Global Sterile Injectables Market Size & Industry Outlook

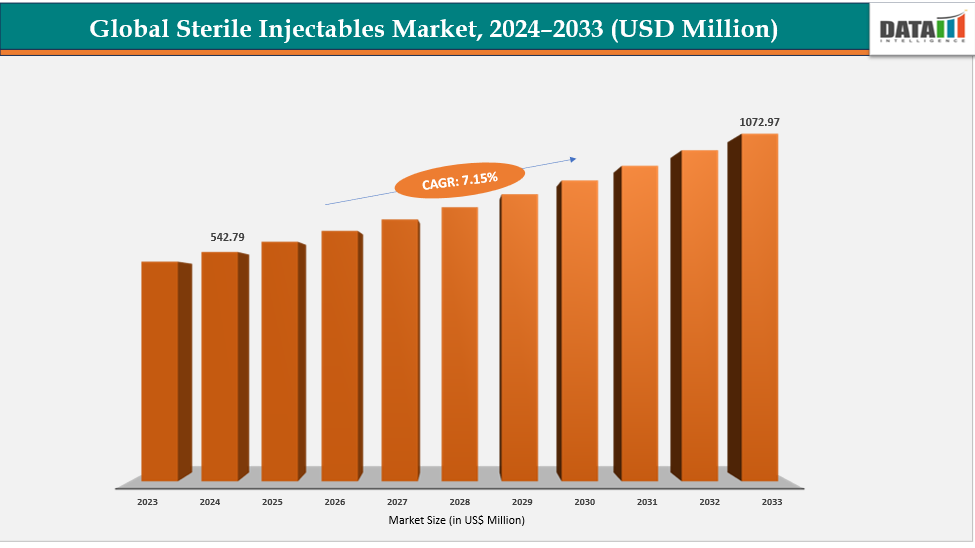

The Global Sterile Injectables Market reached US$ 542.79 Million with a rise of US$ 578.61 Million in 2024 and is expected to reach US$ 1072.97 Million by 2033, growing at a CAGR of 7.15% during the forecast period 2025-2033.

The market for sterile injectables is being driven mostly by the expansion of biologics and biosimilars. Since biologics, such as insulin, cytokines, and monoclonal antibodies, cannot be taken orally, sterile injectables are the recommended method of delivery. Patient access and demand are growing as more biologics and affordable biosimilars are approved. The prevalence of chronic illnesses including diabetes, autoimmune diseases, and cancer is increasing worldwide, which increases the demand for injectables. For delicate biologic molecules, sterile formulations guarantee drug stability, safety, and effectiveness. Therefore, through increasing production, sophisticated manufacturing, and greater treatment usage globally, the rise in biologics and biosimilars directly drives the growth of the sterile injectables market.

Key Highlights

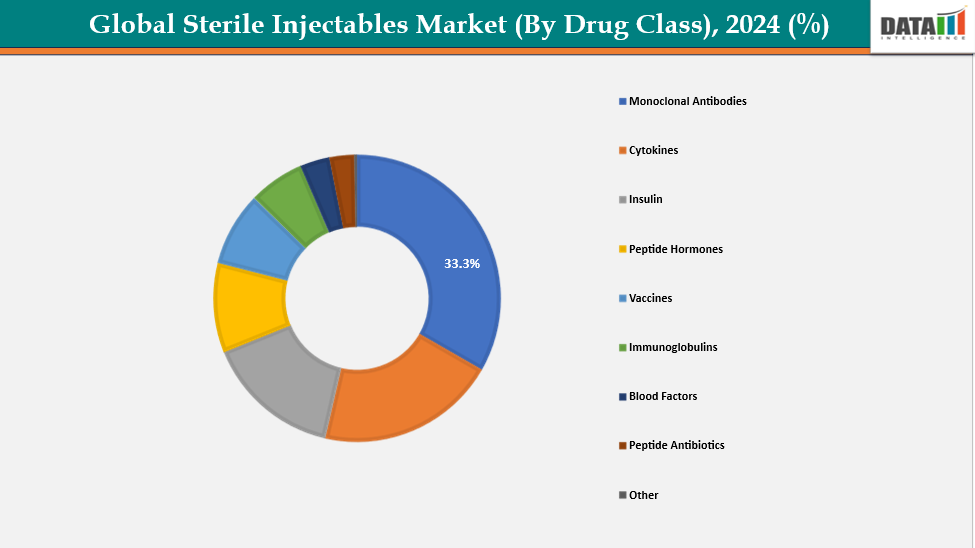

- Based on drug class, monoclonal antibodies are leading the market with strong growth potential, with a 33.3% share in 2024

- Based on the molecule, large molecule dominating the sterile injectable market with a 63.3% share in 2024

- North America is dominating the sterile injectables market with the largest revenue share of 45.4% in 2024.

- Asia Pacific is the fastest-growing region and is expected to grow over the forecast period with a CAGR of 7.5% during 2024

- Top companies in the sterile injectables market are Pfizer Inc., F. Hoffmann-La Roche Ltd, Novartis Pharmaceuticals Corporation, Johnson & Johnson, Sanofi, AstraZeneca, Amgen Inc., Bristol-Myers Squibb Company, GSK, and Takeda Pharmaceuticals U.S.A., Inc., among others.

Market Dynamics

Drivers: Rising prevalence of chronic and acute diseases are significantly driving the sterile injectables market growth

The rising prevalence of chronic and acute diseases is a key driver of the sterile injectables market, as these conditions demand fast, effective, and reliable drug delivery. Sterile injectables are the recommended choice for chronic diseases like cancer, diabetes, and autoimmune disorders because these conditions frequently call for biologics, insulin, monoclonal antibodies, and other treatments that cannot be taken orally. Similarly, in hospital and emergency situations, intravenous or intramuscular injections are required for immediate therapeutic action in acute illnesses such as infections, sepsis, and trauma. Worldwide demand for sterile injectables is still rising sharply due to factors like an aging population, a bigger patient pool, and a greater reliance on biologics and vaccinations.

For instance, according to the Cancer Progress Report 2024, an estimated 2,001,140 new cancer cases were diagnosed, and 611,720 deaths occurred due to cancer in the USA.

As per the International Diabetes Federation in 2024, vision-related conditions included macular degeneration affecting 8 million, glaucoma 7.7 million, and diabetic retinopathy 3.9 million, while presbyopia emerged as the leading cause of near vision impairment, impacting 826 million people worldwide, and approximately 589 million adults aged 20–79 years were living with diabetes globally. Additionally, the CDC reported that in 2023, 919,032 people in the U.S. died from cardiovascular diseases.

Restraints: The high cost of manufacturing of sterile injectables are hampering the growth of the sterile injectables market

The production of sterile injectables involves complex processes, including stringent aseptic techniques, advanced cleanroom facilities, precise filling and packaging equipment, and rigorous quality control to ensure safety and efficacy. The cost of production is raised dramatically by these considerations. This in turn drives up the cost of the items for patients and healthcare providers, especially in low- and middle-income areas. This restricts adoption and accessibility, inhibits market growth, and lowers manufacturer profit margins. The market for sterile injectables is therefore hampered in its overall expansion by the high cost of manufacture.

For instance, the traditional approach to mAb manufacturing relied on large-scale fed-batch processes, which were costly, complex, and difficult to adapt. Production costs often ranged from $150 to $300 per gram, driven by both the complexity of the molecules and the inefficiencies of legacy systems.

For more details on this report, see Request for Sample

Global Sterile Injectables Market, Segmentation Analysis

The Global Sterile Injectables Market is segmented based on molecule, drug class, therapeutic area, route of administration, distribution channel, and region.

By Drug Class: By drug class, monoclonal antibodies are leading the market with strong growth potential, with a 33.3% share in 2024

Monoclonal antibodies (mAbs) are leading the global sterile injectables market with strong growth potential due to their high specificity and effectiveness in treating complex diseases such as cancer, autoimmune disorders, and inflammatory conditions. Their clinical usage has expanded as a result of the global increase in the prevalence of severe and chronic diseases. Biopharmaceutical technology advancements, such as biosimilars and streamlined manufacturing procedures, have decreased costs and increased accessibility. Further propelling market expansion has been regulatory support in the form of expedited approvals for key medicines. mAbs' strong therapeutic value and premium price make them a major source of income and a major factor in the expansion of the industry.

Owing to factors such as the monoclonal antibodies, for instance, in September 2025, the U.S. Food and Drug Administration approved KEYTRUDA QLEX (pembrolizumab and berahyaluronidase alfa-pmph), a mAb injection for subcutaneous administration in adults across most solid tumor indications previously approved for KEYTRUDA (pembrolizumab). This approval was significant for patients and healthcare providers who had been using immunotherapies for years to treat certain cancers, offering a faster and more convenient administration option.

By Molecule: The large molecule segment is dominating the sterile injectable market with a 63.3% share in 2024

The large molecule segment dominates the sterile injectables market due to its inclusion of biologics such as monoclonal antibodies, cytokines, peptide hormones, and vaccines. Cancer, autoimmune diseases, inflammatory problems, and other complex and chronic diseases can all be effectively treated with these highly precise medicines. Clinical demand for big molecules has increased due to the rising prevalence of serious diseases. Efficiency and scalability in the production and delivery of biopharmaceuticals have increased due to technological developments. They are also commercially appealing due to their premium pricing and strong therapeutic value.

Owing to factors such as the prominence of large-molecule biologics, in July 2025, the U.S. Food and Drug Administration (FDA) granted accelerated approval to Regeneron Pharmaceuticals Inc. for Lynozyfic (linvoseltamab-gcpt) to treat adult patients with relapsed or refractory multiple myeloma who had received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti‑CD38 monoclonal antibody.

Geographical Analysis

North America is dominating the global sterile injectables market share with 45.4% in 2024

North America holds a dominant position in the sterile injectables market owing to a combination of advanced healthcare infrastructure, high adoption of innovative therapies, supportive regulatory frameworks, and a strong presence of leading pharmaceutical and biotech companies. The region has one of the highest utilization rates of biologics, monoclonal antibodies, vaccines, and other large-molecule therapies, supported by state-of-the-art manufacturing facilities, efficient cold chain logistics, and widespread access in hospitals and clinics.

Moreover, North America is at the forefront of technological innovation, with leading pharmaceutical and biotech companies actively developing next-generation biologics, monoclonal antibodies, peptide therapies, and advanced vaccine formulations. For instance, in August 2025, the FDA approved LEQEMBI IQLIK (lecanemab-irmb) subcutaneous injection for maintenance dosing in the treatment of early Alzheimer’s disease. The agency granted the Biologics License Application (BLA) for once-weekly administration of lecanemab-irmb, providing a convenient subcutaneous option for patients previously treated with intravenous formulations.

Europe is the second-largest region to dominate the global sterile injectables market share with 31.2% in 2024

Europe represents a significant market for sterile injectables, ranking just behind North America, supported by its strong healthcare infrastructure, well-defined regulatory frameworks, and widespread adoption of biologics, monoclonal antibodies, vaccines, and peptide therapies. Rising prevalence of chronic and complex diseases, such as cancer, autoimmune disorders, and inflammatory conditions, is driving demand for innovative sterile injectable therapies across the region. For instance, a 2023 University of Oxford study involving 22 million individuals found that autoimmune disorders affected approximately 10% of the population across Europe.

The region is also witnessing rapid adoption of advanced sterile injectables, as healthcare providers and patients increasingly prefer innovative biologics, monoclonal antibodies, and vaccines with improved efficacy and safety profiles. Countries such as Germany, the UK, France, and Spain lead adoption due to strong healthcare infrastructure, supportive reimbursement policies, and access to specialized treatment centers, while Eastern and Southern Europe are gradually increasing usage as healthcare modernization and awareness of advanced therapies advance.

The Asia Pacific region is the fastest-growing region in the global sterile injectables market, with a CAGR of 7.5% during 2024

Asia-Pacific is projected to be the fastest-growing region in the sterile injectables market, driven by rising prevalence of chronic and complex diseases, increasing awareness, and improving healthcare infrastructure. The region has a large patient pool, with an estimated 1,562,099 new cancer cases in India in 2024 and 341.75 cases per 100,000 population in China in 2022. Despite this high disease burden, access to advanced biologics, monoclonal antibodies, vaccines, and peptide therapies remains limited. This gap creates significant growth potential, as improvements in healthcare access, increasing awareness, and the adoption of innovative sterile injectables are expected to expand treatment availability across the Asia-Pacific region.

Japan has a rapidly aging population, resulting in a high prevalence of chronic and complex diseases such as cancer, autoimmune disorders, and inflammatory conditions. The country has recently witnessed significant approvals of sterile injectable therapies, including biologics, monoclonal antibodies, vaccines, and peptide therapies, aimed at addressing these prevalent health challenges. Growing healthcare infrastructure and strong regulatory support are driving the adoption of innovative sterile injectables across Japan.

For instance, in March 2024, Japan's Ministry of Health, Labour and Welfare approved ADZYNMA (apadamtase alfa/cinaxadamtase alfa) intravenous injection 1500 for treating congenital thrombotic thrombocytopenic purpura (cTTP) in patients aged 12 and older. It became the first recombinant ADAMTS13 enzyme replacement therapy for this rare blood clotting disorder.

Competitive Landscape

Top companies in the sterile injectables market are Pfizer Inc., F. Hoffmann-La Roche Ltd, Novartis Pharmaceuticals Corporation, Johnson & Johnson, Sanofi, AstraZeneca, Amgen Inc., Bristol-Myers Squibb Company, GSK, and Takeda Pharmaceuticals U.S.A., Inc., among others.

Pfizer Inc.: Pfizer Inc. is a global biopharmaceutical leader with a strong portfolio of sterile injectables, including vaccines, monoclonal antibodies, and oncology therapies. The company leverages advanced manufacturing technologies and robust cold-chain logistics to deliver safe, high-quality injectable treatments worldwide, driving innovation and addressing critical unmet medical needs.

Key Development

- In September 2025, Stealth BioTherapeutics announced that the FDA had granted accelerated approval to FORZINITY (elamipretide HCl), the first therapy for the progressive, life-limiting ultra-rare genetic disease Barth syndrome. The approval enabled treatment to improve muscle strength in adult and pediatric patients weighing at least 30 kilograms.

- In August 2025, Ionis Pharmaceuticals, Inc. announced that the FDA had approved DAWNZERA (donidalorsen) for prophylaxis to prevent hereditary angioedema (HAE) attacks in patients aged 12 and older. It became the first RNA-targeted medicine for HAE, designed to inhibit plasma prekallikrein, a key protein triggering acute inflammatory attacks.

Market Scope

| Metrics | Details | |

| CAGR | 7.15% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | By Molecule | Large Molecule, Small Molecule |

| By Drug Class | Monoclonal Antibodies, Cytokines, Insulin, Peptide Hormones, Vaccines, Immunoglobulins, Blood Factors, Peptide Antibiotics and Other | |

| By Therapeutic Area | Oncology, Cardiovascular Diseases, Infectious Diseases, Neurology, Autoimmune Diseases, Diabetes and Other | |

| By Route of Administration | Intravenous, Subcutaneous, Intramuscular | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The Global Sterile Injectables Market report delivers a detailed analysis with 78 key tables, more than 81 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Reports

For more pharmaceutical-related reports, please click here