Prefilled Syringes Market Size & Industry Outlook

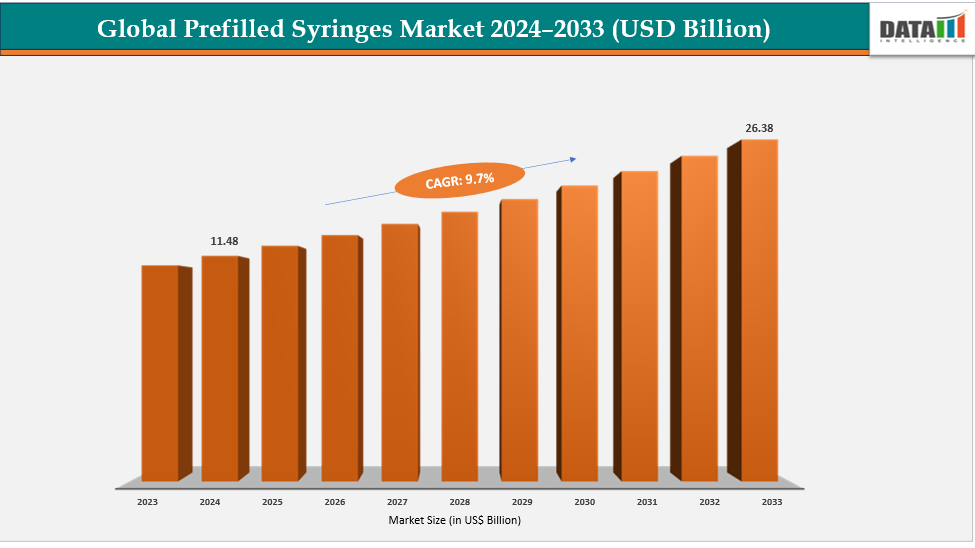

The global prefilled syringes market size reached US$ 10.53 Billion in 2023 with a rise of US$ 11.48 Billion in 2024 and is expected to reach US$ 26.38 Billion by 2033, growing at a CAGR of 9.7% during the forecast period 2025-2033.

The rising prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and cardiovascular disorders is driving demand for convenient and reliable drug delivery systems. Prefilled syringes are perfect for guaranteeing precise dosage and reducing contamination concerns because patients need frequent, prolonged treatments. Adoption is also aided by the worldwide healthcare trend toward self-administration and home care, since prefilled syringes make it simple, safe, and quick to administer medications without the need for expert help. The safety and usability of products are increased by technological developments such as needle safety systems, auto-disable features, and better materials. Pharmaceutical firms are also creating vaccines and biologics that work with prefilled syringe designs, which is speeding up market expansion.

Key Highlights

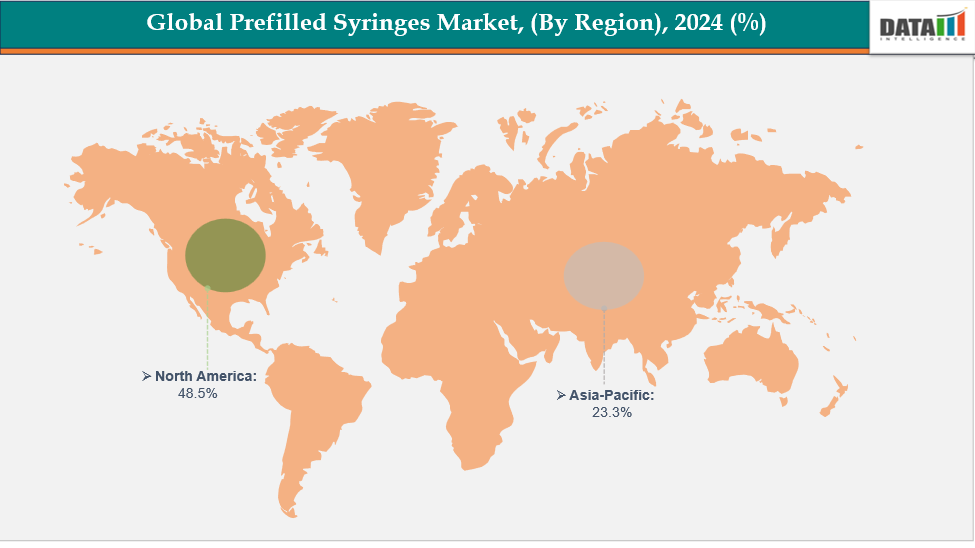

- North America is dominating the global prefilled syringes market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global prefilled syringes market, with a CAGR of 7.7% in 2024

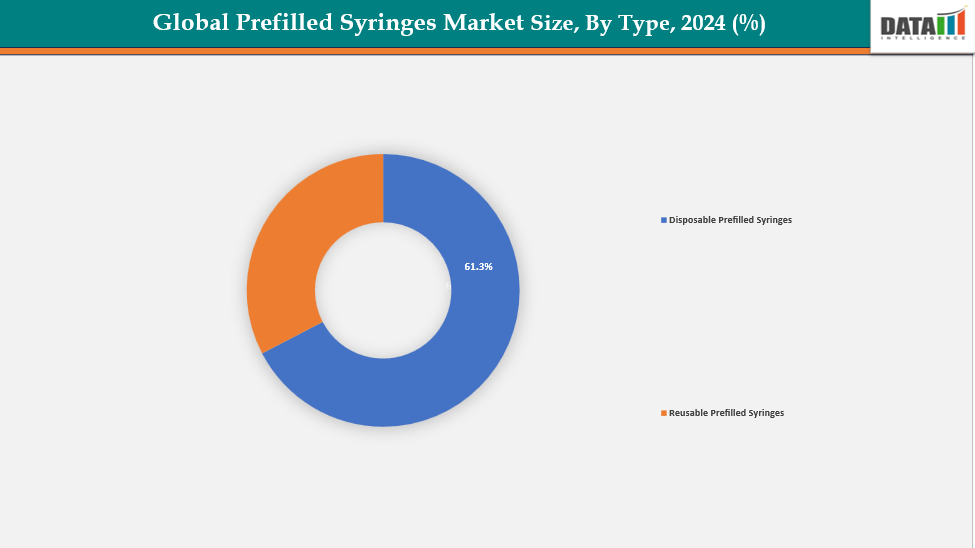

- The disposable prefilled syringes from type are dominating the prefilled syringes market with a 61.3% share in 2024

- The chronic disease treatment syringes segment form application is dominating the prefilled syringes market with a 39.3% share in 2024

- Top companies in the prefilled syringes market include Takeda Pharmaceuticals Inc., Genentech, Inc., argenx, Novartis Pharmaceuticals Corporation, Fresenius Kabi, LLC, Johnson & Johnson, Biocon Biologics Inc., UCB, Inc., AbbVie, and Amgen Inc., among others.

Market Dynamics

Drivers: Rapid growth of biologics and biosimilars are accelerating the growth of the prefilled syringes market

The market for prefilled syringes is expanding at a rapidly due to the sharp rise of biologics and biosimilars, which are usually provided via injection and need accurate, sterile, and practical delivery methods. For complex biologic medicines used in chronic illnesses like diabetes, rheumatoid arthritis, and cancer, prefilled syringes maximize patient compliance, eliminate dose errors, and lower the risk of contamination. In an effort to improve patient convenience and brand distinction, pharmaceutical companies are increasingly selecting prefilled formats as more biologics and biosimilars are authorized for self-administration.

Moreover, new product launches, technological advancements, and regulatory approvals make it more dominant. For instance, in April 2025, argenx SE received FDA approval for the prefilled syringe version of VYVGART Hytrulo, enabling self-injection for adults with generalized myasthenia gravis and chronic inflammatory demyelinating polyneuropathy, expanding patient convenience and treatment accessibility for these autoimmune conditions.

Restraints: High development and manufacturing costs are hampering the growth of the prefilled syringes market

The market expansion for prefilled syringes is being slowed by high development and production expenses. Precision technology and sophisticated aseptic filling lines are needed for production, and stringent regulatory requirements further complicate matters. Manufacturers need to make significant investments in automated systems and sterile facilities to guarantee the safety of their products. Additionally, combining the medicine and syringe presents technological difficulties, particularly for biologics that require particular materials and coatings for durability.

Furthermore, time and cost are increased by lengthy testing and validation procedures. These large investments are frequently out of reach for smaller businesses, which hinders innovation and competitiveness.

For more details on this report, see Request for Sample

Prefilled Syringes Market, Segmentation Analysis

The global prefilled syringes market is segmented based on type, material, application, end user and region

By Type: The disposable prefilled syringes from type are dominating the prefilled syringes market with a 61.3% share in 2024

The market for prefilled syringes is dominated by the disposable prefilled syringes sector because these syringes are single-use, safety and hygienic practices are guaranteed. They lessen the possibility of infection and contamination. Cleaning or sanitation prior to usage is not required. They are therefore perfect for home care, clinics, and hospitals. They are preferred by pharmaceutical companies for the treatment of chronic diseases, biologics, and vaccinations. Moreover, disposable syringes offer simple handling and precise dosage.

Moreover, frequent product launches and regulatory approvals make this segment dominant. For instance, in December 2024, Roche received EMA approval for Vabysmo (faricimab) 6.0 mg disposable prefilled syringe for treating neovascular age-related macular degeneration, diabetic macular edema, and retinal vein occlusion, enhancing treatment convenience and safety for millions of patients across the European Union.

By Application: The chronic disease treatment syringes segment from application is dominating the prefilled syringes market with a 39.3% share in 2024

The market for prefilled syringes is dominated by the chronic illness treatment syringes sector. This is a result of the increasing number of people with diabetes, heart disease, and cancer as well as the introduction and approval of novel products for these conditions. For instance, in February 2025, the FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar, for adults and pediatric patients with diabetes, enhancing glycemic control and expanding access to effective insulin treatment options in the United States.

Furthermore, frequent and precise injections are necessary for these diseases. Treatment is safer and easier with prefilled syringes. They lower the chance of contamination and offer accurate dosage. Patients do not need medical help to utilize them at home. This enhances compliance and treatment convenience. Additionally, modern syringe designs improve drug usage and stability. Patients and medical professionals now accept them more because of these considerations.

Prefilled Syringes Market, Geographical Analysis

North America is dominating the global prefilled syringes market with a 48.5% in 2024

The market for prefilled syringes in North America is dominated by a robust healthcare system, a high incidence of autoimmune and chronic illnesses, and widespread use of biologics and vaccinations. Additional factors driving market expansion include regular product releases, highly qualified medical personnel, and advantageous reimbursement and regulatory frameworks.

In the USA, advanced healthcare infrastructure, ongoing product releases, cutting-edge syringe technologies, and positive FDA approvals that improve patient convenience and treatment results are driving the prefilled syringes market. For instance, in April 2025, the FDA approved Opdivo (nivolumab) combined with Yervoy (ipilimumab) as a first-line treatment for adult and pediatric patients (12+) with unresectable or metastatic MSI-H or dMMR colorectal cancer, offering a new therapeutic option.

Europe is the second region after North America which is expected to dominate the global prefilled syringes market with a 34.5% in 2024

The market for prefilled syringes in Europe is expanding as a result of an older population, an increase in autoimmune and chronic illnesses, and improved healthcare facilities. Innovation and regional market expansion are being propelled by regular EU approvals, appealing reimbursement policies, and ongoing new product introductions. Owing to factors like new product launches, for instance, in September 2024, the EMA approved the Eylea 8 mg prefilled syringe (OcuClick) in the EU, enabling accurate 70‑microliter dosing for neovascular age-related macular degeneration and diabetic macular edema, with Germany as one of the first launch markets.

Germany's market for prefilled syringes is fueled by a sophisticated healthcare system, robust regulations, and a high level of clinical knowledge. The quick uptake of biologics, vaccines, and self-administration tools is facilitated by ongoing innovation, government assistance, and broad hospital access, which improves patient outcomes and sales growth.

The Asia Pacific region is the fastest-growing region in the global prefilled syringes market, with a cagr of 7.7% in 2024

The market for prefilled syringes in Asia-Pacific, which includes China, India, South Korea, and Japan, is growing rapidly as a result of factors like the rise in autoimmune and chronic illnesses, rising healthcare costs, technological developments, better hospital facilities, and increased public awareness of safe, practical injectable therapies like vaccines, biologics, and self-administration medications.

Japan’s prefilled syringes market is expanding gradually due to its advanced healthcare system, cutting-edge technology, and regular PMDA marketing approvals. New product launches, including biologics and self-administered injectable therapies, are enhancing dosing accuracy.

For instance, in September 2025, Alvotech announced that its Japanese partner, Fuji Pharma, obtained marketing approval from Japan’s Ministry of Health for three biosimilars in prefilled syringe format: AVT03 (denosumab), AVT05 (golimumab), and AVT06 (aflibercept), with AVT05 being the first golimumab biosimilar approved globally.

Competitive Landscape

Top companies in the prefilled syringes market include Takeda Pharmaceuticals Inc., Genentech, Inc., argenx, Novartis Pharmaceuticals Corporation, Fresenius Kabi, LLC, Johnson & Johnson, Biocon Biologics Inc., UCB, Inc., AbbVie, and Amgen Inc., among others.

Takeda Pharmaceuticals Inc.: Takeda Pharmaceuticals Inc., a leading global biopharmaceutical company headquartered in Japan, integrates prefilled syringe technology across its therapeutic portfolio to enhance patient convenience and safety. The company focuses on biologics and specialty therapies, including immunology, oncology, and rare diseases, leveraging prefilled syringes to support self-administration, ensure precise dosing, and improve treatment adherence in home-care settings.

Key Developments:

- In June 2025, Argenx SE received European Commission approval for VYVGART (efgartigimod alfa) 1000 mg subcutaneous injection as a monotherapy for adults with progressive or relapsing chronic inflammatory demyelinating polyneuropathy (CIDP). The product, available in vial and prefilled syringe formats, enabled convenient self- or caregiver-administered treatment outside clinical settings.

- In January 2025, GSK plc announced that the European Medicines Agency (EMA) accepted for review its regulatory application for a new prefilled syringe presentation of Shingrix, the company’s recombinant zoster vaccine (RZV) for the prevention of shingles (herpes zoster), aiming to enhance convenience and ease of administration.

Market Scope

| Metrics | Details | |

| CAGR | 9.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Type | Disposable Prefilled Syringes, Reusable Prefilled Syringes |

| By Material | Glass Prefilled Syringes, Plastic Prefilled Syringes, Advanced Materials | |

| By Application | Chronic Disease Treatment Syringes, Autoimmune Diseases Vaccine Syringes, Anticoagulant Syringes and Others | |

| By End User | Hospitals and Clinics, Home Healthcare, Pharmaceutical and Biotech Companies and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global prefilled syringes market report delivers a detailed analysis with 70 key tables, more than 64 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here