specialized skills, more manpower, and additional quality control measures, all of which drive up production costs. As a result, these factors are expected to limit the growth of the sterile injectables CMO market. Thus, the above factors could be limiting the global sterile injectables CMO market's potential growth.

Sterile Injectables CMO Market Segment Analysis

The global sterile injectables CMO market is segmented based on product type, packaging material, formulation, CMO service type, therapeutic area, and region.

Product Type:

The large molecule segment of the product type is expected to hold 64.3% in the sterile injectables CMO market

Large molecules, also known as biologics, are complex, high-molecular-weight therapeutic products derived from living cells. They require specialized sterile injectable manufacturing due to their structural sensitivity, immunogenicity, and complex production processes. As pharmaceutical innovation shifts toward biologics, contract manufacturing organizations (CMOs) play a crucial role in developing and scaling these drugs, particularly for companies without in-house capacity.

Large molecules include monoclonal antibodies, insulin, immunoglobulin, cytokines, blood factors, and others. This segment is driven by factors such as rising prevalence of chronic and complex diseases, advancements in biologic drug development, and growing demand for insulin and immunoglobulins.

Furthermore, key players’ strategies, such as partnerships & collaboration that will drive this segment’s growth in the market. For instance, in March 2025, CordenPharma entered a multi-year partnership with Viking Therapeutics to provide end-to-end development and manufacturing services for VK2735, Viking’s Dual GLP-1/GIP GIP receptor Agonist drug candidate.

This collaboration covers the entire supply chain, supporting both clinical and commercial needs for subcutaneous (sterile injectable) and oral peptide formulations. These factors are expected to maintain the segment's dominant position in the market throughout the forecast period.

Sterile Injectables CMO Market Geographical Analysis

North America is expected to hold 46.6% of the global sterile injectables CMO market in 2024

The North American sterile injectables contract manufacturing organization (CMO) market is experiencing robust growth, driven by several converging factors. One of the primary drivers is the rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders across the region. These conditions often require advanced therapies that are most effectively delivered through sterile injectable drugs, increasing demand for specialized manufacturing services.

The surge in biologics and biosimilars is a significant factor fuelling market expansion. The development and approval of these complex drugs have accelerated in recent years, with many requiring sterile injectable formulations due to their sensitivity and mode of action. This trend has prompted pharmaceutical companies to seek the expertise and capacity of CMOs, which possess the necessary facilities and regulatory know-how to handle these products.

The ongoing expansion of advanced therapies, including cell and gene therapies, further boosts the need for sterile injectables and specialized manufacturing capabilities. Additionally, North America benefits from a favorable regulatory environment that supports quicker approval timelines for sterile injectables compared to other drug types. Strategic collaborations, facility expansions, and acquisitions among market players are also strengthening the region’s manufacturing capabilities.

For instance, in February 2025, American Injectables, a leading CDMO specializing in sterile injectables, announced a series of strategic leadership appointments designed to drive the company’s next phase of growth in 2025 and beyond. These changes come at a pivotal moment for the pharmaceutical manufacturing sector, as demand for high-quality, domestically produced sterile injectables continues to rise.

Asia-Pacific is expected to hold 21.5% of the global sterile injectables CMO market in 2024

The sterile injectable contract manufacturing market in Asia Pacific is expected to experience robust growth over the forecast period. This expansion is driven by rising demand for injectable drugs, rapid advancements in biotechnology, a growing prevalence of chronic diseases, and supportive government policies across the region.

China currently holds the largest share of the Asia Pacific sterile injectable contract manufacturing market, supported by its aging population and a substantial middle-income demographic. These factors are boosting demand for innovative and cost-effective medical solutions, making China an attractive hub for major medical device and pharmaceutical companies.

For instance, in July 2023, WuXi STA, a contract research, development, and manufacturing organization (CRDMO) and subsidiary of WuXi AppTec, announced the launch of its first fully automated high-potency (HP) sterile injectable manufacturing line at its drug product facility in Wuxi City, China.

This new HP injectable line boasts an annual production capacity of 12 million units and significantly enhances WuXi STA’s capabilities in sterile injectable dosage forms. The advanced automation and high-potency handling capacity will enable the company to better serve pharmaceutical clients requiring specialized manufacturing for potent compounds, supporting growing demand and expanding the sterile injectables CMO market in the region.

Sterile Injectables CMO Market Major Players

The major global players in the sterile injectables CMO market include Catalent, Inc., Thermo Fisher Scientific Inc., Samsung Biologics, WuXi Biologics, Lonza, Recipharm AB., Pfizer Inc., Fresenius Kabi, Assia Chemical Industries Ltd, and Aenova Holding GmbH, among others.

Key Developments

In December 2024, Endo, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved the commercial production of VASOSTRICT (vasopressin injection, USP) at its newly established 20,000-square-foot aseptic manufacturing facility in Indore, India. This milestone enhances Endo's capacity for sterile injectable production and strengthens the long-term growth prospects of its injectable solutions business.

Market Scope

Metrics | Details | |

CAGR | 13.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Small Molecule, Large Molecule |

Packaging Material | Vials, Ampoules, Prefilled Syringes, Others | |

Formulation | Powder, Liquid | |

CMO Service Type | Development Services, Manufacturing Services, Packaging Services, Others | |

Therapeutic Area | Oncology, Cardiovascular Diseases, Central Nervous System Diseases, Infectious Disorders, Musculoskeletal Diseases, Hormonal Diseases, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |